- Introduction

- Evaluation of Country Information

- PESTLE Analysis of India and China as possible markets for expansion

- SWOT Analysis of Chinese and Indian Textile Industry

- Porter’s Diamond Analysis for Chinese Textile Market

- Porter’s Diamond Analysis for Indian Textile Industry

- Key Strategic Organizational Issues

- Recommendations

- Reflection

- List of References

Introduction

Super Group Plc is a UK based retailing firm constituting of three brands; Superdry, 77 Breed and Surf Co California. The Super Group apparel takes its inspiration from the Japanese culture of designs and vintage American for its styling and thus provides a very unique manufacture that is targeted to wide demographics.

The company further provides shoes, accessories and bags. The brand was formed in 1985 in London by Julian Dunkerton and started operations as a cult store in Cheltenham (The Telegraph 2011). It gained popularity with the celebrity endorsement by David Beckham and since then has expanded its operations in terms of standalone stores, cult and concessions, UK wholesale and e-commerce.

It has expanded internationally through franchising and license in 40 countries including Japan, Belgium, France, USA and Australia and in 85 stores through its online operations. It has a total of 39 outlets in the UK and Ireland and has 60 concessions and standalone stores in the House of Fraser throughout the country. It is also listed in the London Stock Exchange (Superdry Group Plc 2011).

Evaluation of Country Information

The two countries chosen for an evaluation based on further expansion of Super Dry are India and China as both of these countries are emerging in terms of economics and the textile industry is significant contributor to the GDP in both the countries (Emme 2006).

In case of India, the textile industry is the major sector of the economy; it accounts for 14% of the total industrial production and contributes 20% to the total exports and 5% to the GDP. It is also one of the largest employers of the economy, employing 38 million people in the country hence there is great potential in the Indian industry for further growth and development as it is one of the emerging economies (Balasubramanyam 2005).

Although the Indian industry is plagued with bureaucracy and obsolete infrastructure in many cases and the investment is still limited to meet a global retail demand. However, the textile industry has evolved over time to become one of the most efficient industries in the world today, offering shorter production cycles, greater flexibility, greater value addition and a greater customization (Balasubramanyam 2005).

The sourcing agents and the retailers have a greater propensity and willingness to invest. The country is inclined towards more efficient use of information technology and business process outsourcing making its supply chains more integrated and coordinated. It offers a complete vertical integration of the apparel manufacturing process, from the growing cotton and final tailoring of the ready garments.

India a has a population of 1.1 billion with a large segment of young population with purchasing power and an acceptance for new western trends and fashion styles. At the same time, there exists a cultural diversity in India whereby there are 15 different national languages and the dialect varies from state to state. This presents a complex market situatin where the target market is fragmented and thus a consolidated expansion may not be the most appropriate answer.

Organized retailing in India accounts for only 3% of the market, although this is lower than that of China at 20% but it represents under capacity utilization which means there is room for further development in this sector. There are 100 shopping malls in India today, as per the data of 2006 (Teck-Yong 2010).

China is the leading exporter of textiles with the market share of more than 10% whereas India is third largest exporter with the market share of 4%. China’s population is on a decreasing trend owing to its one child policy thus it does not have a young population as large as India’s (Balasubramanyam 2005).

The introduction of market system in China in 1970’s has changed the economic structure of the Chinese markets and industries; textile and apparel industry provides a similar example of these changes. “It has the largest apparel industry in the world which employs more than 3.9 million of the workforce and had 47,000 establishments in the year 1995. Chinese apparel production amounted to 9.685 billion garments (in units) and total apparel exports stood at a value of approximately US$24billion” (Gu 1999).

Textile exports in china accounted for 29.38% of the total Chinese exports in 1994, soon after the economic reforms were implementing. This suggests the importance this sector receives.

Although this number has reduced over time as China has expanded its markets incorporating a greater amount of electronic and other household items, textile and apparel industries continue to be important in bringing foreign currency into the country. As per the 2008 data, Chinese textile industry valued 65.406 billion USD, an increase of 16.6% from the year 2007. However, the textile exports have shown a relative decline despite the tax rebates that were adjusted twice after the second half of 2008 (Gu 1999).

A major chunk of this production accounts for foreign exports and thus made from imported fabric and cloth. Aimed at a mass a mass market, it has relatively less product differentiation and offers low prices. However, it has strategically divided its operations in production of high quality, high fashion international brands.

It thus has an extensive and advanced distribution systems and outsourcing agents. 80% of U.S. imports from china are transported through the use of intermediary trade. Apart from being a characteristic of immense significance, this also poses a threat to the Chinese export market as it hampers the accurate assessment impossible (Emme 2006).

