Introduction

France is one of the largest and most advanced economies in the world. The country achieved its success through diversification of its economy and prudent management of the public sector finances.

Unlike other developed countries, agriculture contributes significantly to economic development in France. The output from the agricultural sector comes from livestock and cash crops. The leading industries in the country include chemicals, automobiles, electronics, machinery, and textiles.

The main minerals produced in the country include iron, bauxite, and coal. Nearly 75% of the country’s electricity is generated though nuclear energy. The government has since reduced its participation in the economy by privatizing most of its firms.

This paper focuses on the economy of France by analyzing five of its key macroeconomic variables. Additionally, policy recommendations will be suggested to help the country to revitalize its economy. The analysis will focus on the period between 1980 and 2012.

Background

France is among the leading producers of automobiles, aircrafts, cosmetics, and luxury goods. It also has highly advanced insurance, telecoms, power generation, and tourism industries.

The country’s labor force has the largest number of graduates, especially, in science disciples per one thousand workers in the Euro-zone. Following the end of the Second World War, the country experienced a rapid economic growth due to its massive investment in agriculture.

During this period, nearly 40% of the population was employed in the agricultural sector. The country’s GDP expanded at an average rate of 4.1% between 1945 and 1975. Rapid economic growth was maintained through several four-year development plans.

These plans had economic development targets that were set by the government, but were mainly achieved by the private sector. From 1945 to 1986, the government focused on implementing policies of nationalization, as well as, intensive intervention in the economy.

From 1981, Mitterrand’s regime focused on nationalizing major firms in key industries such as insurance, banking, and pharmaceuticals. Following the failure of the nationalization strategy, the country embarked on large-scale privatization of its firms in the 1990s.

Nonetheless, the government still holds a large proportion of shares in the countries major companies such as France Telecom and Renault.

In the 1990s, the country’s economy maintained moderate growth through investments in modern technologies such as the internet and the expansion of infrastructure.

The formation of the European Union and the Euro-zone contributed to the country’s economic growth by providing a ready market for its exports.

However, the economic crisis in Europe and the global economic downturn, which began in 2007, led to severe reduction in the country’s growth rate. In 2009, the country’s “real GDP contracted by 2.6%, whereas unemployment rate increased from 7.4% to 10%”.

Additionally, the country’s budget deficit as a percentage of GDP increased from 3.4% in 2008 to 7.5% in 2009. Public debt also increased from 68% to 89% of the GDP in the same period.

Despite the efforts made by the government in the last five years, the country has not been able to achieve a growth rate above 2% or to reduce its unemployment rate below 10% (IMF, 2013).

Overview of the Main Macroeconomic Variables

France’s real interest rate, unemployment rate, GDP, current account balance, and inflation rate have greatly evolved in the last thirty years. Unemployment rate refers to the “percentage of the total labor force that is unemployed, but willing to work and actively seeking employment”.

