Introduction

Market efficiency can be defined as the degree to which the prices reflect all the available information in the market. In other words, market efficiency is a condition where the market prices display the prevailing conditions.

In some cases, the market prices may not reflect the prevailing market conditions based on the available information. In this case, the market is said to be inefficient. Market inefficiencies occur in rare cases. When this occurs, the market is interrupted from the normal arrangements and this lead to complications.

Explanation for an Efficient Market and How It Operates

As already seen, market efficiency can be defined as the situation where the prices charged in the market reflects all the information available to the participants. In order for the market to function effectively, it is always necessary to have enough participants willing to sell or buy goods (Kirschen and Strbac, 2004). The price determination process is of great significance in the market.

However, this is based on the information available in the market. The information available to buyers and sellers should be unbiased in order to come up with reliable and sustainable prices. The market where all these conditions are satisfied is referred to as an efficient market.

Therefore, under the efficient market conditions for instance, buying or selling of the stock reflects fair returns after deducting the costs incurred through a transaction.

In many cases, when people puts money in the stock market their main goal is generation of returns. In some cases, many investors even aim at getting more than necessary returns by surpassing the market (Heakal, 2011). However, the prices of a particular stock reflect all the information available about the stock.

This implies that there is no investor who can have an advantage of forecasting on the returns of a stock because all the players have access to all available information. Such kind of a market is efficient. Decisions are made with reference to the information available (Investo 2011). All investors have similar knowledge about a certain stock. In this case, all investors are assumed to be rational.

Consequently, they will most likely have similar choices. In other words, investors are assumed to behave in a certain way. Mankiw (2008, Essentials of Economics), observed that the prices only respond to the information available in the market.

Therefore, since every person in the market has equal access to the same information, then no one has the ability to make more profit than the other. In a perfect market, it is assumed that there are a large number of buyers and sellers and a homogenous product and full information (Evans 2004). Therefore, a perfect market is efficient since the participants make informed decisions.

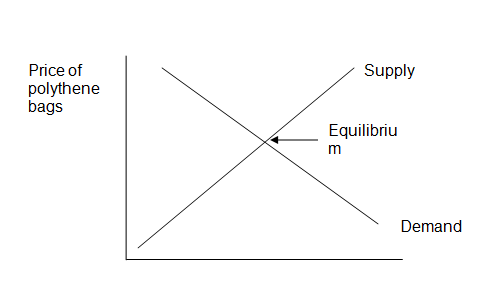

In the illustration above, the supply curve reflects the costs of the sellers where in this case are the polythene bag sellers. On the other hand, the demand curve reflects the value of the buyers. In this case, both the consumer and producer surplus is maximised. Therefore, this leads to an efficient market. In other words, the equilibrium market price leads to an efficient market.

Explanation for Market Inefficiency and Its Causes

In an inefficient market, the prices become random rather than predictable. Even with access to all the available information about the market, the participants’ prediction is rarely reflected in the prices (Barnes, 2009). In this case, the prices become random.

When there are market inefficiencies, the prices may be set in such a way that they don’t reflect the market value. This difference is what is referred to as the market inefficiency. The prices are determined by external forces rather than the market forces. Market inefficiency is regarded as one of the market failure.

Externalities are the main causes of the market inefficiencies. Externalities lead to an inefficient allocation of resources (Mankiw, 2008, principles of economics). This is the main reason why externalities cause inefficiency in the market.

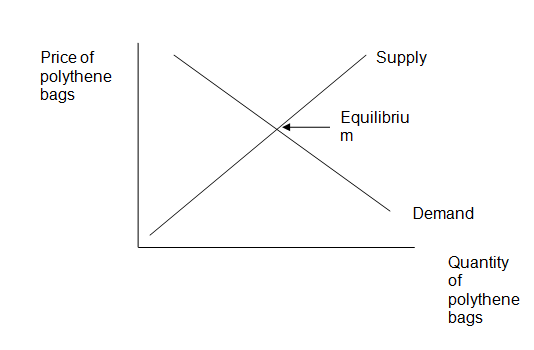

One of the common causes of these inefficiencies through externalities is the government intervention. For instance, the government may intervene in the market fort the polythene bags due to its contribution in environmental pollution. In the absence of the government intervention, the equilibrium price will be reflecting what the consumers are willing to pay for the product given the prices in the market (Boyes and Melvin, 2006).

