Introduction

Canada has long been a potential investment destination among the Electrical equipment manufacturing multinationals from Europe or USA. As a country with substantial economic development, Canada is an economic force to reckon with in a region that has seen significant foreign direct investment growth in the last decade. Among the industries that have shown much economic and investment growth are electronic and electrical equipment. Many factors have a bearing on the long-term growth and sustainability of one of the promising growth industries in the country – electrical equipment. However, Canada has shown commitment to foster a business-friendly climate by easing foreign restrictions to ownership of companies, providing tax reductions, and tax holidays. This could be indicative of certain internal economic factors that allow Canada to gain competitive advantage as compared to its neighbors (Industry Canada, 36).

The largest FDI for US firms had been Canada for some time now. Canada accounted for 57.6% of US’s FDI in the year 2007. The other FDI regions for Canada have been Europe, Asia-pacific and Latin America. US’s relation with Canada in terms of business and trade has been on an extensive scale(US Department of State, Diplomacy in Action, 2009). Canada mostly imports electrical and auto parts from US in order to export finished auto goods to other markets. Canadian electrical equipment has high demand in the US market(Statistics Canada, 2009).

Canada Direct Investment Climate

The North America in which Canada belongs to has seen increased foreign direct investment in recent years. According to the Statistics Canada, the electrical equipment is among the sectors that brought in the largest foreign direct investment into the Country.

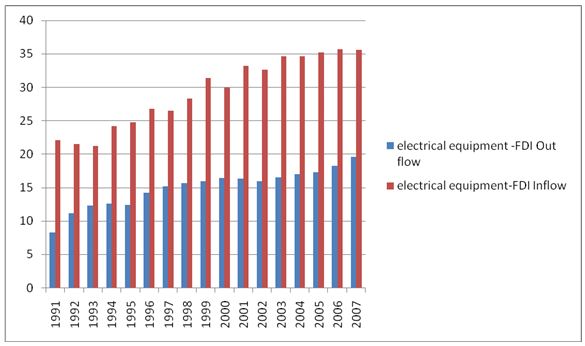

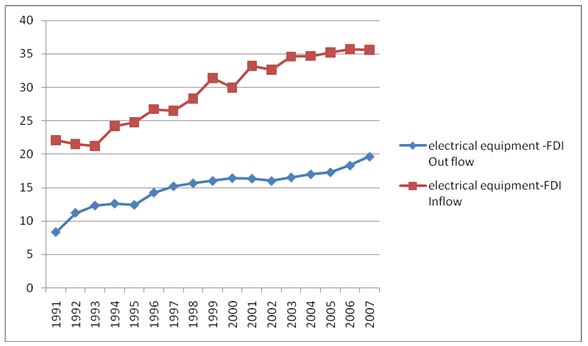

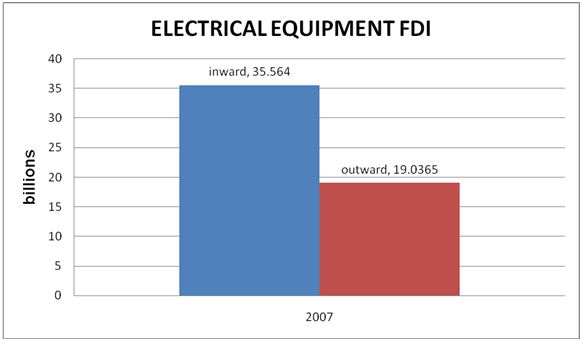

Using the trend curve the graph above will have the following trend for both foreign direct investment inflows and outflows. It can be observed from the bar chart above and trend graph below that both inflow and outflow are taking an upward trend at almost the same speed. The net flow of capital does not have a huge balance in the area of electrical equipment.

In 2007, the total foreign direct investment inflows in electrical equipment sector to the Canada amounted to $ 35.63 billion as shown below.

By 2007, the total foreign direct investment inflows to the region increased 12 percent to US$35.63 billion. Canada received only the 31.4 percent of the total foreign direct investment inflows from Europe while USA was the largest foreign direct investment partner.

Table 1: foreign direct investment Inflows to Canada by sector.

