Introduction

Background

The business world today is going through a painful metamorphosis of financial meltdowns and economic upheavals. Big multinational companies such as the Lehman Brothers, Morgan Stanley, Bear Stearns, Washington Mutual, and Merrill Lynch have been left gasping for survival by the current wave of financial crisis, with some already falling into the doldrums of extinction (Pitzke, 2008). This unpleasant wave, coupled with competition for customers in an ever-shrinking market, calls for businesses to come up with new and innovative ways of maintaining old customers while at the same time developing strategies aimed at bringing new customers to the staple (Renee, 2007).

Customer loyalty translates to profitability for the company. According to Rese (2003), a general relationship exists between customer retention and customer satisfaction, and subsequently to the level of profitability of a business enterprise. Firms will most likely record impressive profits if customer satisfaction is integrated in everyday day running of their activities as a key business strategy.

Business managers need to realize that their customers are their most valued assets. According to Thomson (2002), no business entity has ever been known to exist without customers. Businesses in all sectors – retail, manufacturing, financial, service, and technological – have to deal with customers at one point in time. Ensuring their satisfaction therefore becomes a core strategy used to propel firms and enterprises into profitability and growth in today’s competitive market. Renee (2007) argues that customer satisfaction entails a holistic understanding of how a customer feels after buying a product or service from a dealer and, in particular, whether or not such a product or service satisfies the client or customer according to his or her own expectations. If used effectively, it has the ability to offer sustainable competitive advantage to businesses.

The Study Context

Located in the Middle East, Saudi Arabia occupies just about 80 percent of the Arabian Peninsula. The 2006 provisional population estimates positioned the country at 27, 019,731, with yearly growth rate of 2.18 percent (“Library of Congress,” 2006). According to provisional estimates by the CIA, the population would have surpassed 28, 686, 633 in July, 2009 (CIA, 2009). The population is distributed mainly along with major cities around the country, providing the much-needed clientele to local and international companies operating in the areas.

The telecommunication industry for instance has recorded monumental growth due to the concentration of people in cities. Riyadh, the capital city, has 3.6 million residents; Jeddah, 2.9 million; and Mecca is third with 1.6 million residents. The city of Dharam has 1.6 million residents, while Medina has around 854, 000. The country has a healthy economy that experienced enormous growth from 2003 through to 2005. However, the economy still remains largely reliant on the production and exportation of oil.

Saudi Arabia has made profound advancements in nearly all the key sectors in the telecommunications industry. Of particular concern for this study is the sector of cellular telephony, which has recorded impressive growth and rapid diffusion levels within the last decade. According to Stevenson (2009), Saudi Arabia, Turkey, and Iran represent up to 70 percent of total cellular connections in the whole of Middle East. In the same vein, Saudi Arabia is the second-largest market in the region, representing almost 15 percent of total connections in the Middle East. In March 2007, it was estimated that the country had 21.5 Million subscribers of cellular phones, translating to 89 percent penetration rate. Presently, the penetration rate has exceeded 100 percent.

This unprecedented growth has seen several companies set bases in the country in the hope of making some profits for their stakeholders. The most prominent ones are Saudi Telecom Company (STC), Mobily, Zain, and Bravo. These firms have come with divergent policies and strategies to maintain their customer base, while trying to recruit new clients in the rapidly expanding market. Of importance to the companies is the realization that the mobile market in Saudi Arabia has become more dynamic and competitive in the face of extremely high penetration rates. The strategies employed by individual companies, including customer satisfaction and loyalty will therefore go a long way in determining the market share of each one of the companies. STC, Zain, and Mobily were evaluated in this study.

Statement of Problem

During the past couple of years, the mobile market in Saudi Arabia has risen from strength to strength, reaching dizzyingly high subscription and penetration levels towards the end of 2007. The high penetration rate reveals that customers have positively identified with the services being offered by the four main mobile network operators in the country. The expanding Saudi economy, fuelled by Oil sales, may also have had contributed positively towards the exponential growth of the mobile telecommunications industry since a growing economy means that people will have more money to spend. Still, the rigorous marketing strategies employed by companies offering mobile telephone services, coupled with the cut-throat competition among the service operators to control the market may also have contributed to the speedy growth of the sector in Saudi Arabia (Stevenson, 2007). One thing is clear though; there is a huge market share out there for companies to grab and translate into profitability.

