he principles of taxation

The process of collecting a stipulated fee from an individual is called taxation. Taxation is an enforced law of the state. The statutory powers of the government enforce total compliance. However, the government can review the procedure and method of tax collection. The characteristics of a good tax system include equity, feasibility, efficiency, and simplicity (Shafritz, Russell, and Borick 78). The guideline for tax collection forms the principles of taxation. The principles of taxation affect the equal distribution and collection of taxes. Taxation principles include equity, ability to pay, simplicity, and administrative feasibility.

Equity of taxation

Equity principle means the balanced distribution of tax. An individual is taxed based on the income generated. The equity principle enforces a fixed tax deduction on income and wage.

Ability to pay principle

This principle implies that individuals are taxed based on their ability to pay. Individuals with higher incomes will pay higher taxes. Thus, the ability to pay a fixed tax is directly proportional to the income generated.

Efficiency principle

The efficiency principle states that the marginal cost of taxation must be equal to the benefits. Thus, an efficient tax system will not affect the incentives of workers.

Administrative feasibility

The principle of administrative feasibility stipulates that a good tax system must be simple, convenient, and effective. The taxpayer should understand the reason for tax deductions. The characteristics of a good tax system include efficiency, convenience, just, compatibility, and equity. A successful tax system implies that the individual understands the reason for tax deductions. Thus, the tax pattern is convenient and payable. The above principles justify a good tax system.

Federal and state government revenues and expenditures

Income generated from crude oil, taxation, customs duty, and services is called revenue. Government expenditures include investment, capital spending, and public utilities. The three tiers of government include the executive, state, and local government. Each tier of government derives its revenue from taxation and investment. The sources of federal government revenue include taxation, customs duty, excise duty, agriculture, and investment (Shafritz, Russell, and Borick 98). Government expenditures reflect the revenue generated. The federal arm of the government controls the revenue allocation. The state government collects revenue from taxes, loans, and investments. However, external revenues are shared with the federal government. The major source of state government revenue is its monthly allocation. The state government receives a monthly allocation from the federal government. The expenditures of the state government must correspond with its revenue. State government relies on its monthly allocation for capital expenditures (Shafritz, Russell, and Borick 98). Capital expenditures include salary payment, road construction, investment, and loan. Capital expenditures of the federal government include interstate construction, monthly allocation, foreign aids, salary payment, and investments.

