Introduction

This paper is aimed at investigation of the risk assessment during the acquisition, focusing on management assessment and analytical evaluation. These tools are rather significant to evaluate key resources and competencies necessary to consider the implementation of the organizational goals. Considering that this is the continuation of the primary research in which several managers were surveyed in order to reveal their attitudes towards risks levels, it is possible to provide appropriate evaluation of the results of the survey. In particular, this paper will analyze the post-acquisition risks both from internal and external points. The representatives of Expert Future Cargo can be regarded as the external focus of the assessment while CLA Company as the internal one. After the evaluation, the paper will present a strategic dashboard associated with acquisition of Expert Future Cargo by CLA Company that, in turn, is likely to contribute to the successful completion of the acquisition process and the further productive collaboration.

Risk Typology

One can distinguish between several risk types each of which can cause significant damages. However, it should be emphasized that the level of the potential damage of these risks varies. The list of essential risks to the acquisition of the identified companies is presented below.

- Operational risk is associated with ineffective performance of staff, failure to manage systems and procedures, or impact of external factors. For example, such issues as fraud, improper trade, unfair employment, and others can be noted.

- Strategic risk involves failure to provide effective business strategy. The examples of this type of risk can contain vague corporate vision or poor business decisions.

- Reputational risk is a threat to the image or standing of a company. Every employee, manager, or partners can cause this type of damage.

- Financial risk is associated with potential losses occurred due to inappropriate financial techniques and procedures that can lead to debt or default.

- Legal risk implies failure to follow regulations and obligations related to law.

Analysis of Survey Results

Before starting the analysis of the survey results, it seems necessary to provide some insights into the fundamentals of risk analysis. In particular, it usually consists of four steps: threat, crisis, disruption, and impact. The threat might be identified as an assessment of the probability of threats based on known statistics of occurrence of similar security incidents in the past. The crisis is a demonstration of a risk. Each crisis is marked by certain degree that shows a possible likelihood of events (based on statistics). This degree is used in the risk assessment. Disruption is created by crisis. Precisely speaking, it occurs due to the shortage or unavailability of critical resources and varies between very low and very high. The risk impact is a measure of the severity of the negative effects, the level of damages, or assessment of the potential of risk. Impact assessment includes not only the calculation of direct damages as a result of the implementation of threats. It is more convenient to talk about the extent of the impact in the range from low to extreme. Moreover, such additional factors as life concern or asset loss should be taken into account as well.

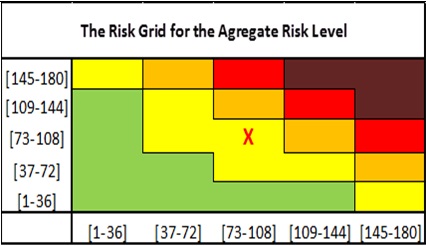

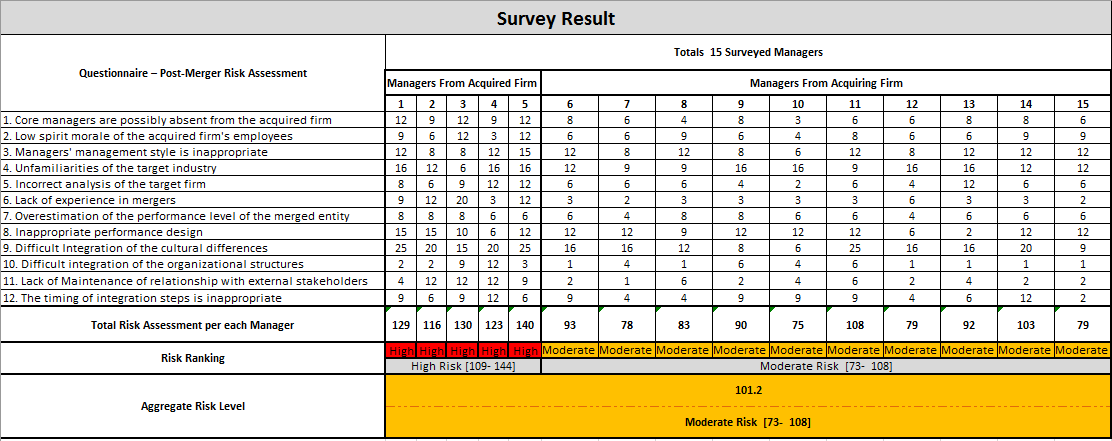

The following table presents the overall survey results.