Organizations the world over succeed by going out of their way to perform optimally what matters most to their own clients. However, the interest exhibited by organizations in maximizing customer satisfaction does not automatically mirror corporate altruism (Allen, 2004). Indeed, an interest in clients and customers is almost always egocentric as it is done with the explicit purpose of enhancing businesses to reap some tangible benefits. The underlying principle is that satisfied customers yield greater profits to the company.

Numerous studies have been undertaken regarding the satisfaction of individual customers. However, nothing much is yet to be known regarding organizational-wide practices with respect to client and customer satisfaction (Allen, 2004). To promote the development of further knowledge, this study concerned itself with evaluating the factors that make the customers to be satisfied from the organizational perspective by looking at the budding telecommunications industry in Saudi Arabia.

Objectives of the study

The general objective of the study was to explore the various factors and strategies that contribute to customer satisfaction from an organizational point of reference by evaluating several mobile network operators doing business in Saudi Arabia. The following were the specific objectives:

- Establishing if the products and services offered by organizations can effectively take ownership for driving, developing and maintaining customer satisfaction and loyalty priorities for whole organization

- Establishing the benchmarks and strategies used by organizations to ascertain if the services they put on display satisfies their customers

- Exploring whether employee satisfaction through incentives can play a significant role in successful client satisfaction program.

- Exploring if staff recruitment and on job training programs on customer service translates to better customer service and satisfaction.

Key Research questions

The study was guided by the following research questions:

- Can the development of an aggressive customer satisfaction policy put the products and services offered by an organization in a central, customer-oriented role within the whole organization?

- What, between staff attitudes, quality of products and services, and pricing, mostly affects and influences the type and nature of relationships that customers establish with organizations?

- Are the money and resources used by organizations to develop and maintain customer satisfaction justifiable empirically?

Value of the Study

The value of this study can never be underestimated. Businesses all over the world are suffering under the weight of poor or inadequate customer satisfaction strategies aimed at harnessing the immense opportunities arising from retaining business clients and customers. This study came up with a body of knowledge that could effectively be used by business managers to arrange their core business processes around the demands, needs, and requirements of their prestigious customers. In addition, results generated from the study can be used by businesses to boost their profitability as a satisfied customer is a worthy asset to the organization (Fojtik, 2009). Indeed, the pursuit of customer satisfaction should be treated like any other profit-driven investment.

Review of Related Literature

The General Overview

The telecommunication industry in Saudi Arabia is as robust as her economy. The privatization of the sector was largely accomplished in 1998 (“Library of Congress,” 2006). Presently, Saudi Telecommunications Company, employing over 70,000, dominates the sector. Saudi Arabia has an up-to-date and expanding telephone system, with over 3.6 million main lines by 2004 (“The Library of Congress”). Presently, it is expected that this number has grown by 10-15 percent.

But perhaps one of the areas that have recorded substantial growth and rapid diffusion is the cellular mobile telephone sector. By the end of 2004, over 9 million Saudi citizens were using cellular phones (“The Library of Congress,” 2006). According to Stevenson (2009), the average market penetration of mobile phones in Saudi Arabia was around 89 percent by the end of 2007. Saudi Arabia, along with Turkey and Iran represented just about 70 percent of all mobile telephone connections in the Middle East. According to Stevenson, the country is the second-largest market in the Middle East, representing about 15 percent of total connections in the region.

By the end of 2006, Saudi Arabia has already surpassed the 20 million mobile phone connections mark. Available estimates reveal that the mobile telephony market grew by another 20 percent in 2007. Today, penetration rates have surpassed the 100 percent mark. This has been made possible by the proliferation of companies offering the service, and the cut-throat competition for customers that ensues. Below, a number of these companies are sampled.

Saudi Telecommunications Company (STC)

Background

Saudi Telecom (STC) commenced its commercial operations in 1998 as the country’s sole telecommunication operator with over six hundred thousand subscribers. In 2000, the telecommunication giant had 1.4 million subscribers, and the number surged to 2.5 million with the introduction of its prepared card called Sawa, later on in the same year (STC, 2009).Towards the end of 2002, the government sold off 30 percent of STC shares to Saudi citizens and organizations. By the end of the subscription period for the IPO, requests for the much-coveted shares exceeded the number offered by 3.5 times. The company had in excess of five million subscribers by the time it was listed on the Saudi Stock Exchange.