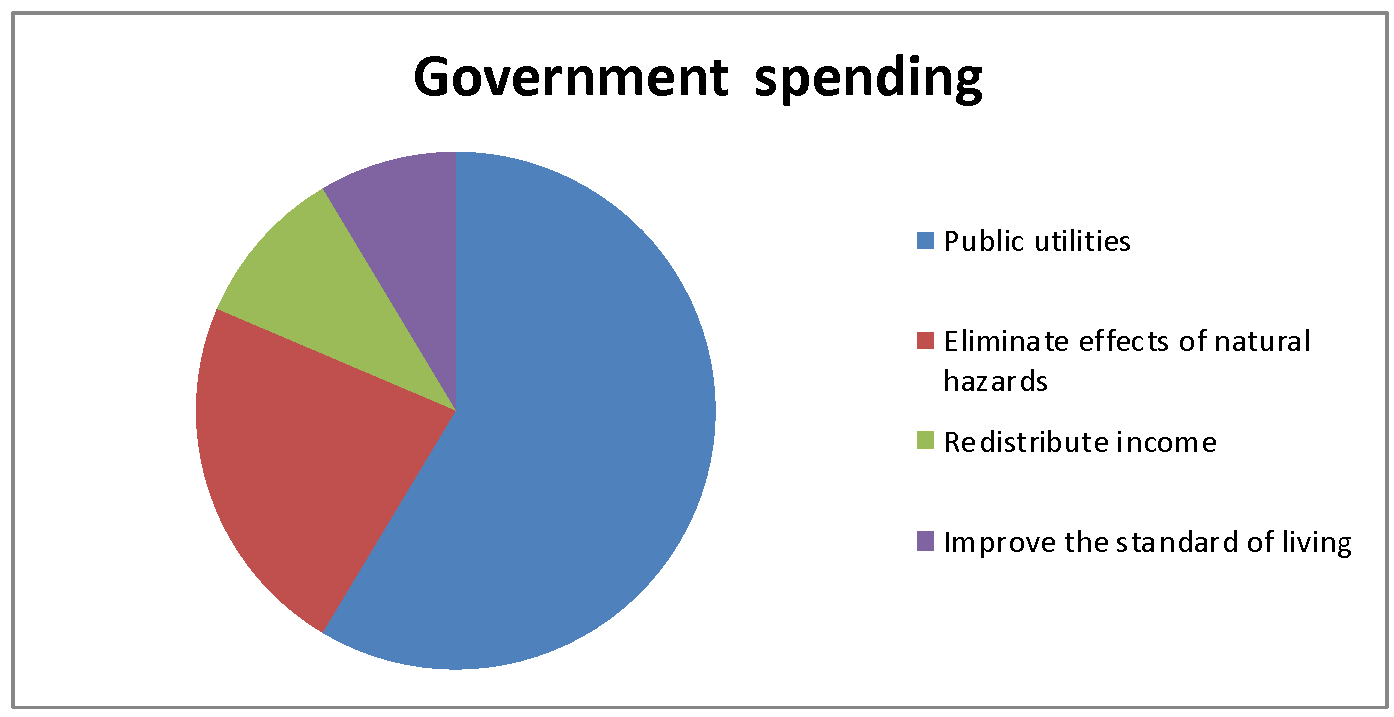

Reasons for government spending

- Build public utilities such as schools, hospitals, railways, traffic lights, water channels, and electricity.

- Eliminate the effect of natural hazards such as earthquake, flood, disease outbreak, drought, erosion, and pollution.

- Redistribute income and stabilize the economy.

- To improve the standard of living by creating subsidies on manufactured products.

Credit expenditures influence long-term defects (Shafritz, Russell, and Borick, 203). The federal government has the statutory powers to spend with a long-term deficit. State government depends solely on the federal government for its capital expenditures.

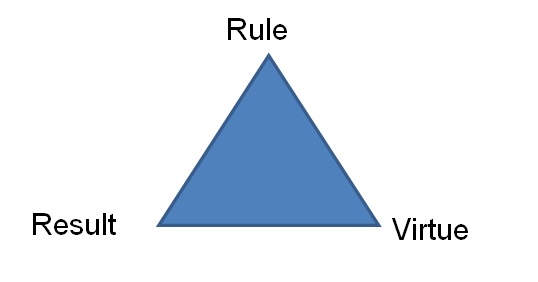

Ethics triangle

Policymakers design government policies. However, the objective of most policies raises ethical issues. The decision-making process is the most delicate part of a policy design. Policymakers used various economic tools to analyze the effect of the policy. The ethics triangle is a model used to analyze ethical decisions. Chief executives can analyze the ethical actions of a policy using the ethics triangle. We can analyze a policy using the three points of the ethics triangle. The ethics triangle includes result, rule, and virtue. The resulting principle analyzes the objective of the policy. Policymakers analyze the influence of the policy on the population. When the policy affects more people, the policy is successful. The ruling principle explains the policy design and objective. For example, the principles of a good tax system imply that it must be convenient, just, and equal. Thus, the ruling principle of the ethics triangle analyzes the equity of the policy. The virtue principle analyzes the pattern, integrity, and procedures of the policy.

Policymakers use the virtue approach to expand the decision-making process. The ethics triangle is not a standard tool but a means of supporting conflicting decisions—the three cardinal points of the ethics triangle access a conflicting decision from a different angle. An economist can debate the dilemma of ethical actions using the ethics triangle. The US medical reform policy is an example of ethical action. Public policymakers can analyze the result, virtue, and rule of Obama care using the ethics triangle. Thus, the reform policy can be successful if it supports three angles of the ethics triangle.

Works Cited

Shafritz, Jay, Russell Edward, and Borick Christopher. Introduction Public Administration. New York, USA: Pearson Education, 2011. Print.