- Real vs. Financial Assets

- Investment Management Process

- Investing vs. Financing

- Direct vs. Indirect Investment

- Portfolio Management and Performance Measures

- Investment Income and Risk

- Return on Investment and Expected Rate of Return Investment Risk

- Factor Residual Variance and Standard Deviation

- Arbitrage Price

- References

Real vs. Financial Assets

The real asset comprises the physical assets of the company that can be determined from the value of property, plant, and equipment (Brealey et al. 2012). The value of the real assets of GE has declined from 2012 through 2014 at an average annual rate of 13.57%. Further, in 2016, the average quarterly decline in the real asset value is 1.24%.

The financial assets of GE comprise of cash and receivables. Cash and equivalent in the balance sheet of GE have declined from 2012 through 2015 (General Electric Company 2016). The average rate of decline from 2012 to 2015 of cash and equivalent has been 1.89%. Total net receivables of GE have increased steadily from 2012 through 2015 at an average rate of 10.8% (General Electric Company 2016). In 2016, net receivables of GE posted an average decline of 1.41% from first through the third quarter. The first three-quarters showed a remarkable decline of 14.9% of cash and equivalent from first through the third quarter in 2016.

The decline in a real and financial asset of GE is due to the company’s focus on focusing more on its core industrial production area and divesting in financial and other businesses. GE aims to become a leaner organization, concentrating on its core function and divesting in its finance divisions, GE Capital. In 2015, the company had announced a sale of $180 billion, of which it has successfully sold $156 billion (Ogg 2016). For this reason, the company has constantly undergone the sale of its real as well as financial assets, reflected in the declining rate of their finances as well as their real assets.

Investment Management Process

An investor makes investments in a particular portfolio by investment management process. The aim is to ascertain the average movement of the investment target returns (Vernimmen et al. 2014). Thus, an investor must look at the investment returns. In the case of GE, the return on equity has declined, steadily, from 11.39% in 2012 to -5.42% in 2015 (NYSE 2016). Further, the return on investment has shown a decline from 4.70% in 2012 to -1.12% in 2015 (NYSE 2016).

Further, the year-to-date return on a price for GE from 2011 through 2015 is -4.37% while that of other diversified companies is 8.35%. This indicates that investing in GE stocks may not be a lucrative idea as the past performance dampens expected returns.

Investing vs. Financing

Investment is spending money to buy equities and shares. The money an investor saves to earn interest at a later period is called investment (Elsas, Flannery & Garfinkel 2014). Investing in GE may not seem lucrative for investors, as the EPS has gone down from 1.27 in 2012 to -0.61 in 2015. Further, the return on equity has fallen from 11.39% in 2012 to -5.42% in 2015. Thus, the basic indicator that shows investors of the healthy working of the company indicates that GE’s performance has been dismal in the past few years.

On the other hand, financing is involved with short and long-term capital structure. In the short run, GE’s performance has been bad, as the year over year operating income change has declined from 1.69 in 2014 to -36.87 in 2015. The 10-year average of the change in operating income has also shown a decline from -2.07% in 2014 to -7.88% in 2015. Further, GE has plans to divest in its diversified business and concentrate on its industrial electrical business. Therefore, financing of capital assets may not be possible when the company is downsizing.

Direct vs. Indirect Investment

Direct investment is the outlay where the investors directly put in money into a scheme. On the other hand, indirect investment is the process in which the investor has to rely on a financial intermediary (Ehrhardt & Brigham 2016). When the investor directly puts his money in stocks or property of a particular company and holds its ownership, it is called direct investment. Indirect investment is a venture where the investor keeps the money in a trust, which makes the investment on behalf of the investors. In the case of GE, it is advisable to undertake indirect investment, as the financial performance of the company is not satisfactory. Hence, the diversification of the portfolio by indirect investment is advisable.