In 2005, STC was ranked the country’s fourth-largest company in terms of market capitalization, with over 12 million mobile subscribers and over 3.3 million fixed lines. Presently, the company covers about 98 percent of Saudi Arabia, and is a major shareholder in Arab Satellite Communications Organization. This company deals in satellite communications and digital television broadcasting. STC also holds shares in the renowned satellite-based mobile telephone company called Thuraya Satellite Telecommunications Company.

Customer Satisfaction Strategies for STC

Customer Satisfaction before Competition

Prior to July 2004, STC used to operate a monopoly in the telecommunications industry, having to be the sole operator from the time the industry was liberalized in 1998. The Saudi government granted the second mobile operator license to Etisalat, owners of Mobily, in 2004, initiating a new competitive age for STC. Immediately after the liberalization of the telecommunications industry was undertaken, STC drew a 5 year period transformation program based on clearly articulated objectives. Activities for the first phase, known as diagnostic phase, were undertaken in 1998. The second phase extended from 1999 to 2000, and was known as design phase. The third and fourth phases, referred to as consolidation and implementation phases respectively, took place between 2000 and 2003 (STC, 2002).

In all the phases in the strategy paper, customer satisfaction was viewed as a crucial component towards achieving economic breakthrough. This was done through addition of value to customers through reduction of tariffs for both mobile and fixed landline charges; service innovation; service segmentation; servicing quality; brand equity building; and fast-tracking the telecommunication market, including distribution channels (STC, 2002). Although STC practiced a monopoly during this time, the above strategies used in customer satisfaction enabled the firm’s client base to grow from 600, 000 in 1998 to over 2.5 Million in 2000. This in turn enabled the company to achieve an average growth rate of 14 percent for the three years from 1998 to 2000. Increased growth rate was expected to continue.

Customer Satisfaction after competition

The introduction of the second mobile telephone operator in 2004 brought the need to reshape and restructure customer satisfaction strategies practiced by STC in the hope that this could help maintain its immense clientele base, in addition to recruiting new ones. In this respect, STC engaged in aggressive marketing strategies after the introduction of Mobily into the market. The company had to implement cost-effective strategies to maximize and add value to its mobile network, in addition to boosting bottom-line revenue (“Telecommunication Report,” 2009). It had to learn how to effectively deal with increased data traffic and emerging technologies that enhanced customer satisfaction. These strategies were being implemented with the explicit aim of locking up the STC market share to potential competition from Mobily.

In addition to the strategies it was using before introduction of competition, and which are mentioned above, the telecommunication giant engaged in other ventures that added customer value to its services. For instance, in 2008, STC signed a five-year sponsorship contract with English premier league leaders, Manchester United, to provide fans, otherwise known as customers, with exclusive content including goals, news updates, and fashionable ring tones (STC, 2009). In addition to being one of the organizations offering the lowest tariffs on 3G technology, STC came up with other value additions for their services aimed at maximizing customer satisfaction. These included mobile TV, Internet accessibility over mobile phones, and video calls.

The company also diversified its products and services to ensure that every customer was well catered for. Presently, products and services on offer include prepaid subscription plans, monthly post-paid subscription plans, roaming services, Multi-Media Service, WAP, fixed line services, Internet, 3.5 G services, VSAT services, and Blackberry oriented mobile services (“Telecommunications Report,” 2009). Having realized that the youth are the future of the Telecommunication industry, STC has come up with one of the most enticing prepaid packages targeting the youth aged between 18 and 25. The results have been impressive for STC. Today, the company through its mobile services provider, ALJAWAL, has a customer base of over 17 million. Through its residential lines unit, ALHATIF, the organization serves over 4 million landline customers. Latest figures indicate that STC has about 73 Percent of the telecommunications industry’s market share (“Telecommunication Report”).

Customer Expectations before Mobily’s Entry

According to Sharp, Page, and Dawas (2000), measuring customer satisfaction in organizations operating in a monopoly is of no relevance at all. Also, organizations operating in a monopoly should not be worried about customer loyalty. In most instances, such organizations engage in customer satisfaction practices to keep up with the regulator’s requirements rather than for purpose of maintaining customers. It is therefore imperative to note that though customer satisfaction and expectation strategies had been included in the original blueprint guiding STC immediately after the industry’s liberalization in 1998, customer preferences , needs, and wants, could not take precedence over other crucial organizational processes during that time.

