Abstract

The use of a loyalty card can increase the revenue of a supermarket or chain stores through various means. It is also more cost-efficient to retain a loyal base of customers. At the same time loyalty schemes provide an advantage when it comes to inventory purposes. An indirect consequence is the ability to stock items that are in high demand and ensure availability all year round. There are problems associated with loyalty schemes but these are problems that can be solved if the management team handling the strategy is willing to make changes.

Introduction

In the 21st century entrepreneurs are aware that conventional marketing strategies are obsolete. One of the recommendations made was the development of a loyalty scheme. An example is the issuance of loyalty card. However, it is imperative to learn more about the importance of a business model before a store can offer a loyalty card. The utilization of the correct business model leads to the creation of value for the customers. Furthermore, the correct business model helps businessmen determine the basis for the business venture. Finally, the use of the correct business model can lead to the creation of the appropriate financial components that will help sustain the business process.

Radical changes in technology, rapid changes in the urbanization of key cities, as well as increasing number of companies working in the same area has resulted in the existence of numerous supermarkets and chain stores in a particular geographical area. These changes created significant developments especially among competitors. As a result business leaders had to adapt a new model of marketing. Entrepreneurs were introduced to the concept of relationship marketing. The core feature of this model was the need to attract and maintain loyal customers. One of the solutions was to “give customers an explicit incentive to be loyal to the store as opposed to the competitor’s store… it came to be known as customer relationship marketing or, more popularly loyalty” (Leonard, 2009, p.1). The need to identify and maintain a number of loyal customers is needed to assure sustainability in business especially in the retail industry.

Data Collection

It is imperative to point out the intricacies of the data collection method used for this particular study. The mode of data collection can help determine the veracity of the assertions made in this report. Thus, it must be made clear that there is only a single mode of data collection that was used and it is the secondary data collection method. The report may appear to be a case study of the UK retail industry but the data used was taken from secondary sources.

Case studies made by other researchers were used for this report. One of the important contributions came from the study made on smart cards. Another important contribution came from a study made on discount cards. There was also a case study on trade store cards with a focus on bargains. The general pattern in all these case studies was to look into the effectiveness of loyalty schemes. An important aspect of these case studies focused on customer loyalty and relationship marketing. There was no company that was used as a focal point for this study. However, popular supermarket chains in the UK were mentioned in the report.

The secondary data collection method was also utilised to gather data with regards to relationship marketing and why loyalty cards were merely a part of the overall scheme of an overarching strategy called relationship marketing. It has to be pointed out that there were certain limitations when it came to the use of secondary data collection method. Since it was not a primary data collection mode, it must be pointed out that there were certain weaknesses with regards to this data collection process. The data collected cannot be verified beyond what was stated in the original research. If the original researcher made an assertion, then, there was nothing that can be done but to trust the veracity of the research results that they used to arrive at a particular conclusion.

The possible error in judgement because of the use of secondary information can be minimized by using multiple sources. In other words, the use of different sources from different authors can provide a clear picture of the UK retail industry and the use of loyalty cards. At the same time the assertion made by one researcher can be verified using research made by others. If there was agreement and similarity in the sources used then it was safe to make the assumption that data used were accurate. In addition, news articles were also consulted to provide a clear overview of the use of loyalty cards in the UK.

Traditional Marketing

Before going any further it is important to determine the evolution of marketing strategies from modern times to the advent of technologically assisted strategies and customer-focused loyalty schemes. In the old way of doing things, marketing can be described through the following statements, “Marketing is the process of planning and executing the conception, pricing, promotion and distribution of ideas, goods and services to create exchange and satisfy individual and organisational goals” (Keeling, 2009, p.1). An examination of the statement would reveal that the emphasis of the old marketing paradigm was to focus on the needs and wants of the company. In contrast the new paradigm focuses on the needs and wants of the customers.

Another feature of the old marketing paradigm is the difficulty when it comes to providing customer feedback. If there was one the feedback takes time to move up from the bottom to the top of the leadership pyramid. In the past, business leaders are adamant that their decisions and strategies are the ones that could ultimately decide the fate of the organization. It is based on the idea that the “marketing mix in terms of product, price, place and promotion is what is going to conquer the consumer and create market dominance” (Keeling, 2009, p.1). The customer’s role in this relationship is to decide whether to pay for the goods or to ignore it.

In the old way of doing things, the consumer’s typical response was to make a decision to buy or not to buy (Hosea, 2009, p.1). But in a highly interconnected world of the 21st century, information can no longer be controlled by a few. A single consumer can create awareness through social networking, blogs, emails, and mobile phones that could influence the behaviour of other consumers. In the present time the power of the consumer to dictate terms and condition has never been greater. The threat of substitutes is also an imminent danger to the sustainable success of a business organization.

