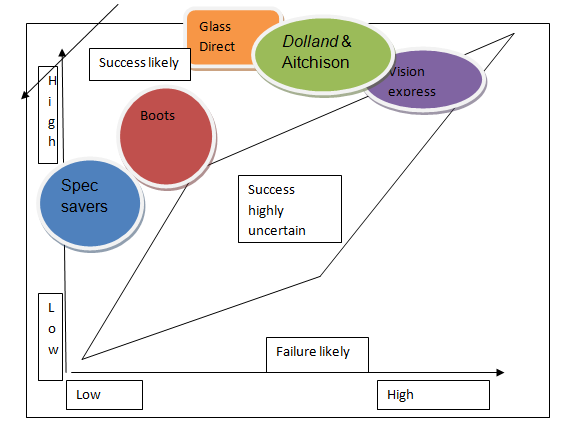

Table 1: strategic characteristics of the industry players

Glasses Direct exercises a combination of strategies that makes it exceptional within the eyeglass retail industry. Its focus is provision of high quality products under differentiation strategy, yet at a price below the industry average.

In addition, Glasses Direct benefits from the extensive customer coverage through online stores. However, the company is constrained by the fact that its products are of limited variety. The above table illustrates how the industry players compare and differs in terms of different strategies as it will be discussed in this paper (Bemowsky, 1992).

Specsavers and boots operate under similar business strategies, in that they both exercise low cost strategy, and offer their products at prices below the industry average. As such, they are both placed above success likely and success highly uncertain, particularly because the consumers tend to become attracted by retailers who sell good quality products at low prices as they increases value for their money.

Dolland and Aitchison is a remarkably successful retailer, perhaps as a result of its differentiated strategy and very high quality products (Lindblom, 1959). Even though their products are sold at relatively high prices compared to the likes of Boots and Specsavers, they seem to have mastered the art of creating strong customer royalty.

This is however irresistible considering the superiority of their products. As such, Dolland and Aitchison are placed above success likely and success highly uncertain (De Wit and Meyer, 2004).

Fig 1.Perceived differentiation vs. competitive brands

Vision express, though pursuing a differentiated strategy, does not appear to win the heart of many customers. This is conceivably because they sell their products at higher prices yet their quality is virtually the same as that offered by other retailers, but at lesser prices.

Seemingly, the customers are looking for means of maximizing the value for their money, especially during this recession period. Consequently, Vision Express is placed between success likely and success highly uncertain (Evans and William, 1999).

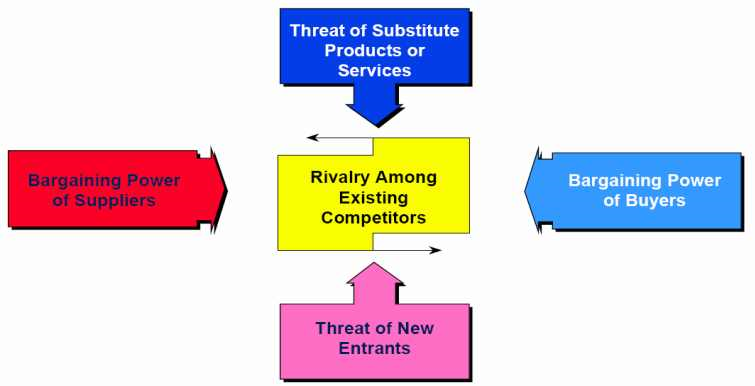

Competitive condition of Glasses Direct in regard to Porter five forces

One of the Glasses Directs’ major competitors seems to be Dolland and Aitchison who holds a commanding market share. However, Glasses Directs’ extensive coverage through online stores and production of top quality products enables it to win sizeable customer royalty from all corners of the world. In this regard, porter five forces model can be used to discuss these issues (Berdell, 2002).

Competitive rivalry: moderate

Glasses Direct offers its products at relatively low prices, though it faces price switching from industry players such as Specsavers and Boots who offers even lower prices. However, Glasses Direct is capable of maintaining its edge as a result of its extensive online coverage and its superior goods (Needham, 1999).

Many customers find it convenient to purchase products online without having to visit the physical office. In addition, many customers are ready to purchase products at a premium with the promise of getting superior quality. Nonetheless, Glasses Direct risks losing a substantial market share if online selling of eyeglasses is declared illegal by the General Optical Council (GOC).

