Introduction

The development of entrepreneurship in terms of investment is a progressive form of market relations, and creating an appropriate base for effective interaction between partners is the key to the stability of this sector. In case communication barriers exist and potential investors and owners of various enterprises cannot cooperate freely, this complicates business communication significantly and slows down the natural process of expanding trade contacts.

As an example that confirms the importance of coordinating the interaction of stakeholders in the business sector, the situation in Indonesia will be examined, which Porter and Ketels (2013) analyze in their case study. The slowdown in investment had had a negative effect on the development of enterprises of various profiles until government agencies responded appropriately to resolve this issue and contributed to expanding freer economic relations.

The competitive barrier that existed in the market complicated the organization of a reliable system of interaction among interested parties. Establishing sustainable market relations and providing local firms more freedom to introduce individual development strategies are necessary and objective solutions in the face of limited business opportunities and uncontrolled financial activities.

Key Problems and Their Root Causes

During its existence, Indonesia has gone through different stages of the formation of statehood, which affected its fluctuations in various industries. For instance, according to the case study presented by Porter and Ketels (2013), at the beginning of the 17th century, in the trading sphere, the Dutch dominated in Indonesia and monopolized all its key industries. The events of the 20th century changed the history of the state significantly since the local government freed from Dutch pressure sought to interact with Japan. However, the country also developed individually, and the republican system was proclaimed after World War II.

At the same time, attempts to create a sustainable system of trade relations were unsuccessful and even worsened the situation by imposing significant restrictions and prohibitions on free entrepreneurial activities.

The government’s inability to create a stable entrepreneurial system in the country was due to several critical reasons, and local business representatives’ lack of freedom to interact with investors was the most severe manifestation. In Table 1, such causes are listed, and basic justifications for these factors are given based on the theories and concepts proposed by Porter and Ketels (2013). In order to describe these issues, the background of the problems will be considered in more detail.

Table 1. Key Problems.

Policy Uncertainty

Although the Indonesian government accepted attempts to resolve the issue of foreign investment in local business projects, there were challenges and gaps. For instance, according to Porter and Ketels (2013), in 1967, a control board was created, which was renamed the Capital Investment Coordination Agency later in 1973. However, the agency called BKPM offered its vision of the value of foreign investors’ participation in Indonesian business. As Porter and Ketels (2013) note, the board proposed a list of industries and companies that were thought to be potentially negative for the local business sector. As a result, although formally, the availability of investment was justified by law, many entrepreneurial areas could not count on partners’ support.

Unstable Judicial System

Another reason that affected the instability of the investment policy in Indonesia was the ambiguous course of development of the local judicial system, which did not have a clear vision for resolving ambiguities and disputes. Porter and Ketels (2013) analyze the situation in the country during the second half of the 20th century. The authors note that the unreasonableness of too tight state control, along with a weak legal framework for the protection of entrepreneurship, created barriers to businesses (Porter & Ketels, 2013). Economic modernization was inferior to the construction of civil spheres in the degree of importance.

According to the recent case study, difficulties in leasing land to investors still exist, and many stakeholders depend on the government (“Case study investment climate & legal certainty,” 2017). As a result, there is no sustainable support for the activities of entrepreneurs who are willing to invest in the development of local projects, which, in addition, can bring profit to the budget.

Financial Fraud

Financial fraud, particularly corruption, was the reason for the slow development of the Indonesian business market in the second half of the 20th century. Porter and Ketels (2013) provide a rationale and note that even the enterprise development program called KIK/KMKP, which ran from 1973 to 1990, could not address this issue. Conversely, due to the involvement of officials in the process of monitoring entrepreneurship in the country, corruption accompanied by a low level of professional training was one of the reasons for an inadequate interaction policy. In addition, even after the interruption of the control program, financial fraud continued. In the list below, one can compare indicators of how the growth of the financial sector in Indonesia changed after the country began to receive appropriate loans from the World Bank.

- 1980 – approximately 70% of investment in Indonesian business companies comes from enterprises owned by the government.