It is easy to understand why companies find it practical and cost-efficient to perpetuate the conventional marketing strategies of the past. There is always the pressure from investors and shareholders to streamline the business operation. There is also apprehension when it comes to the need to diverge from the established path set forth by the founders of the said organization and at the same time there is no need to repair something that is perceived to be working perfectly.

Aside from the prudence of sticking to a simple strategy characterized by the ability to sell a product at a lower cost, there is also the need for a cost-efficient management of operations. In the aforementioned 4 P’s: product; price; place; and promotion; it can be argued that the metrics are easy to track and record. More importantly it is easy for management to determine if the company is profitable or not.

For many decades traditional marketing strategies remained relatively the same because of many factors. But aside from the reasons given earlier another explanation for the need to maintain the status quo was that there was really no incentive to change based on the strategies created by other business leaders in a particular industry. Marketing analysts provided the explanation:

Despite obvious problems, little was changing in marketing education. Marketing theory remained mired in futile search for laws, regularities and predictability. The marketing mix was the dominant marketing model, although it was seen as offering a too seductive sense of simplicity … The toolbox approach of science-oriented marketing was criticised as a neglect of process in favour of structure (Gretzel, Law, & Fuchs, 2010, p.429).

It can be argued that in times of prosperity and record-setting sales the need for change is ignored. But in lean times and shrinking profit margins business leaders are more than willing to experiment with new strategies. In the latter part of the 1990s the need for a closer interaction with customers could no longer be denied. In the face of mounting competition and the presence of substitutes, supermarkets and chain stores, are forced to learn new ways to achieve customer loyalty.

Customer Relationship Marketing

A new business model has emerged as entrepreneurs invested in the application of relationship marketing principles (Smith, 2011). It is important to first identify the deeper implications of this new model. A more technical definition of relationship marketing was provided by a marketing guru and it states, “A relationship is composed of a series of episodes between dyadic parties over time” (Smith, 2011). The key concepts are expressed in the terms episode and time. These terms help illustrate that relationship marketing is not a one time event (Smith, 2011).

It must be pointed out that these ideas are not new, even before “relationship marketing” became popular in the marketing literature, business leaders are aware of the aforementioned activities. The only major difference is that in recent years the strategies linked to relationship marketing are established and applied more deliberately. One of the main objectives in the utilization of relationship marketing principles is the need to earn the trust of the customers. According to a commentary on relationship marketing, “there is supportive evidence for a positive effect of trust… several empirical works find that trust positively influences constructs related to customer loyalty” (Saunders, Skinner, & Lewicki, 2010, p.12). It is therefore imperative to determine the meaning of the term “trust” in the world of business.

According to Smith (2011), relationship marketing spread like wildfire in the decade of the 90s. The airline industry was one of the first to develop strategies linked to this concept. Thus, the goal of business leaders is to offer a unique loyalty program that will help them stand out of the crow so to speak.

Before developing business strategies in the mould of relationship marketing, business leaders must first realize one thing and that is the fact that “relationships are of a dynamic, rather than static, nature, and that this dynamism needs to be considered by relationship marketing researchers as well as practitioners” (Saunders, Skinner, & Lewicki, 2010, p.108). Relationship marketing can be as simple as personally calling a customer to inform him or her about a special offer and it can be as complex as creating a loyalty scheme that not only encourages loyalty but also help establish a mechanism that will inform management of customer preferences.

It is important to lay down the foundational concepts of relationship marketing, trust, and loyalty before proceeding to the second part of the study, which is the analysis of the effectiveness of loyalty cards. Based on the discussion made it can be argued that a loyalty scheme must be an outcome of a strategy based on relationship marketing and that the main consideration is trust. Using the line of reasoning adopted in the previous discussion the expected outcome is the ability to attract loyal customers.

However, the study of loyalty schemes provided mix results. Thus, although trust is an antecedent of customer loyalty, there are other factors to consider. In the case of loyalty schemes it is crucial to consider the importance of prices of good sold and the quality of the products and services rendered.

Business leaders must focus on the basics. For example, it is imperative to develop a mechanism to measure customer perception and customer satisfaction such as “the need to continuously review the process, identify the gaps and take appropriate measures to deliver perceived level of quality” (Lamb, Hair, & McDaniel, 2010, p.248). It is easier said than done, thus, the practical suggestion is to hire consultants that can provide critical inputs with regards to the development of a relationship marketing strategy.

One way to enhance the importance and effectiveness of loyalty cards is to design a loyalty scheme that adds value to the company. It is imperative that “customer loyalty cards need to clearly give the customers benefits” (Lamb, Hair, & McDaniel, 2010, p.249). Take for example the strategy implemented by Harrods – a luxury retailer in London – when they made available their gift cards.

