Abstract

Businesses are always seeking new and innovative ways of minimising operational costs. LED light is one of the most efficient and environment-friendly sources of lighting that can minimise operational cost significantly. LED bulbs have a longer life as compared to other bulbs. In addition, it offers better light quality as compared to other traditional bulbs. It uses a sophisticated energy-efficient technology that can change the future of the US potentially by reducing lighting expenses. A typical LED bulb uses at least 70 per cent less energy as compared to other incandescent lighting options. This paper gives a 5-year plan on how to build a healthy community via the introduction of low-cost LED bulbs in the market.

Introduction

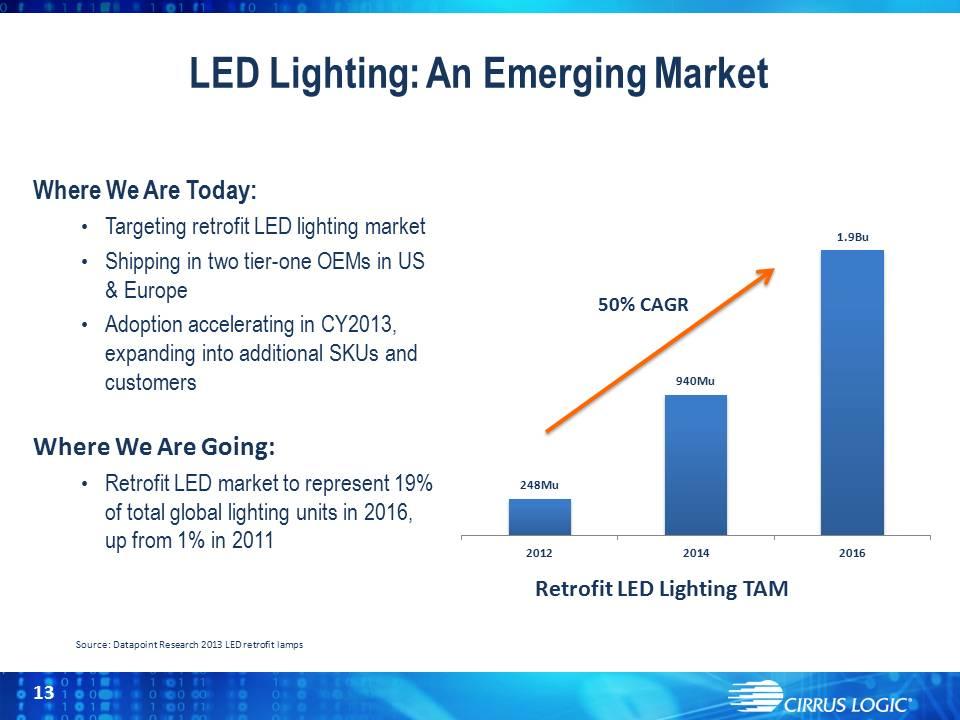

Currently, the demand for energy-saving lighting solutions is on the increase due to the irregular energy price variations courtesy of different factors. Based on the recent invention and advancement in the LED technology in China, it has become possible to manufacture environment-friendly lighting bulbs. Today, no product has entered the market to fill this gap. Therefore, the Beta Company can take advantage of this opportunity by offering high-quality LED bulbs technology. LED lighting is more advantages than fluorescent lighting as it saves more energy in comparison (Jang, Kim & Lee, 2015). Moreover, it has few maintenance requirements, it is environment-friendly, and it does not use mercury.

Even though LED bulbs are slightly more expensive than fluorescent bulbs, the advantages outweigh the disadvantages in the long term. For instance, Long, Gosavi, Qin, and Noll (2012) argue that using LED lighting can save an estimated $52,000 for a retailer over a period of four years. The product targets retail companies in the US, which are engrossed in using the LED lighting to reduce lighting costs. The LED bulbs entail different parts, viz. LED lighting tube installation team and installation fixture. The installation team is our brand benefit for retailers who do not have the installation team in their businesses. The branding of the product will be based on the company’s name.

