Introduction

Cashflow matching is a critical approach to managing an investor’s portfolio. This method matches a portfolio’s cash inflows and outflows to specific liabilities or future obligations. It helps protect a portfolio from interest rate fluctuations, ensuring investors can meet future financial obligations with certainty. This paper aims to evaluate the effectiveness of the cashflow matching approach for managing a bond portfolio in today’s economic conditions.

Cashflow Matching Approach

Purpose

The cashflow matching approach allows you to balance received funds and expected liabilities. It helps minimize interest rate risk so that the portfolio’s cash flows meet the investor’s requirements and expectations. Moreover, this approach to investment management maximizes the possible return on investment (Jansen and Tuijp, 2021). This approach to portfolio management is often used by institutional investors such as insurance companies or pension funds to balance income and expenses.

Components and Concepts

For the cashflow matching management approach to be as practical as possible, it must include key components. The investor should analyze future financial obligations, including regular payments, debt repayments, insurance payments, or any other financial obligations with fixed requirements (Jhawar, 2023). After this, it is necessary to identify bonds, the profit from which exactly corresponds to the timing and amount of the expected obligations.

An essential concept for this type of portfolio management is duration, which is the relationship between the price of bonds and changes in interest rates. Duration matching helps minimize the impact of interest rate fluctuations (Jansen and Tuijp, 2021). In addition, cash flow matching is an ongoing process that allows you to manage risks, minimize costs, and achieve high portfolio performance indicators.

Drawbacks

However, the cashflow matching approach has several key problems that can affect portfolio performance. Firstly, this method does not entirely eliminate the risk of interest rate fluctuations. If the interest rate deviates significantly from the forecasted indicators, this will affect the portfolio. Second, this approach may limit the availability of liquid assets for unexpected needs or investment opportunities (Jhawar, 2023). Since cashflow matching is used to balance the inflows and outflows of finance, this approach does not provide for saving free financial resources for other investments.

In addition, the complexity of the portfolio management process must be considered. Cashflow matching requires constant monitoring and updating of information in order to be effective (Jhawar, 2023). When a bond in a portfolio matures, reinvesting proceeds at prevailing market rates may be difficult, especially in a low-interest rate environment. Moreover, this approach does not neutralize market volatility and its impact on the portfolio’s value.

Technological Impact

Advances in technology have significantly impacted the approach to portfolio management. First, technology has enabled automating data analytics to gain a deeper understanding of market trends and better assess risks (Jhawar, 2023). Automatic data analytics helps determine the optimal choice of bonds for cash flow matching.

Secondly, using artificial intelligence to construct investment portfolios helps predict movements in interest rates, increasing the accuracy of cash flow matching strategies (Jhawar, 2023). This allows managers to anticipate risks and make decisions based on more accurate analysis. Additionally, cybersecurity developments have made essential contributions to investment portfolio management (Jhawar, 2023). New information security measures help protect portfolios and maintain the confidentiality of investor financial information.

Bond Portfolio

Purpose

When constructing a cashflow matching bond portfolio, it is essential to consider various factors affecting efficiency and return on investment. One of these factors is choosing the right trading strategy. The main goal when constructing a bond portfolio is to maintain a balance between the cash flows generated by the portfolio and the expected financial obligations (Jansen and Tuijp, 2021).

Approaches

Different approaches can be used to achieve this goal. First, analyzing the obligations, including the timing and scale of future payments, is necessary. This will help create a cash flow schedule for obligations and determine the amount required to repay them.

