International exchange rates are globally accepted charges per unit for exchanging dissimilar currencies. These rates are prone to change after every second. Several factors trigger alterations in the rates at which currencies are converted. These include inflation, deficits that a country has in its current accounts, the interest rates, debts that the country owe the public, peace within the country, and the conditions that the country gives to other trade partners whenever they want to trade (Tauline, 2008).

Instabilities in exchange rates have several effects on decisions made during the trading process. These include loss of market and unwillingness to compete with businesses dealing in exportation.

For example, a country that engages more in importation than exportation will create a weak international market for the products it manufactures locally. This is because its currency will be weaker against those for foreign countries. Global investors should make decisions on investing in countries that do not import more products than the goods they export (Hisrich, 2010).

Countries with strong currency tend to export less products than countries with weak monetary values. Strong currencies demands extra units when trading. This means that exports will be costly for foreign countries, making them buy fewer commodities than they would have bought when they purchased the same goods from countries that have weak monetary values.

For example, Japan may be willing to purchase products from the USA. The US dollar is stronger against the Japanese Yen compared to South African Rand. Japan will choose to import the products from South Africa because it will pay less compared to when it imports from USA. Global investors should reconsider their decisions of investing in countries that have stronger currencies (MacDonald, 1999).

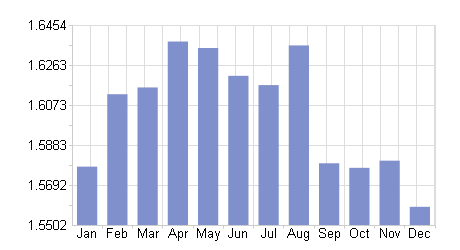

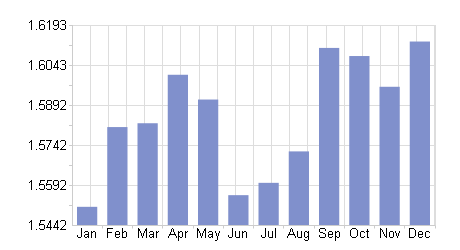

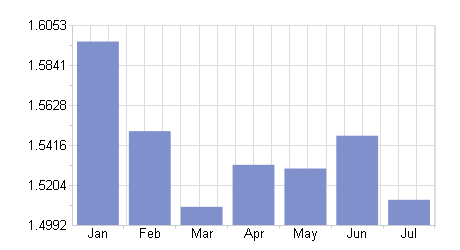

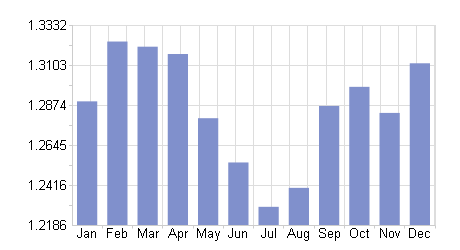

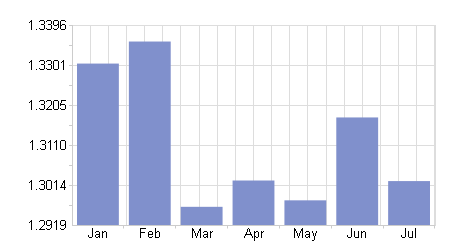

From the trend in the rates of exchange, it would make sense to manufacture products in the USA and ship to Germany or England. This is because the dollar remains weaker compared to the two currencies, which will make the products sell at cheaper prices in Germany and England. Exports of the product will then increase (X-RATES, 2013).

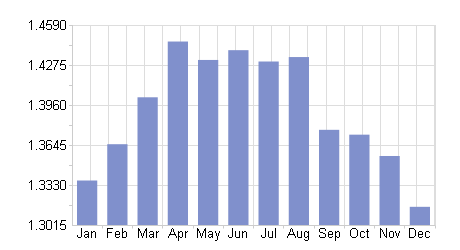

The Yuan is not floating freely in the world market. The result of it floating freely would be the weakening of the dollar against it, which has not been the case. The Yuan is still weaker than the dollar. The impact of this on global trade is China’s production of cheaper products than the USA, which is because of dollar’s strength against the Yuan. This is what makes China grow its international market at a faster rate than the USA (MacDonald, 1999).

In conclusion, exchange rates can be both advantageous and disadvantageous. Countries should be careful with what they import to avoid importing excessively at the expense of their exports.

This will caution them against loss of value of their currencies. Global investors should analyze the trends in the rates of currency exchange to avoid investing in countries that will only lead them to losses. It is not advisable to invest in countries that have very strong currencies. They do not perform well in exportation of goods because other countries choose to import their products from those that sell at cheaper prices.

References

Hisrich, R. D. (2010). International Entrepreneurship: Starting, Developing, and Managing a Global Venture. Thousand Oaks: SAGE Publications Inc.

MacDonald, R. (1999). Equilibrium Exchange Rates. New York: Springer.

Tauline, M. J. (2008). Exchange Rates: Dynamics, Expectations and Adjustment. New York: Nova Science Pub Incorporated.

X-RATES. (2013). Monthly Average. Monthly Average, 1-6. Web.