Abstract

Revenue management in any organization involves four basic elements, which are very vital. These include policy planning, assessment, evaluation and corrective measures. For any organization to run successfully it must have a planning method for its revenues that is concise and meets the organizational needs. In fact, technical expertise is needed in carrying out the plan for implementation.

After the planning process, the organizations need to set achievable goals and objectives within the scope of its work. The goals and objectives should be measurable and specific to maintain focus of the workforce. The stakeholders need to come up with an action plan that they follow to meet their set limits.

The action plan set must denote time and give clear responsibilities to the entire stakeholder. Evaluation and control measures are the final part in policy management that gauge the achievements against the goals set. Corrective measures also need to be followed when deviations are detected.

A study in Florida revenue structure reveals several issues of concern, especially in the health care sector. The revenue collected by the local government and redistributors among the population majorly runs the public health care system. This calls for a proper revenue management by local government to reduce losses and revenue mismanagement. The revenue alone cannot help in solving the health care needs in Florida health.

Therefore, other sources of financing enable them carry out their activities. However, the local government faces several economic challenges in meeting the health care demands.

Introduction

The need to satisfy healthcare demand using the scarce local government resources has led to cost maximization and proper utilization of these scarce resources. This led to the study of how local government revenue can be effectively and efficiently collected and utilized. The study also involves assessment of various factors affecting the local government revenues and the implication of policy system in revenue management.

Government Revenue Assessment

Florida has a well-structured health system. This includes the Government and the public sector. Funding policies have undergone several re-adjustments to create equity, affordability and accessibility of health care to all people.

The rates of revenue historically show drastic changes due dynamic nature of health care investment. The changes in government revenue pattern and rates are majorly attributed to economic patterns, which affect the stability and financial power of the government and the changes in health care system as well as its provision (Cropf, 2008).

These factors include the disease patterns, which have led to more expensive health lifestyle problems. As a result, the government revenue polices are always run to meet these demands. Several government revenue systems are identified in this local government acting at various levels include, taxes, fees, grants, fines, gambling revenue, and aids (Starling, 2010).

Taxes

Taxation is as the major revenue contributor to many local governments. Taxes collected by government are of different types namely; income tax, property taxes, sales tax, payroll tax and property tax.

Government needs include raising revenue for the local authorities operation in different sectors, redistribution of national wealth and price adjustment on externalities such as alcohol and tobacco, which are some of the signs of citizen representation to the government.

Income tax is levied by the government from individual person’s earning, either in business, employment or cooperation sector. In the personal investment, the tax levied is based on profits and net gains. The tax computation is based on national tax law principles.

The income tax can be regressive or progressive in nature depending on the government tax polices and laws. For instance, Pay as You Earn (P.A.Y.E) mode is mostly applied by many jurisdictions on personal taxes. Capital gain tax on capital assets is another revenue source under the government income tax (Lee & Wayne, 1998).

Social security fund revenue is usually found in the health sector of the government. It is a compulsory fund on health, often based on an individual income. Some governments use earning rates to determine the amount paid by an individual while in some cases it is a constant rate according to an individual’s health needs. In some government systems there are upper and lower limits of payments made by an individual (Starling, 2010).

There are also value added taxes and sales taxes. Value added tax (VAT) is imposed on the manufactured goods and services.

The manufacturers sell their products and services at higher prices to the retailers since they need to settle the value added tax paid to the government. On the other hand, Sale tax is levied on consumers when they purchase any product. It is among the major contributors to the government’s revenue collections (Lee & Wayne, 1998).

Moreover, the government gets a lot of revenue from tariffs, excise duty, ad valorem tax, occupation tax from licenses and inheritance taxes. Public facilities such as sports and recreation centres also contribute immensely to the government revenue.

Some of the major sources of revenue to the local government include fees, permits, and licenses. Besides, there are revenues from transport, health care and education sector. Various government businesses and foreign transactions also greatly contribute to its revenues (Usa, 2011).

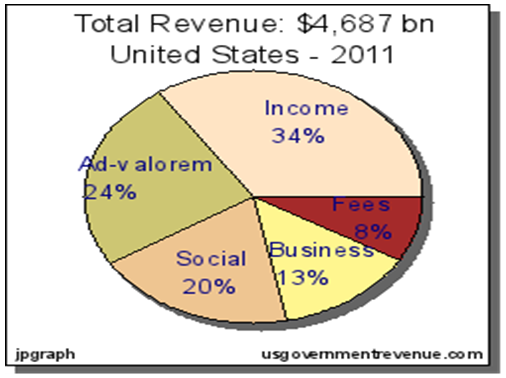

The Chart below shows the United States Total Revenue

This shows the general Federal States revenue, as a major contributor to the local Government Health Care Program. The USA total revenue is also an indicator of the local government capacity in revenue collection. In turn, they receive the federal government aids.