Furthermore, the sewing industry also experiences external economies of scale as much of it is concentrated along the coastal region making it easier for transportation and communication from its international markets hence it provides infrastructure to facilitate rapidly increasing international trade in apparel. However, on the other hand, the labour costs in China are increasing as well as the currency appreciation poses an inflationary pressure on the raw material procurement.

These rising costs have resulted in a more dispersed sewing and apparel industry whereby many of the producers have moved to inland locations to benefit from cheap labor and raw material. This makes it a less attractive market for further expansion of Super Dry as compared to India where the labour costs are extremely low facilitated by a cheaper currency (International Labor Organization 1996-2011).

Thus based on the above data evaluation, India is a more promising industry for further expansion and should be evaluated further. This is because although China is more developed in its operations, intermediaries and supportive infrastructure, it enjoys economies of scale but India still has a gap that can be filled with external investments. This vacuum can be filled with similar international expansions as it has the capacity to produce further, promoting the strategic aims of our expansion.

PESTLE Analysis of India and China as possible markets for expansion

Based on Michael Porter’s Pestle framework, we will now deduce the key external factors that we will have to consider to support the decision of further expansion of Superdry. Following are the most important factors, affecting this particular strategy:

Political and Legal

The Indian government introduced the Multi-Fibre Arrangement (MFA) in India that aimed to increase India’s Global textile market share. It has invested more than $11billion from 2000 to 2005 to increase the cotton production by 57% over five years.

Further, Vision 2010, aimed to achieve export value of $50 billion for textiles growth in the economy. These steps have enabled it to promote investment and growth in this sector (Jing 2010). So if Superdry is to expand in India, it will benefit from favorable government policies and regulations.

On the other hand, Chinese textile industry also receives political and government support, but has experienced a persistent decline after the financial year 2008. The government passed the Revitalization Plans for the Textile Industry in 2009 which aimed at supporting the recovery of the textile industry from a downfall which imitated in 2008. Export rebates have also been increased and adjusted several times to stimulate the industry (Jing 2010).

Economic

The textile industry in India is operating below its capacity at 3% thus has room for further growth. There are fewer barriers to entry as the industry does not benefit from external economies of scale as does the Chinese apparel and textile industry. The increasing population and purchasing power in India is also a positive indicator of Superdry expansion.

The Indian government in injecting significant amounts of money and providing support programmes for the industry growth. The tax rates are lower and so are the wages. The availability of cheap labor is the most significant advantage Superdry will benefit from in India and the abundance of cotton resources makes it a feasible location (Jing 2010).

Social

The Indian society is rapidly adapting the western culture; the spread of western style clothing including jeans and t-shirts is common. English enjoys the importance as of the official language. The Indian lifestyle has evolved itself, creating more opportunities for international brand expansion.

The population constitutes mostly of youth and Superdry is mostly targeted to that demographics. Youth is more prone to adaptation of western lifestyles and luxury consumption. Also, research shows that luxury consumption has increased in India since 2001; the extended family structure in India provides individuals with greater purchasing power as compared to china where members of the households usually earn for themselves and immediate family only.

The Indian consumers are at the “show-off” stage of consuming international brands thus acquiring apparel from international brand is a status boost for average Indian consumer. Although Superdry, unlike other competitors like French Connection does not have a catchy logo, instead its logo is the unique prprostion as it is flexible in terms of writing, yet Indian society still likes to acquire international brands a sign of prestige (Teck-Yong 2010).

Environmental

Both India and China are amongst the emerging economies highly dependent on high- carbon fossil fuels and thus carbon emission in these two countries is considerably high. These “energy giants” require substantial energy to fuel a growing populations as well as a rapidly developing economy.

The Chinese electricity consumption is expected to grow further and Beijing is heavily dependent on coal energy resources. It will incur very high fixed costs to expand Superdry in China as it would require a major structural change in order to introduce an environmentally friendly production method of production while on the other hand, India has a vacuum and less production levels, it does not enjoy economies of scale yet. Thus these changes can be introduced with less costs incurred (Frauke 2009).

SWOT Analysis of Chinese and Indian Textile Industry

Based on the external environmental audit, the following opportunities and threats have been identified while the company analysis has enabled to identify the following strengths and weaknesses, useful in decision making for international expansion.

SWOT Analysis of Chinese Textile Industry

Strengths

- Government has extended its fullest support to the industry by lower taxes, providing credit and easy access to foreign markets.

