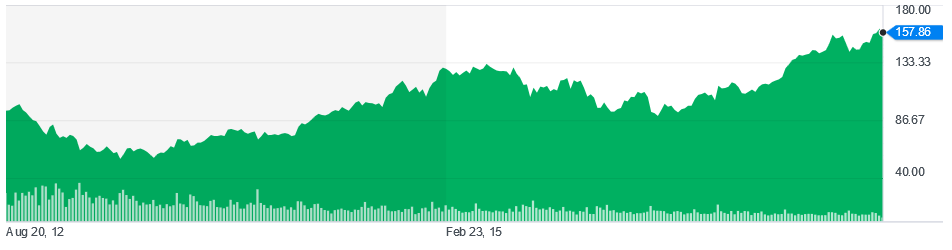

Nowadays, people consider maximizing their investments in long-term, and equity futures are the most effective investment tools that are currently employed in the stock market, as they allow brokers to pay for the current stock price after one year since the actual purchase. Apple Inc. is one of the frontrunners of the technological market that operates under AAPL on NASDAQ platform (Yahoo! Finance, 2017). Its current share price is 158.13, with 0.17% increase (Yahoo! Finance, 2017).

According to the case study, it is assumed that I purchased 100 equity futures of Apple Inc. As a consequence, it could be said that the primary goal of this assignment is to determine whether this investment was rational and evaluate possible potential gain associated with it. It will be assessed with the help of risks of the stocks, its fluctuations, and the financial stability of the price. In the end, conclusions are drawn to summarize the findings of the paper and highlight the ways to increase profits acquired from this offer.

To establish a foundation for discussion, it could be assumed that the price of 100 shares in one year would slightly decrease, and this forecast is based on the dynamics of the prices and general cyclic nature of the stock market.

For example, in 2016, the value of the share experienced a slight downward slope, and despite its rapid growth, a similar situation may incur in 2018. It could be assumed that the price per share will be $150, but this change is insignificant. In turn, this projection is based on the fact that the overall trend is positive and escalating, but it still can be vehemently affected by internal and external forces and various transactions in the stock market.

Another reason for a potential decrease in price for Apple’s share is the intensifying rivalry of the industry. For example, its major competitors, such as Samsung, have well-developed brand images and stable prices per share. Meanwhile, a progressively growing variety of cheaper substitutes has a clear impact on the earnings base and changes the attitude of investors towards the company. This aspect, along with inflation and political and economic fluctuations, may cause severe swings in this market while affecting a share price in a negative way.

Nonetheless, the current price is stable, and these changes may cause only an insignificant decrease in it. Consequently, it may be rational to invest in it, but it will be illogical to consider it as a failure since, in 2018-2019 the price per share is expected to experience growth due to the cyclical nature of the stock market and its rise in the recent future.

In the end, it could be said that the price per share will be lower in 2018 than it is now due to the fluctuations in the stock market and the rising popularity of substitute products. In this instance, to mitigate risks and decrease potential losses, it will be rational to take advantage of the main features of equity futures and invest the expected to be paid financial resources in other projects such as a certificate of deposit.

The price is projected to decrease by 5% at maximum, and it will be rational to invest money ($150,000) in a certificate of deposit with 7% to cover the costs. Nonetheless, not many banks offer it, and usually, the maximum annual rate accounts for 1.7% while investing $159,000 will be logical in this case. Overall, this situation presents the worst-case scenario, and due to a high dependence on the stock price on the internal and external environment, prices may rise.

Reference

Yahoo! Finance. (2017). Apple Inc. (AAPL). Web.