Some of the strategic business challenges that the company is likely to face include the ability to develop a brand name to compete with existing rival companies. Secondly, our products need to have the benefit of strategic uniqueness in order to prevent imitation. Lastly, our product faces high upfront cost, thus making the final product slightly expensive. Considering that customers are price sensitive, it will be difficult to convince consumers to stop using cheap fluorescent and adopt LED lighting, which is expensive.

It is recommended that the company should use a strong brand name in order to overcome these challenges. Moreover, the firm should use differentiation strategy in order to harness the customers’ trust with time. Lastly, the company should focus on effective customer relations through aggressive marketing to create awareness.

Company description

Green Lighting is a public limited company, which is focused on providing efficient lighting solution at affordable prices. Moreover, the company offers installation services for customers who cannot afford an installation team. Green Lighting operates domestically, but it intends to go internationally after gaining market share and enough resources to support expansion.

Objective of the Firm

Energy consumption is one of the pertinent issues threatening the existence of humanity in the contemporary times. Conventionally, people have been using fluorescent bulbs for lighting purposes, which consume a lot of energy. Therefore, there is an urgent need to look for alternative lighting ways that can reduce the energy consumption. The main objective of the firm is to fill the gap in the lighting sector by producing a product that is cost-effective and environment-friendly. The product provides solutions for retailers by offering the bulb, which is the product in this case, and installation services for those who cannot afford to hire such services.

Product and services

Our principal product and services are LED bulbs and supportive installation. The main objective is to penetrate the new market by filling the existing gap of cost-effective lighting bulbs.

Opportunities

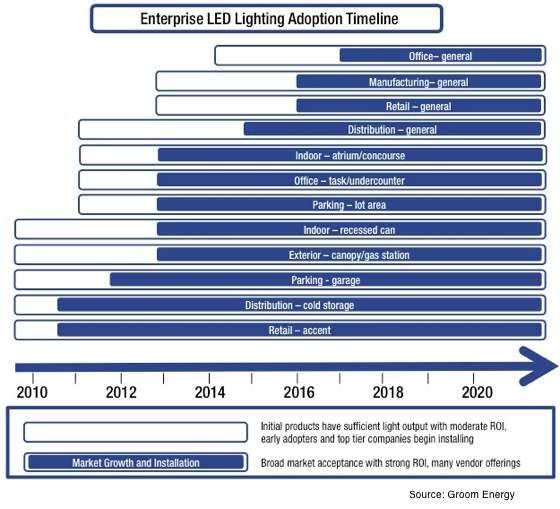

The unpredictable energy and oil prices have increased the need for business lighting sustainability in order to minimise overheads. Consequently, an increasing number of businesses in the United States are seeking environment-friendly and cost effective lighting solutions for their retail outlets. The increasing demand for cost-effective lighting can now be met through the LED lighting technology. In addition, considering the fact that there has been a significant breakthrough in the LED technology in China, thus making it easy to manufacture the LED bulbs at low cost, this market segment presents a huge opportunity for the business. The company is well aligned and ready to seize this opportunity due to its core competence in the LED technology. Over ten years, the company has experienced selling LED lighting in the US market.

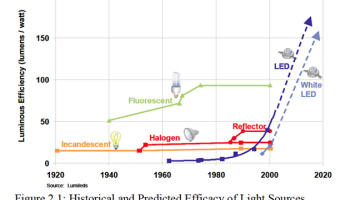

Technology

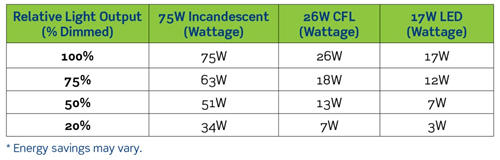

The LED bulbs use advanced technology to produce low-cost lighting. The LED bulbs cut lighting cost by about 60 per cent, thus enabling businesses to reduce overheads significantly. Moreover, the bulb reduces ambient heat produced during lighting (Sun et al., 2013). As a result, the business climate controls costs such as refrigeration and air conditioners are reduced significantly.