- Country has ample human and labour resources.

- Coordination between industry and financial institutions has allowed the industry to see great potential over the years.

- Worldwide acceptance of textile products produced by China.

Threats

- Restrictions under certain clauses of WTO still can be a threat to the Chinese textile products.

- Competition from developing countries such as Cambodia, India, Vietnam etc. could have adverse affect on the demand for Chinese products.

Weaknesses

- There is a lack of strict intellectual property rights.

- Small and medium enterprises face difficulties to make entry into highly competitive market.

- The industry is still considered to be fragmented and much more effort is required.

- Technology being used in the industry requires revamping and high levels of investment may be required which could be difficult to achieve as the global economic conditions are uncertain.

Opportunities

- Textile liberation and expected abolition of export quotas can help the Chinese Textile industry.

- Foreign investment and cooperation will continue to play an important role in the Chinese textile industry as more and more brands and companies are shifting their production houses to China.

- financial institutions has allowed the industry to see great potential over the years.

- Worldwide acceptance of textile products produced by China.

SWOT Analysis of Indian Textile Industry

Strengths

- Strong cotton base

- Cheap Labor

- Strong entrepreneurial class

- Flexibility in production and design

- Presence of intermediaries to serve as third party logistics

- Ability to handle value additions, embellishments etc.

- Good “cultural” comfort with US and Europe.

- Growing market for fashionable Western apparel

- Increased population

- Growing use of information technology

Threats

- Trade blocs and partnerships at the exclusion of India

- Location disadvantage: long transit time to key markets.

- Projected to have increased carbon emission by 2020, decreasing its popularity as a key investment opportunity

- Enhances competition from other countries similarly constrained by quotas

- Pricing pressure, following opening up of quotas.

Weaknesses

- Poor work practices resulting in higher labor cost component in many staple garments, in spite of low labor costs.

- Rigid government labor policy and lack rationalization of duties in MMF.

- High transaction and power cost.

- Too much emphasis on cotton, synthetic fiber base not equally developed.

- Fabric/processing still to gear up to meet international standards.

- Technological obsolescence and lower efficiencies.

- Lack of strong linkages between raw material supplier and the apparel manufacturer.

- Highly fragmented markets, unit production capacities very low in international standards.

Opportunities

- Quotas carried on in China after 2005.

- Good political equation with EU and US.

- Improvements in infrastructure and regulations.

- Research and product development.

- Buyers preferences for India, after China.

- Understanding buyer needs because of language advantage.

India has significantly lower raw material costs, wastage costs and labor costs when compared to other countries as estimated India’s labor costs to be amongst the lowest as $3 a day whereas in China its $18 a day (International Labor Organization 1996-2011).

India can offer flexibility in manufacturing as it is largely a fragmented market with average scale of operations smaller than that of China, meaning India has greater capacity to offer variations and postponement in design at the later stages of production. This facilitates mass customization as well helps to bridge the gap between mass customization and repetitive methods of production.

India has fully developed textile value chain extending from fiber to fabric to garment exports. The capability across the entire value chain within the country is an advantage as it reduces the lead-time for production and cuts down the intermediate shipping time, which means a shorter through put and hence loyal clientele (Balasubramanyam 2005).

India has large growing domestic market, as the disposable income level is increasing as well as consumer awareness and propensity to spend. General consumer mindset is changing that led to increased consumption of personal care and lifestyle products that again offer great growth opportunities for companies across various sectors including textiles. Further, the increasing preference for Western style apparel, including silhetous and leather jackets etc will make the market very receptive to the new brand (Teck-Yong 2010).

India has built adequate infrastructure throughout the various stages in textile development, that is, design, sourcing, merchandising and production that enable companies for quality product design and development (Emme 2006).

Despite a large and growing market, the presence of large number of small-scale players makes the Indian textile industry highly competitive. The high level of competition in the textile industry makes the firm to work efficiently by increasing productivity and innovation which results in manufacturers focusing on quality improvements, cost reduction and high productivity.

Quality can be ensured at all levels of production through a trained and motivated workforce. While at the same time, external pressures of environmental controls is likely to result in its conformance with the environmental regulations, which will also precisely mean a reduced popularity of Indian market as an investment opportunity (Balasubramanyam 2005).

Porter’s Diamond Analysis for Chinese Textile Market

China supports lucrative affairs. China has advanced international relations, expanding economy and effective government reforms, and these all factors support the textile companies to expand their businesses in China. The Chinese Textile Industry promotes structure adjustments and actively upgrade international and domestic markets and resources to provide a rapid and constant growth. The textile industry of China has always been one of the conventional pillar industries of the country.

