Abstract

The following is a business report summarizing HSBC Holdings’ ratio study, analyzing the company’s performance. It involves analysis of the bank’s publicly available fiscal records spanning five years, from 2017 to 2021. Specifically, the analysis includes the balance sheet and income statement as key statements from the annual reports.

The annual reports and accounts reveal a consistent growth in total assets over the past five years, along with indicators of sustained positive investment growth. In the years preceding 2021, the company recorded its first negative investment growth in five years. Over the past half-decade, the company’s balance sheet has reflected its stability and viability, making it a suitable investment for investors. Notably, the pandemic impacted HSBC’s performance in 2020; however, the analysis reveals a trend toward recovery. Liquidity, capital structure, efficiency, and profitability ratios are used to examine HSBC’s strengths.

The report also presents a comparative performance analysis between Lloyds Banking Group and HSBC Holdings over the past two years. According to the 2021 report, HSBC performed better than Lloyds Banking Group. However, Lloyds performed better than HSBC Holdings in a few critical ratios. The report also presents the investor’s perspective, focusing on share price movements, investor ratios, accounting policies, limitations, and recommendations. The bank prepares its accounts in accordance with International Financial Reporting Standards and is further audited by an independent auditor, KPMG. The report concludes with recommendations to enhance reporting and accounting at HSBC, as well as to increase its competitiveness in the British banking sector.

Introduction

HSBC Holding PLC is a United Kingdom-based multinational bank and financial services organization. It is among the largest banking and financial companies in Europe and globally, with a presence in over 63 countries and serving more than 40 million global customers (HSBC Holdings PLC, 2022). Some of the banking and financial services the company offers include loans for investment, mergers and acquisitions, debt issuance, investment advice, and significant project financing. Most HBSC customers include international organizations, companies, governments, investors, and individuals.

Lloyds Banking Group PLC is a British financial and banking services organization established in 2009. The company is also the largest retail, commercial banking, and financial services organization in the United Kingdom. (Lloyds Banking Group PLC, 2022). Lloyds Banking Group provides financial services to over 26 million of its customer base. These services entail issuing loans, current accounts, savings accounts, credit cards, home insurance, investments, mortgages, wealth management, car financing, travel services, and pensions.

