Executive Summary

Susan is a single mother, who has been facing financial issues. Having a low-paid job and defaulting on her payments, she is now facing bankruptcy. To handle the problems, keep her children safe, and retain her financial assets, she will have to redesign her budget and reconsider her priorities.

Client Information Page

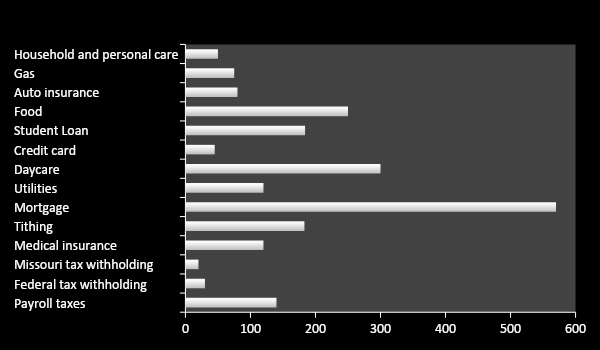

Susan is a 36-year-old single mother of two children, who works as a cashier. Susan has been facing financial issues; she has been defaulting on her payments and is now in a dire situation. Her current expenses are not compatible with the salary that she receives ($1824) (see Figure 1).

Recommendations to Decrease Expenses

A closer look at the current expenses rate will reveal that the situation that Susan is facing now can be defined as borderline bankruptcy. Indeed, given the fact that she has been defaulting on her payments and extending her credit card, therefore, increasing the debt consistently will reveal that she may be in desperate need of a different financial policy aimed at avoiding losing all money (Mahanty 17).

Particularly, it could be suggested that she should consider reducing her mortgage obligations. On the one hand, the above step may create additional threats for losing the property. On the other hand, the financial resources that she will obtain can be used as the foundation for developing the lean approach and promoting the concept of sustainable use of financial resources. It is expected that, after adopting the above approach and using the money retrieved, Susan will be able to handle the current situation and set restrictions on the expenditures. Particularly, she will be capable of defining her buyer capabilities and, thus, avoiding buying products that are either too expensive or unnecessary. Therefore, the lean principle will be applied to the current situation and help the woman handle the problems that she is currently facing.

The daycare-related problem can also be addressed. Seeing that a substantial part of Susan’s income is spent on daycare, it will be reasonable to ask her family members to babysit instead. Thus, she will be able to save $300 per month, which is an essential part of her income, and which can be used to improve her lean management skills.

Major Issues Addressed One at a Time

Susan needs to reconsider the use of her credit card at present. Seeing that going over her financial capacities is currently a major threat, it will be crucial to shift towards the use of cash. A simple yet efficient idea would be to redesign her budget completely so that the use of a credit card could not be an option at present.

The student loan issue is another problem that needs to be managed before it gets out of hand. As stressed above, to acquire certain funds, Susan will have to adopt the principles of lean economy. As soon as she saves a certain amount of cash, she should use it immediately to cover her current loans and make sure that she does not owe any significant amount of money. In light of the fact that the expenses for the daycare services can be cut, it will be a sensible step to use the above money to address the student loan issue.

In case the prepayment penalties are not imposed by the landlord on the tenants, it will be adequate to suggest that Susan should refinance the premises. Although some might view the above step as a rather drastic measure, in Susan’s case, it will give her an opportunity to have a fresh start and to change her current approach toward managing her expenses. Needless to say, the above decision will not lift all responsibilities from Susan; however, it will give her time to consider her options and identify opportunities for gaining financial resources, e.g., locating a part-time job that will allow her to address some of the payment issues.

In addition, the bankruptcy problem can be dealt with by the redesign of the current approach towards costs estimation and management. Specifically, the principles of the lean approach need to be considered. The subject matter can be designed as the adoption of the principles of sustainability and active use of the resources at hand to increase the number of opportunities available (Gerritsen and Olderen 91).

Goals Addressed One at a Time

Reaching all goals within the shortest amount of time, unfortunately, will not be a possibility for Susan. However, after she gets her priorities straight and starts considering some of the available avenues, she will see that saving is a crucial part of being in a good economy.

Revised Budget(S)

The table below creates premises for comparing the current budget that Susan uses as the primary tool for allocating costs (on the left) and the one that is strongly advised as the primary means of keeping a certain amount of funds and creating a reserve one. As the table below shows, substantial changes have been made to the order of the costs that Susan will have to take. The above alteration reflects the redesign in the priorities that she has at present. Specifically, the focus on creating reserve funds ($1,000), exploring the existing saving options, and addressing the mortgage issue, as well as the overall bankruptcy concern, are the key aspects of the budget designed.

