Introduction

Huawei is a large Chinese technology company established in 1987 by Ren Zhengfei, a Chinese military engineer. In 2022, it possessed a 5 – 7% market share in the global smartphone market, and in 2019, it was the second-largest smartphone maker after Samsung. Along with mobile phones, its product and service portfolio includes other consumer electronics, such as laptops, routers, wearables, earpads, wireless technologies, cloud computing, and carrier services.

Its main competitors are Samsung, Apple, Lenovo, and Xiaomi in the consumer electronic industry, as well as Microsoft Azore and Amazon Web Services in cloud computing. The key stakeholders of Huawei are the Chinese government, which holds almost 99% of all its stock, and Ren Zhengfei, the company’s founder, who owns the rest.

The country’s regime, while being authoritarian, promotes the development of national Chinese hi-tech firms and supports them with money, knowledge, and promising opportunities. Therefore, the company obtained billions of dollars from the Chinese government, proving itself an efficient firm with good perspectives (Zhang, Alon, and Lattemann, 2020a). It is active in various global markets, but more than 60% of its revenue is still from the Chinese home market, where it is a market leader (Statista, 2022).

Huawei started its worldwide spread in the 1990s, beginning in Russia, then entering developing countries, and then developing EU and US markets in the 2000s (Zhang, Alon, and Lattemann, 2020b). In 2015 – 2017, its strategy and aims were based on the company’s vision of an interconnected world where everyone can connect (Huawei, 2015). It realized these aims in three segments: consumer electronics, enterprise business, and carrier services. It was successful, leading to a significant rise in Huawei’s revenues and market share in the consumer electronics market.

Yip’s Global Drivers and Industry Environment

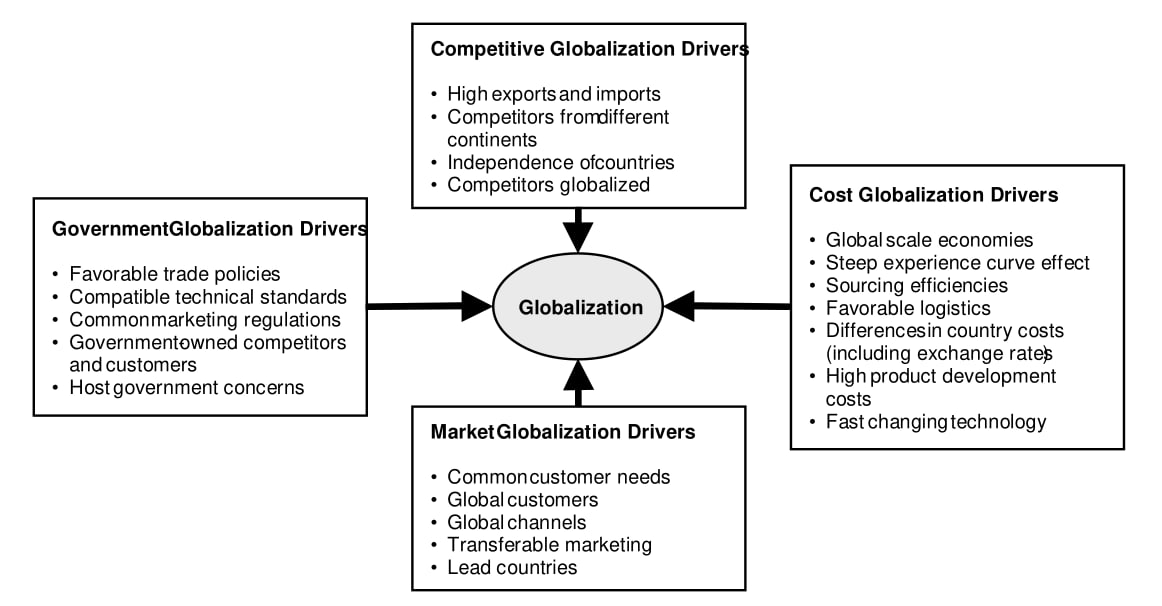

Huawei acts in the hi-tech industries of consumer electronics, cloud computing, and wireless communication. As the consumer electronics industry is the leading segment of the company’s revenue, one should analyze this industry using Yip’s four global drivers to understand the environment in which Huawei operates (Huawei, 2015). It enables one to understand the environment’s peculiarities as the medium where all companies in the industry operate. (Yip, 2003).