This is determined by the information available to both sellers and buyers in the market. Therefore when there is no government intervention, the prices will adjust to balance the supply and demand of the polyphone bags in this case. In this case, both consumers and sellers are able to maximize their surplus.

In other words, this allocation leads to maximization of the total value to the consumers who purchase the polythene bags less the costs incurred in its production (Dimson and Mussavian, 2000).

In this case, the supply curve reflects the costs of the sellers where in this case are the polythene bag sellers. On the other hand, the demand curve reflects the value of the buyers. In this case, both the consumer and producer surplus is maximised. Therefore, this leads to an efficient market.

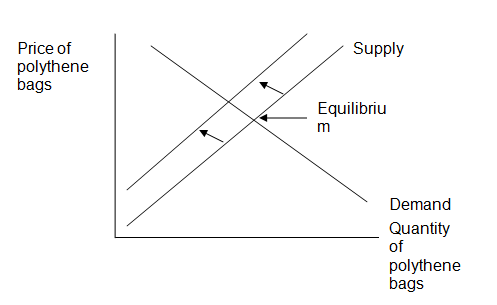

In this case, the government intervention in effort to reduce the level of pollution has led to a drop in the quantity provided in the market below the equilibrium level. The government intervention interferes with the equilibrium level of prices. This shifts the equilibrium level from the original position to another.

This will lead to shortage in polythene bags which will induce the suppliers to increase their prices. This will lead to a decrease in consumer surplus. The prices charged will also not reflect the equilibrium price. This will lead to inefficiency in the market. In other words, any intervention in the market will lead to the market inefficiency.

Similarly, taxation will also act by increasing the prices above the equilibrium level. Consequently, this will result into market inefficiency. This is because the prices will not reflect the equilibrium, market prices. Other government interventions will lead into similar results.

Conclusion

In conclusion, this discussion has given a clear understanding of an efficient market and inefficient market. The study has clearly shown that in an efficient market, all the participants have equal access to the available information.

The market price in a particular time is reflected by the information available in the market (Crosier, 2004). On the other hand, an inefficient market is characterised by random prices. In this case, the prices are not predictable.

From the discussion, it can be seen that the markets cannot be absolutely efficient all absolutely inefficient. In most cases, the market reflects all these aspects of the market. Based on this information, it is advisable for all participants to refer to all the information available in the market in order to come up with the most feasible decisions.

To those investors seeking to invest on shares, they are advised to find out all information necessary about the company in question. This will enable the company. This will enable the investor to determine whether the prices set for shares are reasonable before making their final decisions to buy.

Reference List

Barnes, P., 2009. Stock Market Efficiency, Insider Dealing and Market Abuse. England, Gower Publishing, Ltd.

Boyes, W. and Melvin, M., 2006. Economics. U.S.A., Cengage Learning.

Crosier, L., 2004. Selling Your Business: The Transition from Entrepreneur to Investor. New Jersey, John Wiley and Sons.

Dimson, E. and Mussavian, M., 2000. “Market Efficiency.” Spellbound Publications. Vol.3, Pp. 959-970.

Evans, A. 2004. Economics, Real Estate and the Supply of Land. Wiley-Blackwell.

Heakal, R., 2011. What Is Market Efficiency?. Web.

Investo, 2011. What Is an Efficient Market and How Does It Affect Individual Investors?. Web.

Kirschen, D. and Strbac, G., 2004. West Sussex: Fundamentals of power system economics. New York, John Wiley and Sons.

Mankiw, N., 2008. Essentials of Economics. Mason, OH, Cengage Learning.

Mankiw, N., 2008. Principles of Economics. Mason, OH, Cengage Learning.