According to Chinese Council of International Trade, “The outputs of Chinese cotton yarn, cotton cloth, woolen cloth, silk, chemical fiber and clothing have topped the world, and the export of clothing has been holding the first ranking in the world for many years”(CCPIT 2007).

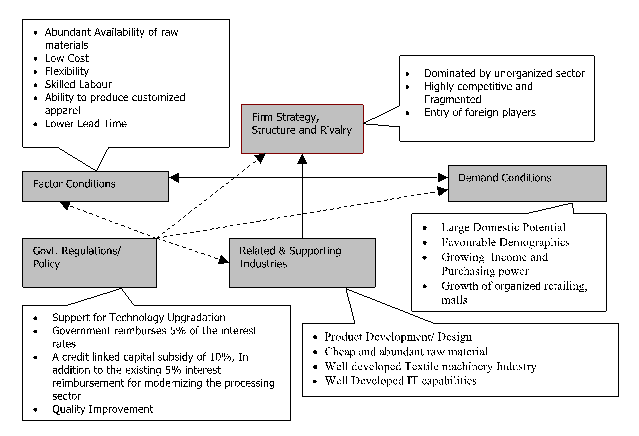

Porter’s Diamond Analysis for Indian Textile Industry

Indian textile industry Textile industry is a strong base for Superdry expansion as it has abundant cotton resources, cheap labor; wage rates are considerably lower than in the rest of the world and most importantly, the communicating is easy as most of the population is familiar and fluent with the use of English (Teck-Yong 2010).

The industry is strengthened by government policies that allow greater opportunities in domestic and international market. Abundant raw material availability helps industry to control costs and reduce the lead-time across the operation. Low cost and skilled manpower availability provides competitive advantage to industry. Large varieties of cotton fiber are available in large quantities and have a fast growing synthetic fiber industry.

Government subsidies and export promotions in the industry create high growth potential and would provide Superdry incentives to enter and grow in India market. Hence there are fewer barriers to entry, as government promotes investments in this sector through extended credit terms and a subsidy of 10% with reimbursements of 5% as shown in the figure above (Emme 2006).

India is also amongst the greatest users of information technology and benefits from an efficient flow of information throughout its production processes, making its supply chains integrated and coordinated. India’s strong performance and growth in the textiles sector is aided by several key advantages that the country enjoys, in terms of easy availability of labor and material, afloat and large market demand, presence of supporting industries and supporting policy initiatives from the government.

The textile industry is undergoing a major reorientation towards non-clothing applications of textiles such “as technical textiles like thermal protection and blood-absorbing materials, seatbelts, adhesive tape and multiple other specialized products and applications” (Kasturi 2010).

Key Strategic Organizational Issues

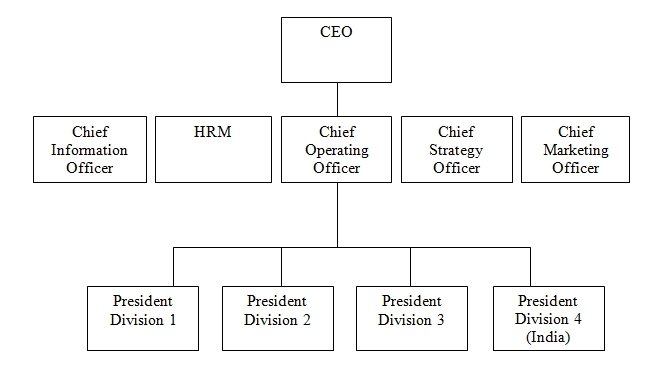

The form of business for Superdry would be a private limited company and the company will have a divisional structure of hierarchy. This division will be by geographic reach.

As shown in the organizational chart above, Superdry has many divisions and thus follows a multidivisional structure. Thus the span of control can be altered but the flow of information will be hindered because of a vast structure and hierarchy.

Apart from this, operations concerns may also exist in the Indian division as just in time production methods may be difficult to employ. Firm must decide if it wants its supply chain to be responsive or efficient and will have to employ infrastructure to facilitate the strategic goals. Political risks and location of major markets will also be a concern for the firm (Kasturi 2010).

Human resource issues include assessing the staffing needs and costs for adopting alternative strategies, motivating employees and developing a strategy supportive culture which would induce employees to support Superdry’s strategic goals.

Research and development issues include hiring the trained and qualified employees to shorten the product life cycles by technological improvements in the products. It is a challenge to implement a well formulated R&D plan. However, as the information technology is taking an up surge in India, this process is likely to be less difficult (Kasturi 2010).