The importance of acquisition is defined by the need to adapt the organization to the requirements of the internal and external environment and learn new knowledge and technology which is principally significant. 5 surveys were assessed as those having high level of stress, 10 surveys as moderate, and no survey identified low risk. According to the results, the managers from the acquired firm believe that risk levels are high and identify it ranging from 116 to 140 points. Among the most crucial aspects, there are difficulties in integration of cultural differences. In particular, all the managers evaluated the above issue, giving it from 15 to 25 points.

Such a negative reaction of employees can also fear them by losing positions, rejection to cooperate, and generation of new conflicts. At the same time, the lowest risk is associated with inappropriate timing. The managers concern that the implementation of the acquisition is too rapid. Nevertheless, slowness in decision-making and vague and responsibility obligations within the acquisition process can cause failure of some unit or even of the whole organization (Weber, 2012). Also, the presence of significant amounts of hierarchical levels between staff and decision-making delays the process of the acquisition. Moreover, these delays in the decision-making process, particularly in such a dynamic field as acquisitions, often turn not only in considerable financial costs but also the loss of opportunities for successful synergy.

In their turn, the managers from acquiring company consider the risk level as moderate, ranging from 78 to 108 points. The highest risk they concern about relates to difference of cultural peculiarities while integration of structures as well as the lack of maintenance of relationships with stakeholders represents the lowest risk. However, the lack of proper control over the process of organization as a whole leads to the absence of a system of indicators that would measure the success of the acquisition and the degree of achievement of objectives along with subsequent integration with the distribution of responsibility.

Taking into account that the majority of managers from both firms regard cultural differences as essential ones, it seems especially important to point out cultural barriers and their adverse impact on the organization’s performance. Under the cultural differences, one can understand not only the differences in nationality but also differences in corporate culture of the merging companies. The diversity workplace assumes people from different countries or people with different ethnicities, beliefs, and background. As a result, employees have various styles of communication. It creates misunderstandings that need to be addressed. The communicative barriers often occur due to the different traditions and world views but, what is more important, due to different communicative styles. Besides, underestimation of cultural peculiarities leads to the possibility of resistance both during the negotiations and the integration phase.

Analysis of the Analytical View

It goes without saying that there are advantages to using a sophisticated algorithm assigning relative weights to each of the risk in defining its potential impact. It helps to identify and analyze all the possible risks, assess the probability of occurrence of a risk, detect any negative effects for a person and society in general, and make the ranking of risks by degree of importance. At this point, internal and external analysis helps to determine the opportunities and threats for the company (Weber, 2012). It gives the company time to forecasting capabilities, for preparing the plan in case of unforeseen circumstances, time for the development of an early warning system for possible threats, and the time to develop strategies that could transform old threats in any profitable opportunities (Fraser, Simkins, & Narvaez, 2015). In terms of assessment of these threats and opportunities, analysis of the role of the environment in the analytics competition process lies fundamentally in response to specific issues including the following ones: organization mission, its tools to achieve the goal, and the ethics of the corporative management.

The classification of risk focuses on its distribution in accordance with certain features. This can be explained by the fact that the classification created primarily to organize the risks and all the other tasks of risk management should be tackled in the next stages of the process of risk management. In this regard, there is an urgent need to establish a risk classification as multitasking tool to the object of management, contributing to the identification of risk effects and ways to manage risk effectively, defining the area of responsibility of those involved in management as well as having mechanisms of adaptation to the peculiarities of the activities of various organizations.

The experts identify strategic, programming, financial, environmental, technological, operational, human resources, legal, reputational, and other risks. In this case, the simultaneous use of all the above types of risk associated with the following problem: the majority of private risks are unique and can be simultaneously classified as several types, and become a completely new type of risk which creates additional difficulties in the identification and management. In order to mitigate this problem, the paper will consider only five types of risks: strategic, financial, operational, legal, and reputational. On the one hand, these types of risk can be separated from each other, necessary for formalizing this border. On the other hand, the risk of any particular organization can be assigned to one of these types of risks. In order to create visibility that helps to understand the point better, the risks will be discussed in bullet points.

- Operational risk. The main component of operational risk is unauthorized transaction, errors in the work of staff, and violations and malfunctions of computer networks and equipment. It becomes evident from the survey results that such aspects as “the low spirit morale of the acquired firm’s employees” regarded as having a high level of risk. Also, 3, 6, 8, 10, and 12 questions belong to operational risks and represent its increased importance.

- Strategic risk. This is the risk of losses resulting from errors or deficiencies admitted in decision-making, defining business strategy, development, and insufficient account of possible hazards that can threat the organization. In this case, questions 4, 5, 7, 8, and 10 belong to strategic risk that is rated as high to moderate.

