Introduction

This report presents an analysis of one of the brands participating in the ‘Get Singapore’ campaign. The aim of the ‘Get Singapore’ campaign is to promote the local brands in Singapore in an effort to attract more local consumers. It has been observed that locals prefer foreign brands to Singapore brands because of the perceived low quality in the former compared to the latter. As such, this campaign also serves to help change this perception and at the same time, increase the brand awareness of many local brands.

One of the local brands participating in this campaign is Cosmoprof Academy. Cosmoprof is a big name in the cosmetic, beauty, and spa treatment industry. This report will give an introduction of the brand background, along with its existing local market position and brand image. After which, the report will explain its current marketing mix strategies and also discuss further strategies Cosmoprof should take up when entering an international market. Before going global, it is important for companies to make decisions related to their level of channels, channel designs, channel management, and channel integration (Kumar, Massie, & Dumonceaux, 2006).

Introduction and background of Cosmoprof Academy

Cosmoprof Academy, also known as Cosmoprof School of Beauty Therapy and Makeup, is a renowned institution that offers recognized diplomas and certificates for its training courses in beauty, makeup, therapies, and spa industries. Having the passion and love in these areas, the founder of the company, Peter Sng, endeavored to provide a complete and valuable experience to clients and customers by providing them with professional makeup services (Get Singapore).

Initially, the company dedicated itself to providing specialized and expert makeup services to the local entertainment industry in Singapore. With the passage of time, it started expanding its scope of business and offered more diploma courses and education in therapies. Through the years, Cosmoprof has also come up with its own range of makeup lines.

The company believes that in order to have an effective, efficient and successful career in the beauty and makeup industry, one needs to have a strong foundation which is only possible with professional training in that field (Cosmoprof).

Over the years, Cosmoprof has built up an impressive list of accolades and achievements as follows:

- Official makeup provider for the finalists of ‘Miss Universe’ competition held in Singapore in 1987

- Official makeup provider for the Youth Olympic Games opening and closing ceremonies held in 2010

- Principal sponsor of the National Day Parades from 1997-2010

- Winner of the Arts Supporter Award from 2001-2008, by the National Arts Council

- Official makeup partner for the Chingay Parade, Asia’s Grandest Street Parade from 2001-2010.

Apart from the above, Cosmoprof has a huge ‘network and portfolio of world class and professional makeup artists providing expert makeup services to various events and programmes including theatre, film, television, special effects and commercials (Cosmoprof).

Target Market

Cosmoprof is taking a two pronged approach in its target market. Its training courses targets both general consumers and corporate clients. General consumers include international students who intend to pursue a career in the local beauty industry, hence seeking training and education with Cosmoprof. Corporate clients, on the other hand, engages Cosmoprof for its services rendered, making use of the company’s large pool of professionals well trained in the fields of makeup, beauty and spa therapies.

Apart from its training courses, Cosmoprof’s own line of cosmetics targets high end consumers. And at the same time offers its products on an international platform.

Current position of Cosmoprof in local market

Being an established brand, Cosmoprof has been in the industry for almost 25 years and is known for its professional and expert services in beauty and spa industry. To determine the value and position of the brand, the Brand Asset Valuator (BAV) is used.

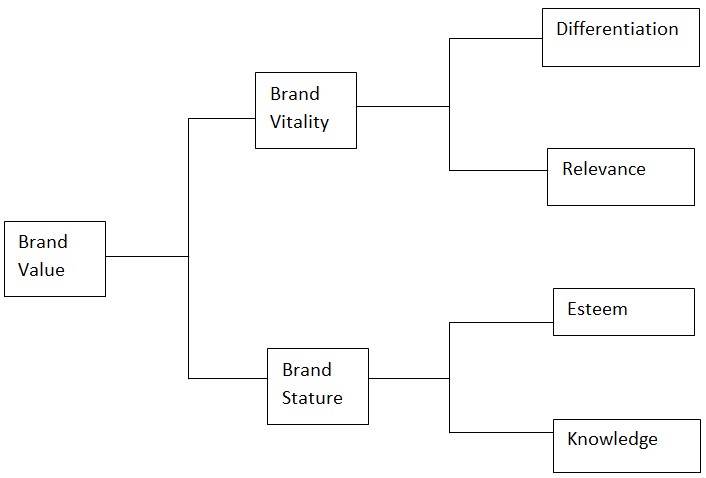

BAV uses four dimensions, namely differentiation, relevance, esteem and knowledge to define and describe the position and status of the brand. Differentiation and relevance describes the vitality and growth potential of the brand while esteem and knowledge describes the current power of the brand (Campbell, 2002)

Differentiation

Cosmoprof is well differentiated from the other competing brands in the industry as it has not only established as a cosmetic brand, but also as a provider of professional training and education services in all areas of the beauty industry, including spa therapies.

