Introduction

Entrepreneurship has gained great significance over the past few decades in both developed and developing economies. Its significance is evidenced by the numerous small and medium sized enterprises [SMEs] being established. Keasey and Storey (2003) assert that the definition of SMEs differs from one country to another.

For example, Dalberg (2011, p.6) holds that in Egypt, ‘SMEs include business that have a workforce of between 5 and 50 employees, while Vietnam defines SMEs as businesses that have a workforce of between 10 and 300 employees’.

On the other hand, Dalberg (2011, p.6) adds that according to the World Bank, ‘SMEs include businesses whose annual sales revenues is $15 million, total asset base of $ 15 million, and a maximum workforce of 300 employees’.

The Dubai Chamber of Commerce in the United Arabs Emirates [UAE] defines businesses that have a human resource base of less than 10 employees as micro, 20-25 employees as small, and less than 100 as medium-sized.

However, the small businesses’ annual turnover has to be less than $10 million while that of medium enterprises has to be less than $25 million. Despite the variation in the definition, most governments have realised the importance of SMEs in stimulating growth in different economic sectors.

A report released by Dalberg (2011, p.7) reveals that the ‘SME sector is the backbone of the economy in high-income countries, but it is less developed in low-income countries’. Furthermore, the Organisation for Economic Cooperation and Development (OECD) asserts that over 95% of all enterprises in OECD member states are SMEs.

Similarly, SMEs account for over 75% of the total formal employment in the Middle East and North Africa [MENA] region. SMEs also play a key role in the economic growth of the Gulf Cooperation Council [GCC] member states such as the UAE. Over 200,000 SMEs have been established in the UAE, which accounts for approximately 86% of the total private sector employment (Hunt 2014).

Subsequently, the role of SMEs in stimulating economic growth through employment creation, stimulating innovation, promoting social cohesion, and regional development cannot be underestimated.

Problem statement

The long-term success of SMEs is dependent on a number of factors, which include human capital, financial capital, and the creation of an environment conducive for doing business. The UAE is characterised by an environment conducive for the establishment of SMEs.

For example, the income levels in the country are relatively high, which means that the citizens have a high purchasing power. Additionally, the country’s infrastructure is well developed and the national population is moderately well educated. Subsequently, most SMEs established in the UAE are professionally operated (Hertog 2008).

Nkuah, Tanyeh, and Gaeten (2013, p.12) emphasise that credit ‘is crucial for the growth and survival of SMEs’. Therefore, it is imperative for policymakers to formulate effective policies that will promote the success of SMEs. Finance is a major challenge for most SMEs globally. SMEs in the UAE face major challenges due to the existence of financing challenges.

Hertog (2008) argues that the financing challenge is predominantly stifling in the emerging economies such as the UAE. Hertog (2008) further contends that due to their informal nature, most SMEs in the GCC region encounter financing challenges. Financial institutions such as banks are reluctant to extend credit finance to SMEs.

A report released by the World Bank in 2005 on world development showed a great disparity with regard to access to finance between SMEs and large enterprises. According to the report, only 30% of SMEs were in a position to access credit finance from external sources as compared to 48% of large enterprises (Le 2012).

Some of the barriers to credit finance experienced by SMEs include high lending rates, lack of collateral and financial institutions’ unwillingness to lend (Le 2012). A report released in 2008 by Dun and Brandstreet shows that 50%-70% of the total credit applications by SMEs were rejected due to failure to meet the set loan requirements (Hertog 2008).

Rationale of the study

Le (2012) asserts that finance is a critical aspect in the success of any business enterprise as it improves the effectiveness with which the firm invests in various strategic activities such as research and development, market expansion, and development of an effective and efficient human capital base.

Considering the importance of finance in the success of a business entity and the significance of SMEs in the UAE’s economic growth, it is fundamental to understand the issues and challenges faced by SMEs.

Objectives of the study

This study aims at achieving the following objectives

- To evaluate the issues and problems faced by small businesses in accessing credit finance from financial institutions.

- To assess the measures that can undertake in order to eliminate the financing barriers faced by SMEs.

Research gap

Numerous studies have been conducted in an effort to investigate the financing challenges faced by SMEs in the UAE. However, none of these studies has emphasised the role of Khalifa Fund for Enterprise Development Centre in assisting entrepreneurs in the UAE to invest in small businesses.

Limitations of the study

Despite the view that financing challenges are common amongst all SMEs in the world, this study specifically focuses on the UAE. Due to the scarcity of resources in relation to time and finances, it was not possible to conduct the study on all SMEs in the UAE.

