Literature on the reasons for cross listing, its benefits of and the costs implications

Cross listing of shares is a business expansion and resource mobilization strategy that helps institutions to expand their capital base. The strategy is considered appropriate for companies that seek to advance their network or gain competiveness. Poitras (2012, p, 199) defined cross-listing of shares as the process of listing equity holdings in different stock markets by firms with an aim of raising more capital for growth. It occurs when a firm sells its shares or equity holdings in diverse domestic and international money markets. That is when a firm lists its equity shares in more than one internal or international security market. Poitras further stated that cross-listing takes place through a structured process in most markets globally. It is guided under well set policies and trading guidelines that are economically relevant. The policies and guidelines ensure that potential investors are able to achieve higher returns as they expect. This has enabled corporations that started their operations as small in-house ventures in medium sized markets to advance into larger markets.

Based on various empirical studies, cross listing has enabled listed companies to record higher performance levels. They have also been able to have higher growth opportunities and strengthen their capital capacity as compared to unlisted corporations. Similarly, listed companies are able to acquire higher premiums and return on investment that facilitates their growth in terms of capital stability as compared to unlisted corporations (Boyd & Cohen, 2000, p, 44). The studies also indicate that cross-listing is essential especially in the current business environment that requires effective capital mobilization strategies since it impacts positively on an institutions equity value. Cross-listing is being done for diverse reasons that are economically and socially pertinent. Firstly, firms engage in cross-listing of their shares as a strategy to enable them benefit from the lower cost of capital that is realized when a firm becomes accessible to international investors (Holt, 2008, p, 6). This is evident since when shares become accessible to international investors, the cost of sustaining trading at the stock market reduces. It reduces because of high demand that makes the floated shares to be purchased as fast as possible and with the highest bidder. Indeed, the higher the accessibility of shares, the more the demand and the lower the cost of capital.

Secondly, shares are listed in most instances to enable firms obtain higher level of market liquidity (Baker & Riddick, 2013, p, 273). This is evident since cross-listing in more liquid markets enable firms to increase the value of their resources and reduce cost of capital. It ensures that a firm manages its resources well, enables a firm to increase the equity level of its stock and facilitate decline in the cost of capital. Thirdly, firms execute cross listing purposely to disclose some basic information that appertains to their products and operating strengths. The process enables institutions to share key information about their activities and reduce the cost associated with information disclosures (Vachani, 2006, p, 292). In particular, cross-listing enables companies to create awareness on the value of their shares and services among potential investors. This is essential in attracting investors and other stock market operators to consider purchasing their shares.

Cross-listing also improves delivery of information to customers and suppliers about the performance levels of an institution. This has made various companies including Cardinal Health Corporation to improve their market share and return on investments (Sinha, 2008, p, 387). Conversely, most firms do cross-listing to enable them attract media attention, to capture greater analyst coverage and to ensure the provision of high quality accounting information. Similarly, cross-listing is used to protect investor’s interests by providing effective bonding mechanisms. This enables incorporated firms to form strong strategic alliances that are driven under mutual ideals and best business practices (Lin, 2011, p, 42). Other reasons why cross-listing is done by most institutions are based on product and labor market considerations. These reasons include the need to increase visibility with customers to improve market share and in turn lead to high returns and the need to advance foreign acquisitions in terms of asset development and cash mobilizations. The need to broaden product identification also forms a key reason why companies cross list their shares in stock markets.

Benefits of cross-listing

Cross-listing has been an effective performance strategy for most firms in various settings including US. It has enabled key institutions such as Dell and Cardinal Health center to expand their capital base. It has also enabled the firms to utilize their resources optimally by reducing cost of operation and floating of shares in the money market. According to Abed (2008, p, 285), cross-listing of shares has presented immense benefits to corporations locally and internationally. Firstly, it has enabled companies to mobilize operating resources without incurring high costs. It has also enabled companies to increase accessibility of their shares by various local and international investors. This makes the value of their shares to gain strength, thus lead to high returns when traded. Thirdly, cross listing of shares give corporations an excellent opportunity to trade in multiple zones and currencies. This enables them to benefit from economies of scale since multiple transactions open the opportunity for attaining high returns.