Figure 1 shows Yip’s four forces and their short descriptions: Each is the set of influences that helps a business spread globally or, conversely, prevents its spreading. Government force includes government regulations and support, a competitive driver is the market competition, cost force is connected with product’s costs and prices, and market drivers are logistical opportunities and the industry demand in various countries.

Government Drivers

Governments can promote globalization by creating attractive environments for foreign investments or limit it by closing their borders for new companies or issuing policies limiting their operations. They are interested in developing countries’ economies and often support and promote successful enterprises in various industries. The hi-tech industry is popular due to its large growth perspectives (Zhang, Alon, and Lattemann, 2020b). There are different approaches: some governments promote local companies to strengthen the national economy, while others invite large foreign companies to obtain their investments.

As hi-tech industries are often connected with national security, governments may limit the activity of companies from rival countries. For example, the United States and China are engaged in constant indirect rivalry, and their governments often prevent each other’s electronics companies from fully entering their markets due to espionage risks (Kynge, 2021). National security is an integral part of governmental drivers, as smart electronic gadgets can collect and proceed with information in large quantities, being either an opportunity or a danger for the country. Therefore, these drivers in the consumer electronics industry include governmental regulation and support, directed by aims of promoting national economies and strengthening national security.

Competitive Drivers

In the hi-tech consumer electronics industry, competition is fierce, as there are many various products and well-known brands that people mostly prefer to buy. This is especially true for developed markets, where unknown brands are often distrusted, which prevents them from entering (Lin, 2022). Large companies that dominate the market tend to acquire smaller companies to adopt their business models, increase their presence, and eliminate competitors. Still, due to the intense competition, there are almost no monopolies in this market, despite Apple and Samsung sharing more than 50%, constantly replacing one another as an industry leader (StatCounter, 2022). Developing markets, where hi-tech industries are emerging, conversely, are perfect targets to enter, as new consumer electronics for affordable prices are always welcomed.

Cost Drivers

Cost drivers include all money-related motivations for the companies to become global. Production, logistics, transportation costs, product prices, and expected revenues are key drivers of these drivers (Cavusgil, Knight, and Riesenberger, 2017). There are various segments in the consumer electronic market, from low-price to premium ones. For example, there are simple smartphones for a limited number of tasks and very hi-tech and prestigious ones with extended capabilities and premium designs. Therefore, there are various price segments for consumer electronic products, each with a well-developed target audience.

Market Drivers

Consumer electronics have become an integral part of the modern world, primarily due to the development of the Internet, and the market drivers are powerful in this industry. People want to buy smartphones, laptops, and wearables to make them feel connected and increase their capabilities (Cavusgil, Knight, and Riesenberger, 2017). Consumer electronics markets are already saturated and vibrant, but new devices always emerge, motivating hi-tech companies to enter new markets and sell their goods.

International Entry Strategy

Huawei started spreading in other countries in the 1990s, beginning with the Russian Federation and developing countries in Latin America and Africa. After those ventures were successful, the company started conquering developed markets in the EU and US in the early 2000s. Therefore, the company tends to start expanding from markets that are easy to enter, becoming a local leader there; after that, it increases its presence in developed countries.

