Introduction

The armed conflict between Russia and Ukraine is significant to Russia’s economy for multiple reasons. On the one hand, the country needs to supply a large military to continue the operation in Ukraine. On the other hand, Russia needs to withstand the pressure from sanctions from the Western world. Since Russia’s economy is known to be largely dependent on oil and products, Western countries see oil products as the primary object of sanctions (BBC News, 2023).

In particular, G7 countries, along with Australia, put a price cap on crude oil from Russia, and the EU banned seaborne imports of refined oil products, such as diesel, from Russia (BBC News, 2023). The purpose of the sanctions is to reduce Russia’s GDP so that it cannot support the war in Ukraine. Since the price cap and other sanctions are expected to reduce revenues and profits from Russian oil, the sanctions are expected to be effective.

This report aims to determine if the oil price cap policy will be effective in the future. To assess the effectiveness of the oil price cap, this paper will determine if the price of Urals brand oil significantly impacted the Russian Gross Domestic Product (GDP) historically between 2010 and 2021. Three research questions will be answered to achieve the purpose of the study. These research questions are listed below:

- What was Russia’s GDP between 2010 and 2021?

- What were Urals brand oil prices between 2010 and 2021?

- How did Urals oil prices affect Russia’s GDP between 2010 and 2021?

Data from open sources, such as the World Bank and Investing.com, will be used to answer the questions. The data will be analyzed using descriptive statistics and regression analysis in Microsoft Excel.

Russian GDP (2010-2021)

A country’s GDP is understood as the total value of all the services and products it produces during a certain period (Fernando, 2022). GDP is used as a measure of a country’s economic prosperity, as it demonstrates its economic potential (Fernando, 2022). The researcher used annual GDP data for Russia, which is available in open access through the World Bank (2022). The data demonstrate GDP by year, measured in US dollars.

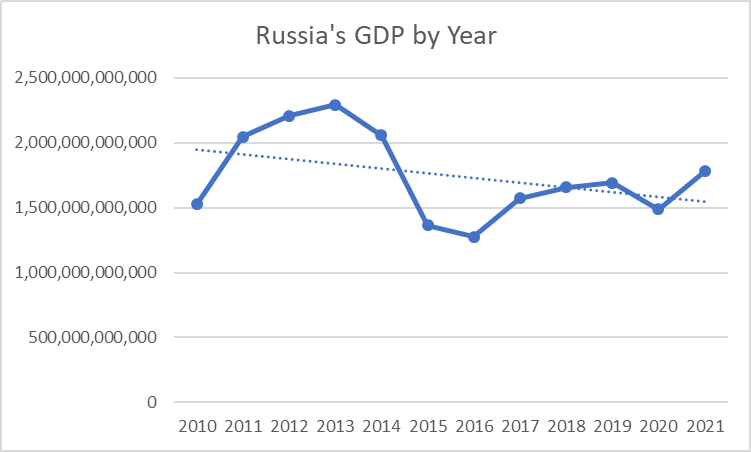

Russia’s gross domestic product between 2010 and 2021 varied between $1,277 trillion in 2016 and $2,292 trillion in 2013. The mean value was $1,747 trillion, with a median value of $1,675 trillion, a standard deviation of $333 trillion, and a range of $1,015 trillion. Table 1 below provides descriptive statistics of Russia’s GDP during the analysis period.

Table 1. Russia’s GDP: descriptive statistics.

