The federal government relies on three major sources of revenue to finance its’ fiscal year budget. They include: individual tax income, social insurance taxes and corporate income taxes respectively (Center on Budget and Policy Priorities, 2011). Revenues from individual tax income have been escalating steadily as federal government continues raising tax rates. For instance, in 2008 total revenues from individual income tax amounted to $ 1,146 billion, while current projection indicates that the government will collect $ 2,475 billion in 2014 (C.B.O., 2009).

Secondly, social insurance taxes have also been increasing steadily corresponding with ever-increasing tax rates. In 2008, the federal government collected a total of $ 900 billion, while 2014 projections indicate that the government will garner $ 1,403 billion from social insurance taxes (C.B.O., 2009). However, it is imperative to note that social insurance taxes, which are levied against salaries and wages, have recorded the highest growth rate as the government continues increasing rates and income limits.

Similarly, corporate income taxes have also been rising steadily though not as fast as individual tax income and social insurance taxes because of reduced profitability. Based on C.B.O.’s Baseline Budget Projections, corporate income taxes averaged at an insignificant figure of $ 355 billion in 2009, while individual income taxes and social insurance taxes were estimated at $2,475 and $1,043 billion respectively (C.B.O., 2009).

The federal government spends its revenues on three major and mandatory programs namely: Social security, Medicare and Medicaid. In addition, discretionary spending, which involves money spent on defense and related programs is ranked on the same scale with social security spending. According to the Center on Budget and Policy Priorities 2009 report, both defense and social security expenditure amounted to 21% each in 2008 fiscal year. This amount translates to $625 billion defense expenditure and $ 617 billion social security expenditure.

The social security expenditure keeps rising as the federal government strives to support the ever increasing programs such as retirement benefits programs, disability benefits and survivors’ benefits. On the other hand, the federal expenditure on Medicare, Medicaid and CHIP amounted to $599 billions in 2008 which translates to 20% of the total government budget. Medicare programs which provides healthcare coverage to individuals over 65years was allocated a total of $391 billion, while the remaining amount was shared equally between Medicaid and CHIP (C.B.O., 2009).

According to CBO projections, federal revenues have been declining steadily, and it is expected that the decline will be more pronounced in the coming years. However, federal expenditure has recorded a sharp increase over the years. For instance, the federal government spent a total of $ 3 trillion in 2008 which translates to 21% of country’s GDP (C.B.O., 2009). Conversely, federal revenues fell below this amount such that the collected revenues could only service $2.5 trillion, while the remaining amount of % 459 billion was financed through borrowing.

According to Gwartney, Stroup, Sobel and Macpherson (2010), when government expenditures exceed revenues, a fiscal deficit is realized. If the government is unable to finance budget deficits in the following fiscal year, it leads to accumulation of yearly deficits referred to as a debt. Currently, the federal government debts amounted to over $ 14.5 trillion in 2010 (C.B.O., 2009).

This current figure is the largest government debt in the world and future economic projections indicates that, the figure will continue rising steadily for the next five years. This debt escalated with over 50% between 2000 and 2007, before the economic crisis and the $700 billion bailout increased the debt from $9 trillion in 2007 to $10.5 trillion in the fiscal year ended 2008 (Center on Budget and Policy Priorities, 2011).

Past and Recent US Federal Debt Trend

The reason behind this unprecedented increase is because of high interest charged on owed loans, which is ranked fifth of the overall federal expenditure items (Center on Budget and Policy Priorities, 2011). Apparently, the federal government decision to cut taxes and increase spending over the recent years is to blame for the steady accumulation of budget deficits. Although the move was economically beneficial in the short run, it is non-viable in the long run owing to the fact that lenders have been increasing interest rates because of the perceived risk of non-repayment (C.B.O., 2009).

In addition, defense/security spending plus a reduction in individual and corporate tax income have also escalated the debt levels. On the same note, the past and project debt trend is a matter of grievous concern because it might end up slowing the economy in the long run. If the current trend is allowed to continue, demand for U.S. treasury bills will decrease; thus pushing interest rates higher and eventually the economy will either slow down or stagnate (Gwartney, Stroup, Sobel & Macpherson, 2010).

As aforementioned, federal government expenditure on discretionary programs has been increasing steadily over the years. As a result, fiscal budget deficits have been widening at an alarming rate, thus sinking the U.S. economy further into debt (Fried, 2010). For this reason, Simpson’s commission proposal to reduce military spending should be enacted into law. The federal government should strive towards a sustainable defense force, by cutting military expenditure as proposed in the Simpson’s commission report (Fried, 2010).

