Background

Telefonica operates in a highly competitive environment, and its financial trends are essential for decision-making. The most critical financial metrics to determine a company’s growth include revenue, net income, operating margin, return on investment, and equity. A company’s financial health is determined by calculating its ratios.

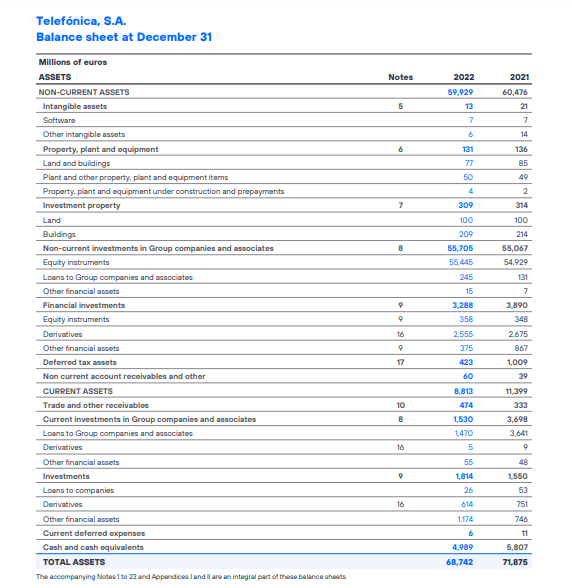

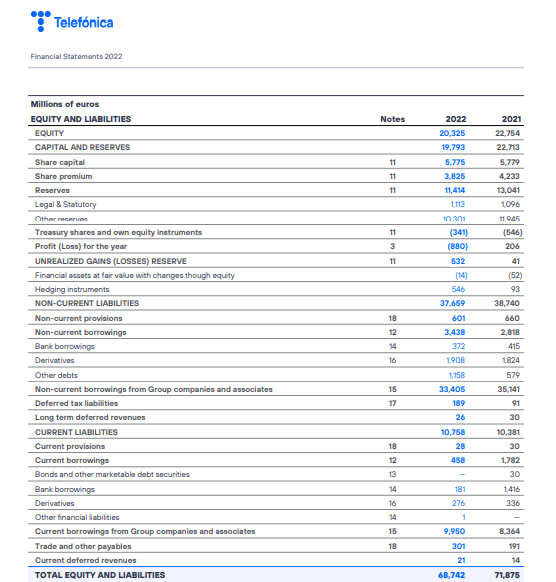

Five essential ratios help decide the fate of a company, including profitability, liquidity, solvency, market, and efficiency (Kliestik et al., 2020). Each ratio determines whether or not the company is growing in a positive direction. The data for calculating the ratios will be extracted from the company’s 2021 and 2022 financial reports. Sample figures of the balance sheet are presented for reference.

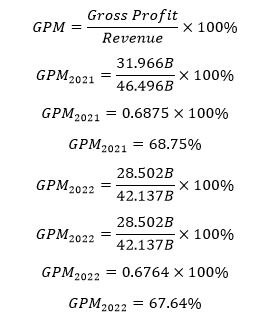

Gross Profit Margin

Gross Profit Margin is a profitability ratio that shows the amount of money remaining after deducting the cost of goods sold. When the gross profit margin of a company remains high, it is a sign that the company is efficient and that its pricing strategy is ideal in the competitive market. The formula for calculating gross profit margin is as follows:

There has been a decline over the past two years, which means the company is not moving in the right direction. Although revenues have been dropping proportionately with overall profits, the company is losing its market share (Telefonica, 2022). It must work towards increasing its sales for more revenue or change its pricing strategy. The business should, therefore, refocus on increasing its market share for more profits. As presently constituted, profitability has been declining, signifying an alarming trend in the business.

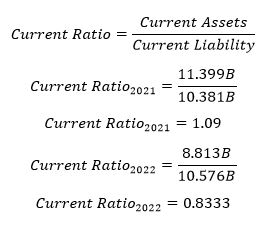

Current Ratio

Current ratios are liquidity determinants that show a company’s ability to meet its short-term financial obligations. A favorable ratio shows the company is creditworthy and can access loans to expand its operations. However, a negative liquidity ratio shows the company cannot meet its short-term obligations (Shah et al., 2019). Figures 1 and 2 show a sample of the balance sheet.

