Introduction

Decision theory represents a general approach to decision making. It is suitable for a wide range of operations management decisions. Among them are capacity planning, product and service design, equipment selection, and location planning. The information for a decision id often summarized in a payoff table, which shows the expected payoffs for each alternative under the various possible states of nature.

The payoffs are shown in the body of the table. In this instance, the payoffs are in terms of present values, which represent equivalent current dollar values of expected future income less costs. This is a convenient measure because it places all alternatives in a comparable basis. If a small facility is built, the payoff will be the same for all three possible states of nature. For a medium facility, low demand will have a present value of $7 million, whereas both moderate and high demand will have present values of $12 million. A large facility will have a loss of $4 million if demand is low, a present value of $2million if demand is moderate, and a present value of $16 million if demand is high.

Cooperative and non cooperative

Cooperative game theory is where players make decisions depending on the other. They are able to cooperate in making the decision and the decision is joined. In cooperative parties enter into an agreement to share information relating to the decisions they are making. The best case in this scenario is decision making in OPEC Countries. They make decision about how much oil to produce and at what price to sell them. In non cooperative decision makers cooperate in other aspects but they make independent decisions which are strategic to each other business (Gintis, 2000).

Symmetric and Asymmetric

A symmetric is where the tradeoffs or the profit that accrue from taking one strategy will depend on the other strategies that the company takes. This is usually influenced by the competitors in the market. For example a company wishing to distribute drugs for Aids related complications in a certain country from United State of America will first make a decision whether the venture is profitable. Then will choose the strategy of entering to the market. The strategy may change if another competitor decides to enter the same market. Nash equilibrium uses the case of prisoner dilemma (Myerson, 1991).

In the case of asymmetric a decision maker will choose strategies which are not identical. In the business set up companies operating in the same industry will take different financing strategies for a particular venture. The competitors may be investing for a certain machine producing a certain types of goods that are required in the market but the companies decide to finance the machine using various strategies (Dutta, 1999).

Zero-Sum and Non-Zero-Sum

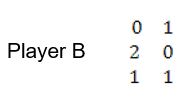

Zero-sum game is where the tradeoffs of the players in the business environment add ups to zero. In this case if a business games a certain unit of the market share the other losses the same. Therefore, it means in a case of companies in a business let us say supplying rice to the military camp of 10,000 staffs; if a company losses the supply of 1000 tons the other will gain the 1000 tons. The tradeoffs in this case are equals to zero. There is no increase in terms of the market share all of them will either snatch the market of the other or gain the market (Osborne, 2004). This case of zero-sum games strategy is applicable in a monopolistic environment where there are a few suppliers of a certain commodity and the market and the market for the commodity is fixed. The following matrix shows zero-sum game.

In this problem player B will choose either one of the three options while player A will choose one of the two options available to him. If A chooses (1, 0, 1) will result in B paying A one unit. It is at this point that one of the players should take a conservative approach to minimise the payments and increase the receipt. In this approach player A will choose (1, 0, 1) while player B will choose (1, 0) in this case he will pay out one and receive one. The tradeoffs will be 0.

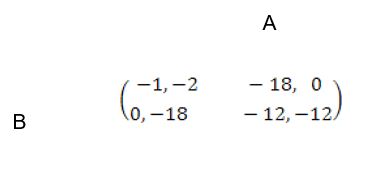

In the case of non-zero sum the tradeoffs does not under up to 0. This is usually used in cases of negotiation and defects in plants.

The matrix below shows the non-zero management game theory.

In this case a conservative decision maker will choose (-12, -12) which will give them non-zero figure each will gain equally.

Simultaneous and Sequential

Simultaneous game is strategies which are made by players simultaneously, but during the period of choosing these strategies none of the players knows the competitors decisions. However in the case of sequential is where players make strategies after having some information about the competitor’s actions. In this case, information in the market place an important role. The main difference in these two decision making games is the availability of information of the other player actions (Dutta, 1999).

Perfect information and Imperfect information

Information plays an important role in decision making process. In game theory sequential game requires information. The information may be perfect or imperfect. Perfect information is where all the parties to the games know the other parties actions. Imperfect information is where one of the parties does not have the other party’s information. Therefore, in this case one party makes a decision under complete information while others do not have information about the other party actions (Poundstone, 1992).

Infinitely long games

Infinitive games are those decisions which are made by players regardless what the other player is doing and the decision remains for a long period. The best example in this case is entering into a contract of mining deplorable natural resources for a certain period. The decision will stand until the mineral is finished.

Discrete and continuous games

Discrete games are those games which are made by a player ones an action has been taken the game is over. The player will need to make other decisions which have different consequences to the decision makers. Continuous games are those games that are made by a player (Fernandez and Bierman, 1998).