Entry Modes Used by Huawei

Entry modes are approaches used by the company to enter the market. There are many of them: joint ventures, export of goods or experts, licensing, joint ventures, alliances, direct investments, and subsidiaries. Huawei uses several of them, depending on the situation and conditions. It usually starts its international ventures by entering developing countries via joint ventures and investments and exporting its Chinese experts to develop local infrastructure (Zhang, Alon, and Lattemann, 2020b). To enter developed markets, it uses contracts with large local companies, using them to establish its positions and then strengthen them.

Joint ventures are the most common strategy Huawei uses to enter foreign markets. It collaborates with local enterprises to create joint firms: a prominent example is Huawei’s extension to Russia, where it cooperated with Russian governmental telecommunication companies to establish a reasonable basis for future development (Wu & Zhao, 2007). In addition, it increases trust in the company as Huawei implements new communication methods, improving the host country’s economy. Russia was in a deep crisis in the 1990s, so it was especially beneficial for the country, and Huawei obtained strong positions there (Zhang, Alon, and Lattemann, 2020b). It used similar approaches when entering Mexican and other Latin American markets, and both cases were highly successful.

Export entry mode is also actively used, especially in developing countries such as Latin America and Africa. It sends its Chinese exports to foreign countries, where it develops an infrastructure for future activity (Wu & Zhao, 2007). As telecommunication and consumer electronic market infrastructures are mostly underdeveloped in such countries, especially sub-Saharan Africa, Huawei has all the chances to become a leader there while having minimum risks due to low costs (Cavusgil, Knight, and Riesenberger, 2017). Ample labor resources are another benefit for Huawei, as people in developing countries are usually ready to work even for low salaries due to low prices in their countries.

Lastly, it uses contract-based cooperation to enter the developed countries markets, such as the EU and US. As these markets are already saturated with strong brands in all industries where Huawei operates, it creates partnerships with various companies, including large ones such as Google (Zhang, Alon, and Lattemann, 2020b). It helps minimize risks, essential in a highly competitive environment, while not decreasing rewards in case of success (Lin, 2022). Huawei established a strong presence in European countries, especially Germany, Italy, and Poland, due to its cheap and quality products and services

Advantages

Huawei first uses joint ventures to establish its presence in countries with middle-level development, such as Russia and other post-Soviet states. This approach has low risk, as these joint ventures require few resources to maintain but can give a strong opportunity to grow (Wu & Zhao, 2007). Using Chinese experts to establish an infrastructure in developing countries helps Huawei make a strong basis for its future operations and, in addition, develops local economies (Cavusgil, Knight, and Riesenberger, 2017). In addition, Huawei has a strong base in its home country, which means it will have enough resources for its ventures.

Risks

Despite using joint ventures and export entry modes to successfully enter developing markets, Huawei still has much lower brand recognition than its competitors. Apple, Samsung, and even Xiaomi, which is a Chinese company too, have a much stronger presence in the world, which means that they can push Huawei out of the developing countries market (StatCounter, 2022). Therefore, while Huawei decreases its risks by using contracts, exports, and joint ventures, competitors can push it out.

Globalization: Benefits, Challenges, and Discussions

Globalization always has opportunities, which can largely increase a company’s revenues and risks many losses. Table 1 provides a global PESTEL analysis for Huawei: PESTEL stands for Political, Economic, Social, Technological, Environmental, and Legal factors. Each of these factors shows how the company interacts with its environment and which challenges and opportunities it can face there. They depend on the company’s capabilities and the markets in which it operates. The analysis provides a basis for elucidating the company’s opportunities and challenges in its worldwide expansion.

Political

The Chinese government supports Huawei with money and opportunities, and governments of developing countries trust it a lot, as it helps them build their economies (Kynge, 2021; Zhang, Alon, and Lattemann, 2020a). However, countries that are Chinese rivals, such as the US and other Western states, may limit Huawei’s activity in their jurisdictions.

Economic

Huawei’s primary income sources are in developing countries with rapidly growing economies, such as African, Asian Pacific countries, and China itself (Zhang, Alon, and Lattemann, 2020b). These countries have a constantly growing customer base, cheap labor forces, and emerging markets, which are substantial advantages of Huawei.