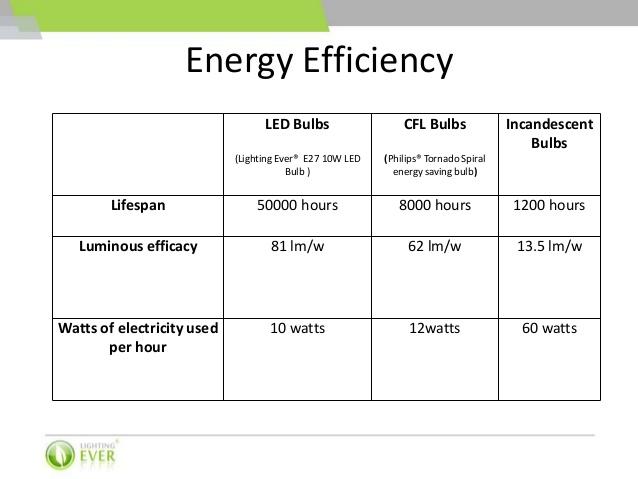

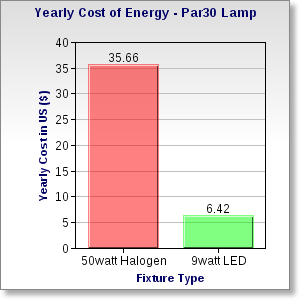

Long Lifetime

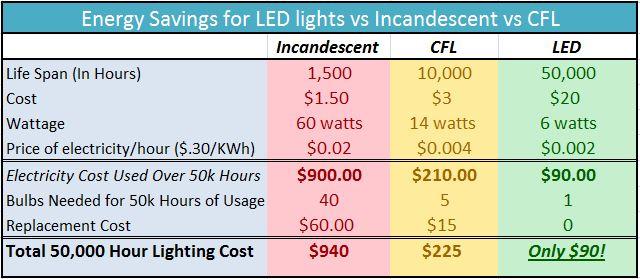

Conventionally, the LED bulbs have a longer lifespan as compared to the normal bulbs, which last for less than 24 months. In fact, Junho, Injae, Myungjun, Jonggil, and Hun (2014) argue that typical fluorescent bulbs burn out in less than two years. However, the LED bulbs have a longer life in which their lumen is gradually reduced over time. For instance, “the LED bulbs from JingJiang last up to 6 years producing only 40 per cent of their original output” (Junho et al., 2014, p. 102). Therefore, it is recommendable for consumers to replace their LED bulbs after 4 years in a bid to get optimal lighting solutions. Simply, the LED technology reduces the overall maintenance cost for retail businesses. In essence, the LED bulbs do not require the generation of physical sparks, as the sophisticated technology allows light to be produced electronically without the need of ballast for ignition. This aspect in turn reduces the maintenance costs since there are little chances of fixture breakage. The following figure shows the yearly cost of energy for LED bulbs in comparison with the normal fluorescent bulbs (Johnson, 2015).

In essence, the LED bulbs cut down carbon emission through reduced energy consumption. Moreover, the bulbs eliminate dangerous waste products from the environment such as mercury and lead. Fluorescent bulbs contain mercury and lead, which pollute the environment. Gessmann and Schubert (2004) argue that these components produce toxic waste into the environment that takes a long time to recycle. Removing this component through switching to the LED bulbs not only makes the world a better place to live, but also it can allow retailers to become certified in the Leadership in Energy and Environmental Design (LEED).

LED uses Safe Materials

Organisations are highly concerned about the safety of their products. Consumers can easily sue organisations due to damages caused a product. Consumer protection laws in the United States and across the world are very stringent, and thus companies can suffer huge losses due to frivolous lawsuits from consumers. As aforementioned, the production of the LED bulbs does not involve mercury and lead components, which are toxic when inhaled or consumed. Instead, they use impact-resistance plastic, which is safer as compared to mercury and lead. Under high voltage, fluorescent bulbs can explode, thus dropping hot shards of glass and emitting poisonous gases that can affect users adversely. However, the LED bulbs can absorb a significant variance of voltage before dimming. Under extremely high voltage, the LED bulbs slowly dim instead of exploding. Therefore, by using the LED bulbs, the company will be assured of minimal or zero lawsuits from consumers based on utility issues.