Application: Using Game Theory to Defend the Bombardier C-Series

For Bombardier to change the game and keep a competitive advantage over its rivals, the C-series plane is expected to highlight an incomparable environmental scorecard. According to the Air Transport Association, commercial aviation accounts for almost 4 percent of greenhouse gas emissions in the United States. Bombardier has identified the adverse effects that greenhouse gas emission has on the environment. Since the fuel consumption of the C-series aircraft family is low, its carbon emission has been significantly reduced. Since carbon dioxide emission is a global problem, the solutions also need to be global. Bombardier should come up with a program that will not only address greenhouse gas emission in Canada, but other countries as well.

The focal point of this paper is on using the game theory to find a non-market strategy that would efficiently change the game for Bombardier giving it a very competitive edge so that the C-series aircraft due to be launched in 2013 can quickly gain a large market share. If the strategy works, then the C-series aircraft family will not only be easily accepted by customers but will also attract customer loyalty from all over the world. One such strategy is leading a campaign on the reduction of carbon emission to take good care of our environment. It should be on the frontline of educating people and encouraging them to take good care the environment. The firm should lead by example through ensuring that the C-series aircraft family emits the least amounts of carbon dioxide. Statistics from the United Nations indicates that the aviation industry contributes the largest share of carbon dioxide emissions, which is very harmful to the ozone layer.

What is even more worrying is that the aviation industry is growing fast but the stakeholders have a very careless attitude towards the environment, which is absurd. The C-series aircraft family will therefore, take advantage of that by educating people on the importance of reducing carbon emissions by ensuring that its planes are very well taken care of so as gain a competitive advantage. As an environment friendly firm, the C-series aircraft family will therefore, take the market by storm by ensuring that greed and carefree attitude towards the environment does not take a toll on them. This will go a long way in ensuring that it penetrates the market with less difficulty given that it is a new product that is good for the environment (Bichard and Cooper 2006).

Embracing the reduction of carbon gas emission as a non-market strategy will work well with Bombardier since the clients would wish to travel with airline companies that not only cares for their personal safety, but also the safety of our environment. Similarly, Bombardier stands to benefit from this strategy since airlines companies shall buy airplanes that are appealing to the clients. Moreover, major organizations like the United Nations Environment Program (UNEP) are very likely to purchase the C-series aircraft family since both are committed to achieving the same objectives, which is saving the environment through reduction on emissions.

Airplane customers and airline companies understand the dangers that come with greenhouse gas emission. Therefore, Bombardier should capitalize on this assertion before introducing the C-series plane. Since the new climate bill has not yet been made into law, Bombardier should seize this opportunity and ask lawmakers to craft in a few laws that will combat carbon gas emission from aircraft. For instance, Bombardier should gunner for the inclusion of a clause that will allow airline companies to receive some discounts on emission tax or extra carbon credits. This clause should only be applied to airlines that fly planes with the recommended rates of emission.

On its part, Bombardier Inc. should ensure that the C-series plane meets the recommended rate for emission during and after flight. This will ensure that airline companies purchase this plane model based on its low level of carbon emission. Similarly, Bombardier should gunner for the inclusion of a clause that will stipulate the duration and distance a plane should cover over its lifetime. This will ensure that older and less environmentally friendly airplanes are grounded before they emit more carbon gas in the environment. To meet this requirement, the C-series plane should have a stipulated time frame on which it can operate. After this time frame becomes overdue, Bombardier Company should recall all the C-series planes for upgrading and repair. This will not only enhance the safety of the passengers, but also reduce the emission of carbon gas. It is imperative to understand that older planes emit more carbon gas than new and upgraded planes, thus the grounding of old planes should be advantageous.

Considering that some airline companies will find it hard to ground old planes, Bombardier Inc. should work hand-in-hand with the Canadian government to ensure that some tax is levied on old planes that are plying in and out of its skies. Bombardier Inc. in conjunction with the Canadian Revenue Agency (CRA) should compel the Canadian government to craft a law that will ensure that an extra tax is paid by airlines that are using old planes. Nonetheless, there are some airline companies and aircraft manufactures who might comply with this law. Such airline companies should either be banned from operating in Canada or pay huge fines for failing to adhere with the law.

On the contrary, airline companies that would adhere to this law should receive some tax cuts. Bombardier shall receive the support from the CRA and UNEP only if it shows its unrelenting fight for a clean environment. From the above discussion, it is imperative to state that developing countries and rich political cronies who own huge aircraft companies will resist any emission ceiling (Bichard and Cooper, 2006). This is because they have a lot to lose if the discussed policies and laws are passed and enacted. In as much as these laws will affect the profits of major airline companies and airplane manufacturers, they are noteworthy ventures and must be applied.