- The beginning of the 1990s – only 5% of all the profits are allocated by the government for the development of local business organizations.

- GDP growth per capita in the 1990s – from 50% to 300% over the past three decades.

- 1997 – the rise of Indonesian industrial market share from 28%, which was a low indicator, to the parameter of 42%.

- At the beginning of the 21st century, Indonesia was a country with one of the highest rates as a business starter in the Asian region.

Business Limitations

Business limitations that the country’s official legislation introduced in the mid-20th century in Indonesia were the obstacles to investment in the business sector. Porter and Ketels (2013) cite the following example: after gaining independence, in 1950, the state offered local business people support programs that included bonuses and giving priorities for local organizations. Nevertheless, the authors note that, in fact, this program involved revenue collection promoted by the government (Porter & Ketels, 2013). Ethnic Chinese were the predominant population involved in managing entrepreneurial projects, and official agencies sought to change the situation by introducing constant restrictions and constraints, which did not contribute to healthy competition.

Theoretical Framework to Develop a Solution

The main source of capital for developing countries is the foreign direct investment (FDI). However, if the government does not allow local companies to develop their businesses individually and compete, this is a testament to the state monopoly and the absence of progressive steps to establish interaction with investors. Several relevant theories will be effective tools for addressing the aforementioned gaps and developing a potentially effective solution. Such competitive concepts will be applied as Porter’s Five Forces Framework, the SWOT analysis, and Porter’s Diamond Model. These models will help identify drivers that influenced the Indonesian market, including internal and external aspects of business activity.

Porter’s Five Forces Framework

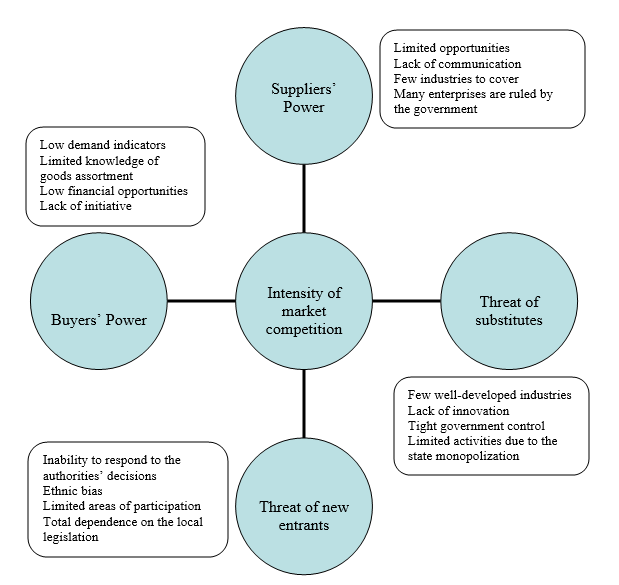

Since the competitive barrier is the main factor that is seen as a brake on the Indonesian business and capital inflows in the case under review, Porter’s Five Forces Framework is a relevant theoretical background for analysis. According to Djulius (2017), although competition between domestic and foreign companies increases knowledge about growth opportunities, in Indonesia, this principle was not possible due to government restrictions. Accordingly, by using Porter’s model, one can highlight the most powerful threats.

In this model, the intensity of rivalry is considered the main determinant of competition. As Porter and Ketels (2013) state, in Indonesia, relevant laws regulating its business were introduced in the late 1990s, and before, none industries had been involved in struggles for market positions. The threat of substitutes was not high because few areas developed in accordance with innovative trends. In addition, both suppliers’ and buyers’ powers were insignificant impacts.

The market depended much on internal resources, and communication with foreign partners was limited (Mahadika et al., 2017). Consequently, buyers had limited knowledge of possible substitute products and their differences. Therefore, the threat of new entrants was the most acute for the government but not for entrepreneurs because, based on the Indonesian market limitations, business representatives had few opportunities due to restrictions and poor competition. In Figure 1, the framework in question is demonstrated in relation to the case reviewed.

