Introduction

Housing is one of the most important items amongst the basic needs for human beings. Most of the important things a man would like to achieve in life would be difficult without quality housing. For instance, to find and keep a job, to learn and to maintain our health would require us to have quality housing.

Access to quality housing, however, is not always available to many people and like any other commodity, housing bears price tag attached. If one wishes to have proper housing, they must be prepared to pay for it. Therefore, the better the standard of housing, the higher the price attached to it. The most important issue in the life of a human being is how to afford the sort of housing they want.

They therefore need to match their income with their aspirations and expectations and the kind of housing they want to buy. People may lack sufficient income for the kind of housing that would best suit their expectations. The most important issue with housing is quality housing and to access it. There is clear trade-off between quality and access to housing. Housing finance tries to enable people solve the problem of housing by giving them a better solution (UNHSP, 2005. P156).

The purpose of this essay is to account for the truth of the claim that “The management of housing finance is the key to successful housing organizations”. The essay starts with exploring a better understanding of housing finance in England and the demand and supply forces that influences the housing. Then the other part is concerned with the contribution of housing finance proper management to the success of housing organizations (Garnett, & Perry, 2007, P.67).

Understanding Housing Finance and Housing organizations in UK

Housing finance is concerned with ensuring that the citizens of a country gain access to quality housing that suits their expectations. In England, the main type of housing is social housing where the councils provide accommodation to low income residents at affordable prices. In social housing, people are usually allocated accommodation with regards to their needs and they are supervised by the social landlords who are indeed the owners. They are controlled by the government through housing associations.

Housing associations are usually self-regulating and are usually not-for-profit. Their main purpose is to provide cheap accommodation to the low income earners who are in need of housing.

In the United Kingdom, they provide accommodations to approximately 5 million residents. In addition to low income earners, housing associations also provide accommodations to people with special needs in the society such as the old and the disabled. They thus work hand in hand with the members of the public so as to enhance good neighborhood.

The government usually provides the housing associations with funds to enable them build new homes as well as to provide houses for the special people. Housing associations are usually in a position to obtain finance against their asset properties but rental income forms the biggest component of housing associations. The Tenant Services Authority commonly referred to as TSA controls the housing associations in the United Kingdom (Reeves, 2005, P.22-25).

Economic and financial factors that affect capital and revenue funding for housing

The forces of demand and supply play a key role in determining the capital and revenue funding for housing. Demand for housing is usually inelastic as shelter is required by all humans.

The demand aspects include the real income of the residents i.e. as the income for individual’s rises, then their spending power is enhanced and so the likelihood to purchase a home is also high. The increase in income often makes the prices associated with houses to go up. On the other hand, the propensity to purchase a house usually declines with respect to a reduction of peoples’ income

The other factor that affects the demand for housing is the interest rates. Interest rates usually influence the mortgage charges and this has an effect on the spending capacity of an individual. A major percentage of the homeowners in the United Kingdom have a mortgage that is varied in that a rise in interest rates causes the mortgage charges to go up.

The bank of England is vested with the responsibility of setting the base rates which should be applied by all the commercial banks. If the Bank of England cuts the interest rates and the commercial banks fails to forward the cuts to the entire public, then the mortgage charges are bound to rise and vice versa (Gruis, 2009, P.21).

The other aspect with regards to demand is the mortgage finance availability. The period between 1950s and 1970s was characterized by harsh limitations with regards to finance accessibility. However, the deregulation of financial institutions enhanced competition and this increased the accessibility of credit facilities in form of mortgage.

This in turn has led to a significant increase in the demand for housing. On the other hand, the credit crisis that was experienced in the year 2008 saw a reduction of the mortgage products which in turn reduced the demand for housing.

Demographic factors affect the demand for housing in that, the larger the figures of the households in England, the higher the demand and vice -versa. Higher life expectancies, early marriages e.t.c. also leads to an increase in the demand for housing.

Another aspect with regards to the demand for housing is speculation. Usually, the investor’s purchases houses with a view of realizing profits form rents. They thus buy the houses at low prices and sell them when the market prices are higher and this renders the market prices to be volatile. There has been an increase in the number of speculators over the past few years and this has resulted to an increase in the demand for housing.

The other aspect that is crucial as far as the demand for housing is concerned is unemployment. Usually, demand for housing is a function of people’s purchasing power. Thus, if the unemployment rate is low, then the purchasing power will be higher and hence the demand will increase with regards to houses. The availability of credit facilities such as mortgage loans on good terms increases the demand for housing and vice versa.

