Introduction

An infographic will be found, and four phrases describing the message will be prepared. Excel charts will be created, and this Excel dashboard will have four charts to answer different queries regarding a given subject. Each chart is intended to give information to assist the reader in gaining insights into the issue. Each chart will be accompanied by a three-sentence narrative explaining the issue that the chart is attempting to answer, the information that the chart is communicating, and why the information is presented in this manner.

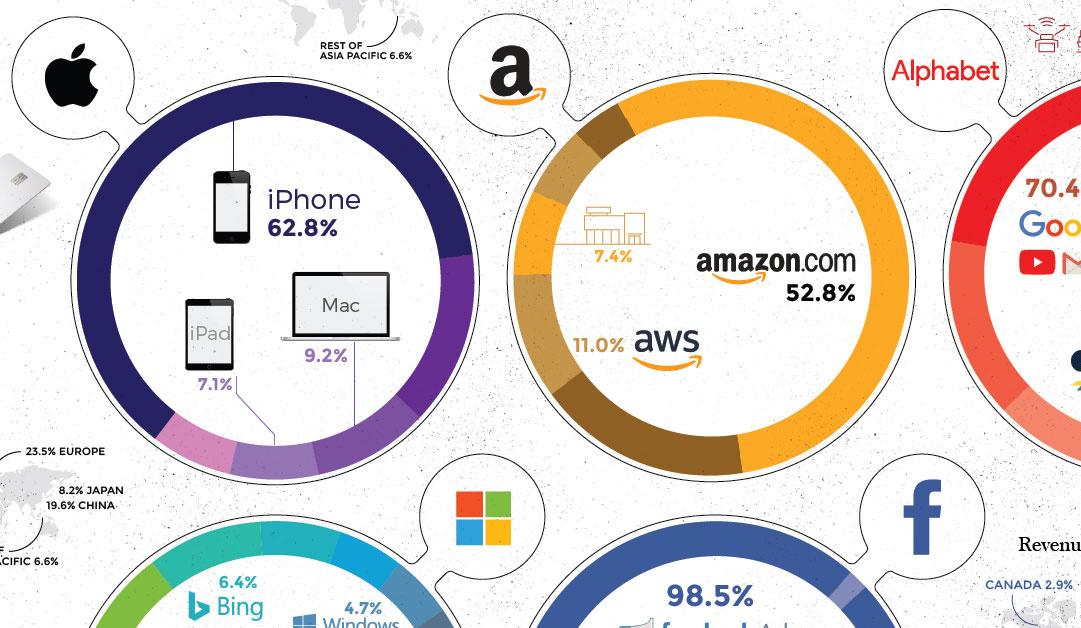

Infographics

This infographic focuses on Apple, Amazon, Alphabet/Google, and Microsoft. Apple is a multinational corporation that creates computers, tablets, and smartphones for the general public. Amazon is an e-commerce platform that offers a broad range of things, from books to electronics to cloud computing. Alphabet (Google) is a multinational technology conglomerate that operates the Chrome web browser, the Android mobile operating system, and the YouTube video-sharing platform. Microsoft is a multinational technology corporation that produces and markets computer programs, components, and services.

Dashboard Write-Up

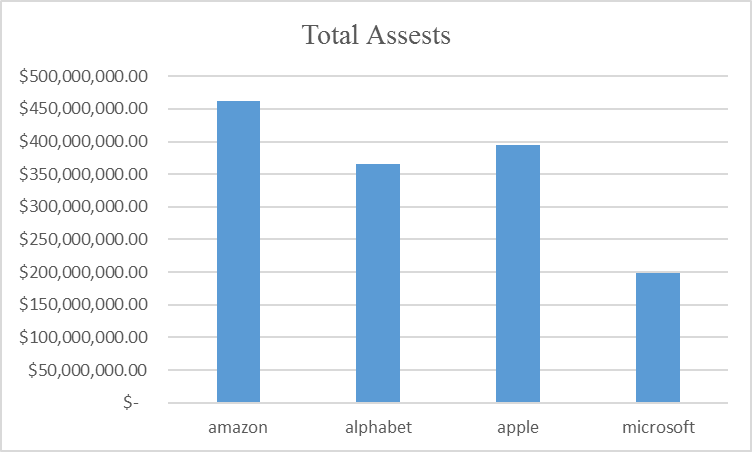

Total Assets

The goal of this graph is to identify the organization with the highest total assets. The total assets of the four businesses are shown in the following pie chart: Amazon ($462,675,000.00), Google ($365,264,000.00), Apple ($394,328,000.00), and Microsoft ($198,270,000.00) (Yahoo, 2023). Given that Amazon is the biggest and most successful of the four, its size and success are likely reflected in this data.

