Introduction

Background

Monks (2002, p.117) claims that Enterprise-Wide Risk Management (EWRM) is a system of protocols, standards, and recommendations that are structured towards enterprise capacity to consistently identify, evaluate, assess and implement measures meant to reduce risk opportunities and threats. In addition, Busco et al (2005) suggest that EWRM has a structural relationship with Governance, Risk identification, and Compliance (GRC) and has been embedded as a concept in ISO 31000:2009. The architecture for risk management is varied amongst different enterprises. This depends on risk exposures. Lam’s (2003) conclusion suggests that financial agencies’ risk architecture depends on agency investment in information technology and the relevance of agency enterprise business processes towards risk management. Information technology impacts on financial agency capacity to implement internal controls.

However, Fraser and Simkins (2010, p.18) claim that the capability of the financial agency to effectively adopt and implement EWRM depends on approaches to risk management, threats to risk management, political structure, competencies of its human capital, and level of agency multi-faced strategies to risk management. Financial agencies ought to document and measure financial risks as a function of interests rate risks, risks in the market, and capacity to manage credit risks. This is based on the capacity for the financial agency to manage risks especially liquidity risks, management risks, possibilities of insurance risks, operating capital adequacy capability, diversification risks, and alignment of EWRM to manage agency systemic risks.

Thesis statement

Financial agencies based on Warner (2008) fail to achieve competitive advantage from EWRM due to inadequacy of enterprise fitness to manage financial risks, technical risks, operational risks and control hazardous risks. This is dependent on capacity of agencies to redesign business processes that are structured towards bringing about organizational fit towards EWRM. As a result, financial agencies fail to comply with enterprise-Wide Designs and structures that could demonstrate capability of the agency to achieve data integration that could support EWRM. Berenbeim (2004, p.28) however indicates that inadequacy of financial agencies to manage entrepreneurial risks is fueled by insufficiency of competent human capital that could contribute into financial agency EWRM. Archer (2002, p.17) claims human capital deficiencies arises from insufficiency of human capital training and development towards sustainable EWRM.

The problem of human capital has resulted into inability of financial business analysts to demonstrate required technological and operational competencies that could support EWRM. As a result, many financial agencies have failed to develop internal and external expertise that could drive management of agency risks and risk exposures. This however has been brought about by failure of financial agencies to recruit or retain employees that could develop sustainable systems for financial agency EWRM (Deloach, 2000).

Sobel and Reding (2004, p.28) argues that deficiencies in financial agency risk management is driven by financial management corporate structure with regard to integration of risk management, governance and compliance with associated regulations. The management structure fails to contribute into capacity for risk management embedment to governance, and compliance due to absence of senior level management support towards risk management or incapacity of management to demonstrate support for risk control which is predisposed by secondary factors like inadequate communication channels that cannot support risk management. Constraints in vertical and horizontal integration have been identified to affect capacity for enterprise to invest in enterprise software system designs. As a result, financial agencies fail to comply with standard specifications in terms of data support that is required for sustainable EWRM. This implies, low level of integration in terms of human capital competence influences on financial agency capacity to achieve economic benefits associated with EWRM.

The financial agencies (Busco et al, 2005, p.41) should incorporate user training and development which is vital towards end-user sufficiency to provide necessary capital support towards EWRM. This has affected capacity for stakeholders to invest in financial agencies and decreased book value of the agencies. Stakeholders however indicate that failure to adhere to demands for investment in the financial sector has been fueled by increased failure of financial agencies to report on their financial status which impacts negatively on their credit risk rating. Other authors cite technology planning and technological integration as contributing factors to shrinking market share of the financial agencies. As a result, investors have continued to demonstrate decreased confidence and trust on the sustainability of the financial agencies subject to interest rate volatilities, decreasing consumption structure and incapacity of the agencies to demonstrate sustainable technological management of constraints that predispose risks.

Aims and objectives

- To determine technological, systematic and operational risks that affect performance of financial agencies hence or otherwise determine mechanism through which financial agencies have been structured towards achievement of best practices in management of operational, systematic and technological risks exposures

- To determine role of organizational fit towards financial agency achievement of human capital competencies, alignment of management structure and control towards support for risk management and mechanism software designs have been tailored towards maximization of economic benefit of EWRM.

- To determine the role of social commitment, human capital training and development and technological planning towards stakeholder confidence in a financial agency economic growth hence or otherwise determine influence of risk project management towards sustainability of risk control and mitigation of a financial agency.