The focus of Harrods’ strategy is on the business-to-business sector as explained in the following remarks: “It works in partnership with employers to provide their staff with gift vouchers as incentives and rewards… the retailer provides the companies with gift vouchers aimed to add value” and enhances the shopping experience of the users (Hosea, 2009, p.1). In other words customers are rewarded with the means to own items that they wanted but could not afford to buy.

Customer Loyalty

A theoretical framework that can be used as a premise for the discussion of relationship marketing is the Organizational Trust Model. According to this theoretical framework, there are five major drivers of trust: a) concern for employees; b) openness and honesty; c) identification; d) reliability; and e) competence (Gillis, 2011, p.46). It is very clear that this framework covers not only the customers but the other stakeholders of the company especially the employees. Thus, an overview of the model would lead to the realisation that the more important facets of the Organizational Trust framework as far as customers are concerned are in the areas concerning openness, honesty, reliability and competence (Gillis, 2011, p.46). In other words customers are not only interested in the quality of the product but also the quality of service that comes with the purchase of the product. It is this realization that prompted business leaders to develop loyalty programs or loyalty schemes.

The Organizational Trust framework can be expounded using Morgan and Hunt’s Commitment and trust relationship model that identified five major precursors when it comes to loyalty programs: 1) relationship termination costs; 2) relationship benefits; 3) shared values; 4) communication; and opportunistic behaviour (Saunders, Skinner, & Lewicki, 2010, p.23). The customers are made aware of the fact that there has already a relationship that exists between buyer and seller. In other words, customers are conscious of the fact that he or she is not just a buyer but someone that has access to special benefits as a member of a particular club or group.

Another theoretical framework that can be used to develop a better loyalty program is the Hennig-Thurau Structural Integrative Model. In this particular framework it is not enough to simply focus on a few factors relating to relationship marketing. The proponents of this view assert that there is a need for an integrative approach when it comes to relational benefits; relationship quality; and consumer loyalty (Saunders, Skinner, & Lewicki, 2010, p.23). In other words, social benefits; special treatment benefits; customer satisfaction; the commitment of the company; and even word-of-mouth communication are linked together and affects customer loyalty.

It has been made clear that trust in the company and a high degree of confidence regarding the sincerity of the supplier or vendor will result in customer loyalty. The ideal goal when it comes to customer loyalty is embodied in the following statement: “Loyalty occurs when the customer feels so strongly that you best meet his or her relevant needs that your competition is virtually excluded from the consideration set and the customer buys almost exclusively from you – referring to you as ‘their restaurant’ or ‘their hotel’” (Saunders, Skinner, & Lewicki, 2010, p.23). It will require a deeper understanding of loyalty and trust to have a loyal customer base.

There are many ways to attract and retain a loyal following. Companies can be assured of a loyal customer base through competitive pricing. Another way to achieve this goal is by providing high-quality products. In addition loyal customers can be had with the conscious delivery of after sales service. However, one sure way to retain loyal customers is through the establishment of a relationship built on trust. Thus, if a customer trusts both the product and the store that delivers the product, then there is a higher probability that this particular customer will not purchase from a competitor.

According to marketing analysts, trust is generally understood as having the sense of confidence and security with regards to a product (Lamb, Hair, & McDaniel, 2010). Analysts pointed out key areas that management must focus on: a) benevolence – a belief that one party will act in the interest of the other; b) honesty – a belief that the other party will be credible; and c) competence – a belief that the other party has necessary expertise (Lamb, Hair, & McDaniel, 2010, p.9). Trust can only be earned through a continuous process wherein customers find consistency on the part of the business organization in the delivery of quality products and services.

In various empirical studies “made all over the world, researchers from Brazil to Hong Kong are in agreement that the customer’s trust or confidence with regards to a particular business enterprise, provider, vendor or supplier resulted to customer loyalty” (Lamb, Hair, & McDaniel, 2010, p.9). In one report, researchers found out that trust reduces uncertainty and anxiety and therefore has a positive link to customer loyalty (Saunders, Skinner, & Lewicki, 2010). It can be argued that trust is an antecedent to loyalty and has a direct impact when it comes to customer loyalty.

In this particular study, researchers discovered that communication and customer-centred strategies were instrumental when customers made the realization that they trust a particular company. This realization led to the conclusion that “customer commitment is the direct outcome of trust” (Gretzel, Law, & Fuchs, 2010). Trust can only be earned if customers are convinced that there is a long-term commitment on the part of the business establishment.

In a similar study, “researchers did not only believe that trust is the antecedent to customer loyalty, they even went further by saying that without trust there can be no initial transaction” (Saunders, Skinner, & Lewicki, 2010, p.23). Trust is the main ingredient and the absence of trust may force a customer to terminate the relationship even before it began (Saunders, Skinner, & Lewicki, 2010). The study of loyalty schemes begins with the realization of the importance of relationship marketing. Afterwards, the assertion was made that a core feature of a relationship marketing framework should include the concept of trust. Furthermore, the existence of trust in a business relationship can lead to loyalty.