Portfolio Management and Performance Measures

This section deals with the way the portfolio of GE compares to that of Union Technologies. This section evaluates GE’s common stock to help investors understand the strength or weaknesses of the portfolio.

Investment Income and Risk

Understanding the risk associated with an investment is essential. This allows investors to gauge the profitability of the investment (Fabozzi & Mann 2012). The risk associated with the investment income is the drop in the interest rate (Ju, Leland & Senbet 2014). Using current value, the price and earnings ratio of GE (35.0) is higher than the industry average (23.3). The dividend yield percentage has fallen by 13% from 2011 to 2015.

Return on Investment and Expected Rate of Return Investment Risk

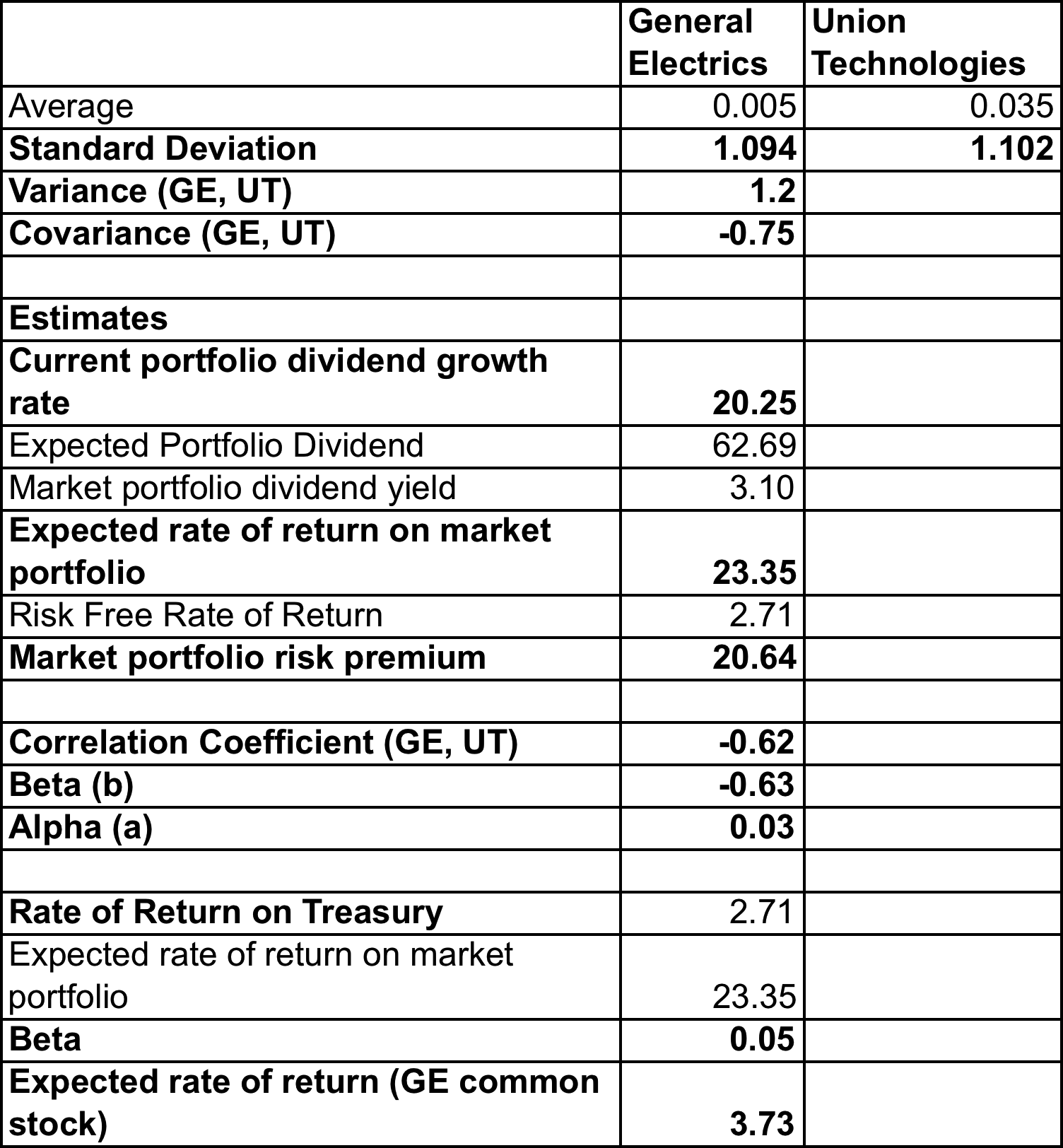

Return on investment (ROI) is the ratio of the difference between earnings and the cost of an investment to the cost. The rate of return is calculated as the sum of income and capital gain divided by the price. The return on investment of the current portfolio of GE is 20.25. This is calculated in comparison to a close competitor of GE, Union Technologies.

The expected rate of return on an investment is the statistically probable yield that an investor can expect after some time (Greenwood & Shleifer 2014). This is calculated as a probability of the ranking of the investment’s income. Whenever there is a loss, it would indicate a negative gain in the future. The expected rate of return for GE is calculated to be 3.73 (see Table 1).

Factor Residual Variance and Standard Deviation

An investment systematic risk is measured using the covariance of the investment return and the market returns. Once it is calculated it can then be divided by the market risk to arrive at the systemic risk. The measure of risk is referred to as the beta (b). Beta is the value of the risk that investors are undertaking in investing in a particular portfolio. The beta for GE in 2016 is -0.63 (see Table 1)