This can be effectively achieved by closing down unnecessary foreign military bases, eliminating costly weapons systems and replacing unwanted private contractors. As a result, excess funds could be used to build the much needed infrastructure to stimulate economic growth. Positive economic growth will translate to increased jobs, leading to increased individual taxes income.

Secondly, the proposed cuts on Medicare should also be implemented. The current Medicare system is too costly, thus by promoting an improved Medicare; fiscal deficits would also be reduced with a substantial amount (Fried, 2010). Savings from Medicare programs can be infused into the economy via infrastructure creation and other stimulus programs, leading to a great reduction in unemployment levels.

Correspondingly, economic analysts utilize economic indicators to predict future economic trends. Following the 2007 economic recession, three types of economic indicators (leading, lagging and coincident) have become very crucial in determining how the world economies are recovering from this downturn. Leading indicators are used to predict future economic events (Steinberg, 2000). For instance, the stock market performance has been utilized as leading economic indicator. At the beginning of 2007 economic recession the stock market showed regression, and this acted as the first indicator of an economic downturn.

On the same note, as corporates start to record profits, U.S. stock markets prices are increasing gradually thus signaling an economic recovery. Secondly, the average input hours by production workers are used as leading indicators in that, more hours translates to recovery due to increased production and vice versa. Lagging indicators are said to follow after a certain economic event has taken place (Steinberg, 2000). For instance, shortly after the 2007 recession began to be felt across the economy, people started losing their jobs as employers strived to cut cost.

Therefore, unemployment has been classified as a lagging indicator, and it is mostly utilized to measure economic recession and recovery (Steinberg, 2000). For instance, following slight recovery of U.S. economy the labor market looks promising as employers begin to recall employees back to their jobs. Secondly, the consumer confidence index is also used as a lagging indicator because only after the economy has revived can the consumers feel confident to buy.

The current outlook indicates that consumers not yet confident with the projected economic recovery as most investors stay away from stock market and other investment opportunities (Steinberg, 2000). Similarly, coincident indicators are used to signal real change of the economy since they tend to change simultaneously with the economy. For instance, increase in payroll income as well as increasing sales and production is used to measure economic recovery whereby an increase in personal income translates to a strong economy (Steinberg, 2000).

Unemployment is a major economic problem that threatens to debilitate a country’s economy. Consequently, unemployment has been associated with reduced income, less consumption and lower living standards. In addition, unemployment decreases total production because when fewer workers are engaged in production, few goods are produced and vice versa (EconomyWatch, 2010). This implies that there is a significant need for effective labor market reforms aimed at decreasing unemployment levels (EconomyWatch, 2010).

Any labor reform policies should focus on key major issues that are aimed at stimulating economic growth to pave way for favorable labor environment. To begin, Obama government should come up with policies aimed at promoting employability through occupational mobility. To achieve this objective, labor force should be equipped with diverse skills to increase their flexibility in undertaking emerging job opportunities (EconomyWatch, 2010).

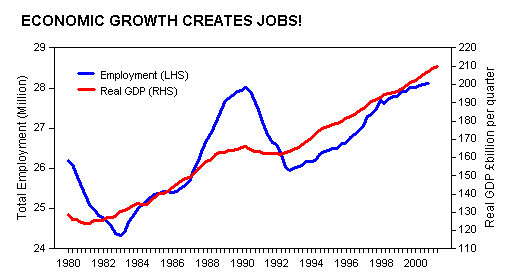

Secondly, Obama government should formulate some tax and benefits incentives policies to encourage people to embrace paid labor. Finally, the government should adopt the proposed reduction in government spending in order to stimulate sustainability of the economy. This will in turn promote creation of new jobs as businesses start to realize increased profits following economic growth at shown in the figure below.

References

C.B. O. (2009). The Budget and Economic Outlook: Fiscal Years 2009 to 2019.

Center on Budget and Policy Priorities (2011). Policy Basics: Where Do Our Federal Tax Dollars Go?

EconomyWatch (2010). Unemployment and Labor Market Reforms.

Fried, C. (2010). Deficit Reduction Proposals: What They Could Mean for You. CBSNEWS.Com.

Gwartney, J., Stroup, R., Sobel, R. & Macpherson, D. (2010). Macroeconomics: Private and Public Choice. New York, NY: Cengage Learning.

Steinberg, E. (2000). Understanding the Federal Budget.