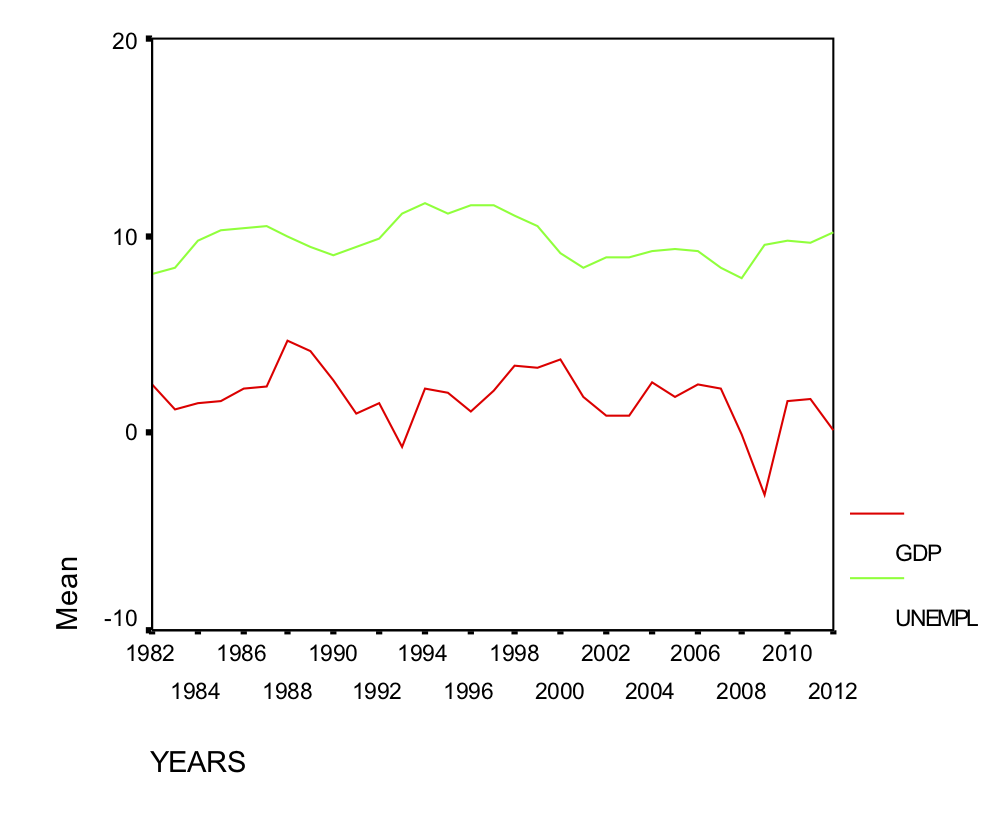

Figure 1 illustrates the fluctuation of unemployment in France in the last thirty years. According to figure 1, the country’s unemployment rate rose steadily from 8.07% in 1982 to 10.5% in 1988.

This increase is mainly attributed to the socialist policies that were implemented by the government, which resulted into poor performance of state-owned firms. This led to a significant loss of jobs. On average, the country’s unemployment rate in the 1980s was 9.56%.

Following the implementation of an expansionary fiscal policy that led to a 4.67% GDP growth in 1988, the unemployment rate reduced to 8.98% in 1990 (IMF, 2013). However, this recovery was short lived since the unemployment rate rose to 11.68% in 1994.

From 1994 to 1999, the country’s average unemployment rate was 11.21%. The country maintained a less than 10% unemployment rate from 2000 to 2008. However, the 2008/2009 global economic downturn led to an increase in unemployment rate above 10%.