Health Care Funding in Florida

Health care sector needs a lot of financing since it is wide and very dynamic. To come up with a proper solution to the funding, policies have been drawn in the local government. The policy systems also ensure equitable and quality health distribution that is accessible to all the social classes.

Although efficient and effective financing system is hard to achieve in health care, many health programs implementation in Oregon have been met through the financing systems (Wallace, 2010).

The federal government funding towards health care is a great contributor in the country’s health care system. This has been undertaken through direct injection of funds or indirectly through the acquisition of facility aid and health personnel from the federal government.

Government funds are state’s risk pool revenues arrangement aimed at all the population extensive health care provision. In addition to government funding, the government offers support to this health care through the social health policy (Wallace, 2010).

Social insurance source of financing is mainly from the employers’ contribution and salaried employees. It also provides a cover to the unemployed in this government through the social funds. The program is associated with benefit package to the health care contributors.

Notably, this is a non-profit program. In Florida, social funds have created minimal dependence on negations of budget other than on the state funded health care system and it is the most strongly supported health funding system by the citizens (Lee & Wayne, 1998).

The local government of Florida authorities have also injected indirectly in community-based health insurance. This health insurance seeks assistance of the government policy makers to help those that are unable to purchase healthcare insurance from the formal sector. It achieved a better health care access to the people in many parts of this local authority (Usa, 2011).

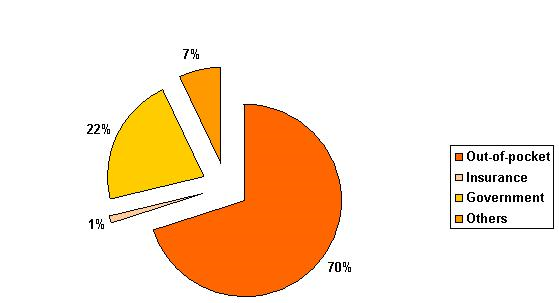

The Chart Below shows Florida local Government Financial Contribution toward Health

Care in the Local Authority

From the chart, it can be noted that the user fees and out of pocket take the largest share of the health payment system. The lowest contributor to healthcare is the insurance that ranks lowest as a result of high charges they offer. The government contributes 22 percent of the finances in health care (Lee & Wayne, 1998).

The governments also provide Medicaid services to enable the low-income groups to access health care. Medicaid is aimed at all the population despite the ages of the people who cannot afford personal insurance. In Florida, Medicare takes the basic health needs burden from the low-income group. Medicaid services are also available for the elderly and disabled group.

To supplement their out-pocket medical use, the local government has promoted the provision medigap method by private insurers. This mostly aimed at the poor who are unable to purchase their health insurance security (Wallace, 2010).

Some of national budgeting data for the government are tabulated. The data were taken from some of the priorities set by the government in health care provision and amount in dollar used.

The table shows the major government priorities in health care budget across the years, including medical services to seniors, venders’ medical users and public health service provision. It is noticed that health cost is constantly rising across the years. This has been attributed to rise in health care diseases among the population (Lee & Wayne, 1998).

The below shows Health Care Financial Budget by the Local Authority from the Year 2005-20010 (m.s) is the medical service rendered to the seniors.

Restrictions in Government Revenues on health Budgeting

Government spending in health care is determined by the economic status of the state and the federal government. During hard economic times, the government spending on health is reduced drastically to compensate for other sectors of the economy.

This comes up with several challenges to the users who are insured under the government like in Medicaid and Medicare provision. At times the cost of health is so high that proper provision needs extra funds, which the local government cannot easily allocate successfully. Therefore, the local government is restricted to the most basic primary health care (Federal Reserve Bank, 1997).

Operation of many local authorities gets a lot of influence from the state government. The local authority finds itself at a cross road at times when undertaking its programs due to regulatory measures by the government providers on the revenue use and application.

The local authority’s policies and health care priorities sometimes do not run with the government priorities, and are often forced to abandon their priorities to meet the financiers’ needs. Due to these, the government restricts the local authorities budgeting (Wallace, 2010).

Dynamics nature of health care and span make its budgeting policies very complex to amend every budgeting period to meet the new challenges. The increase on life style diseases has made it difficult for the health care planners to carry out adequate budgeting.

This can be depicted from financial short falls which normally occur in many planning periods. Budgeting for health generally has become very unpredictable, including the insurance coverage needs (Wallace, 2010).

Effect of Public Decision Policy on Revenue

Policies decisions are vital in revenue collection and creation of a harmonized environment to the revenue users and collectors. Policies enable people to appreciate the need and usefulness of collecting taxes. Every government has a distinct and proper policy set up for collection and use of its revenues.

