Background

The transfer of ownership of goods and services from one person to another is a historical practice. It was named as barter, exchange, and currently known as trade between two or more parties. People exchange their goods and services for other goods, remuneration, and services.

In the current era, the local trade has evolved into international trade that plays a significant role in developing and strengthening global economies. International trade includes the exchange of capital, goods, and services between different countries by governments, companies, and individuals. It has a significant influence on the gross domestic product of any country.

There are many studies that have focused on factors affecting the trade (World Trade Organization 17). There are various economic theories that explain the fluctuations in the trade of countries by identifying different fundamental economic principles/factors. Ricardo is of the view that technological differences between countries cause variations in the trade (Ricardo 356). Heckscher and Ohlin suggest that labor, natural resources, and capital affect the overall trade (Heckscher and Ohlin 196).

The current trade theory explains that countries that have a high level of consumption of certain goods and services would create an export advantage for other countries, and this is the main cause for growth and earnings for these countries (Ricci and MacDonald 17).

In the same way, the current study identifies and correlates factors that affect the trade of African countries. The study covers fifteen African countries are selected for analysis including Algeria, Benin, Cote d’Ivoire, Egypt, Ghana, Kenya, Mauritius, Morocco, Sierra Leone, South Africa, Uganda, Namibia, Seychelles, Sudan, and Tanzania.

Objectives

The objectives of the study are as follows.

- To conduct a literature review of micro and macroeconomic factors affecting trade of countries.

- To investigate the impact of micro and macroeconomic factors on trade of the selected African countries using statistical tools and methods.

Literature Review

The section provides a detailed discussion of different economic factors and their impact on the trade i.e. exports and imports of different countries. It includes findings of the existing literature related to the research topic and develops a conceptual framework to test the variables identified in the current study.

International trade and its complexities are long studied and are the focus of debates all over the world. Various researchers have identified and explained different factors affecting the international trade, and they are of the view that the combination of these factors influences the overall trade of a country.

In 2014, Khan, Azim, and Syed studied the impact of the exchange rate and its volatility on the total trade of Pakistan. The researchers use a data set from 1970 to 2009 and apply least square regression. The study reveals that the overall trade of the country decreased during the period due to the use of US dollar as the currency for exchange. The outcomes of the study also show that the bilateral exchange between the US and Pakistan did not have any impact on Pakistan’s trade.

The researchers recommend that the use of domestic currency when trading with low-income countries (Khan, Azim and Syed 34). Nicita highlights the importance of exchange rate for improving the trade performance of a country. The researcher states that the volatility of exchange rates may cause fluctuations in the international trade, balance of payments, and economic performance. The data set for the research constitute of 10-year data of 100 countries from 2000 to 2009. The study outcomes indicate that the exchange rate misalignment must be reduced to overcome the economic challenges and issues relating to the negative balance of payment (Nicita 5).

Fontagne states that globalization has contributed significantly to the increase in foreign direct investments. The researcher uses quantitative measures to determine the relationship between trade and foreign direct investments in OECD countries. The data set collected for the study data from 1997 to 1999. The results of the study by Fontagne reveal that the relationship between trade and foreign direct investments is a complex one.

Foreign direct investments and international trade by OECD countries have a positive relationship, and the degree of relationship has increased after the mid-19th century (Fontagné 25). Another study by Liu, Burridge and Sinclair (2002) also helps to understand the relationship between the economic growth, trade, and direct or inwards foreign investments in China. The results show that total foreign direct investments, exports, and economic development in China are correlated with each another in a positive manner (Liu, Burridge and Sinclair 1437).

Cambazoglu and Gunes (2016) determine the relationship between FDI (foreign direct investments) and exchange rate and its impact on the overall trade. The motive of the research is to identify and test the reciprocal relationship between various economic factors. The dataset for the study includes time series data from 2007 to 2015 of Turkey. The study outcomes indicate that there is a long-term co-integration between the two factors and they have a significant and positive impact on the international trade of Turkey (Cambazoglu and Gunes 289).

Mohsen studies the relationship between the openness of trade, GDP, and a population of Syria. The data set for the study is drawn from a period 1980-2010. The co-integration test is applied, and the results show that there exists a positive relationship between investment and trade openness of Syria. The outcomes also highlight that GDP and population are also positively and significantly related to trade openness of Syria (Mohsen 22).

Nicholson studies the impact of Value Added Tax (VAT) on the level of trade. The primary objective of the paper is to explore the implication of VAT on the trade that allows a refund of domestic taxes and also imposes taxes on imports of foreign products. The results of the thorough analysis reveal that the implementation of VAT has a positive impact on trade competitiveness of the United States.

The results also show that the impact of VAT varies in different sectors and industries of the US. The researcher states that the results do not explain that VAT applicable in the US increases its trade (i.e. exports) and suggests other statistical implications to support its findings. The results also present that the implementation of VAT in other countries has a positive impact on the US economy (Nicholson 755). There is no specific study that explains the impact of taxes on international trade and overall trade. The researcher uses the variable to identify whether there is any relationship between taxes on international trade and trade in African countries.