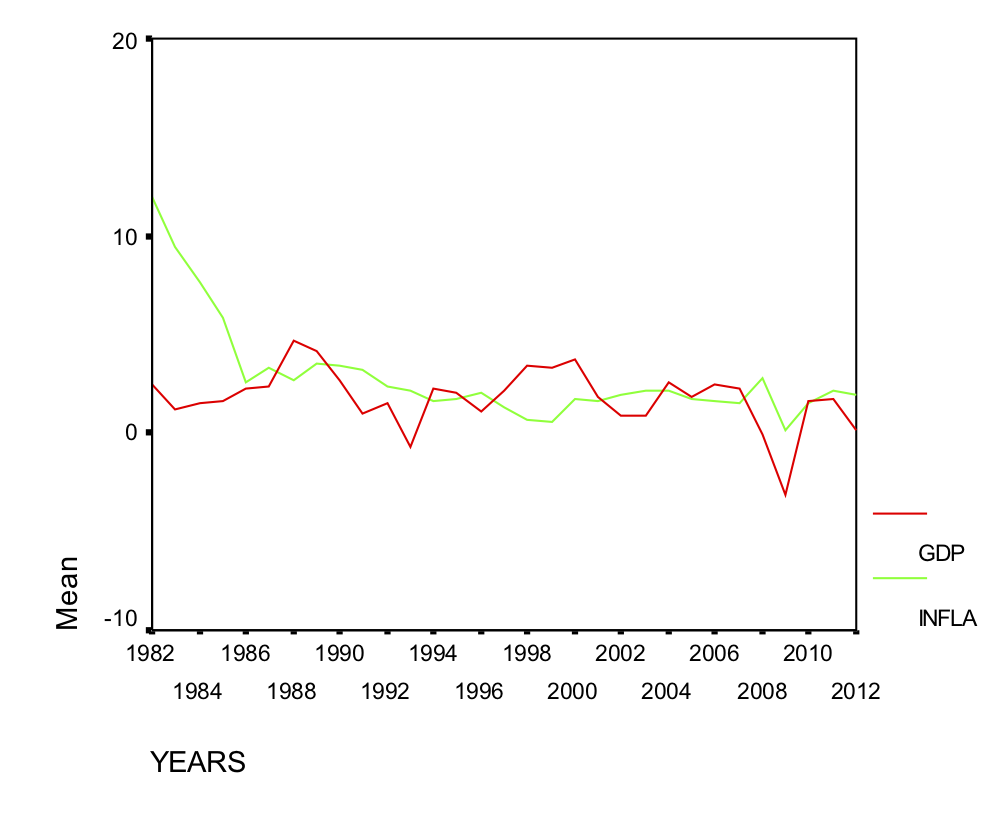

Figure 2 indicates that the country’s inflation rate has been falling from 1982 to 2012. The inflation rate decreased from 11.98% in 1982 to 0.67% in 1998 (IMF, 2013). One of the factors that accounted for the reduction in inflation was the oil glut of the 1980s.

The increase in oil supply in early 1980s led to a reduction in the price of crude oil. Consequently, the cost of production reduced, which in turn led to low inflation. However, inflation rose to 1.92% in 2012 mainly due to the Euro-zone crisis.

Despite the low inflation rate, France’s aggregate consumption and demand did not rise substantially in order to boost rapid economic growth. In this regard, the steady decline in inflation in the last decade reflects the poor growth in the country’s GDP.

This is because inflation often increases when the economy is experiencing rapid economic growth, especially, when the government implements an expansionary fiscal policy.

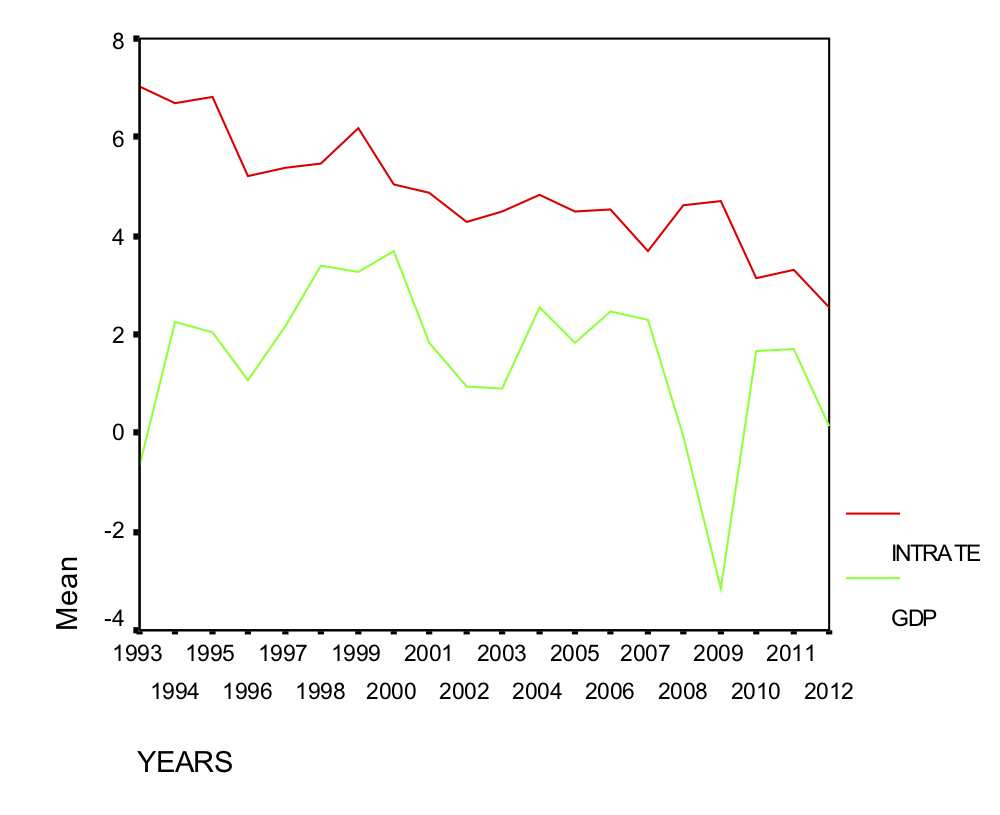

The country’s real interest rate has also been falling steadily in the last twenty years as shown in figure 3. Concisely, the interest rate was reduced from 2.4% in 1993 to 0.12% in 2012 (World Bank, 2013).

