Economic Overview

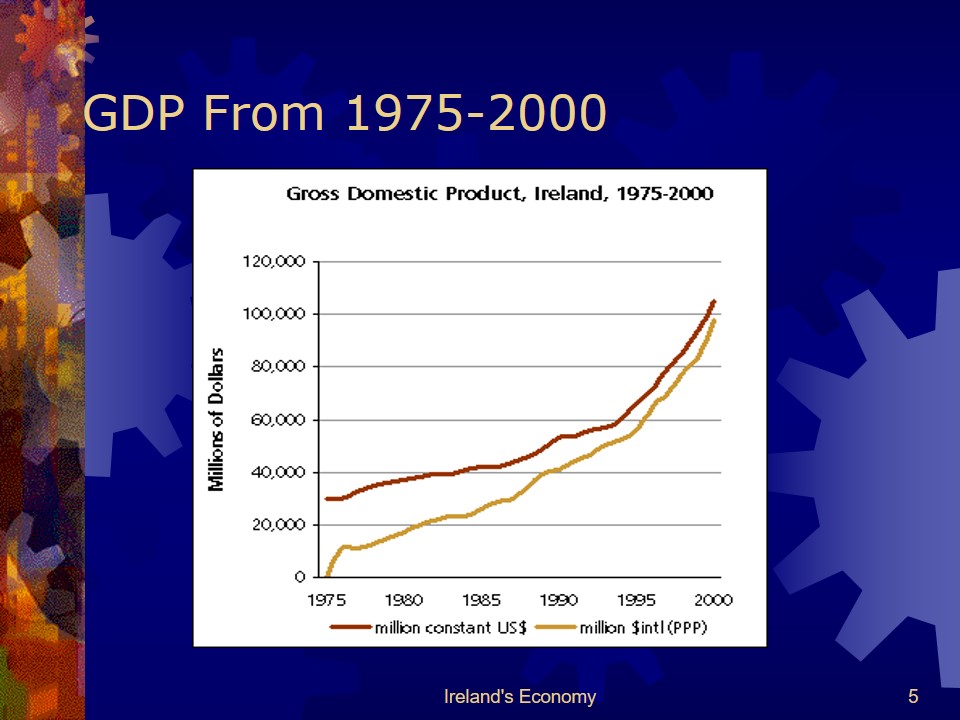

Ireland is a small, moderate and growing economy which is progressing rapidly with an averaging growth rate of 7% as recorded in 97-2005. It was initially an agricultural based economy but with growing trend it has been shifted to industrial sector which contributed a lot in its emergence and revival.

Quick Features of Ireland’s Economy

- Taoiseach (Prime Minister): Brian Cowen (2008);

- Land area: 26,598 sq mi (68,889 sq km); total area: 27,135 sq mi (70,280 sq km);

- Population (2008 est.): 4,156,119 (growth rate: 1.1%); birth rate: 14.3/1000; infant mortality rate: 5.1/1000; life expectancy: 78.0; density per sq km: 60;

- Capital (2003 est.):Dublin, 1,018,500;

- Major cities include: Cork, 193,400; Limerick, 84,900; Galway, 67,200;

- Languages: English and Irish;

- Civilization and Tradition: English and Celtic;

- National Holiday: St. Patrick’s Day , 17th March;

- GDP Growth Rate: $187.5 billion; per capita $45,600;

- Real GDP Growth Rate: 5%;

- Inflation Rate: 4.7%;

- Un-Employment Rate: 4.2%;

