Executive Summary

Hyperinflation is one of the conditions of the economy that affects money and prices in a country. This inflation exceeds 50% per month, however; the Zimbabwean case of 200 million percent is one of the worst in recent times. It means that the prices of goods and services in Zimbabwe are increasing more than 100 million times in a year. Hyperinflation occurred in some countries in the 1920s and currently in Zimbabwe. It has caused a lot of confusion and inconvenience because it distorts the currency of the country there is a large movement of people to South Africa from Zimbabwe and it has eroded the real value of life in the country. Income and wealth are arbitrarily distributed in Zimbabwe and actually, the country is facing serious economic challenges.

The causes of Hyperinflation In Zimbabwe are no different from the causes of inflation in other economies. However, the Zimbabwean case is made worse by poor leadership and economic sanctions embossed on that country.

Hyperinflation has its benefits and there are some solutions to this case. Just to mention a few solutions include the imposition of high taxes, encouraging savings, using price control means, use monetary control tools such as bank rates, credit squeeze, and many others.

Introduction

Hyperinflation – this is a type of inflation in which the general level of prices rises at a phenomenal rate. This type of inflation makes people loose confidence in the currency since the value of money declined daily, and consequently, the monetary system starts to disintegrate. As money is rapidly falling in value, people consider it is an unacceptable method of payment reverting to barter trade as a medium of exchange. This leads to the currency ceasing to act or function as money and eventually has to be scrapped.

Hyperinflation in Zimbabwe

Currently, this type of runaway inflation is experienced in Zimbabwe an African country where its paper money is losing half or more of its value in an hour. The inflation rate currently in this country is 200 million percent.

Hyperinflation I this country started when the president of this country started to grab land large-scale farmers by chasing them away only to donate it to the peasants who were not even productive. As a result, the volume of production output reduced causing the demand for that production to be high than what was produced or was in supply making the general prices of goods to rise. The rise of prices has made consumers to spend more of their incomes than they did previously making their currency to lose value.

Also the introduction of economic sanctions greatly affected their economy which resulted to this hyperinflation. The impaction of these economic sanctions is that the country was not capable to trade internationally causing the demand for the goods and sues in supply to be higher as a result; prices increased for those commodities hence inflation.

In Zimbabwe, the cost of production is very high compelling the firms producing there to raise the prices of their produce, to cover the addition to that increased cost. This increase in the cost of production is not related to an increase in productivity or a rise in the cost of living. Take for example a loaf of bread in the year 2003 in Zimbabwe that was going at 100,000 Zimbabwean dollars, currently, the loaf of bread is going at 400 million dollars. This is a high level of Hyperinflation.

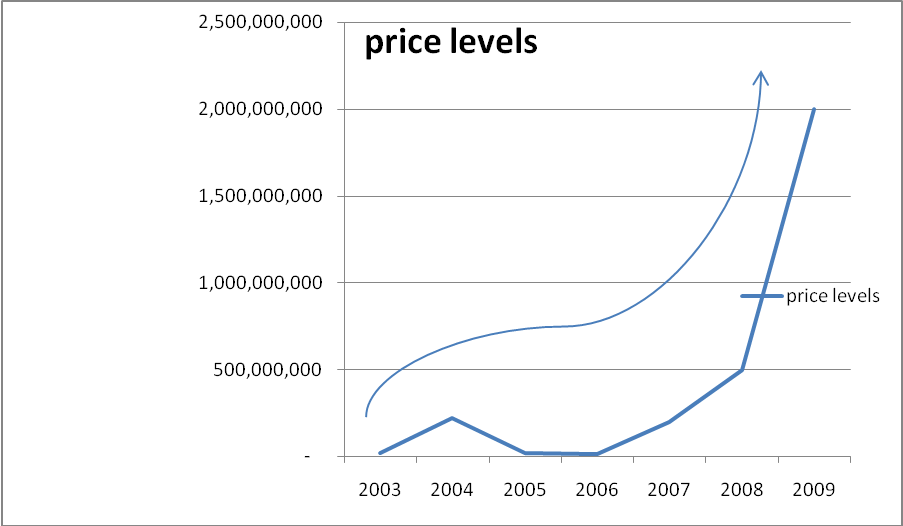

The graph below shows the quantity of money and price levels during Hyperinflation between 2003 and 2009. The quantity of money and price level move close to each other. The strong association between these two theories of supply of money.

Causes of Hyperinflation

There are many causes of Hyperinflation include:

- Increase in money supply unaccompanied by proportionate increase in the output of goods and services. This is a situation where even if there is no increase in aggregate demand, prices may still rise. This may happen if costs particularly the wage costs go on rising. In this, as the level of employment rises the demand for workers also rises so that the bargaining position of the workers also becomes stronger. To exploit this trade unions as for an increase in wage rates which are related to an increase in productivity to the rise in the cost of living. In the process, the employers concede to wage claims due to the increase in input cost, price rises will lead to a further round of wage demand as people endeavors to restore the buying power of their incomes. Further, price increases will cause the chain of events to respect themselves in an inflationary spiral of price and incomes.