Source: Statistics Canada

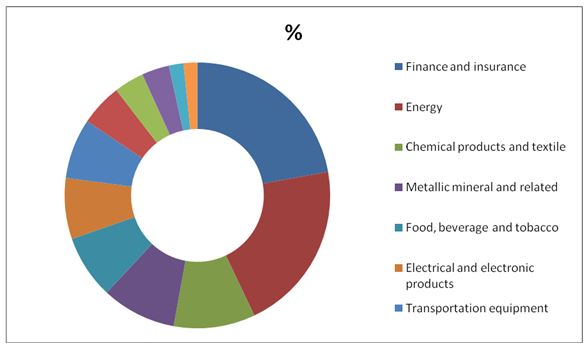

The strong foreign direct investment inflow to Canada compared to other countries may be attributed to the high perception of Canada as a place to do business as well as good relationship with the neighbors. In particular, Canada ranked the best recipient of USA foreign direct investment. Electrical and electronic products received 7.1% of the inflows which translates to $ 35.564 billion. This can be presented in the bar graph as shown below;

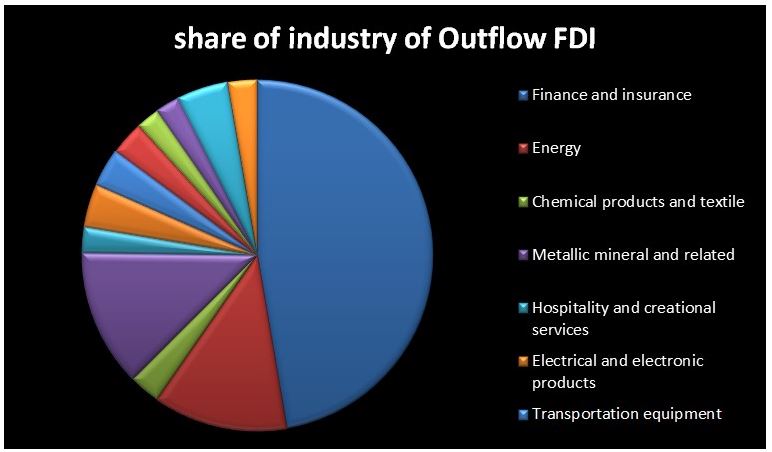

Some of the industrial patterns of international investment are a function of national regulations that prevent foreign firms from entering certain industries. The importance of banking, finance, and insurance in Canada’s investment abroad is striking – one-quarter of the total. We often neglect financial services when thinking about international trade and investment issues, but these data suggest that earnings on capital invested abroad in financial services industries are probably quite significant to the Canadian economy.

However, Canada performed relatively well in terms of foreign direct investment outflow; as shown below

Foreign investment is widely diversified across different industries, as shown in the accompanying figure; however, the industry shares of international investment are far different from the shares in total national investment. These patterns probably reflect in part the firms’ interests in establishing production facilities abroad in markets first penetrated through exports.

Table 1: foreign direct investment Inflows to Canada by sector.

Source: Statistics Canada

Canada has advantages that help it attract more foreign direct investment inflows as compared to outflows in the electrical equipment sector in the future. In particular, good infrastructure and has significantly improved tax laws and a more business-friendly climate. The data shows that Canada received $ 35.564 billion FDI while there was an outflow of 3.7% of about $ 19.0365 billion. The net is an inflow to the economy and it is shown in the graph below;

Canadian Economy

Despite Canada’s recent economic crisis foreign direct investment performance improved and the country has several economic elements that bode well for future investments. For one, the country is well-endowed with natural reserves and good balance of payment.

The optimism in the Canadian economy is also apparent in the strong performance of its stock market by end of 2009. Among the G-8 countries, Canada’s stock market had the most number of actively traded stocks traded. Consequently, Canada accounted for 11.22 percent of the market capitalization of the stock market in the G-8 countries (United Nations, 25).

Regulations

Regulations in the Canada are quite moderate in terms of FDI. The basic standards that Canada maintains for the investors are

- acquiring a license that is issued for respective individual transactions on the basis of the product, the importing country, the end-user and its end use,

- maintaining foreign standards, certification requirements, electricity regulations, packaging, and recycling laws and expected quality,

- one should be aware of the legal considerations like the clauses of contract, intellectual property, legal disputes and anti-boycott laws (Canada Border Services Agency. Customs 5)

The US-Canada trade relationship can be better denoted by agreements North American Free Trade Agreement and FTA formed in 1995 and 1989 respectively. North American Free Trade Agreement was a tripartite agreement formed between USA, Canada and Mexico. (How the Canadian Economy is Dependent on the US Economy, 2009)