Expected outcomes of the study

The study outcomes will contribute into determination of best practices that a financial agency ought to undertake towards EWRM. The findings of the study will play a leading role in determination of mechanism through which risks are exploited towards development of risk system requirements and capacity for a financial agency security requirements as well as mechanism financial agencies develop security concept of risk operations and strategic application of risks towards economic growth The findings of the study will identify rationale through which financial agencies have achieved sustainability of agency information technology systems towards compliance with regulations and capacity for data protection and encryption that support EWRM and ISO 31000: 2009. The findings of the study will help to identify financial agencies continuously upgrade the risk management information technology systems and rationale for financial agency variation of risk management processes, policies and procedures.

The study will identify financial agency capability to manage change through identification of transformational risk operation procedures and processes and variability of the financial markets due to influence of globalization. The study will identify mechanism through which financial agencies dispose information and protocols and standards on information disposal for instance software, data and hardware. The findings will identify standards that inform information technology system change and level of risk security measures that are implemented and underlying systematic risks that may be encountered.

Conceptual framework of study

The study will build on financial theory and theory of financial economics. Based on financial theory, a financial agency ought to undertake business processes that create value to stakeholders through demonstration of capability to achieve EWRM. The theory of financial economics affirms that stakeholders demonstrate confidence towards investments that could be perceived to have positive economic value added which implies financial agency management should not demonstrate capacity to hedge risks that investors can hedge at opportunity cost. Integration of financial theory into opportunity cost results into a scenario where a financial agency cannot invest or create stakeholder value through hedging risks if the price of internal capacity of bearing the risk is equivalent to price of external bearing of the risk. Although financial markets are imperfect, EWRM has been documented to contribute into capability to create economic value to the agency through management of instruments that demonstrate capability to manage enterprise-wide risk exposures.

Literature review

Lam (2003, p.68) argues EWRM is instrumental towards sustainability of stakeholder confidence and trust. The capacity of an enterprise to manage financial risks and risk exposures depends on threats of risks that the financial enterprise encounters. Financial agencies ought to conduct risk analysis, risk evaluation and assessment in order to demonstrate capacity for financial risk determination. This provides foundation for a financial agency to adopt strategies that could maximize likelihood of exploiting values of the risks towards EWRM. Through risk assessment, a financial agency is positioned to identify direct and indirect impacts of a risk and its threat to the organizational reputation and image. This positions an enterprise to identify and determine adequacy of its financial risk planning, contingency planning and capacity of current risk controls to manage emerging risk concerns in the financial market with regard to insufficient financial reporting and internal control.

Competencies in financial risk management have been document to depend on capacity of financial agency to document risks and identify its market risk profile which influences on level of the agency financial planning. Warner (2008) claims that risk prioritization provides basis for ranking risks based on their threats to affect enterprise business continuity. The capabilities to evaluate and rank risks depends on risks controls that the organization implements and the feasibility of the risk mitigation processes towards risk management.

Effectiveness of risk management is dependent on executive support and capacity to participate or report on risk management strategies and approaches. Thus, documentation of risk profile of a financial agency provides direction into risk management which influences on rationale for risk implementation. The mechanism through which an agency implements risks is dependent on cost benefit analysis. The agency ought to identify associated risk costs that impact on risk management which paves way to identification of appropriate strategies for risk management. Risk management is influenced by capacity to assign risk responsibilities to different employees that provides foundation for enterprise capacity to develop and implement risk safeguards for risk implementation process. This involves determination of risk levels that the organization might be exposed to. This has effect of guiding in risk mitigation actions and adoption of appropriate risk controls that not only protect the agency but also build stakeholder confidence.

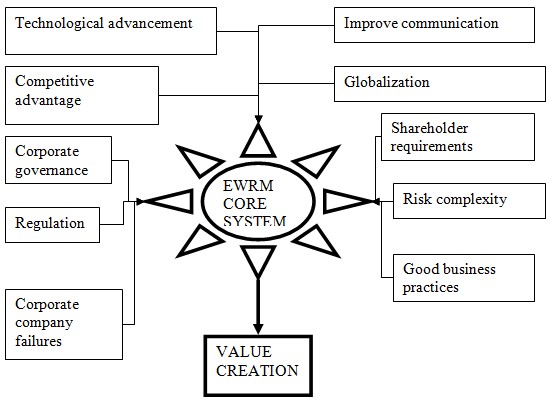

ISO (2009) argues that financial agency risk management planning is essential towards development of a risk mitigation plans as well as contingency plan. Risk planning integrates elements risk management approach; risk planning and risk execution and persons that are responsible. The persons are responsible for risk assessment and identification that includes determination of risk characteristics and threat they pose to the financial position of the agency. Identification of risk characteristics is dependent on capacity for qualitative risk analysis and capability to quantify risk threats that make it possible to rank order risks based on threats. Quantification of risks involves risk categorization through representation of risks in terms of a numerical value. Assigning risks a numerical value provides capacity for an agency to determine tactical and strategic processes that should involve form basis for risk intervention and mitigation (Bowling & Rieger, 2005). Risk management strategies (Berenbeim (2004) influences on risk monitoring and controls that an agency can implement towards achieving sustainable risk management. this involves capacity to track risks, monitor residual impacts of the risks that provides basis for identification of new risks that may be predisposed by secondary factors (figure 1).

