Executive Summary

General Electric (GE) has shown tremendous success in its key market segments. Underlying this success is a set of key competencies that span through the adoption of the latest technology, a strong customer focus, and an excellent success in its global businesses. This research paper recommends the diversification of existing markets, the improvement of the company’s key competencies, and balancing the company’s operational efficiencies with its financial performance as the right strategies that should define the company’s direction in the next five years.

Introduction

This document is a case study to analyze the organizational strategy of General Electric (GE) Company. Using appropriate academic models and concepts, this paper highlights GE’s key competencies and capabilities. This analogy also explains the effectiveness of the same strategies in supporting the company’s overall strategy. Furthermore, this paper also contains a briefing report to the chairperson and Chief Executive Officer (CEO) of GE to support the use of the real options approach in future strategic planning. Its recommendations outline the bedrock of a set of recommendations that outline GE’s potential strategies that are available to the company in the next five years.

GE’s Core Competencies and Capabilities

A value chain analysis, as proposed by Porter (1996), identifies the importance of core competencies in adding value to a company’s business process. Porter (1996) says the value chain process identifies four main value addition stages of a company’s activities – “inbound logistics, operations, marketing and sales, service, and outbound logistics” (p. 62). These key-value addition activities outline the categories which capture the core competencies of GE. Also, these core competencies propelled GE to corporate success. This section of the report outlines technology and innovation, customer focus and integrated solutions, and global presence as GE’s key competencies.

Technology and Innovation

Technology and innovation are key competencies for GE. Many companies have found it difficult to copy this key competence because GE has an unwavering commitment to break new grounds in product development through the development of new technology. Moreover, other companies find it difficult to reach GE’s heights of technological development because they do not have the wealth and resources that GE has (GE is among the largest companies in the world). The competence of technology and innovation integrates perfectly as a key division of GE’s value chain process as it influences how the company operates its core business activities. The use of technology to improve the product development process, therefore, manifests as a strong value addition activity for GE. For example, GE’s core competencies and capabilities have enabled the company to maintain a strong competitive advantage over the past few decades. The desire to diffuse new technologies in the company’s research and development (RESEARCH AND DEVELOPMENT) division is one such competency that has helped GE maintain a formidable market lead over its competitors. For instance, the company’s commitment to embracing the latest technology has emerged in the development of a multimillion-dollar RESEARCH AND DEVELOPMENT facility in Niskayuna and New York (Grant 2010). GE has made similar efforts to construct more global research centers in China and Rio de Janeiro (Grant 2010).

Customer Focus and Integrated Solutions

Another core competency that GE’s manager has nurtured in the organization is customer focus and integrated solutions. GE’s customer focus and integrated solutions are difficult to emulate because the company has an extensive global outreach that has significantly reduced the company’s response time to new complaints (few companies can match this global network). Therefore, compared to other companies, GE’s customers are often satisfied with the company’s commitment to their experience when using GE’s products (Grant 2010). Customer focus and integrated solutions also support “service” as a key-value addition process for GE. Porter (1996) explains that “service” adds value to an organization’s processes by supporting customers through the purchase and post-purchase decisions. Through customer focus and integrated solutions, Immelt has demonstrated that developing strong customer relationships and solving customer problems manifest as profitable strategies for GE (Grant 2010). Indeed, improved customer focus has enabled GE to achieve tremendous success in the marketing division (Grant 2010). After the company shifted its focus to building and nurturing customer relationships, GE received increased investments in its marketing function.

Global Presence

Few companies that operate in the same markets as GE enjoy the same global presence that GE has. Moreover, very few companies can claim to enjoy the same diversification that GE enjoys in its main operating segments – “energy, technology infrastructure, capital finance, and industrial activities” (Grant 2010, p. 756). This diversified business strategy explains why GE has an unrivaled global presence. Through the diversified global presence, GE has achieved enviable success in developed and developing markets. Through its global approach, GE has been able to attract new business and strengthen its ties with new countries. This strategy operates in a wider business-to-country relationship where GE has sought new businesses in Brazil, China, India, and Nigeria. In fact, in Nigeria alone, the company expects to make billions in revenue through several infrastructure projects (Grant 2010).

GE’s global presence, as a core competence, manifests as a value chain addition process that falls within the “marketing and sales” portfolio, as explained by Porter (1996). The value chain process dictates that the identification of customer needs and the generation of sales is a key-value addition process that drives the success of most companies. Indeed from the increased market outreach and the generation of global sales, through GE’s global presence, we can attest to how GE’s global presence maintains its profitability.