SWOT Analysis

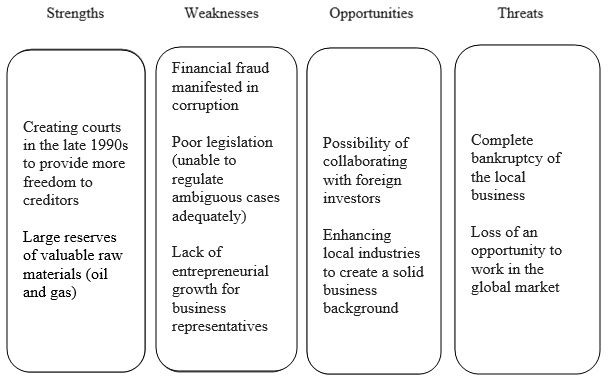

In the 20th century, the Indonesian market was characterized by low competition indicators, and the lack of FDI was a crucial issue. Asmoro et al. (2018) state that local business representatives needed not only capital inflows but also strategies to master their appropriate use. The authors offer SWOT analysis (“strengths, weaknesses, opportunities, and threats”) to review the current situation in the country (Asmoro et al., 2018, p. 76).

As one of the few strengths, Porter and Ketels (2013) mention creating courts in the late 1990s to provide more freedom to creditors. There were many weaknesses, for instance, financial fraud and poor legislation, and the most severe of them were manifested in the lack of entrepreneurial growth for business representatives. As opportunities, the possibility of collaborating with foreign investors was a valuable perspective, as well as enhancing local industries. Finally, as threats, the complete bankruptcy of the local business could happen along with the loss of an opportunity to work in the global market. The scheme of the SWOT analysis in relation to the Indonesian case is presented in Figure 2.

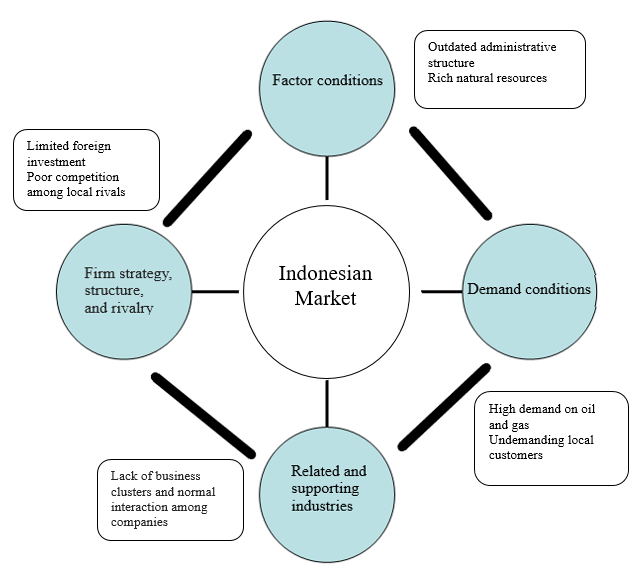

Porter’s Diamond Model

Porter’s Diamond Model is another theoretical framework that may be applied to the case of Indonesia. According to Fang et al. (2018), this concept includes four major dimensions: “Factor conditions; Demand conditions; Related and supporting industries; and Firm strategy, structure, and rivalry” (p. 721). Based on this model, one can assume that the state of the Indonesian business environment was weak. The administrative structure was outdated, which affected the factor conditions negatively. The strategies and structure of the local competition were unexpressed, which slowed down the natural growth of the business sector. Consumer demand was standard, but the market could not provide the population with an appropriate range of necessary goods. Finally, business clusters and normal interaction among companies were absent, which was caused by the dominant role of the government. The features of this model in relation to the Indonesian case are presented in Figure 3.

Solution to the Existing Issue

While reviewing the proposed theoretical background, the most obvious solution to the challenges of the business sector in Indonesia and its inability to attract foreign capital was to provide greater opportunities for the business market. As Porter and Ketels (2013) note, only in the late 1990s, relevant competition laws were introduced. Porter’s Five Forces Framework demonstrates that for the government, providing local entrepreneurs with more freedom to cooperate with foreign investors meant losing its monopolistic status.