Standard deviation may be calculated from the square root of the product of the probability of the rate of return to the excess of yield over expected return. The standard deviation of GE’s stock prices is 1.09 (see Table 1).

Arbitrage Price

Arbitrage transactions consider the prices of the stock in two different stock exchanges. For instance, an investor may buy stock from NYSE and immediately sell it in S&P 500 if the price in the latter is higher. The premium that the investor earns is called the arbitrage gain.

In the case of GE stocks of the NYSE, the arbitrage price is the difference in the prices of the shares in the NYSE and Nasdaq. For instance, the closing price of a stock on 12 November 2016 was $30.71 for NYSE and it was $31.75 in Nasdaq. Therefore, if an investor bought 1000 stocks of GE on 12 November 2016 from NYSE and sold it in Nasdaq then the investor’s arbitrage gain will be $40. This is calculated by subtracting the difference in prices of GE stock in NYSE and Nasdaq and the total number of stocks purchased (and sold) multiplies the difference.

References

Brealey, RA, Myers, SC, Allen, F & Mohanty, P 2012, Principles of corporate finance, Tata McGraw-Hill Education, London.

Ehrhardt, MC & Brigham, EF 2016, Corporate finance: A focused approach, Cengage Learning, New York.

Elsas, R, Flannery, MJ & Garfinkel, JA 2014, ‘Financing major investments: information about capital structure decisions’, Review of Finance, vol. 18, no. 4, pp. 1341-1386.

Fabozzi, FJ & Mann, SV 2012, The handbook of fixed income securities, McGraw Hill Professional, London.

General Electric Company. 2016. Web.

Greenwood, R & Shleifer, A 2014, ‘Expectations of returns and expected returns’, Review of Financial Studies, vol. 27, no. 3, pp. 714-746.

Ju, N, Leland, H & Senbet, LW 2014, ‘Options, option repricing in managerial compensation: Their effects on corporate investment risk’, Journal of Corporate Finance, vol. 29, pp. 628-643.

NYSE 2016, General Electric Company. Web.

Ogg, JC 2016, GE Sells Off More Financial Assets, Sales Closer to Completion. Web.

Vernimmen, P, Quiry, P, Dallocchio, M, Le Fur, Y & Salvi, A, 2014, Corporate finance: theory and practice, John Wiley & Sons, London.