Establishment a binding price ceiling

The basic agenda of an administration establishing price ceiling is to shield consumers from changes in prices. Housing is a basic requirement for all the citizenry hence, if housing becomes unaffordable due to the sky rocketing of prices then the government can take several measures to address the above situation.

One of the solutions is the institution of a price ceiling that will limit the shift in prices and make accommodation affordable. However, the government should make a proper diagnosis of the market before instituting such a measure since there may be other ways to resolve the changes in market prices means such as boosting supply (Perloff 1999, p. 179).

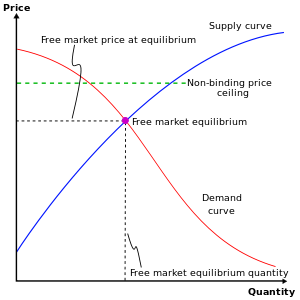

Non-binding price ceiling

Description of the market

Before the price ceiling, the price culminates from the interaction of demand and supply. Consequently, the cost of residential property results from the equilibrium of market forces.

However, the introduction of pricing ceiling will have a considerable impact on the sector. If the price control exceeds the equilibrium price, it will have no impact on the market since consumers will purchase property at the equilibrium value while the supplier will supply at the same price.

Conversely, if the cost is set lower than the equilibrium level then the ceiling will have significant implications. The reduced price will raise demand. Additionally, the reduced price will culminate in reduced supply resulting in a shortage in the entire property market.

Therefore, non-binding controls have no impacts on the market since they are higher than the equilibrium cost. Conversely, binding prices have a significant impact on the market since they are below the equilibrium price (Browning & Zupan 1999, p. 127).

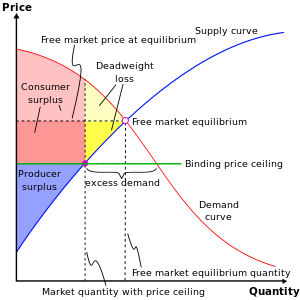

Binding price ceiling

Operations of Black market

Black market denotes a section of business done unlawfully. Since the trade is illegal, the individuals involved in it do not face any taxation. Thus, they may sell their merchandise at reduced prices. Black market will reduce the clientele that purchases property from legitimate suppliers.

Normally, black-market will provide goods of superior value and at inferior cost. Alternatively, this market may provide substitute goods. Entrepreneurs of legitimate rental property will experience reduced consumption. This will reduce the revenues of the rental property industry. The individuals that partake in this trade will have enormous profit since they do not pay any duty. The government will lose heavily since a considerable portion of the market will evade taxation (Davis& Holt 1993, p. 200).

Problems that arise with the introduction of rent controls

Fundamentally, rental controls will limit the ability of the market to determine prices. The equilibrium denotes a pricing at which the suppliers are eager to sell. Additionally, most consumers are also willing to procure their merchandise at that level. Rental controls will offset the equilibrium cost since it introduces a new price.

In this scenario, binding controls will result in greater demand since the price is lower. Additionally, the suppliers will reduce output. As such, most suppliers will dropout of the sector due to dwindling revenues. This will create a significant difference between production and demand culminating in shortage.

The government can address the above shortage by instituting consumption limits. This shows that rental controls are not the only way to address the increase in price. The government should institute measures that will further production. Overall, rental controls will result in contraction of the industry since the supply will reduce. Therefore, the government should institute rental controls on a short-term basis as it institutes measures to boost supply (Cope 2000, p.20).

Non-price techniques of allocation open to the government

Formal rationing is a strategy that the administration may utilize in the allocation of housing. Australia has applied this method in the allocation of its housing units. This method follows a certain criteria to establish the individuals that should receive housing. This technique encompasses establishing the eligible individuals. The method ranks the applicants as per their needs. The system considers family size, income and employment of the applicants. The above ranking forms the basis of allocation of the housing units. However, each country allocates houses on a distinctive criterion. However, most non-pricing method considers similar factors (Cope 2000, p.20).

Non-price techniques of allocation open to the property owner

Tenant discrimination

The rapid increase in rent has necessitated the government to adopt non-price ways of allocating residential property in New York. One of the non-price methods includes desirable tenants. This method allows the property owner to profile the possible tenants and choose the most desirable client.

The property owners discriminate on basis such as household size and income. Tenants with higher income are preferred since they have lower chances of defaulting rental payment. However, this policy has permitted the property owner to discriminate on a racial basis. This has diminished the benefits of such methods since minorities pay higher prices for housing.

This method is efficient since the administrators have no duties since the property owner chooses the tenants. The major advantage of this method is that it allows the property owner to choose the most desirable client (Downs 1992, 712).

Monetary basis

The property owner has the discretion of allocating housing to the occupant that is willing to pay the highest rent. This has culminated to the rapid rise in housing cost globally.

Most housing units apply this method. Consequently, considerable portions of the population live in rundown residence. The major advantage of this method is that it allows the proprietor to choose the most wealth tenant reducing chances of rent defaulting (Cope 2000, p.20).

References

Browning, E & Zupan, M 1999, Microeconomic Theory and Applications, Addison Wesley, Massachusetts.

Cope, H 2000, Flexible Allocations Policies and Local Letting Schemes, National Housing Federation, London.

Davis, D & Holt, C 1993, Experimental Economics, Princeton University press, Princeton.

Downs, A 1992, Policy Directions Concerning Racial Discrimination in U.S. Housing Markets Housing Policy Debate, Vol.3, no.2, pp. 685-745.

Perloff, J 1999, Microeconomics, Addison Wesley, Massachusetts.