Subsequently, the researcher selected a number of respondents from SMEs established in different economic sectors in the UAE. Subsequently, it is assumed that the experience of the selected respondents with regard to the financing challenges experienced in operating their businesses is representative of the prevailing conditions in the UAE.

Organisation of the report

The report is organised into a number of sections, which include the literature review, a case Study of Khalifa Fund, methodology, findings and analysis, and conclusion and recommendations

Literature review

Uma (2013, p.120) asserts that entrepreneurship ‘is indispensable in accelerating industrial growth’. However, the contribution of entrepreneurship is only possible through the establishment of SMEs. SMEs have greatly been recognised as a model of economic growth.

Their significance is illustrated by their contribution to domestic foreign exchange earnings, innovation, and employment creation (Beck, Demirguc-Kunt & Peria 2008). One of the major questions facing SMEs relates to how to promote their growth. Previous studies have assessed the importance of the entrepreneurs’ personality features to the policy environment (Pedrosa-Garcia 2013).

Wong, Ho, and Autio (2005) cite the investment climate conditions as one of the major barriers in the establishment of SMEs. During their formative stages, SMEs depend on personal savings and donations from family and friends. This assertion arises from the prevailing difficulty in establishing credit finance compared to well-established businesses (Were & Wambua 2013).

Hertog (2008) asserts that access to finance is essential in establishing an environment whereby firms can grow and prosper. SMEs in developing economies face significant financing challenges. A study conducted on 4,000 SMEs in 54 countries cites financial constraint as a major barrier in the operation of SMEs. Most banks in the UAE are reluctant in extending credit finance to SMEs especially start-ups.

Most SMEs that have not been in operation for a period of 2-3 years are not in a position to receive credit finance. On the contrary, Hertog (2008) asserts that over 70% of SMEs established in the European Union are in a position to access credit finance. Some of the major challenges that complicate credit finance amongst SMEs in the UAE relate to enforcement aspects and collateral requirement.

Most SMEs in the GCC region do not have valuable assets that can be used as collateral in securing large loans. According to Hertog (2008), banks in the MENA region demand assets worth 150% of the total amount of money extended as loan as collateral. This amount is relatively high as compared to the international average.

Scott and Irwin (2010) further assert that most SMEs depend on personal loans in meeting their finance requirements. Subsequently, most citizens in the UAE have their assets tied up in personal property. Hertog (2008) emphasises that the justice system in the GCC is reluctant to impose eviction orders on debtors from their property due to the strong Islamic region beliefs, which prohibit such acts.

In an effort to access finance, most small entrepreneurs use their mobile assets such as vehicles as collateral (Coleman 2000). This aspect has played a significant role in the promotion of the establishment of secondary market for expensive cars, which are mainly recorded as collateral.

Furthermore, high bank interest rates prohibit SMEs from accessing credit finance from banks and other formal financial institutions. According to Hertog (2008) the interest rate on loans from banks in the UAE are usually 10% higher than the average interest rate set by the Central Bank. The high interest rates on loans aim at cautioning banks from the perceived risk (Howorth 2001).

In order to benefit from such loan, a firm must have high returns on investment. However, this aspect is not usually the case, which undermines the growth of SMEs. The low returns on interest increases the rate of default on loan repayment (Nkuah, Tanyeh & Gaeten 2013). Moreover, banks issue credit finance on short-term basis, which increases pressure on SMEs to settle the loan.

The short duration within which SMEs are required to repay hinders their ability to undertake long-term business planning. Therefore, most SMEs in the UAE exclusively depend on their cash flows and donations from family and friends in financing their operations. Failure to repay debt in most Gulf countries can lead to imprisonment, which further makes credit-based business planning repulsive.

Roper and Scott (2009) further cite the attitude of bankers towards SMEs and skills as other barriers in accessing credit finance. Additionally, Hossain (2013) argues that the inability of SMEs to access credit finance limits SMEs’ ability to have a substantial amount of working and fixed capital necessary to facilitate their operations.

The existence of demanding requirements in SMEs quest to access credit finance is one of the major problems faced. This assertion explains the high rate at which SMEs depend on credit finance from informal sources such as friends and relatives and traditional moneylenders (Nkuah, Tanyeh & Gaeten 2013).

Pedrosa-Garcia (2013) points to a significant room for improvement with regard to accessing credit finance amongst SMEs in the UAE.

