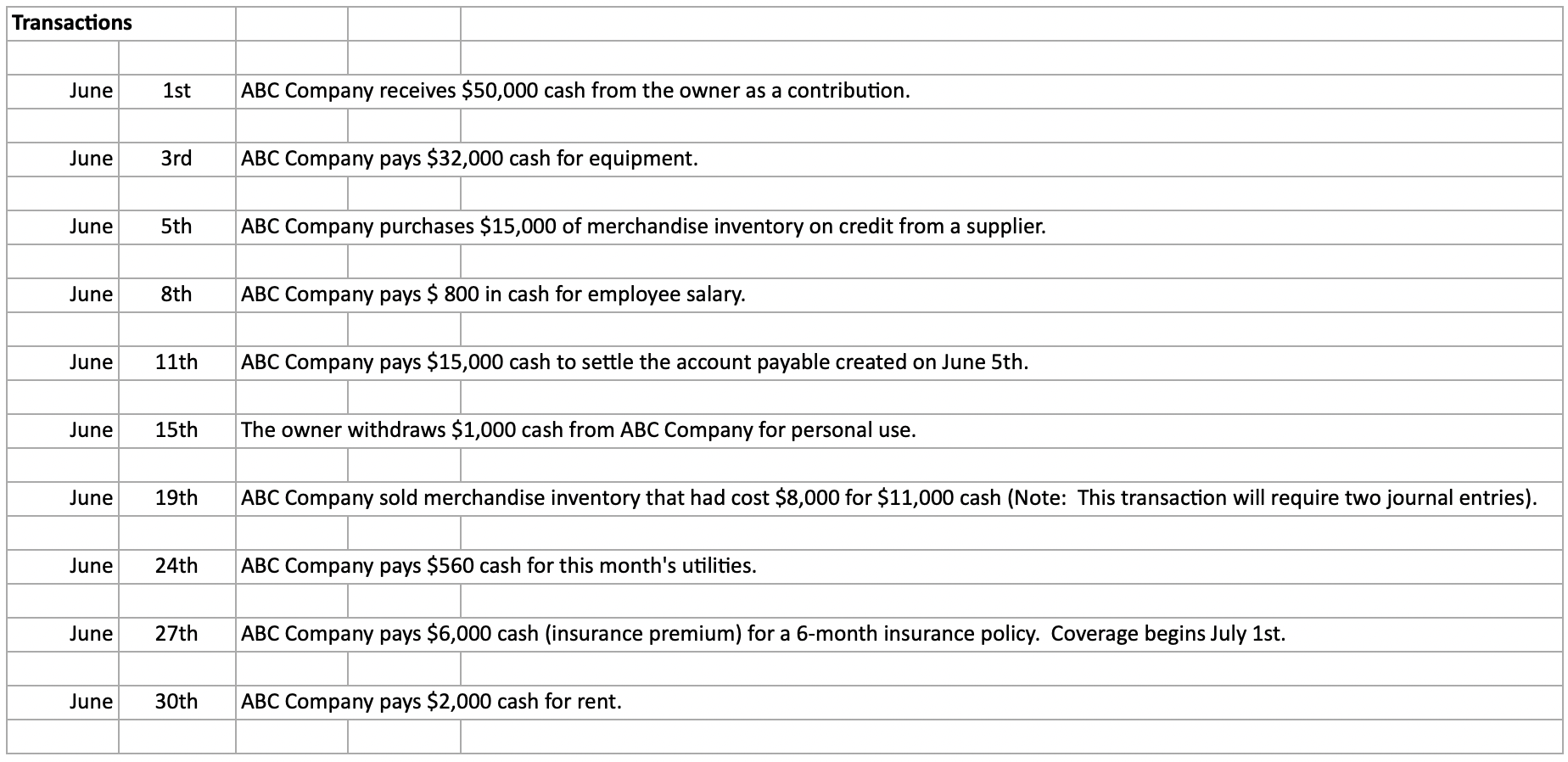

A Trial Balance is a report listing all the accounts in the general ledger and their balances. Its primary purpose is to ensure that the total of all debits equals the sum of all credits, which means there are no errors in recording transactions (Singh & Chauhan, 2020). This report is essential because it helps identify errors in the ledger, which can be corrected before the financial statements are prepared.

After completing the Trial Balance for my company, I discovered that all the accounts were properly balanced. This means all the transactions were recorded correctly, and the financial statements can be prepared confidently. Additionally, thanks to the Trial Balance, I identified and corrected the mistakes made in time. Overall, the Trial Balance is an essential tool for ensuring the accuracy of financial statements and maintaining the integrity of accounting records. Another advantage of the Trial Balance is that it helps to provide a snapshot of the company’s financial position at a particular time. Compiling this report involves listing all the accounts in preparing the financial statement (Singh & Chauhan, 2020). By analyzing the Trial Balance, a company can quickly identify which accounts have the highest and lowest balances. It is a valuable tool for effective decision-making about the company’s financial operations.

Moreover, the Trial Balance can identify discrepancies in the ledger that may indicate fraud or financial mismanagement. The appearance of a negative balance can be seen both in the context of an incorrect distribution of funds and as evidence of financial difficulties in the company. By identifying these discrepancies early on, a company can take corrective action to prevent further financial loss.

In conclusion, the Trial Balance is a valuable tool for checking the accuracy of a financial statement. It provides a snapshot of the company’s financial position and identifies discrepancies in the ledger that may indicate fraud or financial mismanagement (Singh & Chauhan, 2020). Regular preparation of the Trial balance allows you to assess better the state of funds and the correctness of accounting records, and also gives a clear idea of the company’s financial processes and helps make critical decisions.

Reference

Singh , S. K., & Chauhan, S. (2020). Problems & Solutions In Accountancy Class XI. SBPD Publications