Social

Huawei is not as well-established a brand as Samsung, Apple, or Xiaomi, which is undoubtedly the company’s weakness (Lin, 2022). Still, Huawei’s reputation worldwide is primarily positive, and people are happy to use its products, especially in developing countries.

Technological

Huawei relies on its strong technological infrastructure: its mission and vision of interconnecting people rely on high technologies, and all its ventures are based on them as well (Cavusgil, Knight, and Riesenberger, 2017). Poorly developed infrastructures in developing countries provide an excellent opportunity for Huawei to expand there and strengthen its position in the global market by improving these infrastructures.

Environmental

Huawei is concentrating on building a sustainable infrastructure of communication networks with minimum impact on the environment (Huawei, 2015). For example, it helped to restore communication networks in China and Japan after earthquakes and tsunamis.

Legal

Huawei is a private company, which claims that its principal shareholders are its 96000 employees, but it is not transparent, and thus, it is hard to check whether it is really the case (Zhang, Alon, and Lattemann, 2020a). In addition, it was accused by the US government of espionage for the Chinese government by collecting customers’ data and sending them to it (Kynge, 2021). These accusations may decrease Huawei’s reputation and limit its operations.

Initial Conditions: Home Market and Shareholders

In China, the government controls most enterprises, simultaneously funding them and helping promote and develop them. As mentioned, Huawei’s main shareholder is the Chinese government, and Huawei’s workers also have a share in its revenues (Zhang, Alon, and Lattemann, 2020a). Being a private company, it is not transparent, and, thus, it is unknown how much of its share workers actually possess, despite Huawei often boasting that it is a fully employee-owned enterprise. Despite globalization and activity in various markets, China is still the primary source of Huawei’s revenue. In 2020, from its almost 900 billion yuan ($130 billion) revenue, nearly 600 billion yuan ($87 billion) were from the Chinese market (Statista, 2022). It has a leadership position there, being supported by the government, and its revenues in China constantly grow, except for 2020 – 2021 years, due to COVID-19.

New Opportunities

By entering new markets, Huawei realizes its mission of connecting the world and building digital infrastructure. Its revenues almost doubled from 2015 to 2017, which means that it succeeded in its aims to make the world interconnected (Statista, 2022). Its primary targets are developing countries, where a large fraction of people have no smartphones or Internet access: Huawei builds infrastructure in these countries, invests in them, and supplies them with cheap smartphones (Cavusgil, Knight, and Riesenberger, 2017). Their emerging markets are much smaller than Western ones, but they grow much faster, and Huawei’s power grows with them.

The most developed markets, European and North American ones, are highly competitive, but Huawei also has a prominent presence in them. Despite not being as popular as market leaders Apple and Samsung, its popularity has grown steadily since 2015 (Lin, 2022). Its global share in the smartphone market is around 5-7%, similar to Oppo, and it has fewer shares than Apple, Samsung, and Xiaomi (StatCounter, 2022). While it is not an industry leader, it still has a chance to continue its growth and development, using its market entry modes of joint ventures, exports, and contracts.

Markets in developing countries are a large and constantly growing field, where Huawei already has solid positions and experience. These countries welcome Huawei: their government and local enterprises are happy to sign contracts with it, as they understand that Huawei will help develop their economy and provide new workplaces (Kynge, 2021). It has a significant presence in Sub-Saharan Africa, building its telecommunication network infrastructure there and giving local people various services and products at low prices that are affordable for them (Cavusgil, Knight, and Riesenberger, 2017). As those markets rise and integrate into the world market, Huawei’s revenues rise with them, making the company stronger.