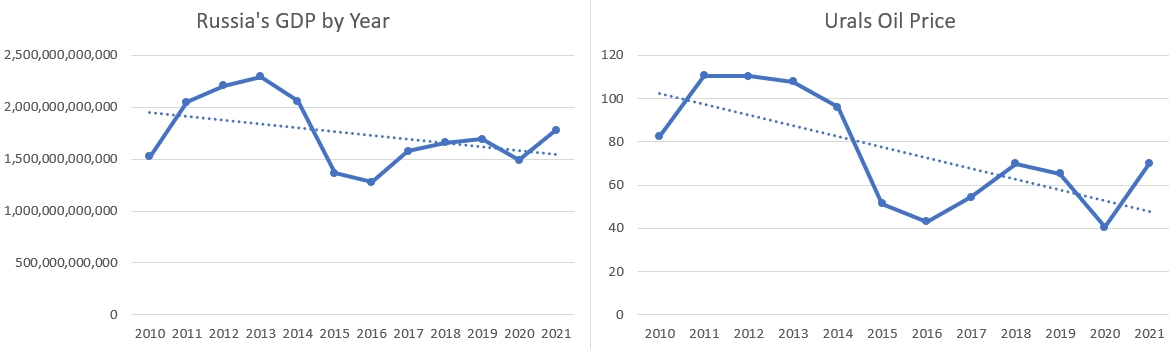

Descriptive statistics demonstrate that Russia’s GDP was extremely volatile during the analysis period. The GDP range was around $1 quadrillion, which is very close to Russia’s minimal GDP registered in 2016. The difference between the highest and the lowest registered GDP was only 3 years, which demonstrates that the country’s economy was very unstable between 2010 and 2021. The figure below provides the changes in the country’s GDP using a line graph. The graph demonstrates the actual changes in Russia’s GDP along with a trendline created using linear regression of GDP against time.

The graph above demonstrates that Russia experienced two significant declines during the analysis period. The first decline was in 2015-2016, the year after Russia annexed Crimea. The second decline was in 2020, when the world experienced the economic crisis associated with the COVID-19 pandemic. However, after the crisis, Russia’s economy was restored steadily. Despite GDP growth during the recovery years, the overall trend in the country’s GDP was negative, as shown by the trendline. The country’s GDP will confirm the trend in 2022, which is expected to drop due to sanctions from Western countries. The data used for the analysis above is provided in Table 2.

Table 2. Russia’s GDP by year (World Bank 2022).

Urals Oil Prices (2010-2021)

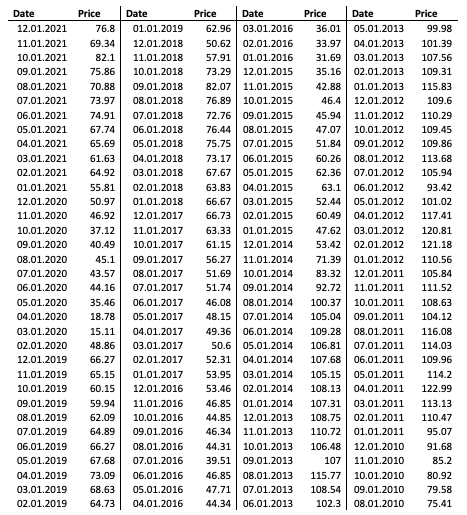

Urals oil prices are traditionally lower than Brent oil prices. Oil prices are set during trade on the New York Mercantile Exchange. Crude oil futures are the most actively traded futures contracts on a physical commodity worldwide. The historical prices of Urals brand oil were retrieved from Investing.com, one of the largest websites devoted to analyses of investing opportunities. The monthly historical prices of Urals oil between August 2010 and December 2021 are provided in the table below.

Table 3. Monthly Urals oil price per barrel (Investing, 2023)

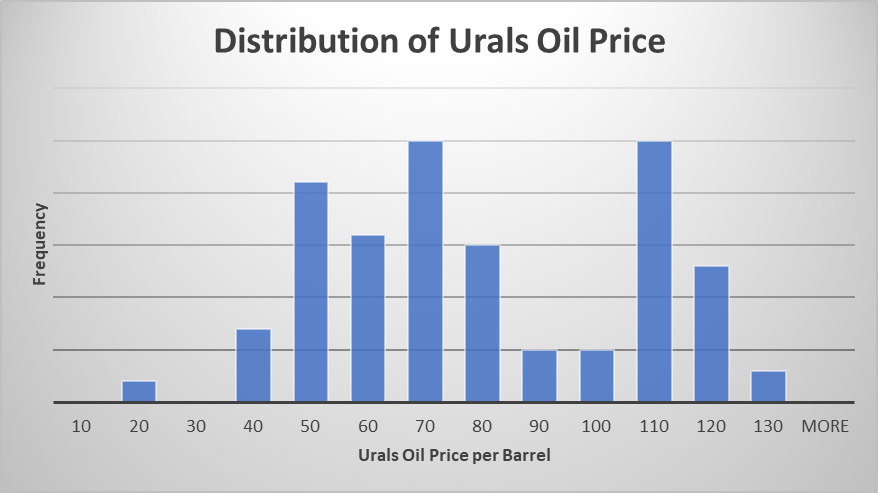

The mean oil price was $76.69 per barrel, with a median price of $67.74 per barrel. The prices varied between $15.1 per barrel in March 2020 and $122.99 in April 2011. The standard deviation was $26.98, with an interquartile range of $54. Table 4 provides detailed descriptive statistics for the sample data.

Table 4. Descriptive statistics of Urals crude oil

The distribution of prices for Urals oil is provided in Figure 2 below using a histogram.