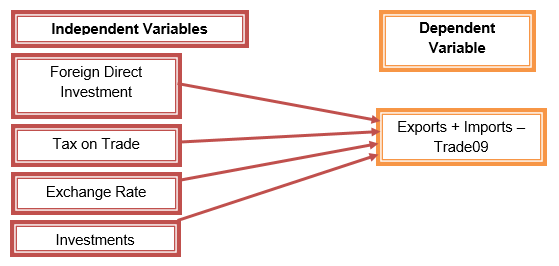

The literature review explains that exchange rate, foreign direct investment, local investments, and taxes on international trade have significant relationships with the trade. Based on the literature review, it can also be noticed that no study has been undertaken to understand the impact all these factors on trade in African countries, and therefore, the researcher includes all four variables as independent variables in the current study. The dependent variable for the study is trade value (export + import) of 15 African countries.

Based on the literature review, the following conceptual framework is formed for the current study. The relationships are investigated using regression analysis in Microsoft Excel. It is a statistical tool to identify the relationship and its significance with the help of numerical values derived from different sources.

The following hypotheses are set up for the current study based on the conceptual framework.

- Hypothesis 1:

- H0: There is an insignificant relationship between FDI and Trade.

- H1: There is a significant relationship between FDI and Trade.

- Hypothesis 2:

- H0: There is an insignificant relationship between Tax and Trade.

- H2: There is a significant relationship between Tax and Trade.

- Hypothesis 3:

- H0: There is an insignificant relationship between Exchange Rate and Trade.

- H3: There is a significant relationship between Exchange Rate and Trade.

- Hypothesis 4:

- H0: There is an insignificant relationship between Investments and Trade.

- H4: There is a significant relationship between Investments and Trade.

The hypotheses investigate different microeconomic and macroeconomic factors that could affect trade of any country (Nicholson; Mohsen; Fontagné 1-30; Khan, Azim & Syed 62).

Methodology

The section provides information about the methodology adopted for the current research. The study design, data collection, and data analysis tools and techniques are identified to explain the way the current study collects, tests, and interprets data.

Quantitative analysis is undertaken in the current study to investigate the impact of micro- and macro- economic factors on the trade of African countries. Fifteen countries are selected, and their data is collected from various sources. The use of quantitative approach allows the researcher to use statistical methods to analyze data and present findings of the study. The results of regression analysis are interpreted and discussed to draw useful conclusions.

Table 1. Final Data for Testing.

Two different websites are used to collect data for the study. The data of independent variables is collected from the official website of the World Bank. The website offers data of several economic indicators for different countries (The World Bank par.1). Additional information is collected from the website of PWT Releases (PWT 8.0), the website provides data of income, output, and productivity of 167 countries (University of Groningen). The website is used to collect data of relevant micro- and macro- economic factors for the current study.

Table 2. Overall Data.

Quantitative research requires data collection and application of statistical methods. The data analysis tool used in the current study is MS Excel. The statistical technique used in the current study is regression analysis. The reason for using regression analysis is that it investigates relationships between variables that are identified in this study. The outcome of regression analysis identifies the direction and strength of relationships between micro- and macro- economic factors and trade of African countries in the year 2009.

The p-value obtained is compared with the confidence interval of 95% (alpha= 0.05) to determine the significance of the relationship. If the p-value is less than 0.05, then the relationship between dependent and independent variables is significant, and the null hypothesis is rejected. On the other hand, if the p-value is greater than 0.05, then the relationship is insignificant, and the null hypothesis is accepted (Freund, William, and Wilson 146). Based on the results of regression analysis, the study accepts or rejects hypotheses and forms a discussion on the research topic.

Findings and Discussion

The findings of the study are obtained from regression analysis that is implemented to test the relationship between micro- and macro- economic factors and trade of African countries. The results of regression analysis help in identifying factors that have a significant impact on trade between African countries and these results are compared with the findings of previous studies.

Table 3. Regression Statistics.

The table provided above indicates the degree of prediction of regression analysis. If the value of R-squared is less than 0.3, then the regression analysis is considered weak. If the value of R-squared is between 0.3 and 0.7, then the degree of regression is moderate. If the value of R-squared is greater than 0.7, then the regression model is considered to have a high degree of reliability and accuracy. The current value of R-Squared is 0.557 than is greater than 0.3 and less than 0.7, therefore, the reliability of regression analysis is moderate.

Table 4. ANOVA.

The table of ANOVA indicates the overall significance of regression analysis. The value of significance measured by F must be lower than.05. If the value is greater than.05 than the regression model does not represent significant results. The value of significance F is.064409 that is greater than.05. Therefore, it can be stated that the regression model does not generate significant results. The coefficient table is analyzed to investigate the relationship between the variables/factors of the study. The coefficient table provides information about individual factors and their relationship to the trade.

Table 5. Coefficients.

The researcher considers coefficients and p-value to investigate the relationship between variables and its significance respectively. The coefficient of FDI indicates a negative value of -2.43. The negative sign shows that an increase in FDI leads to a decline in the trade of African countries. The p-value is.027 is less than.05 that suggests that the relationship between FDI and trade is significant. The results of tax on international trade and exchange rate show negative values of.08 and.004 respectively.

