Introduction

A financial risk plan is crucial for effectively managing finances and identifying suitable investment opportunities. The program is crucial because it enables individuals and businesses to set and achieve their financial objectives. It provides a roadmap to financial success and helps to ensure that resources are allocated appropriately.

A financial plan is also essential for setting long-term strategies and monitoring progress. It helps identify areas of financial strength, weakness, and opportunity, and provides a framework for making informed decisions about investments, retirement, and other financial matters. Individuals and businesses can make informed decisions about their future with a financial plan.

Harry and Sue Jones are new clients seeking professional advice and a comprehensive financial plan. Their primary focus is on personal risk and insurance, investments and estate planning, and retirement planning, with detailed analysis and scenario modeling for each area. Information gathered during the initial interview and questionnaire forms the basis of the plan, and any discrepancies are treated as differences in interpretation rather than errors. This paper aims to provide financial guidance to Harry and Sue, helping them make informed decisions about investments, money management, and insurance to mitigate difficulties in emergencies.

The financial plan will evaluate different circumstances under which Harry and Sue may be affected by financial preparedness, such as death or disability. Therefore, paying close attention to the observations made under different assumptions and conditions is essential. We will focus on three main financial plan sections: personal risk management and maintenance, investment and estate planning, and personal retirement planning.

The plan will evaluate different financial outcomes and current financial conditions and analyze their scope. Additionally, it will provide recommendations for actions that Harry and Sue can take to protect themselves from financial distress. The financial plan is a critical component for successful decision-making and risk reduction; hence, it must be undertaken to enhance protection against economic sabotage.

Current Circumstances

Goals and Objectives

Harry and Sue’s main objective is to ensure they have enough money to retire comfortably when Harry is 60. They intend to sell their home, downsize into a smaller home at around £250,000, and then use the remaining funds to purchase a second home in Spain. Harry also wants to launch a side venture that will cost him £50,000. They wish to assist their children in saving a 10% down payment for a mortgage by the time they are 28, to ensure their financial security. And finally, they want to keep as much of their estate as possible to pass on to their kids tax-efficiently after both pass away.

Harry and Sue have invested in various assets to meet their objectives, including shares in Facebook, Sainsbury’s, Tesco, and Centrica, as well as National Savings Index-Linked certificates. In addition, they have directed their investments toward ISAs that invest in UK equity growth funds and Unit Trusts that invest in North American funds.

For Harry and Sue to reach their financial objectives, their investments must perform at their highest level. They should regularly assess their investment plans to ensure they stay well-diversified and appropriate for their needs. Harry and Sue should also consider tax-efficient investing strategies to protect as much of their estate as possible. Ultimately, they should review their life insurance policies to ensure they have sufficient coverage for any potential future issues.

Attitude Towards Risk

Harry and Sue are aware of the risks associated with investing and have opted for a cautious approach. They have diversified their investments across various asset types to mitigate the risk associated with any single asset. To offset any future liabilities, they have also established life insurance plans.

Yet, they have invested in stocks, unit trusts, and investment bonds because they are prepared to accept certain risks to accomplish their objectives. Harry and Sue are often willing to take on some risk to reach their financial objectives. However, they are also aware of the possibility of losses and will not make any extremely hazardous investments. To ensure that their investments perform optimally, they are also willing to heed the counsel of financial professionals.

Net Worth

Harry and Sue’s current net worth represents the combined value of their assets and liabilities. Their assets include their pensions, investments, and the value of their house. Their liabilities include their mortgage, student loans, and other outstanding debts.

Harry’s total assets are currently estimated to be £299,576, comprising his pension (£130,700), investments (£65,175.50), and the value of his house (£63,700). His liabilities consist of his mortgage of £150,000. This gives him a net worth of £281,576.

Sue’s total assets are currently estimated to be £186,718, comprising her pension (£27,600), investments (£9,018), and the value of her house (£550,000). Her liabilities include her student loan debt of £50,000. This gives her a net worth of £470,000.