Relevance

Cosmoprof has difficulty establishing relevance in the minds of consumers and penetrating the local market. Operating in the niche market segment of ‘specialty makeup’, Cosmoprof’s products are not highly sought after by general consumers. General consumers are not concerned with education and training related to beauty and make up. Instead, they are more interested in over the counter product offerings, which Cosmoprof do not actively partake in. As such, Cosmoprof, as a cosmetic brand, is not able to establish proper relevance with general consumers and hence deemed unimportant.

On the other hand, for consumers seeking a career in the beauty industry, Cosmoprof is seen as an educational institute which would grant them the relevant credentials to succeed in the industry. For clients who wish to engage Cosmoprof’s expertise for events and functions, Cosmoprof is seen as a service provider that could help them meet their needs. As such, the academy would be more relevant for these groups of consumers.

Esteem

Due to its association with different popular and glamorous events and ventures, Cosmoprof is perceived to be a high quality service provider and a highly reputed brand in the beauty industry (Bowing, 2010), the company has a rather well established esteem in the market.

Knowledge

Brand awareness of Cosmoprof is high in the corporate sector, but low to moderate in the general household sector. As mentioned, the general public is less aware of Cosmoprof as a local cosmetic brand, but more aware of it as an educational institute and service provider in the beauty industry. Hence, they are more inclined towards international cosmetic brands that offer makeup products (Mittal and Lassar, 1998).

Brand vitality

After analyzing and evaluating differentiation and relevance of the brand, it can be concluded that the brand has high growth potential, in both the corporate and general public segment. This is due to its competitive advantages by providing both product and service offerings to its consumers. Most cosmetic brands in Singapore only have product offerings in place. Cosmoprof however, took the extra step of providing educational opportunities to the general consumers.

However, Cosmoprof would have to work on increasing its relevance and market penetration of the brand by improving brand awareness and marketing its brand not only as a service provider, but also of a maker of high quality cosmetic products, especially so to the general public.

Brand Stature

On the esteem and knowledge dimensions, Cosmoprof needs to work on its current brand power in the local industry. Although perceived to be of high quality in the corporate segment of the market, brand awareness among the general consumers is low. The image of the company is unclear and confusing to consumers. Therefore, Cosmoprof needs to work on its brand image, by consistently delivering the message of being a credible education institute and service provider, and at the same time, offering high quality products to consumers.

Marketing Mix

Product

Cosmoprof is offering a combination of goods and services in the local market to differentiate itself from its competitors. Initially the company started out with the idea of providing expert and professional services in the beauty industry, only to go one step beyond to provide training and education for consumers. To further increase its competitive advantage, the company then launched a complete range of products to further penetrate the local industry.

The core benefit of Cosmoprof is to make people look better. At the second level, this benefit is turned into an actual product where the brand name, quality and packaging come into play when the company launched its range of cosmetics. Cosmoprof then took it to another level by building an augmented product around the core benefit by offering addition services should they need professional help for events (Morganti, 2000).

On the service level, it is imperative for Cosmoprof to send the right signals about quality as services cannot be seen, tasted, felt or heard before purchase. To uphold quality levels, Cosmoprof ensures that each student sit for examinations at the end of course to certify their level of competency in the area which they are studying. In addition, their diplomas are also recognised locally to help individuals advance in their careers in the beauty industry (Protti, 2010).

Pricing

Having established itself as a brand with high value and competing in the niche market for its products, it could lead to the impression that prices for its service and products would be higher compared to its competitors. On the contrary, its prices are on par with its competitors, in terms of offering diplomas in makeup. For example, its competitor, School of Make Up, is offering the same course at $3300, whereas Cosmoprof is charging $3424 inclusive of 7% GST. Hence, we could conclude that its pricing strategy may be that of competition-based pricing, where companies base their pricings largely on competitor’s pricings. It is difficult for Cosmoprof to engage in value-based pricing because this strategy uses buyers’ perceptions of value. As mentioned previously, the target market of Cosmoprof is very segregated and consumers in each segment have different perceptions of value. Hence, it is difficult to set a common value for the products and services offered by Cosmoprof.

Furthermore, Cosmoprof is providing a huge range of high quality services and products at an affordable and reasonable price (Wajidi, 2010). Its products are made available wholesale at lower prices compared to its competitors. The aim of such a high quality low pricing strategy is to attract consumer and gain market share (CosmoProf Offers High End Beauty Without High End Prices). Besides this strategy, Cosmoprof also engaged in product bundle pricing. By signing up for their training programmes and courses, consumers stand to gain a complimentary make up case, brushes and cosmetics worth $1800. This move helps to attract consumers to sign up for their courses as well as promotes their line of cosmetic products.