Fourthly, it allows companies to form trading partnerships with credible and reliable investors and business entities. This is essential since a business that aspires to have a sustainable growth should have stable and committed trading partners. The partners must be liquid enough to be able to support the institution when there is some evident financial crisis (Walmsley, 1999, p, 56). Notably, companies should form partnerships with stable investors to enable them avert possible financial drain. This explains why global accessibility to a company’s shares is essential. Further, cross-listing ensures that all potential investors receive in-depth information about the listed shares and in turn make applications. This gives share holders the best opportunity to evaluate the potentiality of the investors and then sign business agreement with formidable ones. Similarly, cross-listing gives companies the best opportunity and a credible way of raising capital for expansion. It enables companies to raise capital through a structured process that is based of key economic fundamentals (Hubner & Elmhorst, 2008, p, 129).

In US, most companies have been using the strategy to raise capital to aid their operations and growth. Managers in the companies cite that the strategy forms the best source of finance or capital since it is less costly compared to other sources that are available. They also cite that the strategy has enabled them to build strong and mutual relations with potential investors globally. It has also enhanced the realization of effective understanding between key stakeholders in institutions. As noted by Sinha, (2008, p, 388), cross-listing is instrumental in ensuring effective information disclosure to stakeholders. It facilitates the delivery of basic information that appertains to quality of services, type of products produced, and the value of shares offered including the liquid nature of the company. This helps investors in decision making on whether to purchase shares or not. It also enables other stakeholders such as customers to build loyalty in the company. Variably, cross-listing of shares enables companies to get increased media attention, analyst’s coverage and quality accounting information. This helps in marketing the company and its products in various nations. Its other benefits include broadening of product identification, enhancement of foreign acquisitions and improvement of labor relations (Shapiro, 1999, p, 6).

Key implications/ limitations of cross-listing

Despite the immense benefits that cross-listing presents to corporations, there are evident limitations that compromises its effective application. The limitations that are economically instigated require proper mitigation strategies. Firstly, Cross-listing may be detrimental to institutions since it enables rival corporations to acquire essential information that contribute to a company’s performance, and then design counter strategies to avert their effectiveness (Mittoo, 2003, p, 31). This is a problem since cross-listing fosters disclosure of information pertaining to various elements that contributes to performance in various institutions. The elements include the value of shares, market share, capital structure and quality of services delivered. This enables rival institutions to scheme and develop strategies to counter their competitiveness. It also leads to greater media attention and analyst coverage that exposes a company’s instruments of performance to the public. Similarly, the process of listing shares is capital intensive and requires proper preparation financially and structurally. Its expensive nature has denied most institutions the chance to cross-list shares in various markets. Stringent requirements for cross-listing such as the Sarbanes-Oxley (SOX) requirements that were developed in 2002 have also been affecting the process in most settings. The requirements that were set under Sarbanes-Oxley regulation have made listing in stock markets especially in US very costly and bureaucratic (Holt, 2008, p, 26).

Indeed, companies that seek to receive best returns and gain competitive advantage as fast as possible should consider adopting cross-listing that remains a noble performance strategy. They state that the strategy opens up business operations by providing effective commercial links with potential business operators and customers in various settings (Poitras, 2012, p, 199).

Sources of long-term finance employed by multinational enterprise

This section provides credible information pertaining to key sources of finance that multinational corporations are using to finance their activities. The discussions focus on Cardinal Health Corporation that started its operations in the year 1971. The company that is located in Ohio US focuses its potentials in providing quality health services to locals in diverse settings (Hunt, 2009, p, 3). Notably, the institution has been credited for adopting low cost sources of finance to mobilize capital for financing its key activities. Key sources of finance that it has been using include issuing of shares, debentures, leasing, reinvestment of profits and foreign sources or grants (Hunt, 2009, p, 3). Firstly, the company mobilizes its operating resources through capital market where it offers its shares and debentures for sale.

The company relies on this method of capital mobilization since the markets require low facilitating cost. This has enabled the company to reduce its expenditure and utilize the available resources at its disposal effectively. Secondly, leasing has been another source of resource mobilization that the company has used very effectively. The source of finance has enabled the company to acquire essential machines that are crucial in ensuring its sustainable performance (Droms & Wright, 2010, p, 143). For instance, Cardinal Health Corporation has been able to acquire a modern surgical machine through leasing that helps it in discharging health services to patients. The company has also leased some of the vehicles that it uses in distributing medical and pharmaceutical products to various destinations. Variably, the institution relies on reinvestment of profits and foreign aids from key financial institutions such as World Bank to finance some of its projects (Mayo, 2012, p, 258).