During the period between 1998 and 2004, the market forces of demand and supply within Saudi’s telecommunications industry were controlled by the monopoly service provider – STC. The demand for mobile cellular services was very high, and could not be sufficiently matched by the supply of quality mobile services. Emphasis was not laid on what the customers wanted but rather what the organization was able to offer to the customers (Brown, 2007). In the landline unit, customers could not be offered the telephone lines on demand but rather had to wait for years to be connected. The customers had no choice other than to accept what was being offered by STC. Indeed, it was a challenging task for one telephone service provider to provide communications requirements to the entire Saudi population.

Customer Behaviour after Mobily’s Entry

The second mobile operator to hit the Saudi telecommunication sector was licensed in 2004, heralding an end to the monopoly of STC in the sector of mobile services provision. Mobily, as it came to be known introduced competition in the industry and gave customers the space of choice (Jinfeng & Chaoyang, 2006). This meant that customers could exert their needs, expectations, and preferences; and service providers, especially STC, had to re-organize their strategies to revolve around the needs of customers rather than the organization. In short, they had to map out key consumer expectations and correlate them with their products and services delivery in order to maintain their market share. The beneficiaries of the competition that ensued were customers as they enjoyed a wide range of products and services, reductions in tariff rates, and value-added services.

Mobily

Background

Mobily is the official telecommunication arm of Etihad Etisalat, and is engaged in the provision of a converged line of mobile and data services in Saudi Arabia. It is the second organization to be granted an operational license for mobile services, after the Saudi Telecoms Company. The organization has managed to wrestle substantial number of customers from STC due to its excellent record in quality service delivery and value addition. Towards the end of 2008, the company had a customer base of eleven million customers, representing almost 43 percent market share in the mobile services sector in Saudi Arabia. Although it is the second mobile network operator, it was the pioneer in offering 3G services in the country. (Prasad, 2008). Besides offering GSM services, the company also offers 3 and 3.5 G voice and data services, including multimedia streaming with speeds of up to 7.2 mbps.

Market Penetration for Mobily and Customer Satisfaction

Mobily entered the Saudi telecommunications market at a time when mobile penetration level was below 40 percent (Prasad, 2008). It was granted a license to operate in Saudi Arabia in 2004, and began its roll-out in earnest in 2005. There was a lot of potential for growth due to huge number of individuals and companies in need of quality communication products and services, not to mention the fact that the Saudi economy was booming during that period. However, challenges presented themselves by way of the fact that Mobily was committing itself into a market that had been dominated by a monopoly for nearly six years.

The answer to this challenge came in the form of coming up with products and services that had been tailor-made to fit the specific needs and requirements of customers. It scored a first by introducing the high-speed 3G internet services into the market, enabling customers to enjoy access to the internet even while on the move (Prasad, 2008). Presently, Mobily is planning on how they will launch another service that will give customers their value for money due to its fast internet speed of up to 14.4 mbps.

Mobily was also able to penetrate the Saudi telecommunications market by coming up with innovative products and services that answered the particular needs of all the age groups within the market, especially the youth and high-end users (Prasad, 2008).

Such services included live calls, high-speed internet connections, live TV, multiplayer gaming, and Video/ Audio on-demand streaming services. Many of these services were unheard of prior to Mobily’s entry into the Saudi market. It could therefore be said that successful entry into the market for Mobily was dependent on trying to identify with the needs and aspirations of the customers, and going out of its way to ensure that all these needs are met.

The firm segregated the market, following the fundamental basics of customer satisfaction more than anything else. This made it possible to come up with services that answered the needs of the corporate and high-value customers on one hand, and lifestyle-based offerings on the other hand. Mobily’s marketing strategy revolved around the conviction that each market segment in society has unique needs and characteristics. The needs of a student are uniquely different from those of a frequent traveler. The diversification worked wonders for the company in terms of customer satisfaction.