On the other and, the supply entails the increase in the number of houses and supply is influenced by the following factors: Time affects the supply for housing in that, in the short run, it is usually difficult to increase the housing supply.Therefore, the supply remains inelastic. However, and the supply can be increased in the long-run.

Another factor that influences the housing supply is competition. With regards to competition, the principle of substitution determines the supply in that people do not really buy or lend real estate per se but instead judge properties by considering their different sets of benefits and costs (Larsen, 2003, P.36).

Demand and supply for housing in the United Kingdom

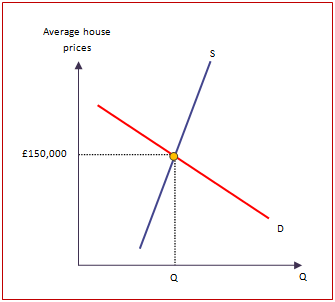

The demand for housing in the UK has been on the upsurge in the recent years. The supply on the other hand has remained stable because the building of houses has been stagnant overtime. The following demand and supply curve below indicates the situation of housing market in the UK.

The number of housing provided and the value of the housing are as a result of the interaction of the forces of demand and supply. In the short run, the demand is downward sloppy implying that the higher the price, the lower the demand and vice versa.

The supply curve is perfectly inelastic implying that in the near future, the supply of housing available is fixed. This is because it is not possible to add instantaneously the supply by constructing new houses. It is also not possible to reduce supply in the short run through demolition or abandonment.

In the longrun, the supply usually adjusts up or down to meet the demand. If the demand for housing increases overtime, developers will build new properties so as to cater for the demand rise. Long run supply may also be reduced by allowing houses to wear out or by demolition. The upwards sloppy curve means that the higher the price, the higher the quantities of houses made available and vice versa (Jackson, 1993, P.16).

Housing finance management and its contribution to success of housing organizations

Affordable housing remains the most burning issue for most residents of the United Kingdom. The housing finance usually has a significant impact as far as the housing in the United Kingdom is concerned. The housing finance is concerned with the taxation which helps to discourage the speculative buying of properties and this in turn helps to avoid the crashes of the house prices.

However, affordable housing cannot be realized without proper management of the housing finance. The management of housing finance is the main factor that contributes to the success of a social housing organization. The government needs to devise various policies with an aim of facilitating affordable housing to the United Kingdom citizens.

The government needs to introduce a legal framework upon which the housing investment needs will be addressed. It should devise legal basis that helps both the standardization as well as the planning process so as to ensure high quality housing is achieved.

The spatial procedures with regards to housing finance also require to be simplified so as to enable the housing associations to carry out their investments with ease. The Building Law also requires to be modified so as to help simplify and accelerate the administrative procedures that are involved in building process

The government needs to directly control the housing market by regulating the housing finance .This is via the housing subsidies, assistance and taxation. In order to cater for the increasing demand of housing, good management is essential.

Housing finance needs to maximize the Information technology usage so as to enhance efficiency .The technology is a useful tool of bringing the tenants closer with their housing organizations because it allows them to get assistance much easier. The internal management records as well as information require to be streamlined so as to enhance efficiency.

Housing finance requires considering cutting down costs and this can be achieved through sharing of the resources by the housing organizations. There is need for housing finance to be flexible so as to adapt to the changing housing situations .The intermediaries should be created so as to provide the necessary property management.

The housing finance may not have the required managerial capability and so it should seek help from the housing associations because they provides good management of houses .The banks reserve requirements should also be increased so as to ensure that there is more prudent lending procedures and to counter the effects that are as a result of under-capitalization of the mortgage markets.

The housing finance should be supported by the government so as to enhance the affordable housing supply. They should be encouraged to adopt a strategy that is less risky so as to increase the housing delivery. The government should thus consider the creation of housing bonds which in turn will help to attract more residents to invest their earnings.

The housing bonds are an important tool of reconnecting the housing fiancé with the local communities and so the government should consider selling the housing bonds so as to pay for housing investment.

A good housing policy by the government is essential as it enables the efficient allocation of the households with regards to the interaction of the forces of supply as well as the demand. With regards to competition, the government should try to cut down the prices by increasing the players in the housing industry through subsidies.

The government should regulate the financial institutions such as banks so as to enable them to continue providing finances to lenders at affordable rates. The government has helped most low –income earners in the United Kingdom to acquire good housing through the subsidies.

Due to the uncertainty that is associated with the housing market, the government needs to intervene and regulate it so that the investors can have confidence to continue providing housing at affordable rates (Pinto, 1995, P.64-69).

The government needs to devise new forms of funding so as to cater for the housing needs of its citizens. The government of United Kingdom has cooperated with the local developers and the lenders so as to minimize the lending costs and to enhance efficiency as well as the accessibility of the funds.