Market Analysis

Pricing

The company targets to retain the production aspect, which is highly price sensitive. Consequently, we adopted low pricing strategy (below competition). Customers are highly sensitive to prices since they can easily substitute with low-cost products. In most cases, consumers seek to get highest value at the lowest cost possible. Furthermore, overhead LED lighting has many competitors who have already established their market segment with loyal customers. Competitors in this industry have a huge pool of resources that enable them to use effective ways of creating awareness. They brand recognition to enable them to pursue high prices effectively. The company’s core competence lies in the ability to produce high-quality LED bulbs at low cost. Consequently, it becomes easier to attain break-even within a short period. As the product gains the customers’ loyalty coupled with attaining high differentiation, it will be possible to pursue higher pricing strategies. The recommended price is $120.01 for WM United States and $130 for one-time retailers.

Target Market

The company seeks to focus on the construction industry in the United States. After establishing a sound market within the US approximately after 2 years, we will introduce our product in other geographical locations such as Asia and Europe. This move will occur after we have enough capital to engage in mass production and the expertise to support market expansion. We intend to use the expertise of our experienced human resource capital to enter new markets. The list below shows potential market in the United States

- Commercial developers

- Airports

- Government

- Hotels

- Hospitals

- City Lighting

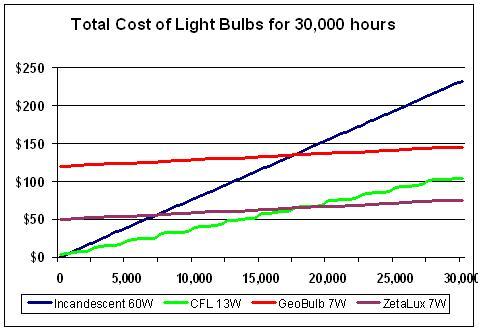

- Libraries

These markets are mostly divided into either new construction or refurbishment. New construction is the best market for this product. Moreover, it is easier to install new buildings than old one. However, renovation can also be considered as a potential market, and thus the company will target such opportunities. The following figure shows the total cost of different light bulbs for 30,000 hours (Piercy, 2009).

Branding

Product branding is one of the most critical marketing tools that enable a product to gain effective market entry. The company has been in a position to create a unique brand name that creates distinction for each of our product. The first brand name will be the ‘Green Lighting Solution’, which targets individual market that is highly price-sensitive. The second brand name will be the ‘Green Light Innovative Solution’ targeting the high-end market, which is not price sensitive.

Competitor’s Analysis

The main competitors include Osram-Sylvania, Philips solid-state lighting, Philips Lumileds Lighting Company, and the GE Lumination. Although there are many competitors in the market, our ability to produce high quality and cost saving LED bulbs will enable the company to penetrate new market easily.

Marketing Strategy

Our strategic marketing plan hinges on two critical factors, viz. positive feedback in form of testimonials and satisfying our customers. The bulbs will be market via different methods including retail outlets and sales persons among others.

Organisational 5 years plan

We plan to buy our product from China in the coming two years. However, after the second year, the company will have enough resources to construct a manufacturing plant here in the US. If the business gains adequate market share, manufacturing will begin the fourth year. If resources are not adequate to support the construction of a manufacturing plant, then the company will continue buying the LED bulbs from China.

Manufacturing Plan

The company’s LED bulbs have two parts that need to be manufactured, viz. a lighting fixture and tow LED tubes. We decided to buy rather than manufacture the product ourselves since such option is cheaper. We have already identified a reliable supplier from China (HKJOTL Ltd.). The second part will also be sourced from China where a metal company, Xiamen, will execute the manufacturing phase in the coming five years. Both products will be branded in their respective factories before they are shipped in the US in containers. However, it is advisable that the company to consider the following factors before sourcing the product

- Availability of raw material

- Reliability of suppliers

- Comparative advantage

- Quality control

- Expertise within the organisation

- Government and other legislative policies

Strategic Alliance

The company has identified JingJiang as our strategic alliance to supply the LED tubes. The alliance is considered strategic since it will allow our company to enter a new market without having to use huge resources for a manufacturing plant. Moreover, the supplier eliminates unnecessary high risks associated with inventory for new entrants (Click & Duening, 2004).