Competition between Mobily and STC

The kind of competition between the two telecommunication giants operating in Saudi Arabia ensured that the customers were the biggest beneficiaries. It was clear to STC that offering poor services in the face of this competition will see their customers cross over to Mobily’s mobile network, an objective that the company’s management was less likely to implement. On the other hand, Mobily led between the lines from the very onset and started to produce and market their products and services using strategies of customer satisfaction and quality service diversification. This ensured their entry into a market that had exceedingly been monopolized by STC (Ramkumar, 2007). The first six months of Mobily’s operation saw it amassing around 2.2 million mobile subscribers, making it the fastest-growing organization in the whole of North Africa and the Middle East in terms of customer acquisition during the first year of operation.

Zain

Background

Formerly known as Mobile Telecommunications Co. (MTC), Zain is the pioneer mobile operator in the Middle East, and the second-largest Kuwaiti organization in terms of market capitalization. It ventured into the Saudi telecommunications industry as the third mobile phone operator in 2008. The company posted a net loss of about $204.1 million during its first quarter, a situation termed as normal for any organization venturing into the telecommunications industry due to its massive requirements of capital and market expenditure during the start-up phase. However, industry analysts project that Zain will be back into profitability by 2010 (Patricia, 2009). Zain recorded a seven percent share of the market within the first four months of operation.

Zain’s Competition Strategies

Competition in a market where mobile penetration rate is thought to be in excess of 100 percent can often be bruising for a start-up company. However, this was not so for Zain, thanks to the strategies employed by the company, directly targeting the customers. One of the company’s packages going by the name of ‘You pay we pay’ saw the company garner 966, 000 subscribers during the first two months in operation. This package was all about maximizing customer satisfaction in that, customers’ phones were credited for free with the exact amount of airtime that the customers could have paid for during the previous month. This was to be a lifetime offer for the first 500,000 customers (Patricia, 2009). This way, Zain was able to penetrate a seemingly saturated mobile market in Saudi Arabia. This package, according to industry analysts sought to heighten value in the market.

A supplementary launch offer made by Zain in its attempt to penetrate the Saudi market came in the form of a double Zain SIM pack, whereby calls between the two numbers were charged at a low premium rate (Patricia, 2009). This again centered on maximizing the value for customers, while offering them the opportunity to enjoy lower tariff rates. When one of the two accounts was recharged, the customers’ phones were credited with 100 percent bonus credit split between the two SIM cards. This customer satisfaction strategy also helped Zain to penetrate and effectively compete in the market.

Zain’s Customer Satisfaction Strategies

The telecommunication giant actively developed customer satisfaction through the development and delivery of a high-end network quality system, in addition to undertaking a rapid network roll-out Programme that enabled customers to trust the organization as a reliable, responsible, and caring partner (Zain, 2008). It was also the promise of Zain to pay special attention to the requirements of their customers with the explicit aim of offering exceptional service quality and customer care.

Conclusion

The above case studies seem to point to the fact that customer satisfaction is an integral component necessary for the growth of organizations the world over. The telecommunication industry is a sensitive one since it directly deals with offering services to the customers. Failure to meet their needs and requirements may therefore prove detrimental to the very tenets that govern an organization. An analysis of the Saudi Arabian telecommunications industry has proved beyond reproach that offering services that are tailored to meet the needs, aspirations, and expectations of customers are the best way to go for any organization intending to make a headway in the ever-competitive business environment.

Methodology

Theoretical Framework

Perhaps one of the most persuasive empirical associations between customer satisfaction and organizational profitability revolves around the American Customer Satisfaction Index (ACSI) model. Developed in 1994, the ACSI model is comprised of 3 primary objectives. First, the model has the ability to measure or quantify the quality of an economic output while relying on subjective client input. Second, the model has the ability to provide a conceptual structure used in understanding how the quality of product or service relates to economic indicators (Allen, 2004). Finally, the ACSI business model has the ability to provide a forecast of future economic predictability by measuring the intangible importance of buyer-seller relationships.