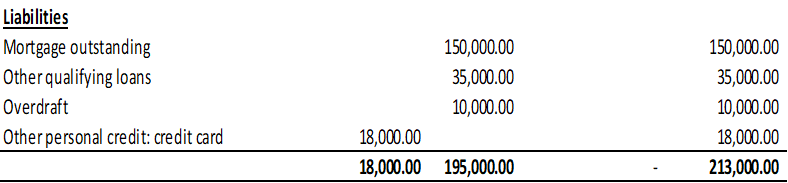

The couple’s combined net worth is estimated to be around £938,294, with assets of £1,151,294 million and liabilities of £213,000. This is a substantial amount of wealth, which should be sufficient to enable them to realize their retirement dreams.

Income and Expenditure

Harry and Sue currently have a combined annual income of £150,000, of which £80,000 is from Harry’s solicitor job and the remainder from Sue’s photography income. They have a repayment mortgage of £160,000 with 10 years to run and are investing heavily in their pension policies. They also invest in ISAs and unit trusts, and have a profits-onshore investment bond that they intend to use to buy their Spanish property. Their current expenditure includes their mortgage repayment, private medical insurance, school fees for their children, and other living expenses. They have also been putting money away for their children’s university education and future mortgage deposits.

To fund their retirement, they must ensure their investments are as tax-efficient as possible while still having enough money to achieve their dreams. They are concerned that the bond profit may not be sufficient to buy their Spanish property due to the recent fall in bonus rates to 3.75% per annum. They are also worried about being able to meet their goals if either of them were to become too ill to work.

Summary of Recommendations on Income and Expenditure

Harry and Sue hope to accomplish several objectives in the following years, including becoming partners in their respective businesses, enrolling their kids in private schools, and retiring soon. They require a detailed financial plan to ensure they can achieve their goals. I advise Harry and Sue to assess their current investments and performance in light of the market’s circumstances.

They should also consider diversifying their investments to lower the risk of underperforming assets or funds. They should also consider purchasing life insurance plans to safeguard their families in the event of their untimely passing. I advise that they establish trusts and utilize any available tax benefits or exemptions to ensure that their money is used in the most tax-efficient manner possible.

They should assess their mortgage and any other debts to improve their ability to save and invest more money. They should consider refinancing to a lower mortgage rate if they have sufficient equity in their home. Ultimately, both parties should review their investment approach and consider hiring a financial consultant to optimize their returns. This will enable them to develop a customized plan that considers their long-term objectives and current financial circumstances. The two should manage their finances carefully to ensure they can achieve their objectives.

Financial Protection

Recommendations in Case of Death

Sue would likely remain in a precarious financial situation if Harry were to die. The two should have life insurance policies to protect their family from financial instability in the event of Harry’s death. This would ensure that Sue has access to some money to cover any outstanding debts and to provide her with financial security (Goyal & Kumar, 2021). Additionally, it would provide a lump sum to cover any costs associated with the children’s private school education and the deposit for their children’s mortgages.

On the other hand, Harry would be left in a similar situation if Sue were to die. Sue needs to have a life insurance policy to protect Harry from any financial insecurity that may arise due to her demise. This ensures that the family remains financially stable in the event of any unforeseen occurrence.

Recommendations in Case of Disability

Sue is likely to encounter financial hardships if Harry becomes disabled. She must protect her family from such instances by taking insurance cover against Harry’s possible disability. That ensures she has access to a regular income to boost her funds, cover medical bills, and provide her with security against outstanding debts and financial responsibilities, such as paying educational fees for their children and mortgages. A similar situation will occur if Sue becomes disabled instead. They should take insurance against any chances of either becoming disabled to protect against similar outcomes.