Information collection and retrieval is of immense importance for the firms and can be a determining factor for firms to gain competitive advantage. Efficient flow of information not only develops a coordinated and integrated distribution networks and supply chains but also considerably reduces inventory costs and enhanced quality (Paul 2001).

Recommendations

- Superdry must implement strategies from an environmental perspective as India is amongst the top countries emitting the highest carbon foot prints. Hence it could conduct regular environmental audits, offer bonuses for favorable environmental results, and provide environmental training to the employees and managers.

- It should invest in cross training for its employees in order to gain a competitive edge over its rivals in the form of better operations management.

- An Employee Stock Ownership Plan (ESOP) should be introduced in the Indian division, to motivate the employees in developing a strategy supportive culture. The employees will be more inclined towards maintaining the quality standards and performance benchmarks of Superdry Group Plc.

- The R&D should be centralized in the head quarter in order to align the business activities more closely to the organizational objectives and in order to mitigate the conflict that may arise between different departments or divisions.

- Information systems should encourage direct communication between all production agents. PDA’s, retrieval systems, material requirement planning should all be used to gain efficiency in inventory management, cross docking and management.

- The organization should be relatively flat, allowing for a two way communication between the employees and the top management. This will facilitate a better understanding of the workforce culture in a new country that will further.

Reflection

The research has allowed the researcher to explore different aspects of evaluating a business decision to expand in the international market. Selecting a target country requires a detailed and comprehensive investigation of the conditions prevailing in that market and what factors could determine the faith of the future of the project that is being considered for expansion. Different models and strategies have been developed and their detailed discussions are available in different books, articles and published reports.

These models include PESTEL, SWOT, and Porter Diamond Model which have been used in this report. These models provide an opportunity to explore the target market by carrying out micro and macro level analysis. By considering external factors prevailing in the industry and evaluating company’s own capabilities and challenges to deal with these factors, these models thus provide a good way of understanding the market mechanism.

The information to be collected for completion of these models and their analysis can come from different sources including primary and secondary sources. Primary sources are more appropriate where the company aims to acquire first hand information which is not available through any other already existing source.

However, this requires careful planning and investment to ensure that the purpose of primary research is achieved in the best possible manner over a period of time. Most of the academic business reports including the one presented above make use of secondary sources which could include books, journals, articles, reports, websites, and published research papers etc.

Various secondary sources have been explored for acquiring information for completion of different parts of this report. Overall, the report writing project has been a challenging one which did require a significant amount of reading and then summarizing the findings in the most appropriate to form a case for India being more suitable for the expansion, as it has abundant cotton resources, cheap labor; wage rates are considerably lower than in the rest of the world.

An expansion of Superdry in India more profitable as apparel industry requires a greater level of customization in terms of color, size and fit as the nature of the business is variable and diversified. Further, India’s cheap currency will make it a profitable place for Super Dry to expand its operations as its exports will become cheaper and the cost of production will also be cheaper as compared to the Chinese Yuan.

So Super Dry can have exposure to a more diversified set of capabilities and skills in terms of diligent workforce and an aggressive increase in the thrust for investments.

List of References

Balasubramanyam, N.V., 2005. Textiles and Clothing Exports from India and China: A Comparative Analysis. Journal of Chinese Economic and Business Studies. 3(1), pp. 23-37.

Emme, Kozloff P., 2006. India’s Textile Industry; Asia’s Second Sleeping Giant. Bernstien Research.

Frauke, Urban., 2009. Climate- Change Mitigation Revisited: Carbon Energy Transmissions for China and India. Development Policy Review. 693-715.

Gu, Qingliang, 1999. The Development of China Apparel Industry. Harvard Centre of Textile and Apparel Research.

International Labour Organization., 2011. Statistics and Databases. Web.

Jing, Ma., 2010. On Trade Barriers to China’s Textile Industry.International Journal of Business and Management.

Kasturi, Das., 2010. Prospects and Challenges of Geographical Indications in India. The Journal of World Intellectual Property. 13, pp. 148-201.

Paul, Joyce., 2001. Strategic Management. Great Britain: Bookcraft (CPI Group).

Superdry Group Plc., Super Group Plc. 2011. Web.

Teck-Yong, Eng., 2010. Psychological and Cultural Insights into Consumption of luxury Western Brands in India. Journal of Customer Behaviour, 9 (1), pp. 55-75.

The Telegraph., August 27, 2011. How Superdry became 2010’s £1bn fashion success story. Web.