Promotion

Cosmoprof is engaging in extensive promotion and marketing to increase brand awareness and knowledge among local consumers. The company has a well maintained website that provides information on programmes and courses offered, as well as the different services and products available. Keeping up with technology, Cosmoprof can also be found on Facebook, where latest activities and course offerings are posted online, and increasing brand awareness.

It has also been involved in and sponsored many different events and projects of international popularity , gaining free publicity as these events are broadcasted in local media, which helps to generate brand awareness at a lower cost, as compared to running its own marketing and promotions campaign.

Channel Design Decision

Cosmoprof should also aim for capturing market share in the international market in view of growing globalization and increasing opportunities in the international market. The most attractive market at the moment for any cosmetic and beauty related company is India. The Indian cosmetic industry is growing at rapid pace and there is high growth potential in the beauty industry of India (Kumar, 2005). Some of the important decisions which have to be taken by the company before starting their venture in India are:

Analyze Consumer Needs

The company has to analyze consumer needs in India in order to be able to serve their needs and requirements in better way. The cosmetic and beauty industry in India is booming and growing at face pace. There is high growth potential in the industry and any such idea of beauty training and education will be highly appreciated and welcomed by the people in India. Cosmoprof can start the training institute in India as the market size is considerable and people there are looking forward to any such opportunity of beauty training and education (Wee, 2003).

As far as the beauty products are concerned, the Indian market is already clustered and saturated with many different national and international brands which have established strong brand positioning and reputation in the market (Kumar, 2005). It will be difficult for Cosmoprof to penetrate in the already saturated market. But at the same time the cosmetic industry in India has growth potential which can be tapped by Cosmoprof. In the start the company can go for discount retailing with penetrating prices in order to penetrate in the market. Cosmoprof can capitalize on the same strategy of low and penetrating prices in the Indian market in order to capture the market share (Cosmetic Industry Review, 2011).

Set Objectives

Cosmoprof has to ensure that the company provides the same level of quality in education and training and other services in Indian market as in Singapore. For achieving this objective the company has to look for experts and high profiled trainers. The company has to also make efforts to ensure that the certificates and diploma courses are recognized in the India.

The objective for the distribution of beauty products is to achieve high responsiveness in order to be able to respond quickly to the demand of the consumers and market and to increase the availability of the product. For this reason the company has to increase the number of intermediaries in the supply chain.

Identify Alternatives

The objective of the company is to be more responsive, in order to achieve this objective the company has to hire services of different distributors and retailers in order to ensure that the product is available in the market. The company in the start has to go for intensive distribution in order to target large segment of the market. Apart from this the company will also have to start manufacturing in India to achieve the objective of being responsive. This will also save the cost of shipping and other related expenses and will allow the company to create competitive advantage of low and penetrating prices (Wholesale Beauty, 2011).

Apart from this Cosmoprof will also have to come with one or two company operated retail stores in order to increase the brand image. The company can also sell beauty products from the training institute which will be established in India.

Cosmoprof has to create acceptance of Singapore brand in the Indian industry. Indian market is always open for the international brands and if the company pursue effective marketing and promotional strategies it can increase the brand awareness and acceptance in the local market of India.

References

Bowing, S. (2010). “Cosmoprof Asia Sleeping Beauty Awakens”. Professional Beauty, 46-48.

Campbell, M. (2002). Building brand equity. Journal of Medical Marketing, 2(3), 208-218.

Cosmetic Industry Review. (2011) Trends report.

Kumar, S. (2005). Exploratory analysis of global cosmetic industry: Major players, technology and market trends. Technovation, 25 (11), 1263-1272.

Kumar, S., Massie, C. and Dumonceaux, M. (2006). Comparative innovative business strategies of major players in cosmetic industry. Industrial Management & Data Systems, 106 (3), 285 – 306.

Mittal, B. and Lassar, W. (1998). Why do customers switch? The dynamics of satisfaction versus loyalty. Journal of Services Marketing, 12(3), 177 – 194.

Morganti, P. (2000). Natural selection. Soap Perfumery & Cosmetics.73, 4, 55-59.

Protti, A. (2010). Cosmoprof proves that packaging industry is pulsing : packaging. South African Pharmaceutical and Cosmetic Review, 37(8), 38 – 39.

Wajidi, A. (2010) Get Salon Quality Beauty Products at Wholesale Prices with CosmoProf Beauty Supply. Wholesale beauty products. Web.

Wee, T. (2003). International Brand Management and Strategy – The Case of the Nuovi Cosmetics. Australasian Marketing Journal (AMJ), 11(3), 72-79.

Wholesale Beauty. (2011) “CosmoProf Offers High End Beauty without high end prices”. Wholesale beauty products. Web.