Case Study; Khalifa Fund

Different programs have been established in an effort to support the growth of SMEs. These programs have led to the establishment of new operational models, which have greatly revolutionised issuance of credit finance to SMEs. Hertog (2008, p.35) asserts that these ‘models have far removed from the mechanical and indiscriminate grant giving used to dominate government supported development funds’.

An example of such fund is the Khalifa Fund, which supports SMEs in different emirates such as Abu Dhabi and Dubai. According to the Khalifa Fund (2014, par.8), the fund was ‘established on 3rd June 2007 with the objective of assisting local enterprises operating in Abu Dhabi with investment capital of up to AED 2 billion’.

Moreover, the fund aims at enriching local entrepreneurs with adequate investment culture. The fund has grown substantially over the years. By summer 2009, the Fund had issued over 320 million Dirham to approximately 200 SMEs.

Khalifa Fund recognises the challenges faced by SMEs in accessing credit facilities. One of the problems identified relates to the high interest rate. In an effort to deal with this challenge, the fund offers interest-free loans to entrepreneurs who require credit financing of less than one million Dirham. Moreover, higher loans are issued at a relatively lower interest rate as compared to banks.

Start-ups and already existing SMEs can access loan of 3 million Dirham and 5 million Dirham respectively. The Fund also provides SMEs with financial support through micro-loans of 250,000 Dirham.

In a bid to promote the long-term operation of SMEs, the Khalifa Fund offers entrepreneurs with a flexible payment plan. The loans are processed through the local banks. In an effort to stimulate economic growth in Abu Dhabi, Khalifa Fund has exempted entrepreneurs from various administrative fees.

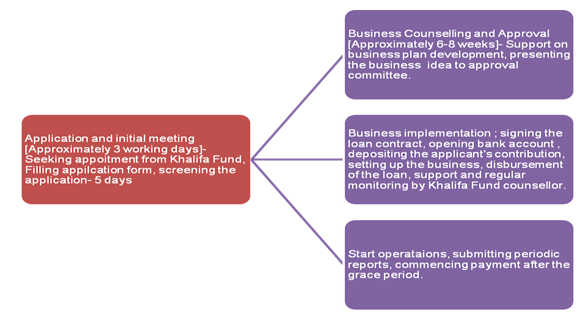

In order to receive financial assistance from Khalifa Fund, the entrepreneurs undergo a comprehensive application process. First, the idea has to be approved. Additionally, the entrepreneur must provide a comprehensive business plan outlining how the intended venture will operate. The chart below illustrates a summary of the application process.

Source: (Khalifa Fund 2014)

Methodology

The objective of this research is to explore the financing challenges faced by SMEs in the UAE. In a bid to conduct the study effectively, the researcher adopted qualitative research design. Maxwell (2005) asserts that research designs make a study logical, hence improving its reliability. The researcher adopted qualitative research design in conducting this study.

The rationale for adopting this study arose from the need to gather substantial information from the study field. Moreover, the researcher decided to adopt qualitative research design in order to explain effectively the major financing challenges being experienced.

Furthermore, adopting qualitative research design was informed by the need to ensure that the relevant authorities and non-governmental organisations in the UAE understand the financing challenges faced by most SMEs.

Sampling

In order to gather a substantial amount of data, the researcher targeted entrepreneurs in different sectors of the UAE economy as the study population. This decision arose from the recognition of the view that they have a better understanding of the financing challenges experienced by SMEs. However, the researcher could not conduct a study on all the SMEs established in the UAE due to resource limitations.

Deming (2002) is of the opinion that sampling makes a study easy and manageable, which enhances the effectiveness with which a researcher can conduct a thorough analysis on the issue under investigation. Subsequently, a sample of 100 respondents was selected from the total population. Random sampling technique was adopted in selecting the sample.

Data collection

Deming (2002) asserts that the quality of data collected influences the credibility and relevance of the study. In conducting this study, the researcher adopted primary sources of data.

The decision to adopt this type of data arose from the need to gather first hand data on the challenges faced by SMEs. Primary data was collected using questionnaires and interviews. The questionnaires were sent to the respondents through emails in order to minimise the cost involved.

The questionnaires were semi-structured in nature, which entailed integrating open and close-ended questionnaires. Using open-ended questionnaires provided the researcher with an opportunity to gather a wide range of information as the respondents had the opportunity to respond to the questions freely.

Prior to issuing the research questionnaires, the researcher conducted a comprehensive review on the questionnaire in order to eliminate and form of ambiguity. This move increased the likelihood with which the respondents understood the questions.