Proposed Methodology of study

The study will be carried out through use of probability sampling technique that will involve use of attribute approach, deductive approach, factor analysis approach and Selective Content Analysis (Garvin, 1991). The probability sampling approach will be used in order to make it possible to generalize the study outcomes on best practices for financial agency risk management. Quantitative approach would make it possible to quantify study attributes hence make it possible to quantify attributes that have capability to contribute into sustainability of best practices in EWRM (Strauss & Glaser, 1967).

Probability sampling will be used in order to quantitatively measure mechanism financial agencies implement EWRM. Attribute approach will be used in the study in order to help in identifying elements that form structure for EWRM, identify threat that affects EWRM and propose strategies towards EWRM. This will ensure the study findings will present quantifiable parameters that could be used to develop strategies for EWRM and identify new dimensions for EWRM based on emerging standards and regulations. Factor analysis approach will be used to identify elements that affect EWRM as an element of enterprise internal control. This will result into identification of factors that should form foundation for best practices in EWRM (Gibbons et al, 2007). Selective Content Analysis will be used to conduct analysis of data on financial agency EWRM. Quantitative research method will be used in order to make it possible to use random sampling during recruiting of the study respondents. Random sampling will ensure a greater population sample is represented in the study.

Proposed research instruments

The study will be designed to use structured closed questionnaires. Closed questionnaires will be used in order to make it easier to compute study findings quantitatively (Hamel et al, 1993). This will also make it possible to carry out data processing and quantitatively carry out study outcomes rank ordering. As a result of data rank ordering, it will be possible to carry out inter-coder reliability (Gibbons et al, 2007). The questionnaires will be presented to study respondents on the day of interview. Questionnaires will be used as favorite study instruments because they are easier to analyze and are compatible with any statistical software. Questionnaires will be used because they are cost effective compared to face-to-face interviews. This will result into use of limited time in collecting data (Yin, 1993). Questionnaires will be used because they make it possible to reduce interviewer bias that might result into homogeneous data findings. Failure to use interview will be meant to reduce possibility of interviewer influencing responses of the study respondents.

The proposed study measurements scale

The study will use a Five point Likert scale. The nominal values of the Likert scale will range from strongly disagree (one) to strongly agree (five). The nominal scale will be used in order to form basis for carrying out geometric data analysis. This will make it possible to determine geometric mode and geometric mean that are important elements in determining moment of correlation, Karl Pearson Moment of Skewness and Kurtosis (Gibbons et al, 2007).

Proposed study sample

The study will be designed to use a random sample of 200 respondents. The size of population sample was calculated to conform to study required level of reliability and validity (Stake, 1995).

Proposed Method of Data Collection

The data would be collected by use of questionnaires and interviews. The questionnaires will be provided to study respondents on the day of interview (Brearley, 1993).

Procedure of data collection

The data collection will be a function of Delphi technique (Pyecha, 1988). The Delphi technique will be utilized since it is compatible with attribute approach and factor analysis approach which are essential in determining factors that affect financial agency EWRM (Alvarez et al, 1990).

Proposed Limitations to the Studies

The proposed limitations could result from failure to determine the actual number of respondent that would finally complete the questionnaire independently. In office setting, workmates could complete the questionnaire which would result into different observation after the follow up study. This could affect reliability and validity of the study findings (Campbell, 1975).

Proposed method of data presentation

The study outcomes will be presented by using tables, figures and histograms. The histograms will be used because they provide visual mode thus number of observations that were made in every categorical data and degree of data dispersion. Tabulation will be used in order to help in rank ordering the data sets (Yin, 1993).

Proposed method of data analysis

Geometric data analysis will be used as the main method of data analysis. This will involve geometrically determining the geometric mean of the quantitative data, followed by determination of geometric variance and geometric standard deviation. The frequencies of the classes above and below the modal class will be used in determination of the geometric mode (Feagin et al, 1991). The results will be used to geometrically determine moments of dispersion of the data namely Karl Pearson moment of skewness and Karl Pearson moment of kurtosis which will define the spread of the data about the geometric mean and geometric mode hence provide basis for symmetry of the distribution. The data findings of the geometric analysis will assume P<0.05, confidence interval for all comparative analysis (Gibbons et al, 2007).