Briefing Report

Background

In today’s business world of unpredictable internal and external market dynamics, it is difficult to pursue one corporate strategy and follow it mindlessly to the end. For example, the 2008/2009 global economic recession complicated GE’s corporate strategy by creating an unfavorable environment for doing business (Grant 2010). Consequently, this environment dented the prospects of attracting new investors, especially since observers regarded it as part of the collapsing American financial system, and a ticking time bomb in the same regard (Grant 2010). It is, therefore, prudent for GE to find more innovative ways of wading through such unpredictable market dynamics. This report examines this issue and provides some workable recommendations that appeal to GE’s internal company dynamics

Business Strategy as a Sequence of Decisions

Essentially, it is correct to conceive GE’s business success as a series of options, as opposed to a set of static financial numbers. Indeed, although people understand GE’s success through its set of impressive financial figures, it is correct to say that a business strategy is not one thing (Financials), but a series of carefully orchestrated sequence of major decisions that lead to this financial success. Based on the complex dynamics that characterize the business environment, it is important to be wary of the dangers of using financial performance as a goal, as opposed to concentrating on the operational efficiencies that organizational managers may manipulate to achieve this goal. For instance, some managers prefer to adopt some business strategies immediately, while others wait for the best market environment to implement their strategies (Haahtela 2012). This dual approach of strategy formulation and implementation shows the way business strategies comprise of a series of options, as opposed to one corporate direction of achieving financial success.

Solutions

To understand how companies should manage economic uncertainties, it is crucial to understand the economy as a complex system, as opposed to a system in equilibrium. The complexity theory outlines this view by proposing that most companies would adopt better strategic decisions by understanding how their strategic choices align with the environment (Hinterhuber 2013). The complexity theory, therefore, perceives organizations as the products of aligned strategies and structures. The complexity theory also stipulates that company managers should understand that economic structures are complex and adaptive (Hinterhuber 2013). This way, it would be easy to understand why GE’s managers should view their economic environment as highly volatile. This way, it would similarly be easy to understand why GE needs to be more flexible in its strategic choices, as the flexibility would allow it to better adapt to economic conditions. The real option technique is a reliable tool that would allow GE’s managers to be flexible and adapt better to complex economic conditions.

For example, the real options technique may offer GE several strategic options that it could employ when faced with different situations. Some of the strategic solutions that could be employed included delaying, abandoning, or flexing a strategic decision (Luehrman 1998). These options may be exercised when GE faces different situations, such as when the company faces large uncertainties regarding a strategic move, when the value of an investment is integrated with possibilities for future growth, and when there is a possibility of future project updates. Faced with such dynamics, GE may use the real option technique to chart the right course of action for the company (Luehrman 1998). For example, it may use the delay tactic when it faces large uncertainties that require more information to formulate a strategy. Similarly, the company may decide to expand its operations if it faces highly dynamic situations because the real options technique allows dynamic analysis development. Broadly, the real options technique may offer more strategic flexibility for GE.

From the flexibility that the real options technique may offer GE, it is crucial to incorporate external and internal market dynamics in the company’s strategy formulation process (Porter 1996). This approach would be appropriate for GE because the company is vulnerable to ongoing market volatilities, both in its developed and developing markets. It is, therefore, crucial for GE managers to manage their company activities actively rather than passively. Adopting the real options approach may effectively provide this active managerial approach. Luehrman (1998) says that the real options approach is beneficial to organizations as it analyses business strategies as chains of real options.

The application of the real options approach may be valuable to GE because it would help in improving the efficiency of its research and development projects by allocating funds, correctly, to the various divisions that exist within its research and development division. Essentially, the real options approach will be beneficial for GE because it will help the managers to make timely decisions or prevent them from openly making wrong decisions. However, its efficiency depends on the inputs.

Summary

The effectiveness of the real options approach shows why GE should adopt this strategy because not only will it provide the company with an opportunity to learn from current strategies, but also because it may provide an opportunity to learn from ongoing market developments. This way, it will be easier for GE to exploit existing market opportunities and avoid unpredictable market dynamics that may threaten its bottom-line, the way the 2008/2009 crisis did.

Recommended Strategies

The balanced scorecard (BSC) technique outlines the framework for the formulation of GE’s recommended strategies. The balanced scorecard technique is a performance measurement tool for managers to understand what strategic choices they should focus on, and how they should measure these choices. In detail, the balanced scorecard technique suggests four perspectives that should guide the strategic choices of managers – the learning and growth perspective, the business process perspective, the customer perspective, and the financial perspective (Kaplan & Norton 1992). The recommended strategies outlined below fall within the four perspectives described above.