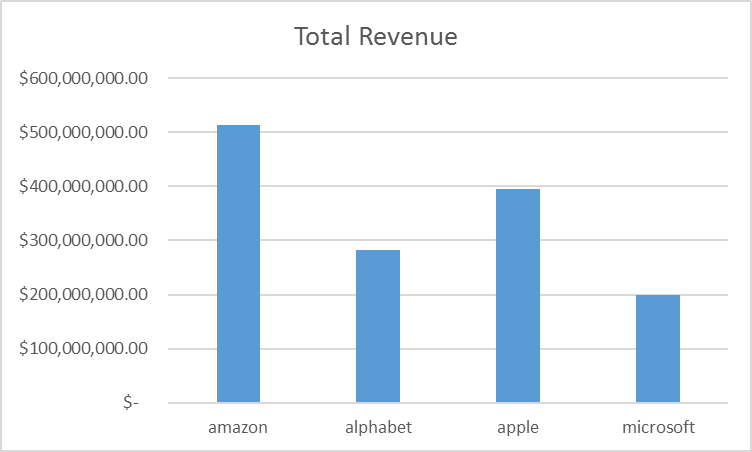

Total Revenue

This graph attempts to address the issue of how much total revenue four big technology businesses made in a particular year. Amazon had the greatest overall revenue of $513,983,000.00, followed by Google at $282,836,000.00, Apple at $394,328,000.00, and Microsoft at $198,270,000.00, according to the graphic (Yahoo, 2023). This means that Amazon is the most profitable of the four internet powerhouses in terms of overall income, owing to their diverse variety of goods and services.

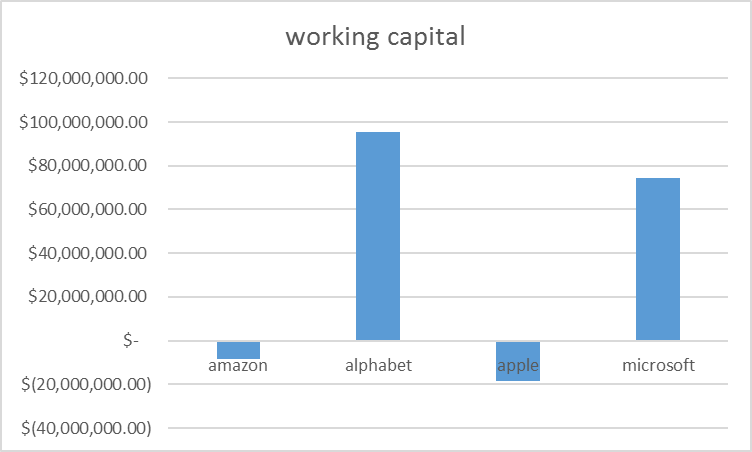

Working Capital

The purpose of this figure is to address the question of what the working capital of four giant corporations – Amazon, Google, Apple, and Microsoft – is. The figure shows each company’s current working capital, with Amazon having the lowest at $8,602,000.00 and Google having the most at $95,495,000.00 (Yahoo, 2023). This data may be related to each company’s size and the kind of goods and services they provide, which might affect their profitability and cash flow.

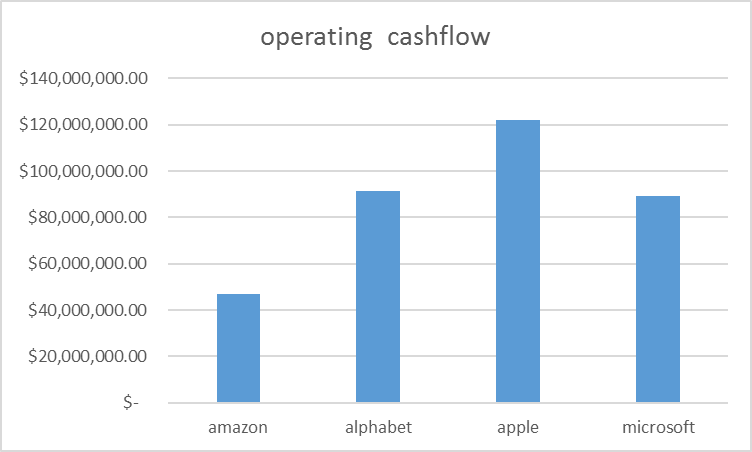

Operating Cashflow

Which firm generates the most operational cashflow is the focus of this graph. Google comes in second with $91,495,000.00, followed by Microsoft at $89,035,000.00 and finally, Amazon at $46,752,000.00. Apple has the greatest operational cash flow, at $122,151,000.00 (Yahoo, 2023). This data probably reflects each company’s size, market share, and financial might.

Conclusion

Ultimately, Apple, Amazon, Alphabet/Google, and Microsoft are all successful technological businesses, each with strengths and shortcomings. Apple had the total assets, Amazon had the total revenue, Google had the most working capital, and Apple had the most operational cash flow. The total results for all four firms were remarkable, demonstrating that they are all profitable and formidable in their respective areas.

According to this research, Amazon is the most profitable of the four corporations in terms of total assets, total revenue, operational cash flow, and working capital. Apple is the runner-up, followed by Google and Microsoft. Any company’s success is likely related to its size, market dominance, and financial strength.

References

Google. (2023). Web.

Yahoo. (2023). Yahoo Finance – Stock Market Live, quotes, Business & Finance News. Yahoo! Finance. Web.