Performance Overview

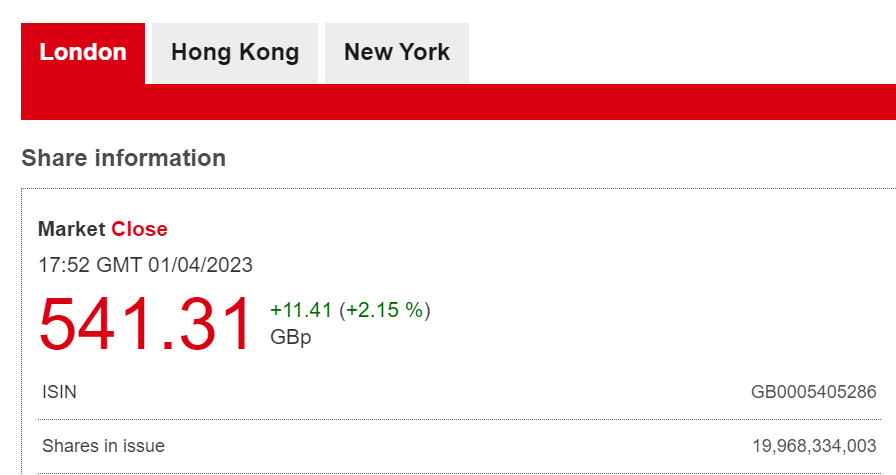

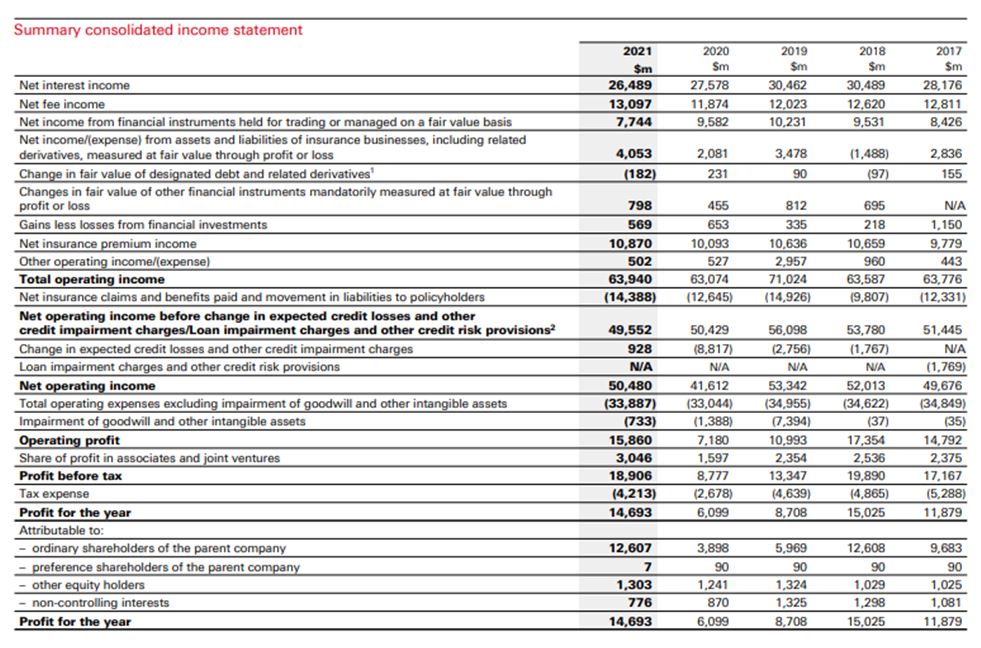

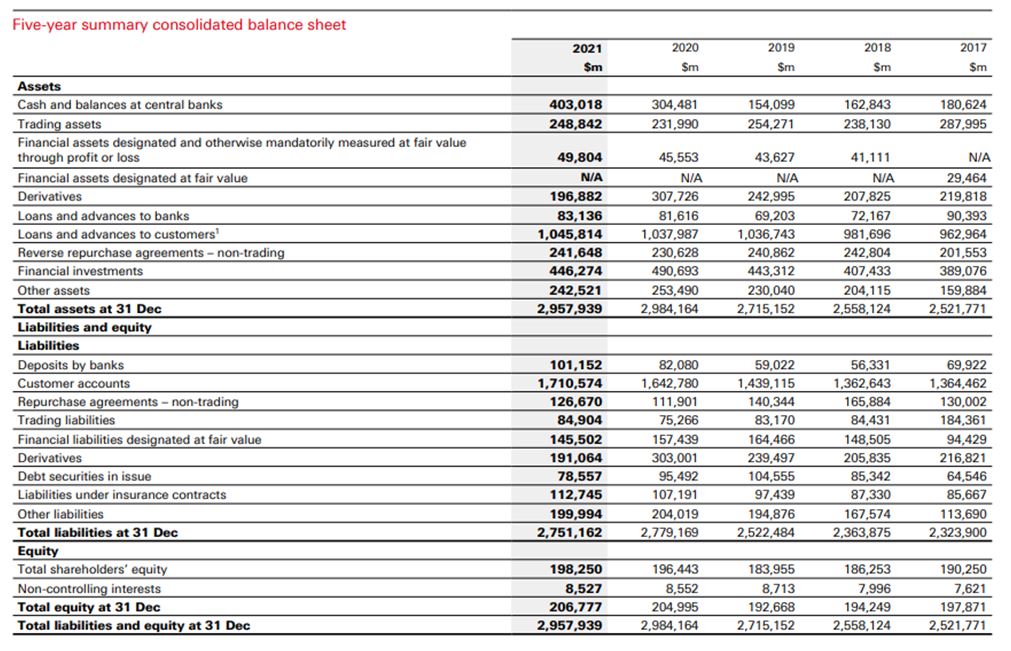

HSBC’s assets have generally grown over the past five years, starting in 2018. The information in Table 1 is extracted from the financial statements attached in the appendices, including the balance sheets and income statements for each year. In 2017, the company recorded total assets worth $2,522 billion. The total assets were $2,558 billion, $2,715 billion, $2,984 billion, and $2,958 billion in 2018, 2019, 2020, and 2021, respectively (Table 1).

Therefore, the bank increased its assets by 17% over the past five financial years. Nevertheless, the risk-weighted assets (RWA) experienced fluctuations that culminated in a 2% decline between 2017 and 2021. The specific figures for risk-weighted assets since 2017 are $857 billion, $865 billion, $843 billion, $858 billion, and $838 billion. Overall, the bank’s assets have increased in the five years analysed.

Table 1: Financial Statements Used in Performance Overview

The bank’s liabilities also increased from $2,324 billion in 2017 to $2,751 billion in 2021, representing an 18% rise. Over the middle three years, the liabilities reported per year are $2,364 billion, $2,522 billion, and $2,779 billion. These figures indicate a sudden increase in borrowing in 2020, followed by a slight decline in 2021.