Rationale for the company’s capital structure

Rationally, Cardinal Health Company’s exemplary performance is attributable to its effective financial mobilization strategies. The company has been using low cost sources of finance that are sustainable. This has enabled it to maximize its resources by ensuring their proper utilization. Ideally, the strategies have enabled the health center to benefit from low cost of capital since they make its shares accessible to global investors (Mayo, 2012, p, 258). The strategies have also been enabling the firm to increase the equity of its stock value especially since it invests in more liquid markets. Indeed, sources of finance are important since they define the level of success that a company may record over a period of time. This is evident since costly sources of finance exposes companies to performance failures as compared to less costly sources of finance (Hunt, 2009, p, 5).

The cost of capital of the MNC

Cost of capital is the total expenditure that institutions incur when mobilizing funds to facilitate their operations. Cost implications normally differ depending on the source of finance. For instance, long term sources of finance have more cost obligations than short term sources of finance (Harris, 2003, p, 3). Cost of capital also differs with the amount of resources borrowed. That is when one borrows resources with high value, he is bound to pay more cost in terms of interests, while low profile borrowings attract less costs. This is apparent since cost elements are calculated based on the principle amounts and fair values for cash borrowings and asset transfers respectively. The calculation enables institutions to make proper decisions on the best sources of finance that they can service effectively if they take. It equips them with requisite information that makes them aware of the interest that they are bound to pay (Besley & Brigham, 2008, p, 642). This enables them to prepare and to craft viable payment modalities. The table below gives the value of shares issued in US and Australian money markets and the total cost implications that are attached to the transactions. The prevailing interest rate in the countries stands at 7.04% in US and 6.90 in Australia respectively.

Cross-listed securities (Amounts in “$000”)

From the chart, it is clear that cost of listing shares in US is higher than the cost of listing shares in Australia. This is depicted by the existing difference in the value of their interest rates that stands at 1.04%. It is also depicted by the total cost that has been realized that stands at $34.49 in US and $33.81 in Australia.

Transactions the company undertook using real exchange rates and the impact of exchange rate volatility

Indeed, Cardinal Health Corporation was exposed to severe monetary risk that was evident due to the differences between USD and AUD where its other key subsidiary is located (Chan, 2005, p, 21). This is shown in the transaction schedule below

As indicated, Cardinal Health Corporation has USD as its home currency, while it exchanges a printing machine with an Australian firm which pays in its home currency of AUD. Currently, the interest value of USD stands at 0.7 in US, while Australian dollar stands at 1.1 due to volatility complications. In the first scenario, the seller receives sales invoice upon delivery of the machine. The company in US receives AU$2M that it converts at a spot rate of 0.7:1 that gives a total amount of US$1.4M. In the second scenario, the spot rate that was quoted at the time of agreement was 1.1 with AU$2M as the price that gives a net worth of US$1.78 when converted. This gives a risk difference of US$0.38M.

How money market hedge and forward contract work, how they can be used to hedge a transaction, benefits, costs and limitations

Money market hedge and forward contract are two essential trading methods that hold distinct contractual conditions. The two trading methods are distinct in the nature by which they are executed in most settings (Doidge, 2013, p, 1). In particular, a forward contract is anon standardized contract that enables contracting parties to exchange products in future at a price that is agreed upon presently or bidding value of the day. For instance, if apiece of land that is valued at $10,000 currently is being sold to a buyer under forward contractual terms, then the agreement between the buyer and the seller must be based on the current valuation amount, but the exchange of the resource will be done latter.

Under this system, the buyer will only pay $10,000 as agreed for the land even if the bid and ask prices increases or decreases. The concept has been widely used especially in markets that face various operating risks (Doidge, 2013, p, 1). It is also appropriate in enhancing service delivery in institutions that faces severe economic complications. Variably, money market hedge remains one of the many forms of trading that are used to facilitate bidding for and selling of assets. This form of trade is based on spot contract terms where exchange agreements of assets and other valuables are done the same day (Madura, 2011, p, 362). The price agreed upon at the time of negotiation remains the delivery price. It is normally paid before environmental controls or economic instruments changes. Notably, money market hedge is a trading method that is progressively used to hedge foreign exchange risk. This enables companies to borrow and deposit funds effectively in the money market industry.