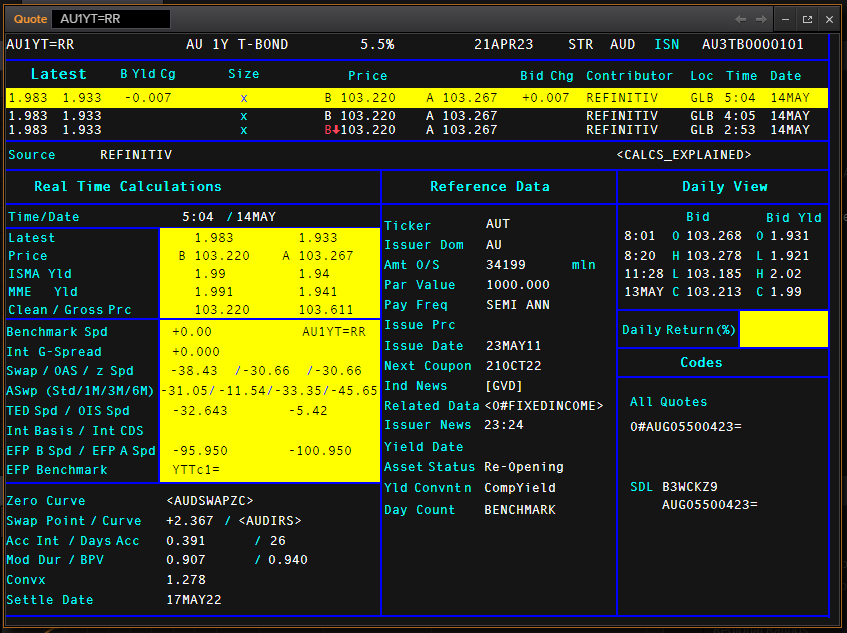

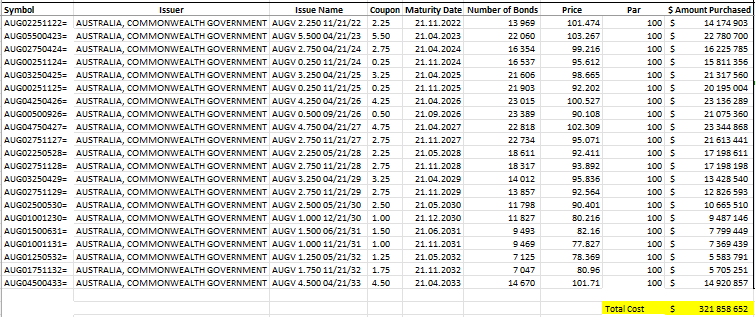

Secondly, after analyzing future financial liabilities, it is necessary to select assets that correspond to the cash flow schedule for liabilities (Jhawar, 2023). When compiling the investment portfolio, the current data about the bond price in Australia was used, presented in Appendix A (Fixed Income, 2023). In addition, to reduce risks, you can adhere to the principle of diversification when compiling a portfolio. This involves investing in different areas to create multiple cash flows for the investor and minimize the risks associated with sudden changes in one of the industries.

Advantages

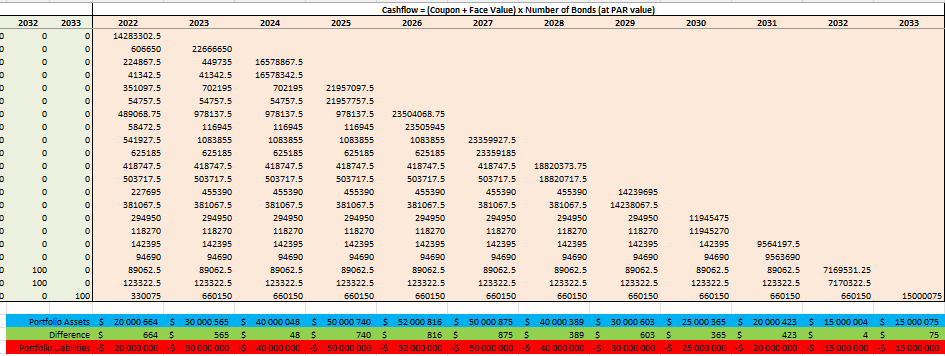

The choice in favor of completed transactions was justified by expectations and requirements for future cash flow. For each year, we selected bonds with coupon payments and maturities that matched the relevant cash flow of the obligation. For example, in 2022, we purchased a 2.25% coupon bond due in November 2022, resulting in an expected liability of $2.25. The number of bonds was set based on the size of the obligations. The main objective was to construct a portfolio so that the present value of cash flows on bonds corresponded to the current value of liabilities (Appendix B). Quotes were selected based on competitive pricing and liquidity (Appendix A).

Findings

The implementation of the chosen trading strategy demonstrated several key findings. First, it showed the importance of careful planning to match assets and liabilities effectively. This implies an in-depth analysis and accurate assessment of financial obligations, allowing us to understand how much financial resources will be required in the future (Jhawar, 2023). Based on this information, you can choose the optimal investments that will help maintain a balance between financial inflows and outflows.

Secondly, the selection of assets for investment requires precision since the slightest deviation can lead to an imbalance. Moreover, it is important to try to diversify your investment portfolio with assets of different classes. This allows you to minimize the impact of market fluctuations on a single asset and as a result, helps reduce risk and meet investment expectations.

Another important observation was the need for constant monitoring and analysis of market conditions. Due to the tendency of the economy to change rapidly, the results initially predicted may not occur (Jansen and Tuijp, 2021). Therefore, a constant analysis of the market situation and revaluation of the portfolio in accordance with changes is necessary to make the necessary adjustments. In addition, there are additional strategies that allow you to secure your investment portfolio, including risk management, asset and crop management in the long term, and consultations with financial experts.

Approaches to Creating Portfolio with Minimal Costs

Creating a portfolio with the lowest possible costs is extremely important for increasing profits and effectively achieving financial goals. In order to create a cost-effective and liquid investment portfolio, it is necessary to take into account various factors and comprehensively analyze market situations.