The other two concepts also confirm that the lack of growth opportunities and the closure of the Indonesian market for companies from other countries affected the quality of the business sector negatively. Therefore, when taking into account both the SWOT analysis and Porter’s Diamond Model, the solution to assist local business companies in establishing sustainable market relations is an objective step.

The validity of this solution may be explained from the standpoint of the specifics of Indonesian foreign trade. According to Porter and Ketels (2013), in 2006, the country demonstrated 25% of revenues from exporting oil and gas in 2006 (p. 13). This figure confirms that the government was interested in promoting one major industry, while other market sectors developed poorly. Addressing the issues related to higher competition and freedom of market activity could help expand budget revenues and attract potential investors. Therefore, providing greater opportunities for local entrepreneurs meant convincing foreign partners of Indonesia’s ability to expand its business potential and follow the modern course of development. In Table 2, corresponding reasons for such a solution are proposed, as well as its implication.

Table 2. Solution to the Problem.

Situation Analysis: Current Measures

When interpreting the findings in this case, one can compare the differences that have been made since the crisis of the 1990s when Indonesia faced an almost complete absence of direct foreign investment. The government reviewed current policies and introduced competition laws that had a positive impact on the local business sector. As Porter (2012) argues, competition is healthy if the trade value, which is characteristic of a particular region, increases regularly and stably. Sodik et al. (2019) state that, in the early 2000s, foreign investment became a key aspect of the development of the Indonesian market because the authorities were unable to provide adequate assets to support the market.

At the same time, as the authors remark, today, FDI indicators vary in different regions of the country, which is one of the constraints on development equality (Sodik et al., 2019). For instance, in 2011-2015, the FDI in Java was $43.542 million, while in Maluku, it was only $583 million (Sodik et al., 2019, p. 2). This unequal distribution of foreign investment keeps the issue of competition relevant, although, compared with the 20th century, the situation has improved significantly.

Due to market evaluation, analysts have identified the most favorable sectors for the inflow of foreign capital. Baskoro et al. (2019) provide valuable data and argue that, based on the experience of the Indonesian market, FDI inflow should “target non-labor intensive rather than labour-intensive industries” (p. 18). From the perspective of Porter’s Five Forces Framework, this outcome is logical since the threat of new entrants is not relevant if not the most demanded business areas are addressed.

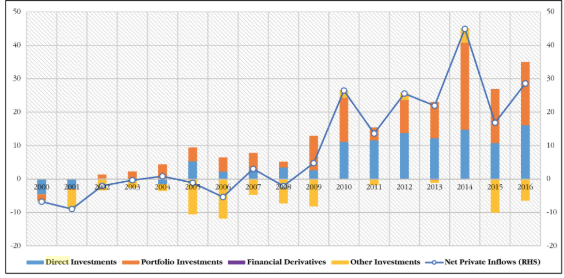

Regarding the SWOT analysis, the main threats were eliminated, and opportunities were partially realized, despite the unfair distribution of investments. When analyzing the outcomes of the work done in the framework of Porter’s Diamond Model, one can note a more advanced cluster structure of the business and less ambiguous development strategies, which was expressed in identifying specific industries to accept foreign investment. Thus, the Indonesian government has been able to partially correct the situation and achieve an inflow of capital into the local business sector. In Figure 4, the dynamics of foreign investment in the country are showed where the X-axis presents years, and the Y-axis presents US$ billion.

Based on the analysis of the case, one can assume that limiting the activities of the market sector due to government monopolization and FDI restrictions affects the economy negatively. The experience of Indonesia is valuable, and by evaluating the mistakes made by the country’s authorities in the 20th century, other states can learn valuable lessons. For instance, for the UAE as a potentially important partner region, the practice of attracting FDI is an important aspect of development.

As Anwar (2016) argues, the state government encourages the creation of free economic zones in which participants have the right to coordinate their activities independently and organize business clusters. At the same time, it is essential to pay attention to the omissions of Indonesia. An equal distribution of foreign capital should be achieved so that all industries and areas in which FDI is involved could have equal growth opportunities for replenishing the state budget.