Using a money market hedge and a forward contract to hedge the transaction

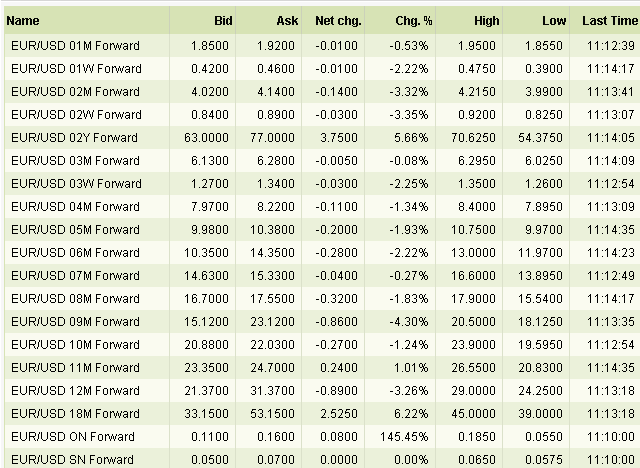

Money market hedging and forward contract exchange systems have been widely used in various nations including US and Australia (Madura, 2011, p, 363). The two methods have been used widely due to their capacity of eliminating market uncertainties and trade volatilities that may impede exchange of assets. They facilitate systematic exchange of resources between contracting parties through effective bidding and asking processes. The transfers are executed at fair value rates agreed upon at the time an agreement is entered by the contracting parties. This is evident since the transfers normally take place at a later date especially in the case of forward contracts (Elliott, 2013, p, 1). The two trading systems enables traders to avoid incurring huge lose especially when the currency value drops as indicated in the chart below.

They ensure this by quoting prices of assets at their present value while payments are made later. Once the agreement is entered, no one can rescind it whether the bidding value goes up or down by significant figures such as +1.2300 or -1.4250, the amount is still to be paid as agreed (Elliott, 2013, p, 1). Similarly, sellers may also lose out from getting more returns especially when exchange rates increases. For instance, when the market price agreed upon of a product increases from $10,000 to 15,000 due to changes in forward rates, the buying price will still remain at $10,000. The increase that is caused by economic changes cannot rescind the instrument of the agreement made. In US, empirical studies show that most individuals and firms are increasingly using money market hedging and forward exchange techniques to execute various exchange transactions as shown below.

List of References

Abed, A 2008, Do Regulations Matter? The Effects of Cross-Listing on Analysts’ Coverage and Forecast Errors. Review of Accounting & Finance, Vol. 7, no. 3, pp. 285-307.

Baker, K. & Riddick, A 2013, International Finance: A Survey. Oxford University Press, Oxford.

Besley, S & Brigham, F 2008, Principles of finance. South-Western, Mason, Ohio.

Boyd, G. & Cohen, S 2000, Corporate Governance And Globalization: Long Range Planning Issues. Edward Elgar, Cheltenham.

Chan, A. 2005, Hedging Foreign Exchange Risk in Chile: Markets and Instruments. IMF Press, Washington, DC.

Droms, G. & Wright, O 2010, Finance and Accounting for Nonfinancial Managers All the Basics You Need to Know. Perseus Books Group, New York.

Doidge,.A 2013, Historical Exchange Rates. Web.

Elliott, N. 2013, Forward Rates, Web.

Harris, L 2003, Trading and Exchanges: Market Microstructure for Practitioners. Oxford University Press, Oxford.

Holt, F 2008, The Sarbanes-Oxley Act costs, Benefits and Business Impact. CIMA Press, Amsterdam.

Hunt, P 2009, Structuring Mergers & Acquisitions: A Guide to Creating Shareholder Value. Wolters Kluwer, Austin.

Hubner, U & Elmhorst, A 2008, eBusiness in Healthcare: from eprocurement To Supply Chain Management. Springer, New York.

Lin, J 2011, The Effect of U.S. GAAP Compliance on Non-U.S. Firms’ Cross-Listing Decisions and Listing Choices. International Journal of Economics and Finance, Vol. 3, no. 6, pp. 42-56.

Mayo, B 2012, Basic Finance: an Introduction to Financial Institutions, Investments, and Management. South-Western, Mason, OH.

Madura, J 2011, International Financial Management. Cengage Learning, Florence.

Mittoo, R 2003, The value of U.S. listing. Canadian Investment Review, Vol. 16, no. 3, pp. 31-520.

Poitras, G 2012, Handbook of Research on Stock Market Globalization. Elgar Press, Cheltenham.

Shapiro, C 1999, Foundations of Multinational Financial Management. Wiley, New York.

Sinha, K 2008, Management Control Systems: A Managerial Emphasis. Excel Books, New Delhi.

Vachani, S 2006, Transformations in Global Governance Implications for Multinationals and Other Stakeholders. Edward Elgar Pub, Cheltenham.

Walmsley, J1999, The Foreign Exchange and Money Markets Guide. Wiley, New York.