Table 1. Revised Budgets.

As the revised budget provided above shows, it is essential that Susan should have a certain source that she could use to collect resources for the further use. As ti has been stressed above, it is crucial for her to have support, both in terms of the emotional one that she will receive from her family members, and as far as the financial support is concerned. The latter, in its turn, may come from the parents for a while, yet Susan should be able to create a reserve on her own so that she could develop independence in the economic and financial sense (Pride and Ferrell 112).

Particularly, it could be suggested that a certain percentage of the money that she will save by using the lean approach mentioned above (e.g., 3% of the overall sum) should be stored for further use as a supplementary resource in case of need. A closer look at the revised budget will show that Susan has several options for saving money; therefore, she will have to create the resources that she will resort to in case of need (Graduate Management Admission Council 12).

Moreover, the table provided above shows quite graphically that the goal of gaining an emergency fund can be gained within the first month. However, Susan must not set her expectations too high. Indeed, the money that she will have presumably saved by the end of the month may shrink due to certain issues and unexpected losses (e.g., one of her children may accidentally break an essential appliance that she will have to replace, or there will be a need to buy an item of clothing instead of the old one, etc. After all, it is crucial to take the fact that the children are growing into account as well).

Starter Emergency Fund

Creating a starter emergency fund within the next month does not seem a possibility for Susan at present. However, by cutting the costs for daycare and choosing to use public transportation instead of spending money on petrol and maintenance for her car, Susan will be able to collect the resources that will finally become the start fund. As it has been explained above, it is imperative that Susan should have a fund that she will, later on, use as the means of not only paying her bills but also increasing her profits.

School

Naturally, studying will require a lot of money, not only because of the cost of courses but also because of the supplementary materials required (e.g., textbooks). Therefore, it is expected that Susan should spend at least $500 in order to re-enter college and get a degree. However, as far as the tuition is concerned, one must mention that there are a plethora of free and low-cost programs that will help acquire the necessary skills and knowledge without spending an extensive amount of money.

It should be borne in mind that the degree, which Susan will acquire as she graduates from the college, may be seen as not very impressive and appealing to potential employers. However, the present-day environment of the global economy allows HR experts to overlook the issues such as a non-prestigious degree or college name and focus on the actual skills and experience that the employee has. Therefore, as long as Susan attends courses and passes tests successfully, she will increase the chances to get a better job and support her children on her own (Liozu and Hinterhuber 205).

Saving for College

Although Susan’s kids are still very young, she has to start thinking about their future now. Therefore, the funds for their education must be created; particularly, it will be necessary to make sure that the children will be able to enroll in a college. Seeing that Susan’s parents may watch over the kids, Susan may consider getting another job. Since working two jobs instead of one is going to be excruciating for her, at present, it is advisable that she should start considering the above option the next month. In the meantime, the costs for household and personal care could be reduced as well. Specifically, cheaper tools for doing chores, clothing, etc. should be considered. For this purpose, the stores such as Wal-Mart, K-Mart, Target, etc., should be considered (Figueroa par. 3).

Saving for Retirement

In order to save for retirement, Susan should consider locating a job that has the necessary retirement options and a nuanced employee benefits program. Particularly, it is desirable that the 401K system should be promoted by the organization as the primary means of facilitating the staff members with good retirement options. Apart from locating the organization that will offer her the above benefits, Susan will also need to use a specific amount of the funds that she will accumulate as the foundation for her retirement budget. It could be suggested that she should consider splitting the above budget into ¼ for her children’s future, ¼ for the retirement plan, ¼ for the future needs, and ¼ for the emergency needs.

Works Cited

Figueroa, Meleiza. Wal-Mart’s Real Cost. 2006. Web.

Gerristen, Dale, and Richard Olderen. Events as a Strategic Marketing Tool. New York, NY: CABI, 2013. Print.

Graduate Management Admission Council. The Official Guide for GMAT Verbal Review 2015. New York, NY: John Wiley & Sons, 2014. Print.

Mahanty, Aropp K. Intermediate Microeconomics with Applications. New York, NY: Academic Press, 2014. Print.

Liozu, Stephan, and Andreas Hinterhuber. The ROI of Pricing: Measuring the Impact and Making the Business Case. Routledge, 2014. Print.

Pride, William M., and Oliver C. Ferrell. Marketing 2016. Boston, MA: Cengage Learning, 2015. Print.