Main Findings

The key issue raised in the case study in question concerns the inability to secure foreign direct investment in Indonesia’s business sector in the second half of the 20th century when the country gained independence. The emphasis on monopolization was a characteristic feature of the government’s development course, which led to the economic isolation of the state. Among the problems that caused this gap, Porter and Ketels (2013) mention the following challenges:

- Policy uncertainty;

- Financial fraud expressed in corruption;

- An inadequate judicial system;

- Restrictions imposed by the government.

Restrictions on business development led to the fact that the oil and gas sector was the only profitable direction of export trade, and foreign investors were not interested in partnerships with local companies. As a potentially valuable solution, providing greater freedom to entrepreneurs is considered to create a healthy competitive environment. Relevant laws and changes in the market structure helped Indonesia to increase its authority in the international arena and attract foreign capital. Nevertheless, some gaps remained, in particular, the unequal distribution of investment in individual regions. The proposed theoretical models have made it possible to assess the quality of the measures taken and the following achieved implications of the updated market development strategy:

- Long-term investment;

- Stable inflow of money to the budget;

- Impartiality expressed in equal opportunities in doing business;

- Establishing free market relations.

The dynamics of foreign investment prove that periodic fluctuations do not impede the participation of local business representatives in the formation of individual development strategies. The inflow of foreign capital has a positive effect on the country’s GDP and allows for the implementation of modern competition models for the productive work of small and medium-sized companies. In the UAE, business clusters and free economic zones are encouraged by the government, which helps strengthen market relations in the country.

References

Anwar, S. A. (2016). A regiocentric strategy for industrial clusters: Reflections on international business innovations in the UAE. Journal for International Business and Entrepreneurship Development, 9(3), 311-323. Web.

Asmoro, N. D., Ciptomulyono, U., Putra, I. N., Ahmadi, A., & Suharyo, O. S. (2018). Role of the Indonesian navy task unit to supporting technology transfer of submarine by DSME South Korea-PT.PAL Indonesia. International Lournal of ASPRO, 9(1), 74-85.

Baskoro, L. S., Hara, Y., & Otsuji, Y. (2019). Labour productivity and foreign direct investment in the Indonesian manufacturing sector. Signifikan: Jurnal Ilmu Ekonomi, 8(1), 9-22. Web.

Case study investment climate & legal certainty: Semen Indonesia. (2017). Indonesia-Investments. Web.

Djulius, H. (2017). Foreign direct investment and technology transfer: Knowledge spillover in the manufacturing sector in Indonesia. Global Business Review, 18(1), 57-70. Web.

Fang, K., Zhou, Y., Wang, S., Ye, R., & Guo, S. (2018). Assessing national renewable energy competitiveness of the G20: A revised Porter’s Diamond Model. Renewable and Sustainable Energy Reviews, 93, 719-731. Web.

Giap, T. K., Mulya, A., Nursyahida, B. A., & Vania, L. D. (2018). 2017 Annual competitiveness analysis and impact of exchange rates on foreign direct investment inflows to sub-national economies of Indonesia. World Scientific.

Mahadika, I. N., Kalayci, S., & Altun, N. (2017). Relationship between GDP, foreign direct investment and export volume: Evidence from Indonesia. International Journal of Trade, Economics and Finance, 8(1), 51-54. Web.

Porter, M. E. (2008). On competition. Harvard Business Press.

Porter, M. E., & Ketels, C. H. M. (2013). Indonesia: Attracting foreign investment. Harvard Business School. Web.

Sodik, J., Sarungu, J., Soesilo, A., & Rahayu, S. A. T. (2019). The determinant of foreign direct investment across provinces in Indonesia: The role of market size, resources, and competitiveness (Penentu pelaburan langsung asing mengikut daerah di Indonesia: Peranan saiz pasaran, sumber, dan daya saing). Jurnal Ekonomi Malaysia, 53(3), 1-13. Web.