A significant reduction in interest rate was one of the strategies of the French government to spur economic growth by reducing the cost of financial capital. In particular, reducing the real interest rate was meant to increase the availability of affordable credit to businesses and individuals.

Consequently, private economic agents were expected to increase their expenditure, thereby promoting GDP growth.

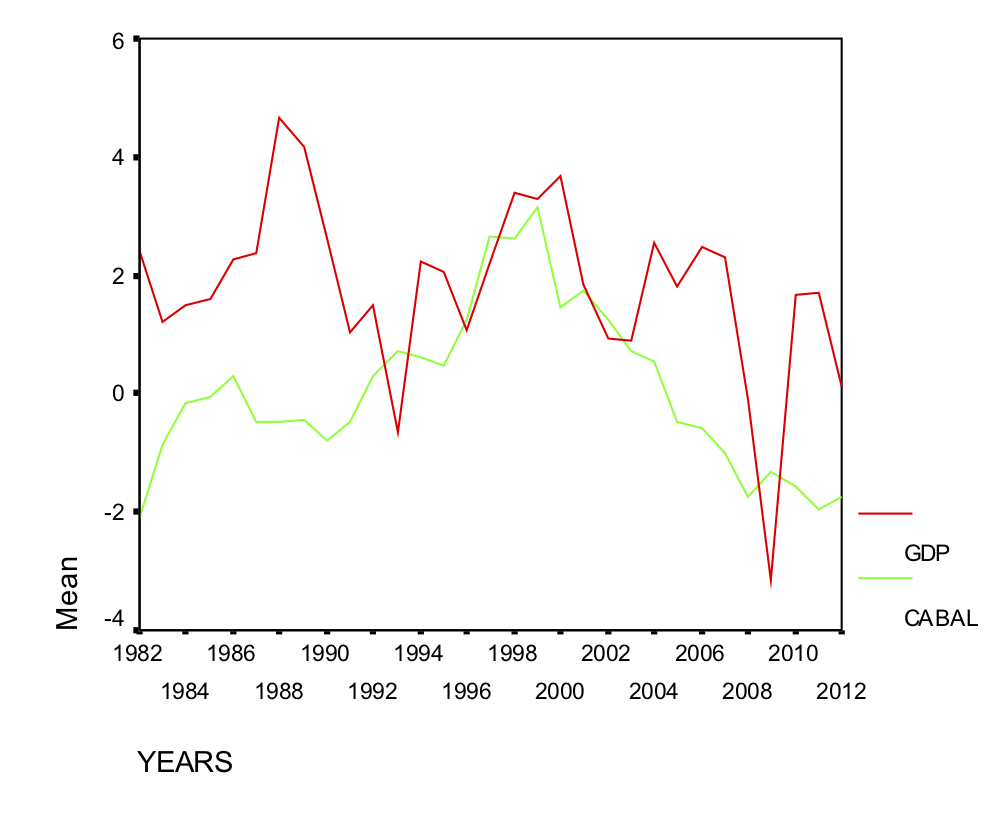

Figure 4 indicates that France’s current account balance has been very volatile in the last thirty years. The country had a deficit between 1982 and 1990. However, it recovered steadily after 1992, thereby reaching a surplus of 3.15% of GDP by 1999 (IMF, 2013).

From 2000, the current account has been declining steadily, thereby reaching a deficit of -1.75% of GDP in 2012. This deficit reflects the inability of France’s products to maintain their competitiveness in the international market.

In particular, high cost of production increased the prices of France’s exports. The resulting reduction in the country’s exports partly contributed to the increase in its current account deficit.

Since 1982, the country’s highest GDP growth was 4.67% in 1988, whereas the lowest growth was -3.15 in 2009. Table 1in the appendix presents the data used to generate figure 1 to 4.

Macroeconomic Analysis

France experienced a high unemployment rate (above 10%) between 1985 and 1988; 1993 and 1999; and 2011 and 2012. The high unemployment rate during these periods is mainly attributed to the conditions in the country’s labor market. France has one of the highest income taxes in the world.