The decision is vital in various ways for the local government, especially in safeguarding government resources. The decisions taken into consideration include revenue recognition in line with the general accounting principles and management of the receivable accounts by the government. Finally, the decisions are important in creating a negotiation on matters related to the revenue systems (Starling, 2010).

The policy structure describes the local government revenue is in the different parts. There are policies on collection and utilization of the government fees from the local health institutions. Grants and aids have systematic methods of handling them as well.

Medical services income and investment income are also handled according to specific policies to make sure there is a proper and transparent health care delivery. In addition, the government has laid regulations and policies on management of contributions and other forms of sources, which are normally channeled to specific programs (Cropf, 2008).

The management and formulation of the policies are under specific management bodies, each charged with different responsibility. The work of the teams is to monitor and start the implementation under their jurisdiction.

This is done according to the need and demand priorities in health care provision to the people. Managers in charge of the policies also ensure accountability, billing and collection of revenue in accordance with decisions on the ground. At times, the revenue management circle follows a given benchmarks to produce targeted goals (Starling, 2010).

When wrong decision on revenue management is made, the collection processes might be impaired from the first instance. This comes as a result of the people’s failure to understand the revenue system. Pressure groups might go against the policies makers as well.

In many places, poor accountability and transparency have led to loss of revenue, thus it becomes necessary that proper handling polices are drawn to ensure efficient collection and use of the resources (Wallace, 2010).

Choosing programs to run the health care requires the managers who have proper understanding of health care structure. The government must come up with proper recruitment policies which ensure that the health system is properly managed by responsible managers and planners.

Revenue collection from other sources such as aids needs proper negotiators who can draw and clearly come up with the requirements of the negotiators. Generally, the decisions made in these stages mark the success or failure of revenue management (Cropf, 2008).

Economic Conditions that Affect Revenue Projections

Revenue projection by the government depends on several economical factors, and any changes in these either positively or negatively affect the revenue. When the consumption pattern changes due to economic cycles, the health care revenue pattern also changes.

This results from economic factors such as inflation, decline in asset values, geopolitical factors, cost of credit and its nature, solvency and the stability of financial institutions, the financial market, and internal and external business pattern. Projecting revenue in any sector also becomes hard as a result of economic uncertainty that affects the financial market (Wallace, 2010).

The demand for health services and the availability of its revenue on the government overlie on the capacity of its purchase. When employment issues arise, the national insurance fund gets affected proportionately. When unemployment looms the contributors to health reduces while the consumers increase in number. This poses a great challenge to the government (Federal Reserve Bank, 1997).

At the same time economical problems like recessions normally result in poor trade pattern, the government might end up making losses in businesses as well as expecting limited revenue from the business sector. Consumers of healthcare at this time find it hard to purchase health products and opt to basic primary health strategy.

Fees charged on the health premises reduce drastically, forming part of the affected revenue system. Many people normally opt for promotion health pattern that do not require much financial investment to reduce their spending (Wallace, 2010).

Taxation patterns change with economic system when economical cycle is low; many people reduce their investment in the capital market. Consequently, manufacturing firms reduce their purchases since the consumption rate becomes low.

This directly affects the VAT and other trade related taxes. The government revenue also falls despite the need for the government to cushion most of its people from the economic challenges. Tariffs and customs also normally get affected by these changes making the revenue projection difficult (Wallace, 2010).

Pension deficits are also major hindrance to revenue projection. Many people under pension who fail to receive their pension become a challenge in projection of revenue since the groups are normally included in the revenue calculation. On the other hand, the government uses a lot of money every year to cover these pensions that in turn cut back into the projection estimates.

Calculation of pension to derive clear projection of revenue is also very difficult due to changes in pattern of employment and unemployment rates. Clear projections of revenues become rather hard or inaccurate for the planners at the national and local level (Federal Reserve Bank, 1997).

Public Debt always forms another challenge facing the revenue projection, both domestic and foreign. The accruing debts come with the expenses, which normally are being carried from one generation to another. The debt repayments normally affect the revenue sectors significantly.

This is because the projected revenues are utilized in non-profit generating programs. Thus, the planning becomes significantly challenging because of the debts. In turn, several public sectors including health get hugely affected due low net revenue (Usa, 2011).

Furthermore, there are economical losses in natural disasters, hurricanes and earthquakes affecting Florida. In as much as they are not anticipated. A lot of investments get destroyed when these disasters occur. At the same time, the government invests a lot to restore these structures in place. A lot of expected revenue is these areas are not met while more is used to restore the situation on the ground.

This has made projection of revenue in Florida generally hard and always results in the failures. It is beyond the control of the government since some of these points mark lucrative investment zones by the local government the tourism industry. Health investment meets these challenges as its funds are utilized in mitigation measures (Federal Reserve Bank, 1997).