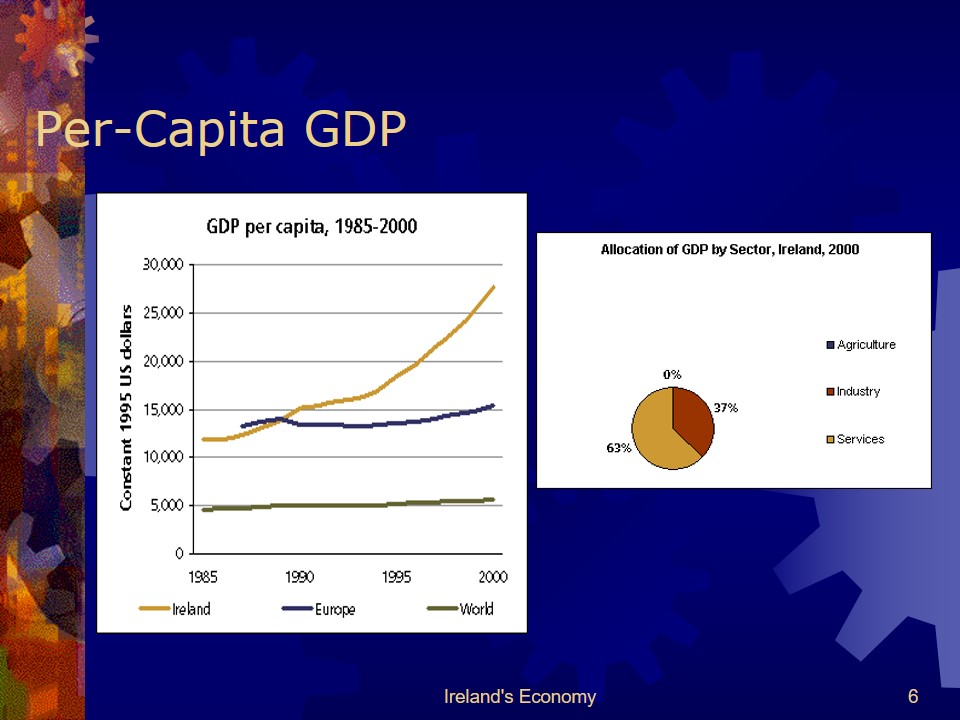

- Per-Capita GDP: $31,900 (2004 est.).

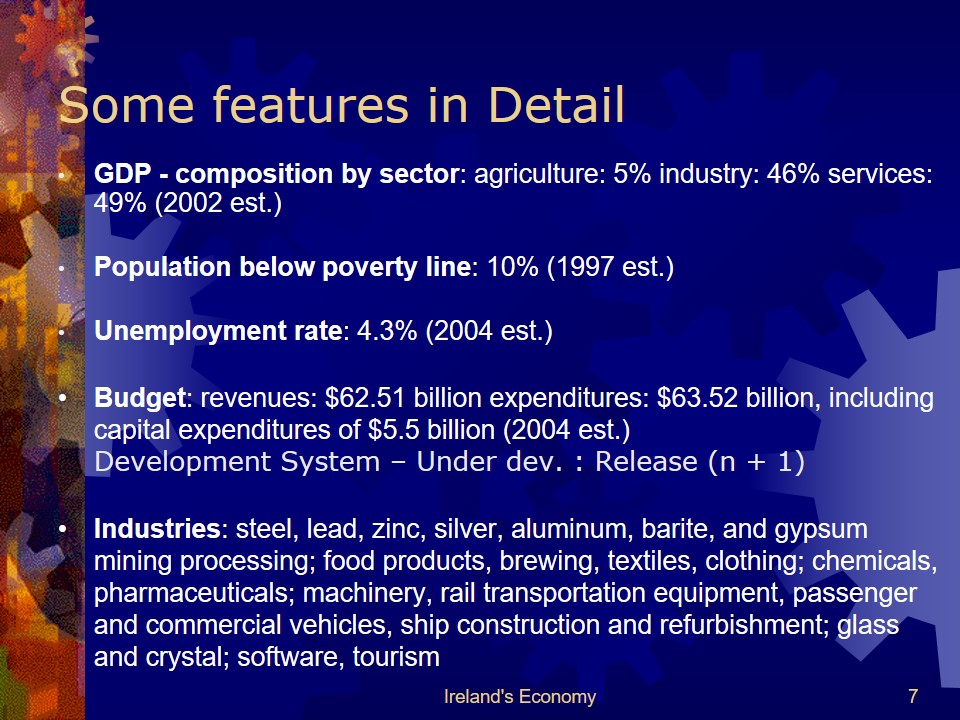

Some features in Detail

- GDP – composition by sector: agriculture: 5% industry: 46% services: 49% (2002 est.).

- Population below poverty line: 10% (1997 est.).

- Unemployment rate: 4.3% (2004 est.).

- Budget: revenues: $62.51 billion expenditures: $63.52 billion, including capital expenditures of $5.5 billion (2004 est.).

Development System – Under dev. : Release (n + 1). - Industries: steel, lead, zinc, silver, aluminum, barite, and gypsum mining processing; food products, brewing, textiles, clothing; chemicals, pharmaceuticals; machinery, rail transportation equipment, passenger and commercial vehicles, ship construction and refurbishment; glass and crystal; software, tourism.

Highlights of Budget 2008

- 9% stamp duty on the balance of house prices over €1m.

- Lesser duty on credit cards – now at €30 ( earlier €40).

- Increase of 30 cents on excise of cigarettes.

- 16.2 billion Euros to be spent on healthcare in 2008.

- Increase in spending for child benefits.

- Rise in contributory and non-contributory pension.

- Increase in Motor tax.

- 9.3 billion Euros to be spent on education in 2008.

- One billion Euros allocated for public transport.

- Allocation on 600 million Euros for regional and local roads.