The country’s personal income tax rate is more than 40%. France’s personal income tax rate is higher than the rate in most developed countries, especially, members of the Organization for Economic Cooperation and Development (OECD).

For instance, the United States of America charges 5%, whereas the United Kingdom charges 11%. The high personal income tax rate has contributed significantly to the reduction of the competitiveness of French companies.

This is because French employees have to demand for high wages in order to compensate for the high taxes that they pay to the government. This increases the operating costs of most firms, especially, in labor-intensive industries.

In order to maintain their competiveness, most French firms in the manufacturing sector relocated their production plants to countries such as China and India, which have cheap labor. This strategy has led to exportation of jobs as companies reduce their workers in order to lower operating costs.

For instance, Peugeot, one of the leading automobiles manufacturers in the country, dismissed 8,000 workers in 2012 in order to reduce its labor costs.

From 2000, the government focused on implementing several reforms in order to boost employment in the private sector.

The reforms included a reduction of personal income taxes for employees earning the minimum wage, as well as, allowing tax breaks for firms that employ young people or trainees. These reforms partly contributed to the slight reduction of unemployment between 2000 and 2003.

Nonetheless, these reforms did not achieve much since unemployment rate began to increase from 2004.

This is because French firms still found it profitable to produce in countries with cheap labor. Consequently, they focused on creating jobs in overseas markets rather than in their domestic market.

Protection of employee rights is another problem that leads to high unemployment rate in France. The labor unions in France have a lot of influence in the labor market. They always participated in the negotiation of salaries and working conditions in most industries.

Consequently, French workers benefit from job security and guaranteed salary levels. Providing these benefits has been a great challenge to small businesses due to their limited financial resources.

Consequently, they are reluctant to create new jobs for fear of the penalties associated with dismissing workers or paying low wages. Low qualification is the major cause of unemployment among the youth.

Due to the high competition in the job market, most employers prefer to hire experienced workers rather than fresh graduates from collages. Fresh graduates (youth) are expensive to employers since they have to be trained before they adapt to the work environment.

Finally, the high employment rate in 2012 is attributed to dismal economic growth that began in 2007.

Figure 1 shows that unemployment has been increasing as GDP growth reduces from 2007. The low economic growth has led to reduced profits, thereby limiting the ability of firms to create new jobs or to sustain existing ones.

According to figure 2, France’s inflation rate was highest in 1982. This is partly attributed to the 1978-1979 oil shock that led to a sharp increase in prices of goods.

The increase in oil prices in late 1970s led to an increase in the cost of production, thereby causing a general rise in the prices of goods. As the economy recovered from the oil shock, inflation began to reduce, reaching a low of 2.5% in 1986.

Following the expansion of GDP by 4.67% in 1988, the inflation rate rose to 3.5% in 1989 (IMF, 2013). An increase in economic growth is normally accompanied by increased expenditure in the private and the public sector, thereby increasing inflationary pressure.

Since 1990, France has maintained an inflation rate below 3%. This low rate of inflation is mainly attributed to slow economic growth and slack in the economy. According to figure 2, inflation tends to be falling when GDP growth is reducing.

The logic behind this trend is that slow economic growth lead to low GDP per capita. The resulting reduction in purchasing power leads to a fall in the demand for goods and services. Consequently, firms reduce their prices in order to remain competitive.

This reduction in prices leads to low inflation rate. In 2009, the GDP contracted by -3.1%, thereby causing a near deflation situation (0.09% inflation rate). The reduction in real interest rate in the last three decades was caused by intense regulation of the banking sector.

Concisely, banking-sector regulations did not permit the increase of nominal interest rates to compensate for the loss of currency value due to inflation. Consequently, real interest rates reduced as inflation increased.

Even though the government liberalized the banking sector in late 1990s, the real interest rates did not rise. This is because France’s central bank lowered its lending rate in order to spur economic growth.

Current account balance refers to a country’s net import of goods and services, as well as, net transfer payment and earnings from sources such as rent. In the last three decades, France’s current account has been in deficit except for the period between 1992 and 2004.

The deficit that occurred before 1992 was due to the high labor costs that led to outsourcing by most French companies. Concisely, most companies relocated their production plants to overseas economies with cheap labor.