- Increase in the community’s aggregate spending which naturally leads to greater demand for the economy’s output and raises its price. There the consumer may be demanding more than what it is in supply and can be as a result of more than one force. For example, consumers may be spending a greater proportion of their incomes or incomes themselves may have risen or cheap easier credit facilities might have been used to finance a spending boom.

- If for any reason, for example, political instability famine, and drought abnormal industrial unrest, the volume of production falls there the demand for goods and services in the economic system will be higher than what is supplied. This will consequently cause a price increase of goods and services.

- Excessive, undue speculation and tendency to hoarding and profiteering on the past of the products. Hence traders and producers will cause a certain commodity all service to be in limited supply. This will result in increased demand for that service or commodity making their prices to increase. This motivate is for traders and producers to make abnormal profits but as a result, hyperinflation may occur.

- When government prints more money

Effects of hyperinflation

In the business, the effect of hyperinflation has always been regarded as beneficial on the ground that production costs tend to lag behind the upward movements of prices and, by widening the profit margin, bring business confidence hence encouraging new investments of capital and stimulate production. But this does not apply where prices follow increases in production cost for example when prices follow increases in production cost for example where a wage increase excessively prompts a producer to raise prices to protect his existing profit margin, if these prices continue to rise sharply then most businesses may collapse since the costs will exceed the selling prices resulting to negative profits.

This may also imply that there would be a little income to spend in the hands of consumers as others will lose employment and the prices will remain higher or wages and salaries will not be increased concerning inflation hence increased cost of living.

In addition, if each day, the value of money will be declining people will decrease their confidence in that currency and will result in the disintegration of the monetary system, consequently people will prefer to trade on exchanging goods for goods as a medium of exchange considering that money is rapidly falling in value and they will not accept it as a method of payment. This may eventually cause the currency to be scrapped if no positive changes are done since it has ceased to function

Solutions to hyperinflation

High taxation: The effect of high taxation is to restrict purchasing power and so on by reducing demand, to prevent rises in prices. For full effectiveness, a government must be prepared to tax to the point of a ‘true’ budget surplus that is to an excess of income over expenditure inclusive of budget outlay for capital purposes. High taxes, however, although they have the advantage of leaving no legacy of debt and interest charges to be met in the future, may nevertheless harm the supply of work and private saving.

Direct taxation can be used to mop up surplus purchasing power, whilst indirect taxes will make goods more expensive in the shops so that buyers will not be able to afford them. Such a tax will of course have an inflationary effect. If the higher shop prices cause demands for greater incomes from consumers.

Savings encouraged: The encouragement of saving by the public through e.g. national savings, campaigns, premium bonds issues, and sufficiently attractive rates. This has a similar effect to taxation except that it leaves a burden on future interest payments.

Monetary policy: An upward movement in the bank rate may cause a corresponding movement in short-term rates as a whole. If borrowing becomes more expensive some consumers may borrow less to spend and businessmen may be less willing to finance stocks of materials or trade debtors. The economic activity may slow down as interest rates increase.

Credit squeeze: The Central bank acting as an agent for the government has given advice or directions to commercial banks as to the desired volume for their lending as to the purpose for which such money should be lent. To underline the the urgency of the situation the central bank can require the banks to make ‘special deposits’ of cash at the central bank, thus reducing the reserve ratios of the banks and their ability to create credit.

Hire purchase regulations to be made more severe. If the number of initial despots is increased consumers will have to save for a longer period before they can spend. If the period for hire purchase repayments is reduced, the periodic repayments will be larger and some potential purchases may not be able to afford them.

Administrative control: The government can limit its expenditure in the public sector of the economy, and may also impose restrictions on spending by local authorities. The demand for goods and services will be reduced and inflationary pressure eased.

Prices and income policy: The aim of a prices policy is to secure price stability. This is very difficult to achieve. A price and income policy can be voluntary or statutory that are the government enforces compliance on trade unions and employers. However, in a free society, where trade unions are committed to retaining their freedom to negotiate on behalf of their members, the statutory enforcement of wage levels may not be a practical proposition.

Conclusion

From the above case, I conclude that the inflationary tendencies in Zimbabwe should be controlled because the happening currently is a result of poor leadership. The government of Zimbabwe has deliberately ignored the need to control inflation. The purchasing power has been eroded and they are currently suffering because of a bad leader.

References

Mankiw, N. Gregory, and others. (1993): A Symposium on Keynesian Economics Today” Journal of Economic Perspectives, 7 (1993): 3–82.

Mankiw, N. Gregory (2006);Principles of Economics; Thompson South-Western; 4th edition.

Robinson, J. and Eatwell, J. (1973), An introduction to Modern Economics, McGeaw Hill Book Company (UK) Limired.