Total equity has increased steadily from 2017 to 2021 by 4%, except in 2019, when a decrease was recorded. The specific recorded amounts include $197.9 billion, $194.2 billion, $192.7 billion, $205 billion, and $206.8 billion. This information is crucial in determining the company’s leverage.

Reported and adjusted revenue before tax had significant changes between 2017 and 2021. The revenues recorded were $51.4 billion, $53.8 billion, $56.1 billion, $50.4 billion, and $49.6 billion each year. These values indicate a steady positive growth until 2020, when revenues decline by slightly over 10% from the previous year.

Similar to revenues, these profits declined by 34% in 2020 compared to 2019. Although recorded revenues also decreased in 2021, the before-tax values show a tremendous recovery, reflected in an over 100% increase to $18.9 billion. Therefore, the income statement shows that HSBC Holding has not suffered a loss in the five years analysed.

HSBC Holdings PLC has paid dividends to its shareholders every year. The dividends declared and released per ordinary share are $0.51, $0.51, $0.51, $0.3, and $0.25 in 2017, 2018, 2019, 2020, and 2021, respectively. Before the 2020 Covid-19 crisis, the bank’s target was to sustain the $0.51 payout. However, there was a sharp decline of 41% in 2020, followed by a further decrease in 2021. The bank’s performance appears to have been negatively impacted by the pandemic, yet it remained profitable.

Overall, HSBC Holdings PLC is in a healthy financial position as reflected in its annual financial statements, including the balance sheet and income statement. The total assets have been increasing throughout the five years to a record high of $2.958 trillion, placing it as the largest financial institution in Europe at the end of 2021. The bank’s assets maintained a relatively stable risk as the RWA did not show significant changes, showing a proper balance between different asset classes at HSBC Bank. Notably, RWA increased by 1.8% in 2020 when the economy faced a crisis due to the pandemic, showing that the bank has a favourable asset portfolio.

Competitors’ Comparison: Lloyds Banking Group

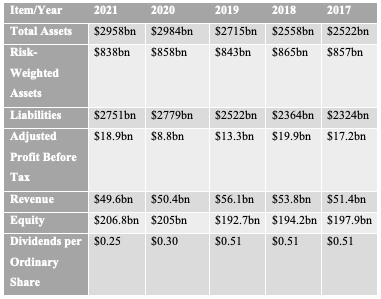

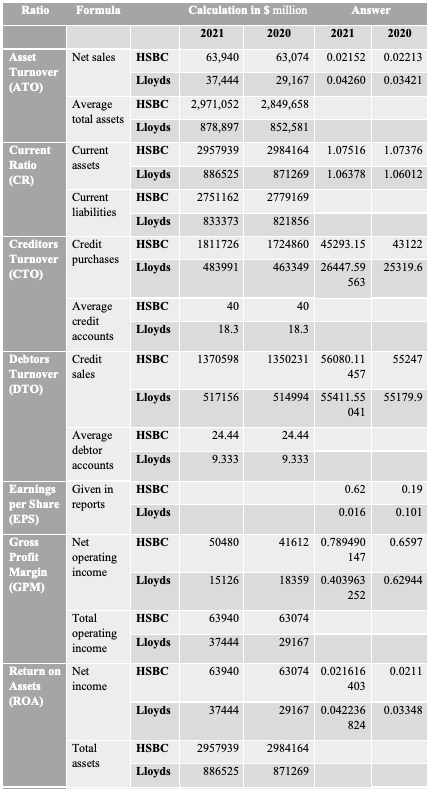

Compared to Lloyds Banking Group, HSBC Holdings generally has a better ratio performance than Lloyds Bank. The analysis is done in Table 2 below, and the comparison rating is given as lower or higher than Lloyds in the last two columns. Since Lloyds’ statements are prepared in GBP, the historical exchange rate of 1 USD to GBP = 0.739 was used (US Dollar Exchange Rates, 2023). The liquidity ratio covered is the current ratio, the efficiency ratio is the asset, creditor, and debtor turnover ratios, and the profitability ratios are EPS, GPM, ROA, ROE, and ROI. In contrast, cost efficiency is a capital structure ratio.

A lower ATO for HSBC shows that the competitor is more efficient in utilizing its resources to generate revenue. Lloyds almost doubles HSBC’s ATO ratio for 2021, showing a significant difference in asset management. HSBC has a higher current ratio, indicating it has more resources to pay its short-term debt and obligations than Lloyds Bank. Nevertheless, the difference between these values is relatively slight and may not make a quantifiable impact on investor choices.

