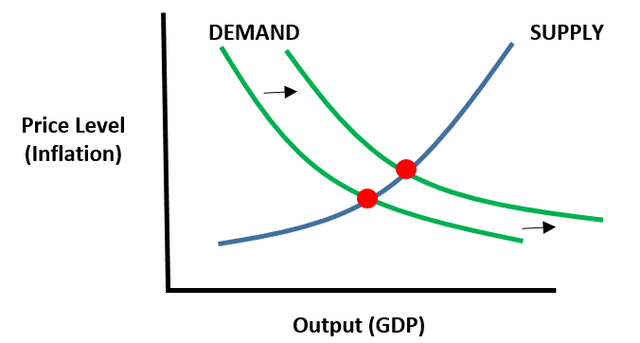

Prices have never been a solid and constant quantity because of a large number of aspects that affect this field. Different factors like competition, the elasticity of demand, the economic environment, or government policy can all become the reasons for price change. Massive changes in prices for products in a country are called inflation. There are two types of inflation: demand-pull and cost-push. The demand-pull inflation happens when demand for services or products grows faster than supply.

To understand the operating principle of inflation hypothetical new strain of COVID-19 will be considered. That version would be even more infectious and deadly dangerous than previous versions of coronavirus. In that scenario, the Government would need to impose another lockdown to secure American citizens from the virus. Gyms are forced to close, and that way, people who are members of gyms could not visit them like before. People to equip gyms at their homes because of not knowing how long the lockdown will take. This creates an unaccustomed demand for exercise equipment because of people’s massive ordering online and the increased supply because of the inability of training equipment manufacturers to provide enough goods. In that case, the aggerate demand shifts to the right and causes the price level to grow while not enough products are produced. The mentioned type of inflation can stimulate the economy and increase demand for jobs, but at the same time, it raises the prices and is usually more expensive than cost-push inflation.

When the economy is well-balanced, demand-pull inflation means that the population has more money to buy more goods. Consumers spend money in peace when they do not have problems with their jobs, and the market is competitive and growing. The circular flow model helps to understand the system of inflation better. Tsoulfidis et al. (2019) describe “productive activity as a never-ending circular flow of capital activated to produce use values for the purpose of profit-making on an expanded scale” (p. 54). The global market gets its resources from households to sell them for a higher price to companies that produce goods and sell them to people using the goods market. In the same way, money goes in circles from the global market to households, the goods markets, and companies and ends up returning to the global market.

Every basic American perceives inflation as a short-term discomfort, while it needs to be considered more seriously because of its possible long-term impact. Inflation can severely impact the worth of people’s income and savings. The consequences of inflation can change the situation of every person’s spending and revenue drastically, even retired people. The inflation numbers are used by Government to understand which field needs the raise more. That is why inflation can cause the enlargement of pensions or vice versa. However, the main problem of the pensioners is their purchasing power in terms of their health, rest, and other vital necessities. Studies show that “a wide majority of older retirees depend on Social Security benefits, as ninety-three percent of retired individuals aged 65 and older claim it” (Lake, 2022). At the same time, social security’s crucial influencing factor is the inflation index which is used to calculate the price of living.

There is another factor that affects retirees’ payments negatively, and it is connected with the last years of pensioners’ employment. Most of the time, pension payments depend on their salary during the previous years of their career before retiring. That way, if inflation happens during these years, it can affect the amount of money the person gets. However, an outdated salary can distort the actual market rate if inflation happens after retirement. That means that even the shortage of not vital objects like exercise equipment can cause bad changes in their income and savings.

There are many ways that the Government can use to fight inflation and its negative consequences. Price control as a method was used in the past, but it turned out to be unusable and failed. In 1971 Richard Nixon closed the gold window, and “over the next decade, the dollar lost more than half of its purchasing power” (Lowenstein, 2021, p. 24). However, contractionary monetary policy works the other way around, raising interest rates by reducing the money supply in the economy. They can also use the discount rate to make discount windows that are short-term loans. Unfortunately, inflation cannot be easily stopped, but still, Government has its pressure levers. A contradictory monetary policy remains the best way to control inflation because price control can worsen the situation.

To conclude, in the modern world, inflation is inevitable, but it can be controlled. Most of the time, this phenomenon negatively affects people’s lives. Still, it can also be a sign of the growing economic situation in the country, especially the demand-pull type of inflation. However, inflation is a common problem and not a temporary one. Still, even though it can destroy savings or cut salaries and other payments, it is important to understand its core to be able to control it.

References

Lake, R. (2020). How inflation impacts your retirement income. Investopedia.

Lowenstein, R. (2021). 1971 and the undermining of Fed independence. The International Economy, 35(3), 24-25.

Tsoulfidis, L., & Tsaliki, P. (2019). Classical political economics and modern capitalism: Theories of value, competition, trade and long cycles. Springer.

White, J. (2022). Demand-pull inflation: Definition & causes. Seeking Alpha.