In detail, this section of the report recommends diversification, balancing GE’s operational efficiencies with its financial performance, and focusing on core competencies as the main strategic directions that GE should follow. Diversification is a strategy that resonates with the learning and growth perspective, balancing GE’s operational efficiencies with its financial performance resonates with the financial perspectives, and focusing on core competencies resonates with the business process perspective. The above categorizations show how the BSC approach informs the recommended strategies outlined below.

Diversification

One event that greatly threatened the success of GE was the 2008/2009 global economic crisis. This crisis prompted the reorganization of the company’s strategy as it diversified its options by venturing into new markets, tightening its finances, and selling some of its assets to consolidate existing global markets (Grant 2010). This paper proposes that GE should strengthen its diversification strategy, further, by entrenching its growing market presence in emerging markets. Already, this strategy has proved to be profitable, especially as the company has posted significant profits in some emerging markets in Asia and the Middle East. Since this strategy may insulate the company against economic vulnerabilities that may happen in one part of the world, it is also important to expand the company’s outreach in more emerging markets like Africa. Already, GE has a noticeable market presence in some of these regions, but it needs to cement this strategy, as opposed to using it as a “by-the-way.” Nonetheless, this paper is cognisant of the risks that such markets pose. Therefore, it proposes the adoption of the cost-benefit model as the main framework that should guide future diversification plans.

The cost-benefit analysis is a simple tool that allows companies to compare the costs and benefits associated with different strategies. The cost-benefit analysis will be an instrumental tool for GE as it ventures into new and risky markets. This model provides the company with an opportunity of weighing the cost of venturing into the new markets and the potential benefits associated with this strategy (Linn 2011). This way, GE may easily ascertain if the chosen strategy will be a sound investment decision, or if it will not be feasible for the company (Linn 2011).

Balancing the Company’s Operational Efficiencies with Its Financial Performance

“What you measure is what you get” (Kaplan & Norton, 1992, p. 71). This statement defines the approach the GE should take in the next five years. The company should define the corporate direction and measure its results according to this criterion. The operational performance criterion evaluates operational indicators that drive financial performance. This should be GE’s focus. However, GE should not think that operational performance should be the only performance measure for the organization; it is important to balance operational performance and financial performance to get a more accurate understanding of how an organization performs (Kaplan and Norton 1992). The nature of the balanced scorecard model manifests through the significance of balancing operational and financial indicators.

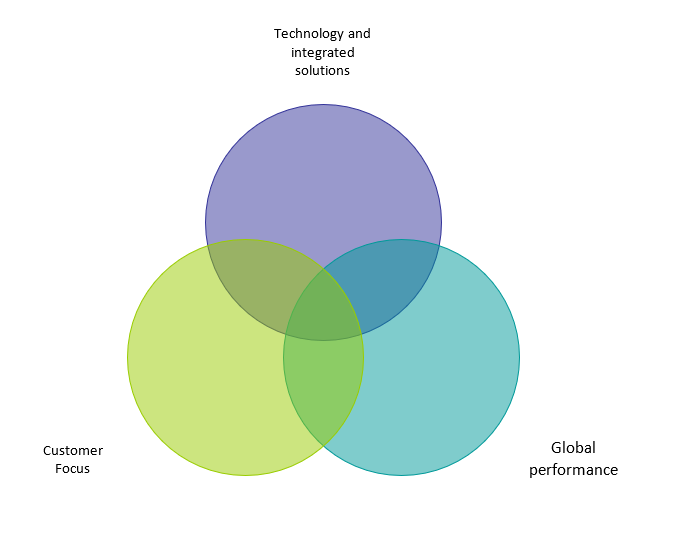

The balanced scorecard model will be useful to GE because it will help the company to expand and improve its core competencies as its main drivers of organizational performance. This paper realizes that the main operational indicators of GE are customer perceptions, global performance, integrated solutions, and the adoption of technology as shown below

The adoption of the above-balanced scorecard may help to improve GE’s strategy because it may align GE’s key performance drivers to the company’s overall corporate strategy. Therefore, it will be easier for GE to realize its corporate vision. The balanced scorecard technique will also help GE’s managers to have a broader picture of the company’s business operations, through the understanding of the company’s business goals and strategies. Lastly, the balanced scorecard technique will maximize cooperation across all levels of the company’s business operations (Kaplan and Norton 1992).

