Introduction

One of the primary goals in business is to estimate the potential profitability of projects, and the Internal Rate of Return (IRR) and Net Present Value (NPV) are two practical methods to achieve this objective. Both strategies allow the analysts to calculate the value of initiatives, but they use different initial variables and provide unique metrics. In the present case study, Excel is an appropriate tool for determining IRR/NPV and deciding which of the two projects is more profitable.

Internal Rate of Return and Net Present Value

Before calculating the values, discussing the concepts of IRR and NPV is essential. The former enables an estimation of the project’s profitability and generates a percentage number that indicates the annual growth rate (Agung et al., 2023; Tan et al., 2022). On the other hand, NPV demonstrates the currency value the project is expected to yield (Agung et al., 2023). Therefore, the two strategies have different purposes: to generate unique final metrics and utilize distinct variables since NPV requires specific discount rates for calculations.

Calculations

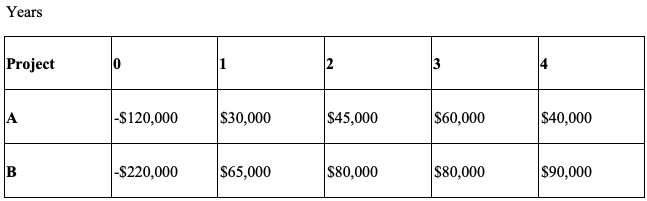

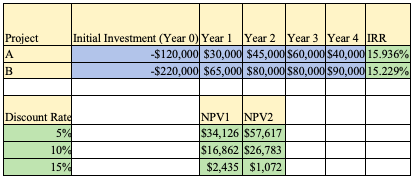

After the brief description of IRR and NPV, it is essential to utilize these methods in Excel to determine which projects are more profitable (see Fig. 2). The first step is a thorough analysis of the input; Year 0 refers to the initial investment (negative) in these projects, while Years 1-4 demonstrate future cash flows (Lohani, 2023). The second step is to use the formula for IRR, the standard Excel function that uses each year’s value to calculate the profitability (Lohani, 2023). In addition, it is plausible to format the cells for IRR metrics and add several decimal places to determine the exact differences between projects.

If the chosen calculation method is NPV, then it is necessary to input the discount rates (DR) in the Table. Consequently, the NPV for Project A can be calculated through the standard NPV Excel function and the addition of the initial investment (Lohani, 2023). Therefore, unlike IRR, which uses the whole row (Year 0 to Year 4), the NPV function utilizes only Year 1 to Year 4 and then adds Year 0 value later. Ultimately, the exact formulas for Project A are IRR (B2:F2) for IRR and NPV (A6, C2:F2) + B2 for NPV (DR=5%).

Analysis and Recommendations

Based on the calculations, it is possible to determine which project is more profitable and under which conditions. Following the IRR strategy, Project A is slightly more profitable (a higher IRR implies higher profitability) (Tan et al., 2022). However, if other discount rates are introduced in the investment predictions, then Project B is more favorable, with DR equal to 5% and 10%. If the DR is 15% (close to the actual IRR), then the conclusion is consistent with the former strategy, and Project A is preferable. Hence, it is recommended that Project A have an unspecified DR equal to 15% and Project B in case the DR is 5% or 10%.

Conclusion

Determining the profitability of projects is a critical process in any business, and the present paper has demonstrated how IRR and NPV can help achieve this objective. Excel provides highly effective and easy-to-use functions to calculate these metrics. As a result, the paper has determined that Project A is a preferable option with an unspecified DR or if it is equal to 15%. At the same time, if DR is 5% or 10%, Project B yields higher profitability. In summary, it is critical to invest carefully after determining the potential viability of the projects via IRR and NPV methods.

References

Agung, T. S., & Zuhri, B. S. S. (2023). Analysis of the financial feasibility of potential post-pandemic businesses using the net present value (NPV), internal rate of return (IRR), and payback period (PP) methods (case study: MSME environmentally friendly bioplastic products). Jurnal Multidisiplin Madani, 3(7), 1432-1441. Web.

Lohani, S. K. (2023). Excel for finance and accounting: Learn how to optimize Excel formulas and functions for financial analysis. BPB Publications.

Tan, Q., Chen, Y., Wang, X., & Zeng, Z. (2022). Studies on the modifications and applications of the net present value and internal rate of return. In 2022 6th International Seminar on Education, Management and Social Sciences (ISEMSS 2022) (pp. 1001-1009). Atlantis Press. Web.