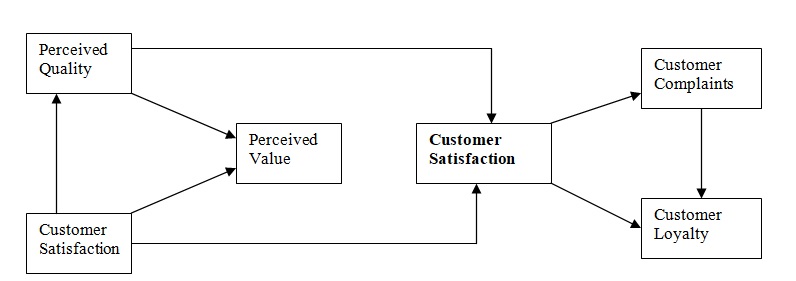

The ACSI model is of the argument that casual progression begins with client expectations and professed quality measures, which cumulatively affect the perceived value of a service or product, together with customer satisfaction (Allen, 2004). According to the model, customer satisfaction has two precursors: customer complaints and customer loyalty. The latter is quantified in terms of price forbearance and client retention. In the same vein, the model argues that companies values repeat customers as a representation of substantial profit base. Consequently, customer satisfaction and retention, explained as the reported repurchase probability, forms a strong forecaster of profitability. It is therefore imperative to argue that the model, as it is used today, can effectively confirm the associations among quality service, client satisfaction, and financial performance (Allen). Below is a diagrammatic representation of the ACSI model of customer satisfaction

Research Design

This study utilized qualitative research methodology to explore the various interplay of factors that necessitated customer satisfaction at an individual and organizational-wide level by evaluating and analyzing the telecommunications industry in Saudi Arabia. The companies targeted for the study included Saudi Telecommunications Company, Mobily, and Zain. The study utilized the qualitative research design in its attempt to generate descriptive information about the strategies and policies used by these telecommunication giants in their attempt to control the immense and ever-expanding market in the region. Qualitative research design was also used in trying to establish the benchmarks for success in customer satisfaction. Finally, the research design was used to come up with organizational indicators that could be used to correlate profitability and customer satisfaction.

Qualitative research designs are useful when the respondents are too multifaceted to be answered by a straightforward yes or no hypothesis (“Experiment Resources,” 2009). The research designs can also be utilized to effectively understand a product or service through the eyes of the customers, in addition to undertaking an in-depth exploration of the customers’ experiences and expectations (Beadley, 2007). These types of research designs are also easier to plan and execute, and also useful when budgetary assessments have to be factored in.

According to Chenail, George, Wulf, Duffy, and Charles (2009), qualitative research design is the best tool to be used when the aim of the study is to gather an in-depth understanding of human characteristics and behavior, including the reasons that govern such behavior. This is the objective of this study; to try and understand the factors behind customer satisfaction. The design is best at investigating the why and how, not just the what, where, and when.

Target Population

The target population for this study included customers or subscribers of the three firms offering telecommunication services in Saudi Arabia – STC, Mobily, and Zain. These were either males or females, knowledgeable enough to give an account of what makes them feel satisfied. The target population for this study also included customer relationship managers of the three companies, or their representatives. This group was specifically chosen to shed light on organizational-wide management practices and strategies that are being constantly used by the organizations for purpose of offering maximum customer satisfaction.

Methods of data collection

Primary data was collected through the use of personalized in-depth interviews. There were two sets of structures for the in-depth interviews, one for the customers and the other for customer relationship managers or their representatives within the selected telecommunication industries. In the structures, focus was laid on trying to bring out all the underlying factors that informed customer satisfaction from an individual’s as well as the organizational point of view. In the same vein, factors that directed individual’s choice of one Telecommunication Company over the other, including the factors that informed the interrelationship between individual customers and the organizations were sought.

In-depth interviews are effective in exploring perspectives of a particular thought, program or situation (Boyce & Neale, 2006). In addition to conducting an extensive review of the companies involved in the study, secondary data was also collected from the administrative data of these telecommunication companies in the form of call volumes data and fact-sheets relating to customer feedback. According to Beadley (2007), customer feedback – including complaints, suggestions, and complaints – can be effectively used to reveal current areas for improvement as well as in the identification of the suitability of customer satisfaction strategies in organizations.

Study Limitations and Constraints

Although there are many other telecommunication industries in Saudi Arabia, this study was limited to studying the three named organizations, – STC, Mobily, and Zain. Therefore, while the design may provide the basis for generalization of the study findings with regard to customer satisfaction strategies in the above-named companies, the same cannot be done on other telecommunication companies operating within Saudi Arabia. A more comprehensive study would have shed more light on the factors that make customers feel satisfied, in addition to the relationship between customer satisfaction and organizational profitability.