Focus on Core Competencies

Hamel & Parhalad (1990) introduced the concept of core competencies. The test of core competency evaluates if a core competence is relevant, difficult to imitate, and easy to apply (breadth of application) (Namkung & Jang 2008). By analyzing the concept of relevance, GE’s core competencies should demonstrate that they give the customers a strong reason to choose GE (Namkung & Jang 2008). If the competencies do not demonstrate this fact, it is difficult for GE to maintain its competitive advantage. GE’s core competencies should also be difficult to imitate so that the company continues to provide products that are better than the competitors’ products. Lastly, GE’s core competencies should provide other markets for the company because it is important for the company to sustain its growth. Through GE’s unique customer services and superior products, the company’s key competencies pass the test of core competency.

Adherence to Rumelt’s Criteria

The above strategic approaches apply to Rumelt’s criteria, which relies on the concepts of consistency, consonance, feasibility, and advantage (Hinterhuber 2013). Rumelt emphasizes on the need for the internal dynamics of an organization to support company strategies (Pehrsson 2006). Based on the alignment of GE’s core competencies and the proposed strategic approaches, it is easy to see how Rumelt’s criterion suffices in the recommendations of this paper. For example, the core competencies are chosen for the balanced scorecard technique outline the company’s key competencies. These key competencies, therefore, highlight the company’s internal management strategies (focus on technology, global appeal, focus on the customer, and integrated solutions)

Rumelt also suggests that company strategies should be in consonance with external trends of the business environment (Hinterhuber 2013). The focus on core competencies as a future company strategy for GE meets this criterion because this strategy mirrors the existing market trend, where many companies today are outsourcing their “weak” operations and focusing on their core competencies. This widely accepted corporate strategy has shown immense success in many of today’s organizations.

Concerning Rumelt’s suggestion that corporate strategies should be feasible, the proposed strategies for GE are highly reasonable, in the context of GE’s resource capability. In other words, GE has the money, capital, management expertise, technical resources, and professional knowledge to adopt the above strategies. Indeed, the company is a leader in the industry, and it has been able to amass a wealth of knowledge and resources to undertake the proposed strategies.

Lastly, the proposed strategies for GE, as outlined above, may easily improve GE’s competitive advantage, thereby meeting Rumelt’s last criterion for corporate strategies – competitive advantage. For example, Hamel & Parhalad (1990) say the focus on a company’s core competency provides a proven method for improving a company’s competitive advantage. Through the same strategy, GE would be able to improve its resources, skill pool, and position in the market.

Conclusion

GE has exhibited unrivaled industry competitiveness in its core business segments. Most of the strategies that the company has adopted seem to have justified this success. However, Immelt needs to mitigate the environmental threats that exist for GE by strengthening some of the company’s existing strategies, like diversification to emerging markets. Indeed, to overcome some of the market vulnerabilities that GE experiences, it is important to diversify the company’s operations, further, and balance its operational efficiencies, viz a viz its financial performance (balanced scorecard technique). Coupled with the adoption of the real options technique, GE may further improve its market position and respond better to existing and future market uncertainties.

References

Grant, R 2010, Contemporary Strategy Analysis, John Wiley & Sons, London.

Haahtela, T 2012, ‘Differences between financial options and real options’, Lecture Notes in Management Science, vol. 4 no. 1, pp. 169–178.

Hamel, G & Parhalad, C 1990, ‘The Core Competence of the Corporation,’ Harvard Business Review, vol. 68 no. 3, pp. 79-91.

Hinterhuber, A 2013, ‘Can competitive advantage be predicted?: Towards a predictive definition of competitive advantage in the resource-based view of the firm,’ Management Decision, vol. 51 no. 4, pp. 795 – 812.

Kaplan, R & Norton, D 1992, ‘The Balanced Scorecard: Measures that Drive Performance’, Harvard Business Review, vol. 70 no. 1, pp. 71–79.

Linn, M 2011, ‘Cost-benefit analysis: examples,’ Bottom Line: Managing Library Finances, vol. 24 no. 1, pp. 68 – 72.

Luehrman, T 1998, ‘Strategy as a Portfolio of Real Options,’ Harvard Business Review, vol. 76 no. 5, pp. 89–99.

Namkung, Y & Jang, S 2008, ‘Are highly satisfied restaurant customers really different? A quality perception perspective,’ International Journal of Contemporary Hospitality Management, vol. 20 no. 2, pp. 142 – 155.

Pehrsson, A 2006, ‘Business relatedness measurements: State-of-the-art and a proposal,’ European Business Review, vol. 18 no. 5, pp. 350 – 363.

Porter, M 1996, ‘What is Strategy,’ Harvard Business Review, vol. 74 no. 6, pp. 61–78.