5 years Financial Analysis

This part explores the financial analysis of the pro forma income statement and balance sheet. First, the section will evaluate the feasibility of buying the product rather than manufacturing. The buying price is $75.23 while the manufacturing cost is $102. Therefore, it is easy to buy than to manufacture the product ourselves. The decision to manufacture or buy the product was based on the following calculations,

Cost of buying the product from China $ 75.23

Manufacturing

- Direct material $20.9

- Direct labour $30.4

- Variable overhead $ 40.2

- Total contribution $91.5

- Attributed fix cost $10.5

- Cost of manufacturing $102

Sales and Revenue for 5 years

This section is an analysis of the sales revenue expected to be achieved in the next five years of operation. The US retailer construction industry is critical and thus for the success of this product, focus has to be on this industry. In addition, the international exchange rates might vary from time to time and this aspect is expected to affect our operations. Currently, the exchange is 6.7RMB to 1 dollar, but in the future, it is expected that changes will occur. The impacts of such changes have been analysed in the updated pro forma statement. Projections in the table below assume that normal conditions exist over the period of our operations. The market sales increases by 30 per cent in a year and income tax is 40 per cent. The cost per unit is $123.01. In addition, the cost of goods sold represents 30 per cent of total sales

6.0.2 Performa balance sheet

Strategic issues

The major strategic issue facing our company is stiff competition from rival companies that have a huge pool of resources. They are strategically positioned since they have the capacity to use huge resources for research and development to come up with innovative products that are unique and difficult to imitate. In addition, our product may not stand out from the rest because currently there are numerous energy-saving bulbs in the market. There are many varieties of products that resemble the company’s LED bulbs, hence it easy to imitate.

Recommendations

Providing exceptional customer service will enable us to compete with big companies effectively. Moreover, we offer installation to customers who do not have the capacity to hire professionals, which is perceived as a benefit by customers. This benefit will attract many customers since they will perceive our product as a double reduction of cost.

Exit Strategy

Our exit strategy would be to merge with other companies or sell the company. Before considering a merger, the company plans to expand and manufacture its own LED bulbs locally. This aspect will enable the company to develop unique products in order to gain competitive advantage. However, if sales go below 85 per cent of 15000 units, the company would consider merging with similar companies. Alternatively, we can sell the company to a third party.

References

Click, R., & Duening, T. (2004). Business Process Outsourcing: The Competitive Advantage. Hoboken, NJ: Wiley.

Gessmann, T., & Schubert, E. (2004). High-efficiency AlGaInP light-emitting diodes for solid- state lighting applications. Journal of Applied Physics, 95(5), 2203-2216.

Jang, D., Kim, R., & Lee, K. (2015). Correlation of crosscut cylindrical heat sink to improve the orientation effect of LED light bulbs. International Journal of Heat & Mass Transfer, 8(4), 821-826.

Johnson, H. (2015). Light Bulb Showdown: LED vs. CFL vs. Incandescent. Web.

Junho, B., Injae, L., Myungjun, N., Jonggil, L., & Hun, O. (2014). Design and Implementation of a Smart Control System for Poultry Breeding’s Optimal LED Environment. International Journal of Control & Automation, 7(2), 99-108.

Karafiath, G. (2012). Stern End Bulb for Energy Enhancement and Speed Improvement. Journal of Ship Production & Design, 28(4), 172-181.

Long, S., Gosavi, A., Qin, R., & Noll, C. (2012). Evaluating Useful Life and Developing Replacement Schedules for LED Traffic Signals: Statistical Methodology and a Field Study. Engineering Management Journal, 24(3), 15-23.

Piercy, N. (2009). Market-led Strategic Change: Transforming the Process of Going to Market. London, UK: Routledge.

Sun, B., Zhao, L., Wei, T., Yi, X., Liu, Z., Wang, G., & Li, J. (2013). Shape designing for light extraction enhancement bulk-GaN light-emitting diodes. Journal of Applied Physics, 113(24), 243-249.

Appendix