The threat in substitution: high

The threat in substitution may affect market prices since the customer can prefer a different substitute the company’s goods or services. This threat may affect the company’s marketing power.

The threat of substitution may affect market prices since the customers can switch to substitute products in case of a price increase. This may weaken the company’s bargaining power considerably. Eye glassless are close substitutes, and certainly their demand is highly elastic with respect to price changes (Johnson and Scholes, 1999)

Supplier bargaining power: moderate

In assessing supplier power the company needs to identify the ease in which suppliers drive up prices. There is also a need to analyze the product’s difference and their uniqueness. It is important to know the number of suppliers per input and the advantage they will have over others because of the differences in material requirements.

Due to limited number of suppliers who can supply some specific inputs, Direct Glasses may not be able to select the suppliers hence increasing their power. However, the company has been able to maintain close relationship with the most trusted suppliers, hence avoiding unnecessary exploitation (Hill and Jones, 2007).

Threat of new entry: moderate

Glasses Direct bargaining power can suffer immense loss in case a new entrant enters its market. While it is possible to concur that it is not possible for fresh new entrants to invade its territory due to its competitive strength, it would not be possible to ignore an entry threat by stronger players such as Dolland and Aitchison who have substantial capital.

A decision by closer competitors with adequate capital, to invest in online sales would be a great blow to Glasses Direct (Godfrey et al., 1997).

Buyer Power: moderate

Glasses Direct uses product differentiation and brand royalty to retain customers; however that does not preempt possibility of brand switching by some customers.

If product differentiation is not adequate enough, some customers may switch to other company’s products which are offered at lesser prices. The superior products that are produced by Glasses Directs make it possible to retain most of the royal customers (Armstrong and Kotler, 2008).

Fig 2. Michael Porter’s Five-Forces Model & Sovereign States

Attractiveness of investing in Glasses Direct

As noted above, Glasses Direct draws most of its competitive strength from its extensive online selling which risks being invaded by other players. Besides risk of entry, the future of online selling is questionable as it is awaiting GOC legality ruling. Both of these eventualities portend great threat to the company’s profits or its existence at the worst (Kaynak, 1993).

Nonetheless, assuming that these factors will not turn against the company, then Glasses Direct is a vibrant and profitable company that is worth investing in.

This is because the combination of differentiation strategy with high quality products which are extensively supplied through the online market have strengthened its brand, built customer royalty and enhanced its market share in this industry (Babette, Bensoussan and Fleisher, 2008).

References

Armstrong, G., and Kotler, P., 2008. Principles of Marketing. University of California: Pearson/Perentice Hall.

Babette, E., Bensoussan,C., and Fleisher, k., 2008. Analysis without paralysis: 10 tools to make better strategic decisions. New Jersey. FT Press.

Bemowsky, K., 1992.The quality glossary. Quality Progress, 25(2), pp. 18-29.

Berdell, J., 2002. International trade and economic growth in open economies: the classical dynamics of Hume, Smith, Ricardo and Malthus. Cheltenham: Edward Elgar Publishing.

De Wit, B. and Meyer, R., 2004. Strategy Process, Content and Context. International Perspective. London: Thomson.

Evans, J. R., and William, M. L., 1999. The Management and Control of Quality. 4th ed. Cincinnati: South-Western.

Godfrey, G., Dale, B., Marchington, M. and Wilkinson, A., 1997. Control: a contested concept in TQM research. International Journal of Operations & Production Management, 17(6), pp. 558-573.

Hill, L.W.C., and Jones, R. G., 2007. Strategic Management an integrated approach. New York: Cengage learning.

Johnson, P., and Scholes, k., 1999. Exploring Corporate Strategy: Test and Cases. London: Prentice Hall.

Kaynak, E., 1993. The Global Business: four key marketing strategies. London: Routledge.

Lindblom, C., 1959. The science of muddling through, Business Strateg. Penguin Books: Middlesex.

Needham, D., 1999. Business for Higher Awards. Oxford: Heinemann.

Shiques, P., 2007. Marketing Strategies & Solutions. Web.

Spangengerg, O., 1992. A systems approach to performance appraisal in organizations, the 25th International Congress of Psychology. London: International Thomson Business Press.

Walton, M., 1986. The Deming Management Method. New York, NY: Perigee Books.