Lastly, a prominent Chinese market, where Huawei has leadership positions, is another great opportunity: it means that it has a strong basis for future expansion in developing markets. Chinese government trusts Huawei and supports it with as much money as necessary (Zhang, Alon, and Lattemann, 2020a). Having enormous resources there, the company may continue its expansion on developing markets successfully, being able to support all its enterprises and investments (Cavusgil, Knight, and Riesenberger, 2017). Thus, Huawei has all the necessary resources to continue its sustainable growth and expansion worldwide.

Challenges

Despite being a global company that operates in more than 170 countries, Huawei is still not as widely known as its competitors. Apple and Samsung consumer electronics are widely popular and are top-10 the most recognizable brands, while Huawei’s rating is far lower (Lin, 2022). The reason is that Huawei is a latecomer in the industry: although it was established in 1987 and had a strong position in China, it became a well-known local company only in the 2010s. It maintains a leadership position in the Chinese market, but its share of global markets is much smaller, and its competitors are numerous, including very well-known brands (Zhang, Alon, and Lattemann, 2020b). This means that Huawei risks being pushed out of its high market position if it does not manage to increase its brand awareness.

Being a Chinese company, Huawei is closely associated with the Chinese government, which leads to difficulties when operating in countries with tense relationships with China. Huawei is widely accused of espionage by the Chinese government, which is the reason for limiting the usage of Huawei production in the United States (Kynge, 2021). A prominent example was in 2014 when the US authorities forbade Huawei to bid on a government contract in a network communication industry, accusing it of alleged espionage for Chinese authorities (Cavusgil, Knight, and Riesenberger, 2017). Therefore, its position poses a danger to the company’s reputation in Western countries, which may prevent it from reaching strong positions. However, the example of Xiaomi, another Chinese company with a stable third place in the global smartphone market, shows that Chinese companies can still reach leadership positions.

Conclusion

In the 1990s, Huawei began expanding as a carrier, telecommunication, and consumer electronics company, concentrating on rapidly growing and developing markets. In 2015 – 2017, its primary aims were to make the world interconnected and ensure everyone has access to this interconnection network, including people from developing countries. Therefore, it invested in the telecommunication infrastructure of emerging countries, such as Sub-Saharan Africa, and produced smartphones to sell for an accessible price.

Huawei successfully fulfilled these aims, and its revenues increased rapidly starting in 2015, continuing to grow to 2020, when it experienced a slight income drop due to the COVID-19 pandemic. However, despite being a sizeable globalized firm supported by the Chinese government, Huawei still has many challenges in reaching its declared aims of interconnecting the world. Its brand awareness is still relatively low, and it is accused of espionage due to the company’s close connections with the Chinese government.

Reference List

Cavusgil, S.T., Knight, G.A. and Riesenberger, J.R. (2017). International business: The new realities. Boston: Pearson.

Huawei (2017). 2017 Annual Report. [online] Web.

Kynge, J. (2021). Developing countries sign Huawei deals despite US espionage warnings. Financial Times. [online] Web.

Lin, H. (2022). The Strategy for Huawei Going Global. Proceedings of the 2022 7th International Conference on Social Sciences and Economic Development (ICSSED 2022). [online]

StatCounter (2022). Mobile Vendor Market Share Worldwide | StatCounter Global Stats. [online] StatCounter Global Stats. Web.

Statista (2022). China: Huawei revenue by region 2012 – 2021. [online] Statista. Web.

Wu, D. and Zhao, F. (2007). Entry Modes for International Markets: Case Study of Huawei, a Chinese Technology Enterprise. [online] ResearchGate. Web.

Yip, G.S. (2003). Total Global Strategy II. Pearson College Division.

Zhang, W., Alon, I. and Lattemann, C. (2020a). Huawei goes global. Volume I: Made in China for the world. Basingstoke: Palgrave Macmillan.

Zhang, W., Alon, I. and Lattemann, C. (2020b). Huawei goes global. Volume II: Regional, geopolitical perspectives and crisis management. Basingstoke: Palgrave Macmillan.