One of the approaches to minimizing costs is the competitive selection of quotes. This approach allowed us to compare prices and select the most cost-effective quotes for each bond. In addition, in most cases, when forming a portfolio, massive transactions in bonds were carried out. This reduced transaction costs, including commissions and brokerage fees. Another way to reduce costs is to use electronic trading platforms. They usually provide access to a large selection of bonds and have lower fees.

Moreover, to reduce costs, it is important to ensure minimum portfolio turnover. Selecting bonds that closely match the cash flow schedule of the obligations and avoiding unnecessary trading can significantly reduce transaction costs. Another important factor is the size of the portfolio, which should match his goals (Jhawar, 2023). In addition, investing in different share classes has improved cost efficiency by increasing the strength of the portfolio. Diversification is one of the most common ways to insulate a portfolio from the impact of external changes in the market.

The main purpose of the portfolio was to match the cash flows generated by the bonds with the expected future liabilities. There are 14 main fixed-income shares available for purchase on the Australian market (Fixed income, 2023). During portfolio planning, the amounts of financial obligations for several years in advance were determined, and bonds were selected to potentially provide financial inflow to repay obligations. This provides a high degree of confidence in meeting future obligations.

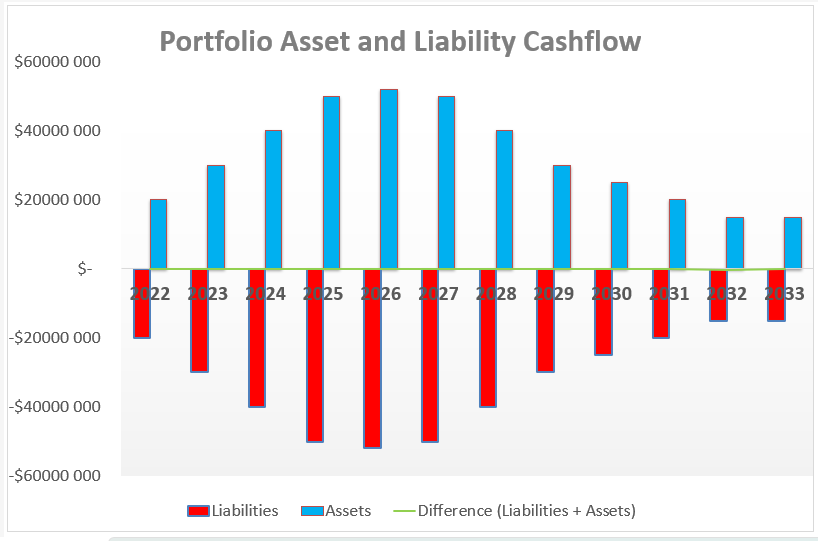

The total cost of creating the portfolio was $241,970,247, which is the maximum optimal amount to guarantee payment of liabilities. Appendix C presents the relationship between liabilities and assets achieved through the portfolio. The diagram shows a clear relationship between these indicators with minimal differences (Appendix C). The difference between portfolio assets and liabilities for each respective year is minimal, indicating that cash flows from bonds closely match expected liabilities.

When compiling the portfolio, a high level of bond diversification was achieved, due to which investments are more resistant to changes in interest rates and market volatility. Moreover, the portfolio is structured to be flexible in changing market conditions. This is necessary to achieve your goals and ensure portfolio liquidity in the long term. Using a cashflow matching approach to building an investment portfolio helped ensure its efficiency and minimize costs while simultaneously guaranteeing timely repayment of financial obligations in full.

Conclusion

In conclusion, building a bond portfolio requires careful market analysis, as well as in-depth knowledge to predict future investment results. Using a cashflow matching portfolio management approach allows you to balance financial inflows and outflows, maintaining the organization’s financial efficiency and ensuring that it fulfills its financial obligations. This implies that the type and quantity of assets for investment are selected in such a way that the income from them covers the obligatory expenses of the company.

The compiled investment portfolio takes into account various factors that made it possible to achieve the optimal ratio of assets and liabilities with minimal costs for the organization to create and maintain the portfolio. The portfolio considers potential risks associated with changes in market conditions and is also focused on the long term. This approach to investing is optimal for various institutional organizations that have regular financial obligations of significant size and seek to compensate for them through investment.

Reference List

Fixed income (2023). Web.

Jansen, K. and Tuijp, P (2021) ‘A survey of institutional investors’ investment and management decisions on illiquid assets’, The Journal of Portfolio Management, 47(3), pp. 135-153. Web.

Jhawar, V. (2023). Portfolio immunization vs. cash flow matching: What’s the difference? Web.

Appendix A

Appendix B

Appendix C