Additionally, some companies outsourced their back office operations to foreign countries. This led to increased imports, thereby causing the current account deficit. The deficit that occurred after 2004 is mainly attributed to France’s participation in the Euro-zone.

In particular, the deficit has been caused by the monetary union in the Euro-zone. The use of a common currency means that France’s exchange rate in the Euro-zone is fixed.

Consequently, its currency cannot depreciate relative to other Euro-zone countries such as Germany in order to boost exports and reduce imports. Figure 4 indicates that France’s current account has been worsening when its GDP is falling and vice versa.

This implies that the reduction in productivity as indicated by a reduction in GDP limits the country’s ability to export. Arising GDP, on the other hand, implies increased productivity that increase the country’s ability to export, thereby improving the current account balance.

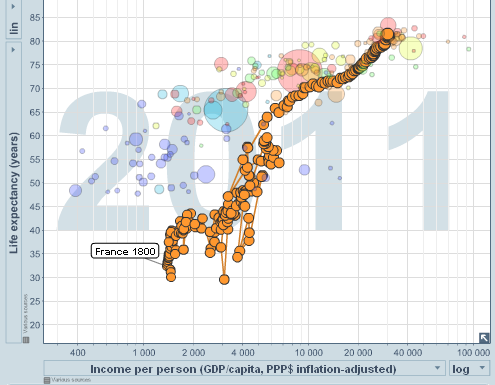

According to figure 5, France has been able to achieve a rapid growth in its per capita GDP since 1800. Consequently, it has been able to catch-up with other developed countries such Spain and Sweden (Gap-Minder, 2013).

Nonetheless, figure 1to 4 shows that the country has not been able to maintain a rapid growth of its GDP in the last three decades. From 1982 to 2008, France’s average GDP growth was approximately 2%. Other advanced economies such as the USA grew by 3% over the same period.

After 2008, France has not been able to achieve any growth above 1.6% (IMF, 2013). The factors that account for the poor performance include the following. To begin with, the economic model that spurred rapid growth after the Second World War lost its effectiveness from the 1970s to 1990s.

This is because the country has been experiencing a sharp decline in returns on capital, labor productivity gains, and investments since 1970s. Low productivity among the working class has also contributed to the country’s poor economic growth.

The number of hours dedicated to work per full-time employee has reduced considerable in the last three decades. France’s investment efficiency has reduced substantially in the last four decades. Investment efficiency refers to the “variation in GDP in relation to net fixed capital formation”.

The combined effect of low productivity gains and reduced investment efficiency led to a reduction in firm profits, thereby limiting growth. Consequently, firms focused on cost reduction and maintaining profitability rather than expanding their markets.

The reduction in profits limited the firms’ ability to make new investments, thereby slowing job creation. The resulting increase in unemployment rate led to a reduction of wages. Consequently, aggregate demand fell, thereby discouraging economic growth in the 1980s.

In the 1990s, the government introduced labor market reforms such as fixed-term contracts. These reforms enabled most firms to return to profitability. However, they did not succeed in enhancing domestic demand in order to promote economic growth.

Even though investment rebound in late 1990s, France did not define a new economic model to sustain a rapid growth. Due to unfavorable labor market conditions and low profits, most French companies embarked on foreign direct investments in the 1990s.

This strategy did not only lead to capital flight from the country, but also worsened its current account deficit and unemployment rate.

