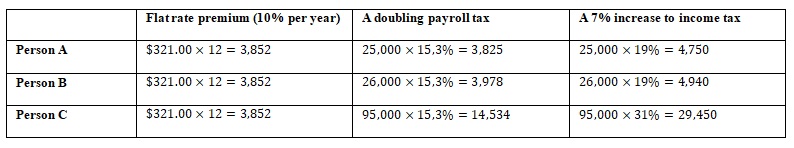

Undoubtedly, the regular tax payments for social services should be reduced to increase medicine availability. Without going into detail about the benefits of affordable medicine, it is only essential to clarify that this policy has serious advantages for the government, so officials should take care of developing optimal insurance programs. Although the total payments for three people are minimal in the first scenario, the same payments for each citizen are characterized by “dystopia” and injustice. The financing should be progressive: those who earn more, pay more. For this particular case, doubling the payroll tax would be ideal, as it is a compromise between equal payments and overpriced insurance.

The insurance market has grown in recent decades. “Health & medical insurance” (2018) has reported a 1.5 increase in the market value since 2010. The expansion of plans can hardly be called a wrong action by the authorities. On the contrary, according to the fundamental laws of the market economy, the higher the competition, the better the quality of services provided. Thus, every citizen who registers in Medicare can choose a specific plan depending on financial possibilities and expectations from insurance. The emergence of such diversity stimulated the demand, as it had affected more different cohorts among the population. In other words, those citizens who previously refused insurance because of travels in the country can now use HMO-POS. Alternatively, if a person wants to save on insurance, the HMO will be optimal.

At least six factors have been identified that affect the demand and pricing in the health insurance market. First of all, it is citizens’ general welfare: if a person has much money, works responsibly, and pays taxes, the cost of insurance must remain acceptable. Secondly, it is the prices for developing high-tech medical services. It is unprofitable for clients to pay for medicine on their own, but choosing insurance will save money. In addition, the medical culture of the population is an important factor: if citizens realize the importance of taking care of their health and the benefits of insurance programs, it increases the demand. Fourthly, the format of relations with government policy may reduce or increase demand for services, because it is known that private insurance plans do not provide full guarantees of stability and payments. Fifthly, a crisis may have an impact: when the government is covered by an epidemic, more people worry about their health and decide to use insurance. Finally, prices for services are highly dependent on the oversupply of the market. Thus, if insurance programs are represented by dozens of different companies, the cost is usually reduced according to competition laws.

References

Bloom, E. (2017). Here’s how much the average American spends on health care. Make It. Web.

Health & medical insurance in the us market size 2005–2026. (2018). IBIS World. Web.

Josephson, A. (2020). Federal income tax brackets for tax years 2019 and 2020. Smart Asset. Web.