Major revenue challenge in projection comes from the management of social security fund and retirement. This comes with failure to many people in Florid to take their own saving measures. Many people reach retirement age with little or no saving for both livelihood and health care.

The government hence spends a lot in social security funds and other revenue sources to cater for the basic needs of these groups, mostly in Medicare and Medicaid insurances. Projection of the revenue is a challenge since it is never accurate in calculation of the amounts invested in health (Usa, 2011).

In the technological advancement, the states spend a lot in to cope with technology in various fields like in business, security and science.

Projection of yearly spending on these sectors is very hard since each year comes with a new challenge, often at a higher cost. The state hence is unable to accurately determine the revenue amount it spends in these sectors. These make revenue projection generally hard and most unachievable (Usa, 2011).

Revenue Policy

For an effectively management of health care system in Florida, there is a need for concrete management and control of the revenue system. This calls for a properly diagnosed health revenue procedure and policies. In Florida, the local government came with a revenue control and management policies in all it sectors to ensure accountability, transparency and efficiency in running the program (Cropf, 2008).

The policy system runs as shown:

Internal Control Measures

In order to manage revenue effectively, a proper organization of input, process and out put resources are put into place. Proper coordination in communication and technological application is enhanced. A chain of hierarchy is drawn from managers to lower level work force (Wallace, 2010). The aspects of internal control are;

- Work organization and delegation of duties

- Process of payment recording from various accounts

- Efficient fund deposits to respective areas

- Reconciliation of major accounting books

- Creation of security measures

- Application of automated systems for accurate processing and harmonization

- Creation of control and fraud detection procedures with efficient reporting process

- Checking on compliance and non compliance measures by internal audit

Accounting

Records from different health department need to be kept according the standards accounting procedures. At the accounting stage;

- Proper general ledger must be used in recording

- Fiscal accounting period must be given consideration

Billing

There must be a properly established account of receivable for the advanced health care services (Wallace, 2010). The bills need;

- To be properly dated except when stated by resolution or ordinance

- On going account is necessary for service taken prior to payments

- The bills need to be handled from central account then transferred to central ledger.

Fund Deposits

Proper depositing criteria need to be followed any time funds are to be deposited. In the health care deposits are;

- Numerically controlled tied to official document from that department

- Mode of payment should be indicated

- Receivers identity need to be noted

- Transfer of receipts to the accounting books

- Posting the changes to the supervisor

Remote site

These are areas away from the treasury. These collection points need to;

- Have a cash threshold that they deposit early the following day

- All collections need no surpass five working days before deposit

- Non deposited funds securely locked in safes

- Keeping of shortage account for differences

- No application of change drawer for personal work

Escrow Funds

When funds are sent to the system before the recognition of the revenue to remitted back they should be deposited in Escrow liability account that earns interest.

- Interested will only remitted in Escrow under agreement

- When they have gone proper identification they are hence transferred as revenue

- Can only be returned under compliance payee on transferring for non-compliance

Collection

Collection will be done under each department with procedural and within specified period.

- Receivable accounts needs to be recorded to permit analysis by the entity

- Notice must be given to past due accounts and restrictions provided as possible

Returns

It the duty of each department to monitor and control returned cheques. They shall;

- Unless specified, be handled by treasury

- Fees charged on these cheques

Bad Debt

For these be dealt with, it need to be considered under receivable account. The computation should be annually based on write offs and aging of the receivables.

Budgetary Review

The monitoring of the accounts shall be within a specified time by the supervisors. Considerations shall be on;

- Oversight from the departments

- Revenue budget presented with documented evidence

- Monitoring shall be carried out across the year

The policy system is aligned a specific checklist that evaluates the performance standard at each level (Wallace, 2010).

Conclusion

Despite challenges faced in Florida health care system, the government has high potential of helping the population as long as better measures of revenue collection and utilization are in place.

This calls for identification of challenges in revenue management and development of mitigation measures, which are supportive. After the identification process, the revenue structure should be assessment and re-drawn to meet the local government demands. This way, health and other sectors in Florida stand high chances of success.

References

Cropf, R. (2008). American Public Administration: Public Service Administration for the 21st Century. New York, NY: Pearson Longman.

Federal Reserve Bank of Cleveland. (1997). Economic Review (Vols. 33-34). New York, NY: New York Press.

Lee, R, D., & Wayne, R. J. (1998). Public Budgeting System. Canada: Jones and Bartlett Publishers.

Starling, G. (2010). Managing Public Sector. Boston: Wordsworth Publishers.

Usa, I. (2011). Samoa, American Country Study Guide: Strategic Information and Developments. Washington, DC: International Business Publishers.

Wallace, S. (2010). State and Local Fiscal Policy: Thinking outside the Box. Massachusetts: Edward Elga Publishers.