Results

Introduction

This study aimed at exploring the factors that made customers be satisfied from an organizational-wide perspective as well as from an individual customer’s perspective. The study relied heavily on the analysis of Saudi Arabia telecommunications industry with specific reference being made on three companies that offered mobile services in the country – Saudi Telecoms Ltd., Mobily, and Zain. In that effect, semi-structured in-depth interviews were conducted on subscribers who used the products and services of the above-named companies. A different set of semi-structured in-depth interview schedules was administered to customer relationship-building managers of the three companies, or their representatives.

The in-depth interviews were centered around trying to understand the multifaceted thought processes, behaviors, attitudes, values, and interpersonal dynamics that informed the practice of customer satisfaction, and if such satisfaction translates into economic well-being for organizations. The analysis of the interviews brought several interrelated themes based on the objectives of the study as well as the questions that guided the study.

Strategies used by companies to achieve Customer Satisfaction

The underlying themes arising from the study revealed that all the executives were in agreement that customer satisfaction was an engine for economic growth for organizations in today’s competitive environment. According to them, monopoly hurt competition as it effectively made the customers lack the freedom of choice and independence. According to one representative of STC, the company was indeed making more money than it used to during the monopolistic days as it had effectively learned to diversify its products and services around the needs and requirements of its customers.

After careful analysis of the qualitative data, it was clear that all three companies had engaged in rigorous development and introduction of value-added services into the market for the explicit purpose of maintaining a foothold in the competitive telecommunications market. This was being done through the introduction of services such as Mobile TVs, Internet accessibility over mobile phones, Video calls, and Video and Audio Streaming services. Through thoughtful probing, it was revealed that such services were not the primary core businesses for the organizations but were rather meant to keep customers satisfied.

Another theme that came up strongly regarding the topic of interest is service segmentation. Industry players were all in agreement that optimum customer satisfaction was only possible in highly segmented markets as the needs and aspirations of one segment are always totally different from those of another segment. In this respect, all companies under the study reported having come up with enticing prepaid or post-paid packages targeting various segments in society. All the executives agreed to have used age and income as the basis of segmenting the market.

Service innovation and servicing quality were other themes that arose during the process of data analysis. Zain’s representative argued that it was the former that enabled them to penetrate into a market that seemed flooded. Mobily was able to penetrate the market due to the fact that it engaged in offering innovative products and services that answered the needs of all age groups within the market (Prasad, 2008). Due to their innovation of the ‘You pay we pay’ package, Zain was able to amass for itself a 7 percent market share within the first two months in operation (Patricia, 2009).

The quality of services offered was also of great importance as all the industry players were in agreement that voice clarity during calls made the customers stick with the preferred network provider. To win customer satisfaction, for instance, Zain had heavily invested in a high-end network quality system together with a rapid network rollout Programme. All the service providers were in agreement that exceptional service quality and customer care were key ingredients towards attaining optimum customer satisfaction. Other themes that arose from the study regarding the factors by which customer satisfaction could be achieved include reduction of tariffs, brand equity building, and improving distribution channels.

All the company executives were in agreement that customer satisfaction directly translates into increased profitability for the organizations. Some underlying themes resulting from the study also revealed that companies do invest huge amounts of money for on-the-job training of their employees on proper customer handling and care. Zain and Mobily had an extensive training Programme for new staff members that run a span of two months, while STC had an intensive one-month training Programme for their new members of staff. This underlines the great importance and value that the firms hold on ensuring optimal customer satisfaction. Members of staff were also remunerated relatively well to motivate them in service delivery.

Customer satisfaction from the Customers’ Perspective

All the customers interviewed for the study were in agreement that various interrelated factors had to be put into play to achieve the desired customer satisfaction. To them, businesses must always encourage face-to-face dealings with their clients, in addition to exercising an open door policy where customers can always have access to relevant staff to answer their queries and clarifications (Thomson, 2002). Most respondents were in agreement that members of staff dealing directly with the customers must be friendly and approachable. Messages coming from the customers must also be responded to promptly to keep them well informed. Respondents said they felt irritated when they were kept waiting for days for a response that could have taken hours to formulate.

In addition to above, many respondents targeted for the study argued that businesses must always maintain an explicitly defined customer service policy. Respondents also argued that it was the function of business managers to anticipate the needs of their customers, and go out of their way to help them achieve those needs and requirements. Attention to detail and honoring your promises also serve to facilitate customer satisfaction.