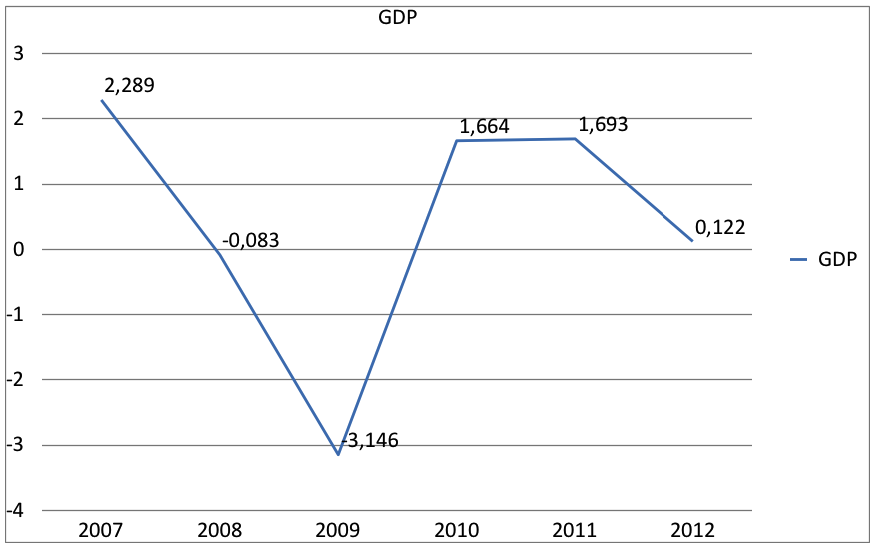

France is yet to recover from the shocks of the Euro-zone crisis and the 2008/2009 economic downturn, which have reduced its economic growth in the last five years. Figure 6 shows the trend in the growth of France’s GDP in the last five years.

According to the figure, France’s GDP began to decline just before the global financial crisis in mid 2007. The country’s aggregate demand declined during the crisis, thereby reducing its GDP growth from 2.289% in 2007 to -0.083 in 2008. The GDP growth further reduced to -3.146% in 2009.

This reduction is attributed to the fact that by 2009, the financial crisis had negatively affected consumption in most European countries, which are the main export destinations for France’s products. Consequently, France experienced economic decline due to a reduction in its exports.

The country’s business cycle shifted from recession to recovery phase in 2010. Additionally, its GDP growth remained stable at a rate of approximately 1.6% between 2010 and 2011. However, this gain was lost as the effect of the Euro-zone crisis spread across Europe.

In particular, the Euro-zone crisis led to low investor confidence, capital flight, low demand and consumption in the region. These shocks led to a decline in France’s economic growth from 1.693% in 2011 to 0.122% in 2012.

Policy Recommendations

The following suggestions can help France to return to rapid economic growth. To begin with, unemployment can be reduced through labor market reforms. These include wage compression that involves lowering the minimum wage rate and implementing a negative income tax.

A lower minimum wage will encourage local firms to create new jobs, whereas a negative income tax will compensate employees for the income lost through the reduction of the minimum wage.

The payroll tax should also be reduced in order to encourage local firms to create jobs by investing in France rather than relocating to other countries. The current account deficit can be corrected by increasing net exports outside the Euro-zone.

This is because the depreciation of the Euro against other currencies will make France’s exports more competitive. The current account will improve as exports increase and imports reduce. The government can avoid deflation by loosening its monetary policy.

The resulting increase in money supply will encourage investment and consumption, thereby preventing deflation. However, loosening monetary policy should be moderate in order to avoid high inflation. Finally, France should improve its economic growth by reforming its tax system.

Concisely, it should raise taxes for the high-income earners and lower taxes for the low-income earners. This will ensure that the government has adequate tax revenue without discouraging expenditure among the low-income earners.

Reducing the budget deficit to 3% of the GDP will negate the need for austerity measures in future, thereby encouraging growth through public and private expenditure.

Conclusion

The aim of this paper was to analyze the French economy. In particular, it focused on the evolution of the economy’s GDP, unemployment rate, inflation rate, current account balance, and real interest rate in the last three decades.

Results show that GDP growth has remained dismal in the last thirty years. The factors that account for the slow growth include high labor costs, lack of an effective growth model, and low investment efficiency.

The current account has been deteriorating. Similarly, high unemployment has been a persistent problem. Nonetheless, the real interest rate and inflation have been declining. In light of these revelations, the government should take immediate measures to improve the economy.

Appendix

Table 1: Data for figure 1 to 4.

References

Boyes, W., & Melvin, M. (2010). Macroeconomics. New York, NY: McGraw-Hill.

Couleaud, A., & Delamarre, F. (2010). France’s national economic wealth declined in 2009 for the second year in a row. Paris, France: Banque de France.

Gap-Minder. (2013). The wealth of nations. Web.

IMF. (2013). Economic data. Web.

Kabundi, A., & Simone, F. (2011). France in the global economy: A stractural approximation dynamic factor model anlysis. Empirical Economics, 41(2), 311-342.

Miotti, L., & Sachwald, F. (2004). Growth in France from 1950-2030: The innovation challange. Paris, France: IFRI.

World Bank. (2013). World development indicators. Web.