- Reputational risk. This type of risk refers to the risk of losses occurring as a result of reducing the number of customers because of the negative image from the society. According to the survey, potential reputational risk involves financial instability, low quality of services. The reputation is a public assessment of the organization’s strengths and weaknesses which develop under the influence of a variety of factors. It seems that 2, 4, 5, 6, 9 questions relate to this risk and present a high level.

- Financial risk. This is the possibility of losses due to unfavorable development and modification of the financial markets. The modeling and control of this risk require the use of accurate analysis tool based on mathematical models. The questions 5, 7, and 12 relate to this type of risk that is rated as high to moderate.

- Legal risk. This type of risk is managed in order to identify, measure, and determine the acceptable level of legal risk through continuous monitoring and adoption of measures to support legal risk at a level that does not threaten the financial stability of the organization. The exclusion of the company’s involvement and participation of its employees in unlawful activities including proceeds from crime and terrorist financing. The questions number 4 and 8 relate to this type of risks and presents moderate level.

Overall Assessment and Recommendation

Speaking of the theory of punctuated equilibrium and connecting it with the acquired and acquiring companies, it is necessary to point out different perceptions of their staff. The overall risk of synergy of two companies was evaluated as moderate by the representatives of the acquiring firm and as high by managers of the acquired company. At this point, change management is a key factor in the successful implementation of the quality system and organization development as a whole. As a rule, the impetus for change is a crisis. In this case, it should be emphasized that the reorganization is not an end in itself, but a means to implement new tasks and activities. The priority objective of change is achieving better results, namely, the development of advanced techniques, the elimination of routine operations, and the implementation of progressive changes in the management system. In fact, the organizational recommendations for development can be determined as a long-term, thorough, and comprehensive process of change and development of the organization and employees (Holloway, 2014). The process is based on the training of all employees through direct interaction and transmission of practical experience. The overall purpose of these changes is to improve the performance of the organization and quality of work at the same time.

- In order to minimize operational risk and avoid possible losses, it is possible to recommend providing investigations on a regular basis by the identification and collection of data concerning both internal and external factors of operational risk. Based on the information generated, it is necessary to create the analytical framework involving recorded information on the types and sizes of operating losses in the context of the acquired organization, certain operations and other transactions, and the circumstances of their occurrence and detection.

- In terms of strategic risk, appropriate information communication should be provided to the employees of the acquired firm as changes in the management could frighten them. The acquisition is never easy and accompanied by several complications. It seems that there is a need to create training guidance in order to make restructuring and summarize strength and weaknesses of the effective team building. Third, some problems night appear with the effectiveness of the working process. Therefore, it is of great significance to keep a check on employees, in particular, their time management and effective resources utilization. Moreover, management of the acquiring company is to realize that it can face incomprehension of the employees and even resistance as the style of a new can be different.

- Seeing that cultural differences cause the highest concern among both representatives of the acquiring firm and the acquired one, it is essential to suggest certain recommendations as well. First of all, it seems essential to consider all the cultures working for the company or for the department in the case of a large company. Special meetings and programs aimed at understanding of each other might be quite effective in avoiding misunderstanding. It is also important to develop appropriate management strategies to be sure that communicative messages are accurately received and correctly understood. According to Tashakova (2011), a founder of Academia of Human Potential, there are several measures promoting the effective communication in the diversity workplace (para. 9). In particular, the employer should raise cultural awareness and tolerance of employees’ teaching them empathy. Tashakova (2011) states that all the managers should provide a policy of integration and engage employees in the workplace communication (para. 9). Besides, it is necessary to use no metaphors and slang as they can have no sense or even be offensive for the other culture representatives. In addition, asking for feedback and using intermediary are useful tools in establishing safe and friendly workplace.

In conclusion, it should be stressed that nowadays extremely increased pace of life dramatically raises the need for effective acquisition management in organizations. It should be stressed that the further implementation of the acquisition management should be systematic and structured and the communication process between the managers and the employees should be on a high level as the effectiveness of acquisition largely depends on a manager. Furthermore, it is of great importance to employ a comprehensive approach to address potential risks. In other words, to provide an effective synergy, it is necessary to consider several aspects instead of focusing on the single one. As a result, the acquisition process is likely to be completed without significant losses and perspective post-acquisition successful collaboration.

Strategic Dashboard

In order to integrate the analysis conducted in this paper, it seems appropriate to create a strategic dashboard.

References

Fraser, J., Simkins, B. J., & Narvaez, K. (2015). Implementing enterprise risk management: Case studies and best practices. Hoboken, NJ: Wiley.

Holloway, G. (2014). Change management: New words for old ideas. New York, NY: Xlibris.

Tashakova. O. (2011). Workplace communication and cultural diversity. Web.

Weber, Y. (2012). Handbook of research on mergers and acquisitions. Cheltenham, MA: Edward Elgar.