The C-series plane engines are powered by the Pratt & Whitney engine. It is argued that this engine has been manufactured using the Pure Power technology. Does this engine not only reduce fuel consumption, but also carbon and noise emission. Bombardier should use this technology to their advantage. It should urge the Canadian government to increase the taxes that are levied on airplanes that consume huge amounts of fuel. By doing this, Bombardier will ensure that the C-series plane model has a competitive edge over big aircraft that are manufactured by its rivals. Having discussed the above, it is imperative to discuss how the C-series airplane has been built to meet the above objectives.

Since the weight a plane carries and its design contribute a lot to fuel consumption, the C-series plane has been built with lighter composite material. Similarly, the C-series plane has been installed with an 11-foot vertical panel named winglets. The winglets are meant to augment the weight a plane is expected to carry by almost 12,000 ponds as well as reducing drag (Negroni, 2009). With the winglet installed in a plane, half a million gallons of fuel can be saved each year, and as a result, carbon emission will also be reduced. Moreover, the C-series’ flight deck is equipped with conventional side stick and fly-by-wire controls that lower the plane’s weight as well as reducing fuel consumption. As discussed above, a plane that consumes less fuel and is light in weight will emit less carbon as compared to other planes.

The most noteworthy improvement on the C-series comes from the changes made on the way it flies. Unlike Airbus and Boeing’s airplanes, the C-series is able to use global positioning information when on transit. This allows the C-series planes to cover shorter distances by following more direct routes to their destinations instead of following rigid routes, that take miles out of the way as they fly from one ground-based radar beacon to the next. It is imperative to understand that by covering shorter distances when flying, as well as following rigid paths reduces carbon emission.

The C-series airplane family has a unique landing procedure named the continuous descent approach. This procedure allows the pilot to reduce the amount of fuel that flows to the engines during descent. This allows the engine to achieve an idle setting as they begin to descent. According to experts, the continuous descent approach can reduce fuel consumption by 7% thus, a reduction in carbon emission. Since the C-series airplane families can get and reduce 7% savings across every flight through the continuous descent approach, it means that fuel consumption will reduce by 85 million gallons every year. This culminates to a reduction in carbon emission of 1.7 billion pounds (Kahn, 2004).

Conclusion

The competitive strategies devised by airlines to sustain competitive advantage in various markets forms the framework for what is known as a “business model”, the business model holds together the strategy that aims at achieving the goals of the organization. The business model also describes the way in which the airline does business and how it buys, produces and sells. An airlines business model is actually a value that the company offers to its targeted customers and provides a framework for managing its internal and external resources to achieve this. It is made up of two elements: a revenue model that deals with matters such as product design and sources of revenue and a cost model that deals with the financial aspects of the revenue model and addresses various business processes (Holloway, 2008). Airline business models have been changing rapidly over the last few years mainly because of three factors: deregulation and liberalization, the Internet and advances in aircraft technologies (Holloway, 2008). In a deregulated environment, due to high level of competition, prices are lowered and service offers are more diverse and there are many business models (Holloway, 2008). Three main airline business models are full service carrier, low cost carrier and charter carrier (Cento, 2008). A full service carrier is an airline company that has the following elements in its business model: core business, hub and spoke network, full coverage of as many demand categories as possible by optimisation of connectivity in the hub, global markets covered, development of alliances with partner carriers, vertical product differentiation and constant customer base. Moreover, the full service carriers have sophisticated yield management to support product differentiation and the sales are made through multi channels. External companies such as Global Distributed Systems are used to provide technological support for the distribution (Cento, 2008).

Reference List

Bichard, E. & Cooper, C. 2008. Positively Responsible: How Business Can Save the Planet. Oxford: Butterworth-Heinemann.

Cento, A. 2008. The Airline Industry: Challenges in the 21st Century. Heidelberg: Physica-Verlag Publishers.

Dutta, P. 1999. Strategies and games: theory and practice, New York: MIT Press.

Fernandez, L. & Bierman, H. 1998. Game theory with economic applications. New York: Addison-Wesley.

Gintis, H. 2000. Game theory evolving: a problem-centred introduction to modelling strategic behaviour. New Jersey: Princeton University Press.

Holloway, S. 2008. Straight and level: practical airline economics. New York: Ashgate Publishing, Ltd.

Kahn, A. 2004. Lessons from Deregulation: Telecommunications and Airlines after the Crunch. Washington D.C: AEI-Brookings Joint center for Regulatory Studies.

Myerson, R. 1991. Game theory: analysis of conflict. New Jersey: Harvard University press

Negroni, C. 2009. Altering Planes and the Way They Fly, to Save Fuel. Web.

Osborne, M. 2004. An introduction to game theory, Oxford: Oxford university press

Poundstone, W. 1992. Prisoner’s Dilemma: John von Neumann, Game Theory and the Puzzle of the Bomb, New York: Anchor