Oil prices in the world market have registered volatile oil price rises with a consequent impact that has created ripple effects on the performance of various market segments all over the world.

The performance effects are reflected both at the macroeconomic and microeconomic levels in every sector of the world economy. A typical example is the effect of rising oil prices on the global transport sector. Both the internal and external transportation systems of every country have been affected by rising oil prices.

In addition to that, the internaltional market is also affected by rising oil prices since the global economic system is entrirely dependent on oil. Typically, the movement of commoditities from one destination market to the other must involve the transport sector which depends on oil as the main variable to enable any movement (Price Theory Lecture 2: Supply & Demand, n.d).

. Research into the ripple effects of oil prices on the performance of the world market indicates a significant effect on the demand and supply of goods and services. That includes the inability of world economies to sustain a stable economic growth based on an overall effect on the cost of transportation with a direct and indirect impact on the performance of markets.

In addition to that, rising oil prices have a signfifcant effect on the balance of payments typical in low income countries. In addition to that, the rising levels of inflation have registrered an impact on the stock market (Price Theory Lecture 2: Supply & Demand, n.d).

Sustainability of the Global Economy

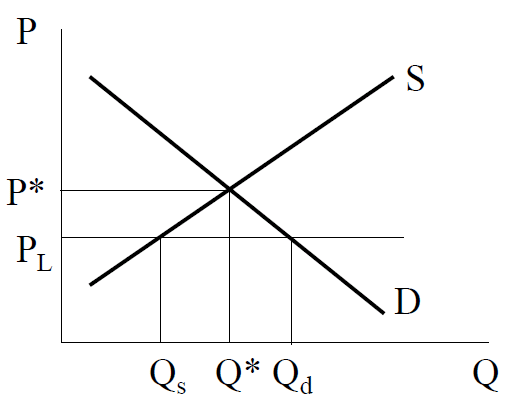

The world economy, as metioned above is heavily dependent on oil as a factor of production in both the product and service industry. Typically, when the price of oil increases, the cost of production appreciates increasing the price of the final product. In theory, when the price of a product or service increases, the demand for a similar product decreases as illustrated on the graph below.

A crtical analysis of the above scenario in broader terms indicates that market celarinf conditions can be achieved when an equilibrium prices is reached. However, when the prices continue to apprececiate against a sustained demand, then the following scenario unfolds (Price Theory Lecture 2: Supply & Demand, n.d).

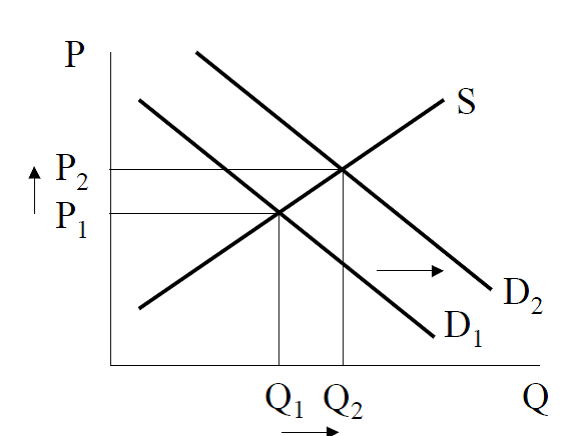

However, when the other variables come into play, the market shows a different behavior due to the elasticity of market variables (Price Theory Lecture 2: Supply & Demand, n.d).

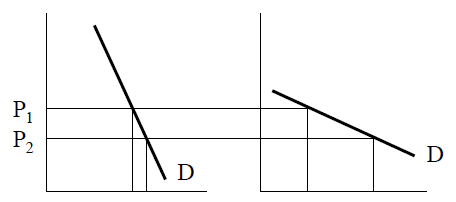

The demad and supply curve based on the pricing argument of rising oil prices can further be analysed from the behavioe of the stock market prices as discussed below.

The Stock Market

The pricing mechanism for any security reflects both actual and hypothetically prevailing economic conditions in the world market. It is hypothetical in terms of speculations and actual values in terms of prevailing and probabilistic stock market price variations based on perceptions of the intrinsic values of securities (Fama, 2008)

In addition to the pricing theory discussed above, speculations affect the demand for oil consequently affecting oil prices and the ultimate behavior of the stock market. When speculations are large in the market, it stimulates large quantities of purchases ultimately causing a rise in the cost of oil. Since the dependence of the world econonmy relies heavily on oil, the resulting effect is a rise in the price of products and servces since one of the key factors of production has increased in price (Fama, 2008)

Typically, therefore, a rise in the price of oil causes a speculative effect on market prices. In turn, speculative purchasing is triggered somsequently resulting in a corresponding rise in the price of oil. The long term consequences on rising oil prices trigger a ripple effect on the price of goods and services due to a rise in the cost of production (Fama, 2008).

Typically, that is due to oil being one of the key factors of production. In addition to that, the effect on the global economy largely relies on the the impact on the transport sector. Each sector of the economy is variably affected by the cost of transporting a product from source to the market.

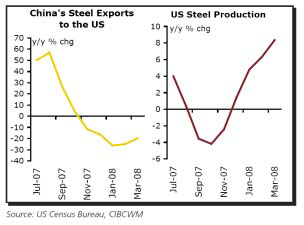

Transport Sector

One of the key components drivers of the world economy is the transport sector. As demonstrated in the above pricing model, when the price of oil increases, consequent rises in transportation costs are experienced. The resulting effect is inflationary on the price of products and services. A typical example is the agricultural sector (Transportation economics & management systems, inc., 2008). Typically, a comparative analysis of the US and Chinese business transactions due to the effects of a rising oil prices is illustrated in the Fig.4 below.

Typically, the rail and road transport systems are overly affected by these price risesand the overall impact tricked down to all sectors since reliance in the movement of goods and services characterizes each sector.

In essence, that influences governments to introduce fiscal policies targeting taxes, monetary policies on excahange rates, and overall effect on the imposition of taxes on key items such as cereals and other foodstuffs.

References

Fama, E. F. (2008). The Behavior of Stock-Market Prices. Web.

Price Theory Lecture 2: Supply & Demand. (n.d). Web.

Transportation economics & management systems, inc. (2008). Impact of high oil prices on freight transportation: modal shift potential in five corridors technical report. Web.