These indicate that the level of trade declines in African countries when the tax on international trade and currency exchange rate against US$ increase. The significance value (i.e. p-value) is greater than.05 that means that the relationships are not significant. Finally, the relationship between investment and trade show a positive and moderate relationship as the value of the coefficient is.50. However, the significance level is not achieved.

The overall results of regression analysis show that only the relationship between FDI and trade is positive and significant, and all other variables including tax on international trade, exchange rate, and local investment show no significant relationship with the trade.

Discussion

Based on the findings of the study, it could be indicated that FDI has a significant positive relationship with trade, and therefore, the null hypothesis of the study is rejected, and the alternate hypothesis is accepted that is H1: There is a significant relationship between FDI and Trade. The outcome contradicts the findings of Fontagné who determined a positive relationship between these variables in OECD countries (25).

The findings present that investment by foreign businesses is the only significant factor that increases trade of African countries. On the other hand, the results indicate that other factors including tax on international trade, exchange rate, and local investment have an insignificant relationship with the trade. Therefore, the null hypothesis is accepted for all independent variables except FDI that suggest that an insignificant relationship is present between dependent and independent variables of the study.

The results of the study are contradictory with those identified in the literature review. The current study finds a positive but insignificant influence of local investments on trade, whereas, Mohsen finds a significant positive relationship between the variables in Syria (Mohsen 22).

The relationship between exchange rate and trade in the current findings are negative and insignificant, whereas, Khan, Azim, and Syed identified a significant and negative relationship between the selected variables in Pakistan (Khan, Azim and Syed 31). Finally, the results of the study indicate that tax on international trade in African countries has an insignificant and weak relationship with the overall trade. The results show that the null hypothesis is accepted that is H0: There is an insignificant relationship between tax and trade).

The outcomes of the study show that the impact of economic factors in developed countries is different from African countries. The FDI has a positive and significant impact on trade, whereas, all other factors have no significant relationship with the trade.

The research study suggests that there are other micro- and macro- economic factors that may have an impact on trade of African countries, and future researchers can include these factors in their study. The research also highlights that the degree of relationship between FDI and trade is also confusing as Fontagné finds a positive relationship between FDI and trade in OECD countries (Fontagné 25). The researcher also suggests that the number of African countries can be increased in future research studies to obtain better results.

Conclusion

Based on the findings of the current study, it is concluded that comprehensive literature is available that identify various micro- and macro- economic factors affecting the overall trade of countries. The current study considered Foreign Direct investment (investments by other countries and individuals), exchange rate, local investment (for example investments by government, the private sector, and public investments), and taxes on international trade.

The results of regression analysis indicate the relationship between trade and micro and macroeconomic factors. The findings indicate that FDI has a negative, significant relationship with the trade of African countries. Other factors, including taxes on international trade, exchange rate, and local Investment do not have any significant relationship with the trade. The results contradict studies discussed in the literature review but as the data of African countries does not indicate the same effects of micro- and macro- economic factors on trade.

Works Cited

Cambazoglu, Birgul and Sevcan Gunes. “The relationship between Foreign Direct Exchange Rate and Foreign Direct Investment in Turkey.” Economics, Management & Financial Markets 11.1 (2016): 284-293. Print.

Clausing, Kimberly A. “International Tax Avoidance and U.S. International Trade.” National Tax Journal 59.2 (2006): 269-287. Print.

Fontagné, Lionel. “Foreign Direct Investment and International Trade Complements or Substitutes?” OECD Science, Technology and Industry Working Papers 1.3 (1999): 1-30. Print.

Heckscher, Eli Filip and Bertil Gotthard Ohlin. Heckscher-Ohlin trade theory, Massachusetts: MIT Press, 1991. Print.

Khan, Abdul Jalil, Parvez Azim and Shabib Haider Syed. “The Impact of Exchange Rate Volatility on Trade: A Panel Study on Pakistan’s Trading Partners.” The Lahore Journal of Economics 19.1 (2014): 31–66. Print.

Liu, Xiaohui, Peter Burridge and P. J. N. Sinclair. “Relationships between economic growth, foreign direct investment and trade: evidence from China.” Applied Economics 34.11 (2010): 1433-1440. Print.

Mohsen, Adel Shakeeb. “The Relationship between Trade Openness and Investment in Syria.” Journal of Life Economics 2.2 (2015): 19-27. Print.

Nicholson, Nichael W. “The Impact of Tax Regimes on International Trade Patterns.” Contemporary Economic Policy 31.4 (2013): 746-761. Print.

Nicita, Alessandro. “Exchange Rates, International Trade, and Trade Policies.” United Nations Conference on Trade and Development 56.1 (2013): 1-23. Print.

Ricardo, David. On the Principles of Political Economy, and Taxation. London: John Murray, 1821. Print.

Ricci, Luca Antoni and Ronald MacDonald. Purchasing Power Parity and New Trade Theory, Washington: International Monetary Fund, 2002. Print.

World Trade Organization. Factors shaping the future of world trade, Geneva: World Trade Organization, 2013. Print.