For both Canada and US, NAFTA was formed to strengthen their bilateral relations, contribute to the broader cooperation from both countries, create markets, and establish rules for better sustainable trade by enhancing their market existence and promoting development for the people of both the countries. (NAFTA Secretariat- Canada Section, 20) Under North American Free Trade Agreement, the parties are required to eliminate their custom duties but can only be done so with the consultation of the parties involved. Moreover, under North American Free Trade Agreement goods imported from US to Canada bear no taxes or duties. If goods bear ‘Made in USA’ then the importer enjoy duty-free rate. Although in few provinces of Canada the importers have to pay provisional sales tax (Canada Border Services Agency. How, 8).

Supply and Demand

There has been continued growth in the Canadian electrical market. Electrical equipment makers are in a continuous process of pressurizing the Electrical equipment dealers to reduce prices. In recent times the Electrical equipment suppliers face tough times due to inflation. It is tougher for the small Electrical equipment suppliers to carry along smooth businesses. It has become a cause of concern for the suppliers as there remain chances of uncertainty in schedules for the manufacturers of original equipment production (Central Intelligence Agency, 12). Moreover the suppliers have to battle out lower cash inflows coupled with less working capital. Circulation of money becomes inadequate due to which suppliers find it difficult to provide supply assistance to the larger companies or for export purposes (Britton, 7).

Conclusion

On the positive side, this paper has proven that Canada has managed to remain financially wealthy and prosperous due to its resources, adequate infrastructure, deep financial reserves, and well-established financial markets. In terms of the country’s financial sector, the banking, equities, leasing, and fund management service segments can be described as vibrant and robust (Lerner, 49).

Canada remains an attractive option for foreign direct investments in electrical equipment by USA firms because of two critical reasons. One is that the Canadian government has good infrastructure and neighbors USA. The second reason is the openness being displayed by the government to foreign investors. By relaxing its stringent rules and implementing more business-friendly laws, the government has clearly shown its commitment to making the country a better place to do business in. Of course, Canadian’s long-term economic growth also depends on how the ruling government sets its political laws. If some members of the Parliament and the ruling elite could not compromise on many issues, then Canadian economic sustainability and foreign direct investment inflows may be paralyzed.

Overall, the electrical equipment industry foreign direct investment has been of great importance to the Canadian economy. It is basically due to its great size. The dependence of several manufacturing industries on the auto industry also facilitates a larger amount of import of auto parts from countries like the US. The transportation system has been quite easier in terms of their roads and rail linkages. The emergence of various agencies aided by moderate legal procedures provides a helping hand towards restructuring the Canadian economy (Rudiger, Stanley, & Begg, 79).

Works cited

Britton, John. “Canada and the Global Economy”. Restructuring in a Continental Production System. 2006.

Canada Border Services Agency.Customs Self Assessment Program. 2009.

Canada Border Services Agency. How goods qualify under NAFTAs. 2009. Web.

Central Intelligence Agency. “The World Fact Book”. Exports: Commodities. 2009. Web.

Dunning, H. John. “Multinational Enterprises and the Global Economy.” Journal of International Business Studies. 40. (2009): 5-19.

Dunning, H. John and Lunda, M. Sarianna. Multinational Enterprises and the Global Economy. Cheltenham: Edward Elgar Publishing, 2008.

Henderson, Vernon, & Poole, William. Principals of economics. Lexington, Massachusetts Toronto: D.C. Heath and Company, 1997.

How the Canadian Economy is Dependent on the US Economy (2009). Excerpts from the paper.

Industry Canada. Canadian Importers Database (CID). 2009. Web.

Lerner, Josh. (2009) Boulevard of Broken Dreams. New Jersey: Princeton University Press.

NAFTA Secretariat- Canada Section. North American Free Trade Agreement: Objectives. 2005. Web.

Rudiger Dornbusch, Stanley, Fischer &David Begg, David. Economics. New York: McGraw-Hill International Edition, 2008.

Statistics Canada. Imports, exports and trade balance of goods on a balance-of-payments basis, by country or country grouping. 2009. Web.

Unctad/Dite. Canada in Brief. Unctad/Dite. 2009. Web.

United Nations. World Economic Situation and Prospects. Geneva, Switzerland: United Nations. 2009.

US Department of State. “Diplomacy in Action”. Background Note: Canada. 2009. Web.