The government needs to plan for larger enhancements of the housing supply so as to meet the future needs of its people. It should also provide the housing organizations with financial support so as to renew the already existing neighborhood.

The government also needs to ensure that the houses that are developed meet the required standards so as not to expose the lives of the United Kingdom residents. The government should also enhance the accessibility of the houses by ensuring that site quality is maintained (Lawrence, 1996, P.101-105). Innovations i.e. technological developments are very crucial with regards to the management of housing finance as they create efficiency and effectiveness.

Housing finances should also be well managed to ensure that the credit that is available in form of mortgages is ideal for the investors.This will in turn encourage the developers to obtain more funds and invest in houses.

The financial management actions that housing organizations use

The housing organization usually coordinates with treasury and the finance department to ensure that effective management of funds is achieved. The treasury provides loans at affordable rates to the housing organizations so that they can be able to develop more housing.

The finance department ensures that the management accounts of the housing organizations are well prepared in accordance with the laid down procedures. It also provides early warnings to the housing organizations with regards to spending behaviors so as to ensure that they don’t collapse as a result of mismanagement. The finance department also provides funds to the housing organizations and this is crucial because they act as alternative source of income.

Furthermore, the housing organizations also encompass the operational management tools so as to ensure that all the financial related tasks are well accomplished for instance rent arrears, procurement savings among others. Operational management also ensures that tenants are well involved as far as financial decisions are concerned. This thus provides accountability on the part of the housing organizations and it ensures that funds are used for the purpose which they were intended for only (Jackson, 1993, P.16).

Factors of success of housing organizations as depicted by housing finance management

The three factors of success include strong leadership, expertise as well as the financial probity. Strong leadership is concerned with ethical leadership and it entails a leader to guide his members about the need to be visionary and focused with regards to the achievement of a common goal. Strong leadership of housing organizations is an important aspect as it helps to ensure public confidence.

The people who are trusted with the management of housing finance should have managerial skills so as to enhance the efficiency of the housing organizations. They should thus be creative and conversant with the new trends in the housing.

Financial probity entails the housing finance management team to have integrity with regards to the management of funds. They should thus be guided by moral principles so as to ensure that the funds are not embezzled and the overall objective is achieved (Reeves, 2005, P.22-25).

Conclusion

The government of the United Kingdom has longstanding objective to provide affordable and decent homes to its citizens. Social housing is very important with regards to the residents of the United Kingdom. It provides many people with quality housing which are relatively cheaper as compared with the private sector.

The government has a responsibility of addressing the housing needs of its people and thus this commitment has enabled the formation of a housing policy that is aimed at providing cheaper and affordable housing for the entire population. The management of housing finance is the key to successful housing organizations and so the government has partnered with the private sectors, financial organizations as well as non profit organizations so as to ensure that there is proper regulation and management.

The successful management of housing financial institutions could not be achieved without the engagement of the above. The development of affordable housing is usually a process and so, the government should carry out its planning activities well so as to ensure that the housing development addresses the needs of its citizens.

It should also carry out house approvals and inspections with respect to new houses so as to ensure that all the necessary compliance has need met and that the lives of England citizens are not put at risk following shoddy housing projects by quacks. Renovations should also be undertaken on regular basis so as to ensure that the citizens are safe.

Housing remains an existing agenda as far as the government is concerned and the government should ensure that there is proper management of the housing finance so as to enable the housing organizations to continue providing affordable homes to the massive low income earners who are in dire need of accommodation. Without proper management, low cost ownership of houses by individuals cannot be realized and so there is need for the government to intervene by coming up with good housing policies (King, 2009, P.9-15).

Reference List

Garnett, D & Perry, D., 2007. Housing Finance. London: Chartered Institute of Housing association.

Gruis, V., 2009. Management of privatized housing: international policies & practice. New Jersey: John Wiley and sons.

Jackson, J., 1993. Surveys for Town and Country Planning. London: Hutchinson University Library.

King, P., 2009. Understanding Housing Finance. Oxford: Taylor & Francis.

Larsen, J., 2003. Real estate principles and practices. New Jersey: John Wiley & Sons Inc.

Lawrence, R., 1996. Fundamentals of investing. New York: Harper Collins College Publishers.

Pinto, R., 1995. Developments in housing management and ownership. Manchester: Manchester University Press ND.

Reeves, P., 2005. An introduction to social housing. London: Butterworth-Heinemann, United Nations Human Settlements Program (UNHSP). Financing urban shelter: Global Report on human settlements. New York: UN-HABITAT.