Proposed ethical study perspective

The study will conform to legal doctrine on research studies that involve use of human subjects through compliance with ethical principles for voluntary participation, anonymity, beneficence, malfeasance and autonomy (Garvin, 1991). The study respondents will be informed on the rationale of the study, procedures of the study and expected outcomes of the study and associated ethical implications for their participation before their signatory for informed consent for participation (Hamel et al, 1993).

References

Alvarez, M., Binkley, E., Bivens, J., Highers, P., Poole, C., & Walker, P (1990) Case-based instruction and learning: An interdisciplinary project. Proceedings of 34th Annual Conference (pp. 2-18), College Reading Association.

Archer, D. 2002. Creating a risk management framework: Seven steps to promoting risk awareness across all level of an organization. CMA, Management, 76, 16-19.

Ballou, B. 2005. A building-block approach for implementing COSO’s enterprise risk management- integrated framework. Management Accounting, 6, 1-10.

Banham, R. 2004. Enterprising views of risk management. Journal of Accountancy, 197(6), 65-67.

Berenbeim, R. 2004. The value based enterprise: A new corporate citizenship paradigm. Paper presented at The Asia Foundation’s Hong Kong Symposium on Corporate Citizenship and the Taipei Corporate Citizenship Forum, held in Hong Kong, 2004.

Bowling, D. M., & Rieger, L. 2005. Success factors for implementing enterprise risk management. Bank Accounting and Finance, 18(3), 21-26.

Brearley, D. (1993). The case study: Threat or opportunity? Counselor Education and Supervision, 33, 35-37.

Busco, C., Frigo, M.L., Giovannoni, E., Riccaboni, A., & Scapens, R. W. 2005. Beyond compliance: Why integrated governance matters today Strategic Finance, 87(2), 35-43.

Campbell, D. (1975). Degrees of freedom and the case study, Comparative Political Studies, 8, 178-185.

Deloach, J.W. 2000. Enterprise-wide risk management: Strategies for linking risk and opportunity. London: Financial Times, Prentice Hall.

Feagin, J., Orum, A., & Sjoberg, G. (Eds.), (1991). A case for case study. Chapel Hill, NC: University of North Carolina Press.

Fraser, John, and Betty Simkins, eds. 2010. Enterprise Risk Management: Today’s Leading Research and Best Practices for Tomorrow’s Executives. Robert W. Klob Series in Finance. Hoboken, New Jersey: John Wiley & Sons, Inc.

Garvin, D. (1991). A delicate balance: Ethical dilemmas and the discussion process. In C. Christensen, et al. (Eds.), Education for judgement: The artistry of discussion leadership (pp. 287-304). Cambridge, MA: Harvard Business School.

Gibbons, M.L., Lomoges, H., et al, (2007) Research methods for business students, Harlow, England, FT: Prentice Hall, Pearson Education.

Hamel, J., Dufour, S., & Fortin, D. (1993). Case study methods. Newbury Park, CA: Sage Publications.

International Organization for Standardization (ISO). 2009. “ISO 13000:2009-Risk Management: Principles and Guidelines.” Geneva.

Lam, J. 2000. Enterprise-wide risk management and the role of chief risk officer. eRisk.

Lam, J. 2003. Enterprise risk management from incentives to controls. Canada: John Wiley & Sons, Inc.

Liebenberg, A.P., & Hoyt, R.E. 2003. The determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Management and Insurance Review, 6, 37-52.

Monks, R.A.G. 2002. Creating value through corporate governance. Corporate Governance, 10(3), 116-123.

Monks, R.A.G. 2002. Creating value through corporate governance, pp.118-119.

Pyecha, J. (1988). A case study of the application of noncategorical special education in two states. Chapel Hill, NC: Research Triangle Institute.

Sobel, P. J., & Reding, K. F. 2004. Aligning corporate governance with enterprise risk management. Management Accounting Quarterly, 5(2), 29-37.

Stake, R. (1995). The art of case research. Thousand Oaks, CA: Sage Publications.

Strauss, A., & Glaser, B. (1967). The discovery of grounded theory: Strategies for qualitative research. Chicago: Aldine.

Warner, Larry. 2008. “Reporting that Drives Business Decisions and Improves Results.” Presentation to Conference Board of Canada’s International Risk Management: Increasing Business Impact Conference. Toronto. 2008.

Yin, R. (1993) Applications of case study research. Beverly Hills, CA: Sage Publishing.