Table 2: Comparison of Financial Years 2020 and 2021

Investors’ Point of View

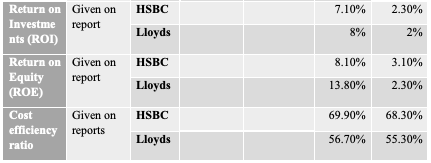

HSBC shares were relatively affordable due to the lower profits reported in the last two years, which would allow most potential investors to buy. The company also believed that pressure from its key shareholders, such as ‘Ping an Asset Management’, was another cause of its falling share price. However, the share has risen over the last year, 2022, to over 540 GBP or $730 (Appendix D).

Before the pandemic, the bank had maintained a payout per ordinary share of $0.51, making it a promising investment venture. In addition, with an expected EPS of over $0.80 in 2022, the price-to-earnings ratio could range around 7. The weakening economic environment is a significant force behind the bank’s declining profits. Appendix A shows that during 2021, the share price of HSBC increased from 359.75 GBP to 455.50 GBP, which equals $486.81 to $616.37. Out of the major investor ratios, namely EPS, working capital ratio, ROE, the quick ratio, price-earnings (P/E), and debt-to-equity, two have been analysed and both indicate a promising future for HSBC.

Accounting Policies

In the 2017/2018 financial year, HSBC Holdings PLC introduced a new financial reporting standard, leading to changes in its accounting presentation. Although HSBC declared the changes in the accounting standards to have no economic consequences, the change greatly impacted various presentations, including assets, liabilities, and cash flows. On the other hand, Lloyds Group PLC executed various measures that the IFRS 16 standard allows (Lloyds Banking Group, 2022). These measures included using a single discount factor on lease investments that portrayed reasonably similar features and referring to the previous reports to determine how burdensome the lease was (Taylor and Aubert, 2022). The company also used past experiences to identify whether the lease terms whose contracts allowed extension were worth renewal, or discontinuing the lease would be a more significant option.

Limitations

This report only presents ratio analysis, which is a quantitative data design. As a result, it does not consider other aspects of HSBC and the banking industry. For instance, the report may indicate a high current ratio, which may not reflect strong liquidity when current assets involve a large inventory of outdated products. Therefore, it renders it difficult to qualify that particular ratio.

The company’s financial accounts lack disclosure of nonfinancial factors that critically affect its operations; hence, ratio analysis may not lead to the desired objective. The reports also fail to reflect on the causes of the fluctuations in amounts that lead to wrong and unreliable conclusions. Hence, the report implores the investors to employ personal judgment further to make decisions without wholly relying upon the report.

Conclusions and Recommendations

In conclusion, HSBC Holdings strongly supports integrated reporting, backed by its outstanding corporate reporting system. Over the past five years, its annual reports indicate that HSBC Holdings PLC has made tremendous progress. Although the HSBC Bank has automated internal control systems, stringent control measures are recommended to enhance its operations. Further, the company’s management needs to improve internal controls to guarantee integrity in the company’s operations. To strengthen its financial muscle, HSBC should drastically improve its efficiency.

Another recommendation for improving its accounting tools is to add business information capabilities and knowledge management. The availability of this information in its reports and accounting systems will enable the employees to make informed decisions, thus enhancing its competitive advantage. Lastly, another recommendation would be that the company should consider its impression on the investors and its economic situation before introducing changes to financial reporting standards. For instance, HSBC’s accounting presentation change impacted various assets, liabilities, and cash flows.

Reference List

HSBC Holdings plc Annual Report and Accounts 2017 (2018) Web.

HSBC Holdings plc Annual Report and Accounts 2018 (2019) Web.

HSBC Holdings plc Annual Report and Accounts 2019 (2020) Web.

HSBC Holdings plc Annual Report and Accounts 2020 (2021) Web.

HSBC Holdings plc Annual Report and Accounts 2021 (2022) Web.

Lloyds Banking Group Annual Report and Accounts 2021 (2022) Web.

Taylor, D., and Aubert, F. (2022) “IFRS-9 Adoption and Income Smoothing Nexus: A Comparison of the Post-Adoption Effects Between European and Sub-Saharan African Banks”, Journal of Accounting and Taxation. Web.

US Dollar Exchange Rates for 31/12/2021 (31 December 2021) (2023) Web.

Appendices

Stock Analysis Chart 2021

Consolidated Income Statement HSBC 2021

Consolidated Balance Sheet HSBC 2021

Current Share Price. HSBC 4 January 2023