International exchange rates are the ones used to exchange a country’s currency with another country’s currency in a particular period of time. Exchange rates influence various monetary systems in different parts of the world. Exchange rates change depending on factors related to demand and supply (Gaspar, 2011, p. 67).

For instance, an increase in the demand of goods produced in Japan causes the Yen to appreciate while a decrease in the demand of Japanese goods will make the Yen depreciate. Low rates of inflation in an economy increase the value of the local currency while high rates of inflation in an economy decrease the value of the local currency. High interest rates in an economy increase the value of the local currency due to an increase in the amount of money deposited in banks (Melicher and Norton, 2012, p. 79).

Changing exchange rates has a big impact on the amount of revenues a company obtains in a particular market. For instance, a business manager whose firm sells crude oil in the US needs to know the exchange rate of the dollar because a weak dollar will make him obtain crude oil imports at a higher price. Therefore, he/she needs to plan how his firm will withstand risks associated with changing currency rates (Brigham and Davies, 2012, p. 53).

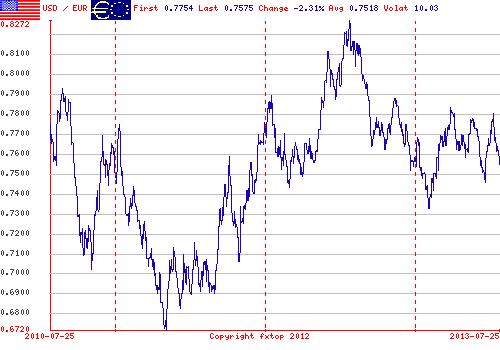

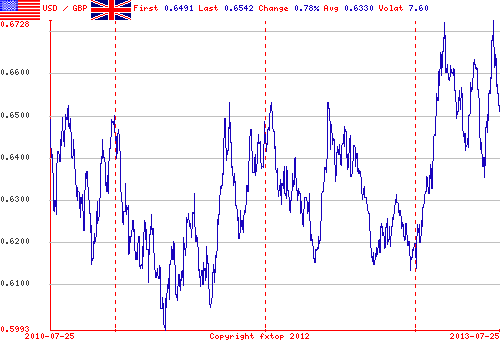

Germany, just like several European Union member countries, stopped using the Mark in favor of the euro, more than 10 years ago. The current exchange rate of the US dollar equivalent to the euro is pegged at 1 dollar to 0.76 euro. The current exchange rate of the dollar equivalent to the British pound is pegged at 1 dollar to 0.6553 pound. It is better to produce goods in the United States and ship them to Britain or Germany because most international transactions are pegged on the dollar.

Graph showing exchange rate between the dollar and the euro for the last 3 years.

Graph showing exchange rates of the dollar equivalent to the sterling pound for the last 3 years.

The Chinese Yuan is not allowed to float freely in international markets and its use is highly restricted by the Chinese financial authorities. Many Chinese companies which operate internationally prefer to use the dollar instead of the Yuan in their transactions (Scott, 2012). Any firm that invests in the country is in a better position to diversify its foreign currency reserves. This will protect it from risks associated with instabilities in foreign exchange markets.

References

Brigham, E. F., & Davies, P. R. (2012). Intermediate financial management. Mason, OH: Cengage Learning.

Gaspar, J. (2011). Introduction to global business: Understanding the international environment. Mason, OH: Cengage Learning.

Melicher, R. W., & Norton, E. A. (2012). Introduction to finance: Markets, investments, and financial management. New York, NY: Wiley.

Scott, R. E (2012). The China toll. Economic Policy Institute Publication. Web.