Introduction

Financial reports are very important tools used in gauging the financial health of business enterprises and making predictions of the future of a business. It is therefore important that any business organization use these reports in formulating its strategies and future goals to be delivered.

While the financial reports give a wider picture of the state of affairs of the business, the ratio provides specific areas of strength within the business and provides an opportunity for the management to leverage on its areas of strength and take corrective measures against the weaknesses.

This paper will provide the financial statements and the corresponding ratios for Lemonade stand business for the two seasons. This will be followed by a critical analysis of the financial health of the business as shown by the financial report.

Financial statements

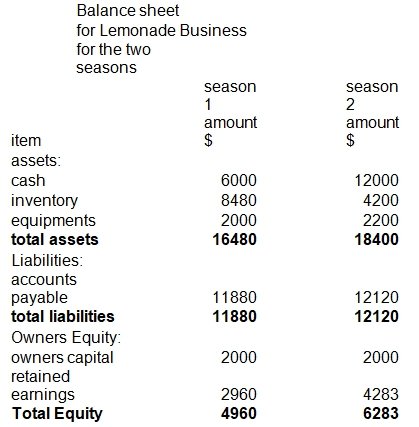

Balance sheet

This is a very important financial statement in a business entity. It shows the financial position of the business in terms of assets, liabilities and the owner’s equity. A well prepared balance sheet must therefore clearly indicate the assets owned by the business, the liabilities that the business owes and the money invested by the shareholders or owners of the business. The financial statement below shows the balance sheet for Lemonade business for the two seasons:

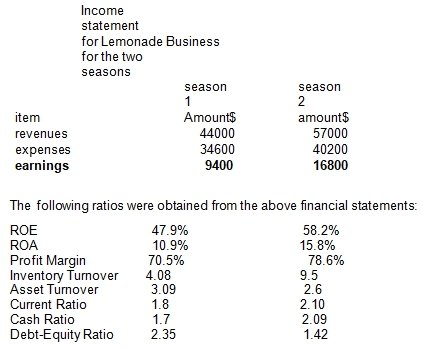

The income statement on the other hand provides information about the financial performance of a business within a certain period of time.It gives the revenues and expenditures which must be matched to realize the earnings. The income statement below is a summary of the Lemonade business for the two seasons:

Analysis of the ratios and the financial statements

The balance sheet above shows that the business financial position improved greatly between season one and season two as the balance sheet value increased from $16480 to $18400 representing a 12.22% jump in the value of the balance sheet.

The same trend was witnessed with the equity side of the balance sheet as the value of equity increased from $4900 to $6200 which was quite impressive for the business. The company liabilities also increased from 11880 to 12120 representing 2% increase. This can be attributed to the increase in the level of activity as the firm tried to improve its level of operation.

From the income statement the firms total earnings increased by more than 78% from $9400 to $16800.The increase in earnings is attributed to the large jump in the firms revenues from $44000 to $5700.Although the expenses also increased, the percentage increase stood at 17% which was too low compared to the increase in the revenues which stood at 29%.

One of the key factors that determine the financial health of any business is the liquidity. A closer look at liquidity ratios such as current ratio and cash ratio shows a great improvement in the firm’s liquidity from season one to season two.

The current ratio in season two stood at 2.10 up from 1.8 in season one and this clearly shows that the firms current asset were able to cover the current liabilities by more than 2 times compared to 1.8 times in season one. The same trend is seen in cash ratio where the firm’s cash and cash equivalents stands at 2.09 times its current liabilities. This is an improvement from 1.7 times recorded in the first season.

The debt to equity ratio which shows the level of exposure to debt financing reduced from 2.3 to 1.4 from season one to season two. This means that the firm is properly protected from too much debt and hence the company can use much of its earnings to finance expansion projects rather than repay debt.

The inventory turnover increased from 4 times to 9 times which clearly shows an improvement in the firm’s efficiency in operations and hence stock is able to move faster than in the first season. The asset turn over however declined from 3.09 to 2.6 which means that every dollar of asset invested only realized 2.6 in season two compared to 3.09 in season one. This calls for better ways of managing assets in the business. The firm should also avoid keeping too much idle assets (Brigham & Houston, 2009).

Another major indicator of the financial health of a business is the profitability and from the profitability ratios presented the business was able to record improved profits in season two compared to season one. The profit margin increased from 70.5% to 78% and this indicates the firm was able to realize more than 78% sales as profits.

The return on equity increased from 47% in season one to 58% in season two. The returns on assets also increased from 10% in season one to 15% in season two. These are clear indications of poor management of equity and assets respectively and hence the need for prudent ways of managing assets and equity.

Based on the above financial statements and ratios the firm still stands at a better position provided by strong liquidity and less exposure and hence it has a bright future. The management must however set up proper methods of managing assets and owners equity to realize maximum returns.

Reference

Brigham, E.F. & Houston, F.J. (2009). Fundamentals of Financial Management. 12th ed. Mason, OH : Cengage South-Western.