Education Expense Recommendations

Harry and Sue’s educational goals are to enable their children to attend a private school between the ages of 7 and 18. They also intend to help with raising a 10% deposit for a mortgage for each of their children when they turn 28. Additionally, they want to ensure their investments are structured in a tax-efficient manner while still retaining sufficient funds to achieve their retirement dreams.

Harry and Sue have invested heavily in their pensions to achieve their educational goals, with all the policies invested in ‘balanced’ managed funds. Harry and Sue have put safety nets in place to ensure their educational goals are met in case of illness or death. Harry has private medical insurance covering the whole family, while they also have a level term assurance policy of £160,000 payable on the first death. Harry and Sue have done a great job ensuring their educational goals are met and have an excellent plan to help their children achieve them.

Harry and Sue have several options to achieve their educational goals. Firstly, they can continue investing in their pensions, ISAs, unit trusts, and shares. They can also increase the money they put away each month to build up their savings.

Additionally, they can look into other tax-efficient investments, such as Enterprise Investment Schemes or Venture Capital Trusts. They can also explore the possibility of taking out a student loan to help cover private school fees for their children. They can also consider setting up a trust fund for their children, which would allow them to save money for their children’s education in a tax-efficient manner.

Retirement Plan Recommendations

Summary of Retirement Goals

Harry and Sue have a well-thought-out retirement plan, which includes helping their children purchase a house and move to a smaller, more affordable home while they are still relatively young. They have also made intelligent investments, such as buying stocks, ISAs, and unit trusts, while taking out a repayment mortgage and a level term assurance policy.

The couple has also invested in pension policies, which will mature when Harry reaches 60, and a profits-onshore investment bond, which they plan to use to purchase a Spanish property. However, the recent decline in bonus rates may strain the couple’s financial situation, making it difficult for them to achieve their dreams. To secure their retirement, they may need to consider other investment vehicles or strategies, such as life insurance, annuities, or estate planning.

Recommendations for the Retirement

I recommend that they review their investments and retirement plans to ensure that Harry and Sue can achieve their retirement goals. They may need to adjust their investments based on their current financial situation to ensure a secure retirement. One option they should consider is investing in life insurance. This will provide them with a lump sum payment in the event of an untimely death, which can be used to help cover costs such as tuition fees or a mortgage deposit. Additionally, they should look into annuities to provide a steady income stream during retirement.

Finally, I recommend that Harry and Sue consider estate planning. This will ensure that their children are cared for in the event of their passing and help them preserve as much of their estate as possible. They should consult a financial advisor to ensure their estate plan is tailored to their needs and goals.

Financial Recommendations

I recommend the following measures to help Harry and Sue meet their financial goals:

- Diversification of Investments: Harry and Sue should diversify their investments to reduce the risk associated with any single asset. This will help them receive a steady return on their investments and mitigate the risk of losses (Huynh et al., 2020). They should ensure their investments are diversified across different asset classes, including stocks, bonds, and mutual funds.

- Consider Tax-Efficient Investing Strategies: Harry and Sue should examine the tax benefits and available exemptions that allow them to make the most tax-efficient use of their money (Alesina et al., 2019). They should consider setting up trusts and other estate planning tools to protect as much of their estate as possible.

- Review Their Life Insurance Policies: Harry and Sue should reassess their life insurance policies to confirm they provide adequate protection in the event of death or disability. This will ensure that their families are financially protected if they pass away or become disabled.

References

Alesina, A., Favero, C., & Giavazzi, F. (2019). Effects of austerity: Expenditure-and tax-based approaches. Journal of Economic Perspectives, 33 (2), 141-62. Web.

Goyal, K., & Kumar, S. (2021). Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies, 45 (1), 80-105. Web.

Huynh, T. L. D., Hille, E., & Nasir, M. A. (2020). Diversification in the age of the 4th industrial revolution: The role of artificial intelligence, green bonds and cryptocurrencies. Technological Forecasting and Social Change, 159, 120188. Web.