The liquidity ratio is calculated using the formula given below:

A sharp decline from 1.09 in 2021 to 0.8333 indicates that the company’s creditworthiness is reducing daily. The company does not have sufficient working capital to overcome the short-term obligation. Therefore, the company is heading in a negative financial trajectory as its ability to compete effectively is affected by insolvency.

Debt Ratio

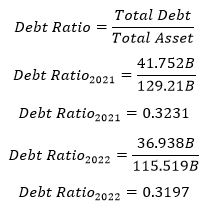

The debt ratio is one of the most important solvency ratios, determining how much debt a company uses to fund its operations. If a company funds most of its operations with debt, it means that the company is unstable and likely to fail in the long run (Boisjoly et al., 2020). The debt ratio in any company is calculated using the formula below:

The company is at risk of instability because a significant part of its operation is funded by debt. However, it is imperative to note that there was a slight decline in the debt ratio from 0.3241 in 2021 to 0.3197 in 2022, indicating that the company is moving in the right trajectory as it reduces the amount of debt used to conduct daily operations in business.

Efficiency Ratios

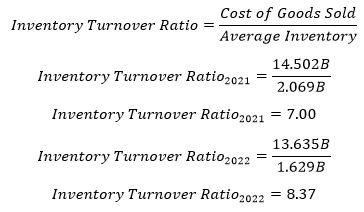

Efficiency ratios help determine how well an organization is being run. The inventory turnover ratio compares the cost of goods sold and the average inventory, and a high number means that more goods are sold and that the business is likely to attain profitability (Husna and Satria, 2019). Efficient inventory management proves that a company can make more sales. The formula for the ratio is given in the equation below.

The change in ratios from 7.00 in 2021 to 8.37 in 2022 means that the company has an efficient inventory management system that efficiently ensures the inventory is sold out. The company is on the right track in inventory management and is likely to be more profitable in the discourse.

Marketing Ratio

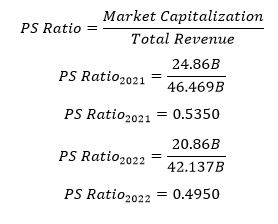

Marketing ratios show how effectively a company can market its products. One of the ratios in the marketing realm is the price-to-earnings ratio, which helps investors determine the value of the stock (Telefonica, 2023). The stated ratio focuses more on revenue than the company’s profitability (Awaysheh et al., 2020). The value compares a company with its peers and enables them to make informed decisions. The formula is as given below:

The ratio declined from 0.5350 in 2021 to 0.4950 in 2022, indicating that the investors are undervaluing the company’s financial abilities. The trend in the ratio shows limited financial growth, and the market confidence in the company is declining by the day.

Reference List

Awaysheh, A., Heron, R.A., Perry, T. and Wilson, J.I., (2020) ‘On the relation between corporate social responsibility and financial performance.’ Strategic Management Journal, 41(6), pp.965-987. Web.

Boisjoly, R.P., Conine Jr, T.E. and McDonald IV, M.B., (2020) ‘Working capital management: Financial and valuation impacts’. Journal of Business Research, 108, pp.1-8. Web.

Husna, A. and Satria, I., (2019) ‘Effects of return on asset, debt to asset ratio, current ratio, firm size, and dividend payout ratio on firm value.’ International Journal of Economics and Financial Issues, 9(5), pp.50-54. Web.

Kliestik, T., Valaskova, K., Lazaroiu, G., Kovacova, M. and Vrbka, J., (2020) ‘Remaining financially healthy and competitive: The role of financial predictors.’ Journal of Competitiveness, 12(1), p.74. Web.

Shah, D., Isah, H. and Zulkernine, F., (2019) ‘Stock market analysis: A review and taxonomy of prediction techniques.’ International Journal of Financial Studies, 7(2), p.26. Web.

Telefonica SA (2022) Consolidated Financial Report 2021. PwC. London.

Telefonica SA (2023) Consolidated Financial Report 2022. PwC. London.