Discussion

The bottom line for this study is that people tend to seek gratifying experiences while avoiding the painful ones. They will therefore tend to return to business enterprises that meet or surpass their needs and requirements whilst avoiding business entities that fail to meet them (Hill, Roche, Allen, 2007). It is therefore imperative for business managers to come up with products and services that meet the needs and requirements of the customers. The prepaid card introduced by STC called Sawa saw the customer base within the organization plummet from 600, 000 in 1998 to 2.5 million in 2000 (STC, 2009). Such growth is crucially important for the long-run development and sustenance of a business entity.

Many solutions have been given regarding what really makes a customer to be satisfied and therefore maintain loyalty to the organization. From the organizational side, factors such as cost reductions, service innovation, service segmentation, servicing quality, aggressive marketing strategies, effective use of emerging technologies, and value-added services have all been advanced. This study can therefore serve as a point of reference for business managers who want to improve their business systems using the above-named processes. It should always be remembered that there is a firm correlation between quality, customer satisfaction, and financial performance according to the ACSI model of customer loyalty (Allen, 2004).

The customers have spoken too. According to them, face-to-face dealings should be the norm rather than the exception when working towards effective customer satisfaction. Businesses must always maintain properly defined customer service policies. Such policies ensure that customers are kept in the know about the operations of the company thereby eliminating the annoyance that customers have to put up with when they are being shuffled from one person to another during their stages of inquiry about a product or service (Thomson, 2002). Anticipating the needs and requirements of customers is advantageous for business managers in that such an action always reinforces the rapport between the business and customers, ensuring that customer loyalty is maintained in the process.

Works Cited

Allen, D.R. Customer Satisfaction Research Management. 2004. American Society for Quality. Web.

Beadley, S.P.T. (2007). How to Measure Customer Satisfaction: A Tool to Improve the Experiences of Customers. Web.

Boyce, C., Neale, P. Conducting In-depth Interviews: A Guide for Designing and Conducting In-depth Interviews for Evaluation Input. 2006. Web.

Brown, SL. What is “The Customer Expectation Paradox?” 2007. Web.

Chenail, R.J., George, S., Wulf, D., Duffy, M., & Charles, L.L. “Qualitative Research Design.” The Qualitative Report, Vol. 13, No. 2. (2009).

CIA. The World Fact Book: Saudi Arabia. 2009. Web.

Experiment Resources.com. Qualitative Research Designs. 2009. Web.

Fojtik, C. Calculating the Strategic Value of Customer Satisfaction: What do your Metrics Tell You? Web.

Hill, N., Roche, G., & Allen, R. Customer Satisfaction – The Customer Experience through the Customers Eyes (1st ed). Cogent Publishing. 2004. Web.

Jinfeng, B. & Chaoyang, L. “Studies on the Evolution of Market and Customer Behaviour.” Systems, Man, and Cybernetics, Vol. 1, Issue 5, pp 220-225. (2006).

Library of Congress – Federal Research Division. Country Profile: Saudi Arabia. 2006.

Pitzke, M. US financial Crisis: The World as we know it is Going Down. 2008. Web.

Patricia, M.L.E. Zain Saudi’s Q1 Loss Narrows to $ 204 Million. 2009. Web.

Prasad, U. Mobily all Set to Offer Wimax Services in Saudi Arabia. 2008. Web.

Ramkumar, I. “STC, Mobily, fight it out for Big Slice. Arab News. Web.

Rese, M. “Relationship Marketing and Customer Satisfaction: An Information Economics Perspective.” Marketing Theory, Vol. 3, No. 1, pp. 97-117 (2003). Web.

Renee, H. Marketing: customer Satisfaction. 2007. Web.

Saudi Arabia: Internet Usage and Marketing Report. 2008. Web.

Sharp, B., Page, N., & Dawes, J. A New Approach to Customer Satisfaction, Service Quality and Relationship Quality Research. 2000. Web.

Saudi Telecom Corporation. Telecom Privatization and Learning’s in the Kingdom of Saudi Arabia. 2002. Web.

Stevenson, M.T. The evolution of Mobile Phones in Saudi Arabia (Present and Future). 2007. Web.

Telecommunication Report Saudi Arabia. 2009. Web.

Telecommunication Companies Saudi Arabia. 2009. Web.

Thomson, A. Customer Satisfaction in 7 Steps. 2002. Web.

Zain. Strategy. 2008. Web.