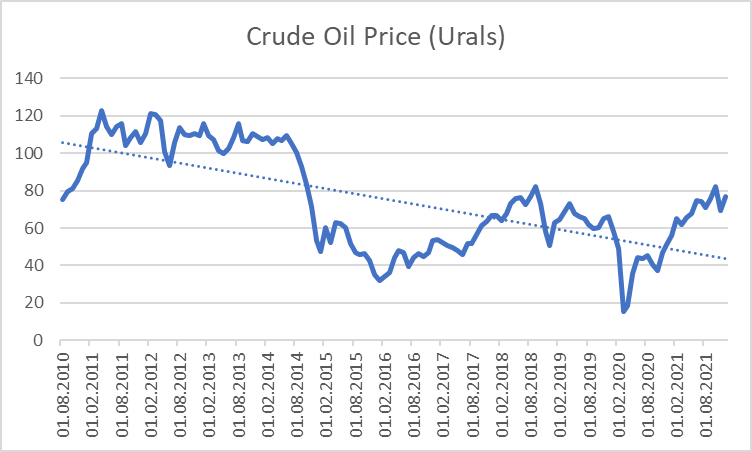

During the analysis period, the price of Urals oil fluctuated wildly. The range was $107.88, which is extremely high considering the maximum price of $122.99 per barrel. To understand the reasons for such volatility, a line graph was created with a trendline calculated by regressing the price against time. Figure 2 below demonstrates how the prices of Urals oil varied between August 2010 and December 2021.

The graph demonstrates that Urals crude oil prices had a similar pattern of changes compared to Russia’s GDP. Urals brand prices fell tremendously in 2014 due to the conflict in Crimea, reaching the local minimum of $31.69 per barrel in January 2016. In 2020, oil prices hit their lowest in recent history, reaching $15.11 per barrel in March. Oil prices could not return to the levels of 2011-2013 after the conflict in Ukraine, reaching a maximum of $82.1 per barrel in 2021. The trendline of the oil prices is also negative, similar to Russia’s GDP. However, the line appears steeper in comparison with that of Russia’s GDP.

Relationship Between GDP and Oil Prices

The descriptive statistics analysis demonstrated a visible correlation between Russia’s GDP and Urals crude oil prices. However, statistical analysis is beneficial in confirming the significance of the correlation. The monthly oil price data needed to be transformed into annual data to test the correlation. Average annual prices were used for further analysis. The final dataset is provided in Table 5 below.

Table 5. Russia’s GDP by year and average annual Urals oil prices.

Figure 4 below juxtaposes the trends in data to compare the changes in GDP to changes in average oil prices. The comparison demonstrates visible similarities in the patterns of data.

A regression analysis was conducted since visual assessment provided significant evidence for a suspected positive correlation between the datasets. Table 6 demonstrates the output of the regression analysis using Russia’s GDP as a dependent variable and the Urals oil price as the independent variable.

Table 6. Regression analysis output

Summary Output

ANOVA

Thus, the regression analysis demonstrated that the following formula can be used for predicting Russia’s GDP:

- GPD = 867,669,444,815 + 11,712,924,350 * Urals Oil Price + ϵ

The coefficient for the intended variable was statistically significant, as the p-value was below the threshold of 0.05. Moreover, the created model had a high degree of predictive ability, as the coefficient of determination (R2) was as high as 0.83. This implies that the model could explain around 83% of the variation in the dependent variable, which implies that Russia’s GDP depends on the price of Urals brand of crude oil y 83%. Thus, it may be concluded that the petrol price in the Urals region greatly impacts Russia’s GDP.

Conclusion

The study aimed to assess the effectiveness of capping the price of Russian crude oil to diminish Russia’s economic strength and its ability to finance the military conflict in Ukraine. The research addressed three main points. First, it analyzed the volatility of Russia’s GDP between 2010 and 2021, noting an average of $1.747 trillion. Second, it looked at the fluctuating average price of Urals crude oil during the period, which stood at $76.69 per barrel.

Finally, a regression analysis showed a strong link between Russia’s GDP and oil prices. This model predicted that a $20 drop in the price of Russian crude oil per barrel would reduce Russia’s GDP by $234 trillion, or 13% of its 2021 GDP. The statistical findings indicate that a price cap is viable for reducing the country’s economic potential.

Reference List

BBC News (2023) Russia to cut oil production over price caps. Web.

Fernando, J. (2022) Gross Domestic Product (GDP): Formula and How to Use It. Web.

Investing (2023) Crude Oil Urals Europe CFR Spot. Web.

World Bank (2022) GDP (current US$) – Russian Federation. Web.