Data analysis and presentation

In a bid to improve the outcome of the study, the researcher ensured that the data collected was effectively analysed. The data collected from the field was voluminous, and hence the need for simplification.

Furthermore, the data should be presented effectively in order to make it easy for the respondents to understand the research findings. The data collected was analysed using Microsoft Excel using percentages. Moreover, using Microsoft Excel enabled the researcher to present the data effectively using graphs, tables and charts.

Findings and analysis

Accessing finance is a fundamental element in the operation of SMEs, hence stimulating the UAE’s economic growth. However, the success of SMEs is threatened by the existence of the prevailing financial constraints. Financing challenges is predominant amongst the GCC countries such as the UAE.

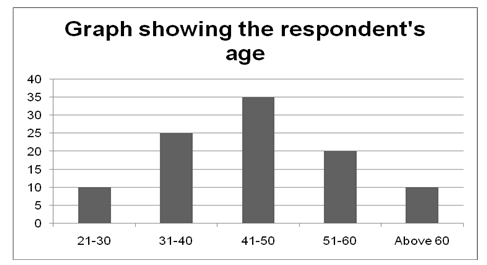

The objective of this study is to understand the major hurdles in accessing credit finance amongst SMEs in the UAE. The study has taken into account respondents characterised by diverse demographic characteristics as illustrated below.

The respondents selected were of different gender and age as illustrated in the chart below.

Table 1.

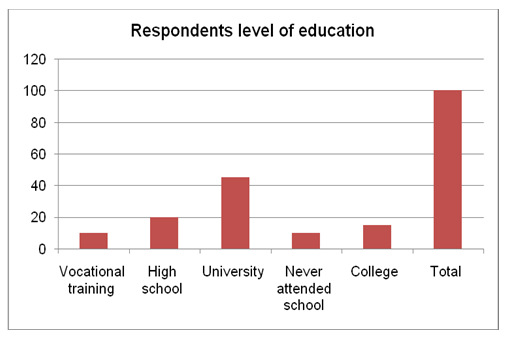

The educational level of the respondents also varied as illustrated by the table below.

Table 2.

The graph above shows that entrepreneurship is a common trend amongst Emiratis despite their level of education. However, the number of respondents who have acquired a certain level of education is relatively higher as compared to those who have not attended school.

Analysis of the research questions

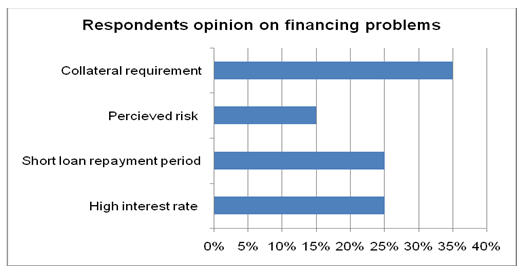

When asked about main issues and problems faced in accessing credit finance from formal institutions such as banks, the respondents’ opinions varied. The graph below illustrates the respondents’ opinions.

Table 3.

Twenty five percent (25%) of the respondents cited high interests as a major hindrance to accessing credit finance. When asked the main reason behind the high interest rate, 15% of the respondents were of the opinion that most banks in the UAE perceive SMEs as high-risk investments.

On the other hand, 34% of the respondents interviewed argued that banks perceive SMEs to lack the necessary financial shrewdness to sustain their operations into the long term. The respondents further argued that this perception arises from the SMEs’ inability to meet the set loan conditions. Subsequently, banks perceive the rate of defaulting from loan repayment to be relatively high.

Thirty five percent (35%) of the respondents argued that most UAE banks have set high collateral requirements in order to issue credit finance. The respondents were of the opinion that they do not usually have the collateral requirements necessary to access loans. Lack of the high collateral requirement arises from the view that the SMEs are relatively small.

Moreover, the respondents were of the opinion that most banks do not trust SMEs. On the other hand, 25% of the respondents were of the opinion that the loan repayment period is relatively low. This aspect hinders the effectiveness with which SMEs undertake long-term planning such as business expansion.

Gap analysis

Despite the enabling environment for the operation of SMEs, firms in the UAE experience a number of challenges. Some of the challenges arise from the existence of structural rigidity. The analysis above shows a significant gap between SMEs’ efforts to access credit finance and the banks’ willing to extend credit finance. Most SMEs in the UAE experience high rejection rates with regard to the application of their loan.

