In economics, organizations that operate in oligopolies markets compete by trying to steal market shares from one another. Therefore, instead of competing by lowering prices, the kinked demand curve points to an understanding that the strategy does not work since every organization reduces costs (Von, & Quartieri, 2016, p. 65). Companies utilizing this strategy often compete using a factor directly affecting profit and hence the quantity being sold. The Cournot model finds application when organizations produce standardized or identical products and, thus, do not collude (Von, & Quartieri, 2016, p. 65).

The assumption by France, Germany, Spain, and the United Kingdom is that the rival’s decision maximizes profit. Duopolies, on the other hand, operate by the understanding that companies compete by the produced quantity. The assumption by the Cournot duopoly model is that two organizations move simultaneously, having similar market demand perspectives and having good knowledge of the cost functions of each rival (Von, & Quartieri, 2016, p. 66). With this, firms choose how to maximize profit through their output based on the belief that rival organizations make similar choices.

For the U.S., the decision to support Boeing lies in the revenue diversification the former has over the latter in the American region. For France, Germany, Spain, and the United Kingdom, Airbus is preferred due to its revenue collection abilities, which heavily rely on civilian aircraft, helicopters, and commercial. That makes up 80 percent of the revenue collected by the four countries, while Boeing does not offer the European countries civilian helicopters, and its commercial airplanes make up 60 percent of its revenue (Duddu, 2020).

Cournot’s duopolies model of economy assumes competitors operate by the understanding they compete by the produced quantity. When analyzing the difference between Boeing and Airbus, in America, both manufacturers offer products in the same categories, comprising uncrewed aircraft, commercial aircraft, space systems, and military aircraft; Airbus is differentiated by civilian helicopter quantity (Duddu, 2020). The Airbus portfolio product, constituting civilian helicopters, sets it apart from Boeing and includes several models ranging from twin-turbine heavy-lift rotorcraft to light single-engine produced by Boeing.

Further, the two companies offer a majority of commercial aircraft; however, the most famous aircraft models constitute the Airbus A320 aircraft family, while Boeing has the 737 family. The United States supports Boeing primarily based on its manufacturing of missile systems categories that Airbus does not produce. Despite lacking direct offerings in the developer of the European missile and holding a 37.5 percent stake in the region, the competitive edge held by Boeing is in ballistic missile space (Duddu, 2020). While the manufacturer MBDA holds direct offerings in the European missiles space, Boeing has a competitive edge over it due to the ballistic missiles space.

The United States supports Boeing since the company has been in operation since 1924. In the 54 years the company enjoyed a monopoly, the country relied on Boeing in its air transport. The reliance by the U.S. on Boeing in all of its operations has been the primary reason why Boeing has had its most significant revenue (44.2percent) originating from the North American region (Duddu, 2020). However, despite most of Boeing’s revenue being associated with North America and the Asia Pacific, Airbus has been eating into Boeing’s pie of large commercial aircraft. Airbus’s better diversification enables it to earn higher revenue from the Asia Pacific, a region Boeing acknowledges as being crucial for its future expansion.

America to Boeing is what Europe is to Airbus in that while Boeing dominates the North American region, with 44.2 percent revenue compared to 17.5 percent by Airbus, Airbus dominates the European area (Duddu, 2020). The revenue contribution by Airbus to the four countries, France, Germany, Spain, and the United Kingdom, is 27.9 percent compared to the 12.8 percent generated by Boeing (Duddu, 2020).

The U.S. offers state benefits that are fundamental to the growth of Boeing in the North American region. The benefits have ensured that while both aircraft manufacturers enjoy the boom in commercial aviation, the costs of margin for Boeing are relatively higher compared to those of Airbus. However, Airbus is also benefiting from the state support given to Boeing by the U.S. government and federal states since the benefits have enabled Airbus to generate revenue of 17.5 percent in North America.

The welfare implications associated with the U.S. supporting Boeing is that any influence by the U.S. government increases welfare for Boeing, and this has been because the market share Boeing enjoys in North America is above the critical level. If there is a need where production surplus declines by margins that are higher than the increases in consumer surplus, then Boeing’s output expense will be efficient.

Producer surplus tends to decrease due to small, high-cost firm output, which increases with more efficient firm outputs. The state benefits enjoyed by Boeing in the U.S. will always increase its output by more than it increases the production of Airbus, and with this, the aircraft industry’s output will always rise. Therefore, the unfair state benefit enjoyed by Airbus in the U.S. will ensure that surplus in consumers increases for Boeing but will never ensure that there is a surplus in production. Therefore, by intuition, any increase in consumer surplus at Boeing, together with the rise in its market share, will eventually result in the decline of Airbus’s profit.

Observing the critical level or the smallest upper bound will therefore be determined by four fundamental forces within the market. The forces constitute inverse demand derivatives in the first and second orders, the share market held by Airbus, and the second-order cost function derivative. Therefore, while it might be possible to see a more straightforward formula for market share, the Cournot model does not provide a more precise expression.

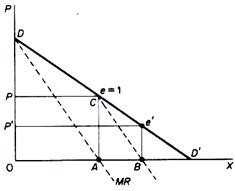

Cournot’s assumption of the model was that in the presence of two organizations, each operating at zero cost and possessing a mineral well, the output to the market would be a straight-line demand curve. Each organization acts based on the assumption that its rival will never alter its production and, therefore, chooses to maximize its profit based on its output (Trisha, n.d). By assuming Boeing (A) is the first to produce and sell air crafts, its production quantity will be A and its price P, with the profits set at a maximum since MC-MR=0. Based on the market’s demand elasticity at the output level, which equals unity, the firm’s total revenue will be maximum (Sun and Sun, 2018). With no costs, maximum revenue (M.R.) will imply maximum profit (M.P.).

Airbus (B) will assume that its Boeing (A) will maintain a fixed output at 0/1, and therefore, it will consider its demand curve to be CD. It becomes clear that firm Airbus will produce half of what A.D. grows since, based on Cournot’s assumption of rival’s fixed output, level output at A.B.’s, of price F, profit, and revenue will be maximum (Trisha, n.d). Airbus will therefore produce half of what Boeing makes and will not have supplied to the market. That is to say, Airbus’s output will be one-quarter of the entire market. Faced with the same situation, Boeing will assume that Airbus will maintain its quantity in the next period (Sun and Sun, 2018). So, it will produce one-half of the market that Airbus has not supplied (Trisha, n.d). With Airbus covering one-quarter of the market, Boeing will be forced to make three-eighths of the entire market in the next period.

Reference List

Duddu, P. (2020). Airbus vs Boeing: a tale of two rivals. Aerospace Technology. Web.

Trisha. (n.d). Cournot’s Duopoly Model (With Diagram). Web.

Sun, S., & Sun, N. (2018). Management game theory. Springer.

Von, M. P., & Quartieri, F. (2016). Equilibrium Theory for Cournot Oligopolies and Related Games: Essays in Honour of Koji Okuguchi. Cham: Springer International Publishing.