According to a survey conducted by the Abu Dhabi Council of Economic Development [ADCED], SMEs experience major difficulties in accessing credit loans from banks (Haider 2013).

According to the survey by ADCED, only 33% of SMEs evaluated reported that they received the total amount of loan sought. Furthermore, the respondents also argued that bank usually take a long time before approving their loan application. This aspect makes banks unattractive source of external finance amongst SMEs.

Conclusion and recommendations

Banks rank amongst the main suppliers of credit finance for most SMEs in the MENA and Gulf regions. However, entrepreneurs are not in a position to access credit finance from formal institutions such as banks. Some of the major obstacles relate to high interest rates, high collateral requirements, perceived risk on the operation of SMEs, and short repayment periods.

These conditions hinder the SMEs’ ability to access credit finance from banks. Subsequently, it is essential for policy makers such as the UAE government to enhance the development of an enabling environment for the establishment and long-term operation of SMEs.

It is imperative for the UAE government to improve the financing environment for SMEs by taking into account the following aspects.

- The UAE government should ensure that commercial banks adhere to the interest rate set by the Central Bank. This aspect will prevent exploitation of SMEs by banks through high interest rates.

- The UAE government should also support the development of SME unit in banks that will focus on improving the efficiency with which banks process the SMEs loan applications. One of the ways through which the UAE government can achieve this goal is by developing a loan guarantee program.

- It is also imperative for financial institutions to minimise the collateral requirement by adopting other strategies such as mortgages and leases.

Reference List

Beck, K, Demirguc-Kunt, A & Peria, M 2008, Bank financing for SMEs around the world ; drivers, obstacles, business models and lending practices, The World Bank Development Research Group, New York.

Coleman, S 2000, ‘Access to capital and terms of credit; a comparison of men and women owned small businesses’, Journal of Small Business Management, vol. 38 no. 3, pp. 37-52.

Dalberg: Report on support to SMEs in developing countries through financial intermediaries 2011. Web.

Deming, W 2002, Sample design in business research, John Wiley and Sons, New York.

Haider, H 2013, Financing key SMEs obstacle. Web.

Hertog, S 2008, Benchmarking SMEs policies in the GCC: a survey of challenges and opportunities, The EU-GCC Chamber Forum, Dubai.

Hossain, M 2013, ‘Leasing; an alternative financing mechanism for SMEs’, ABC Journal of Advanced Research, vol. 2 no. 1, pp. 1-21.

Howorth, C 2001, ‘Small firms demand for finance’, International Small Business Journal, vol. 19, No. 4, pp. 78-86.

Hunt, D 2014, SMEs have a big role to play as UAE economy roars ahead. Web.

Keasey, K & Storey, D 2003, ‘A theory of discouraged borrowers’, Small Business Economics, vol. 17 no. 3, pp. 11-29.

Khalifa Fund: about us. 2014. Web.

Le, P 2012, ‘What determines the access to credit by SMEs; a case study in Vietnam’, Journal of Management Research, vol. 4, no. 4, pp. 90-115.

Maxwell, J 2005, Qualitative research design: an interactive approach, Sage Publication, New Jersey.

Nkuah, J, Tanyeh, J & Gaeten, K 2013, ‘Financing small and medium enterprises in Ghana; challenges and determinants in accessing bank credit’, International Journal of Research in Social Sciences, vol. 2 no. 3, pp. 12-26.

Pedrosa-Garcia, J 2013, ‘Access to finance by small and medium enterprises in the Arab region; policy considerations’, Economic and Social Commission for Western Asia, vol. 3 no. 6, pp. 1-16.

Roper, S & Scott, M 2009, ‘Perceived financial barriers and the start-up decision: An econometric analysis of gender differences using GEM data’, International Small Business Journal, vol. 27 no. 2, pp. 149-171.

Scott, J & Irwin, D 2010, ‘Barriers faced by SMEs in raising bank finance’, International Journal of Entrepreneurial Behaviour & Research, vol. 16 no. 3, pp. 245-259.

Uma, P 2013, ‘Role of SMEs in economic development of India’, Asia Pacific Journal of Marketing & Management Review, vol. 6 no.4, pp. 120-127.

Were, M & Wambua, J 2013, Assessing the determinants of interest rate spreads of commercial banks in Kenya: an empirical investigation, Kenya Bankers Association, Nairobi.

Wong, P, Ho, Y & Autio, E 2005, ‘Entrepreneurship, innovation and economic growth; evidence from GEM data’, Small Business Economics, vol. 24 no.2 pp. 335-350.