Loyalty Cards

A loyalty card is a generic term used to describe various types of loyalty schemes developed by supermarkets and chain stores. Thus, a loyalty card is a mechanism that allows customers to make known their intention to develop a relationship with a particular business establishment. But it can come in different forms. It can come in the form of a plastic card with magnetic strips or a card with computer chip. The end result is the capability to track the items purchased and the buying pattern of the customer.

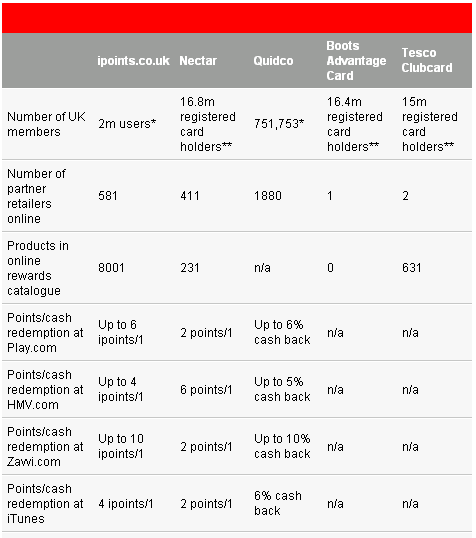

The use of loyalty cards has gained popularity in recent decades. As a matter of fact, “around 70 per cent of UK consumers have customer loyalty cards… the fastest-growing modern point-of-sale development” (Keeling, 2009, p.1). Consider the following report: “The biggest retailer, Tesco, runs its own loyalty scheme, Clubcard, with 15 million cardholders spread across half of all UK households. The supermarket re-launched the scheme in a £150 million campaign to attract a further 1 million members” (Taylor, 2009, p.1). Tesco will not invest hundreds of millions of pounds if their loyalty scheme is a failure.

The popularity of loyalty cards can be attributed to the belief that business owners can convince customers to be loyal to a particular brand. According to one commentary: “In the 1970s, European researchers studying business-to-business marketing discovered that suppliers who form close working relationships with their customers are more loyal to their suppliers and often give them a greater share of their business (Smith, 2011, p.37). If this idea is applied in contemporary times, entrepreneurs must not only develop strategies to attract loyal customers but also to incorporate into that particular strategy the use of Information Technology. The marriage of the two will result in the type of loyalty cards that are used today.

Using the Commitment-Trust Theory of Relationship Marketing and the need to incorporate IT-based applications to contemporary business models one can argue that business leaders are interested in the use of loyalty cards because of the following beliefs about customer loyalty, “Many customers want an involving relationship with the brands they buy. It should be possible to reinforce they buyer’s loyalty and encourage them to be even more loyal. With database technology, marketers can establish personalized dialogues with customers resulting in more loyalty” (Smith, 2011, p.38). It was an important realization for many businessmen.

The assertion made by Smith can be considered true for a certain type of customer. It is true that loyal customers tend to be loyal as long as there are no compelling reasons to force them to terminate an ongoing business relationship with a company. But it can also be argued that there are customers that cannot remain loyal to a particular brand because they only focus on the price and the quality of goods sold. Nevertheless, it is also true that a loyal customer will find it more practical to maintain that relationship especially if the store provides incentives to enhance the value of membership to a particular loyalty scheme. In the case of Tesco, the company rewards customers that “make repeat purchases from them” (Smith, 2011, p.39). The same pattern is followed by their competitors.

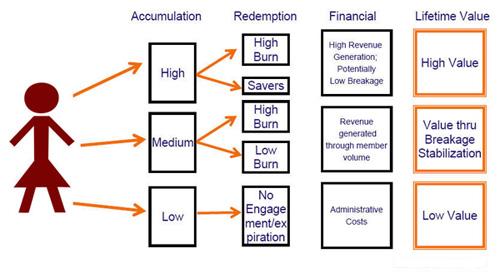

One of the main incentives cited by companies investing in a loyalty scheme is linked to a mechanism that enables them to increase their revenue. If a store succeeds in attracting and retaining a loyal customer base then the company can expect an increase in revenue coming from multiple streams. Loyal customers are considered to be more profitable as a result of “reduced servicing costs, less price sensitivity, increased spending, and favourable recommendations passed on to other potential customers by loyal buyers” (Smith, 2011, p.40). There is another way to increase revenue and this is related to the capability of supermarkets and chain stores to manage their inventory much more efficiently through the use of customer data.

In the case of Harrods in the UK, their executives attest that “typically, Harrods sees an uplift on spend so that if a customer uses a £25 gift card, there is another £6 spent on top of that” (Hosea, 2009, p.1). In this particular loyalty scheme where the store offers a gift card, management testified that customers are not limited to the value of the gift card, voucher or coupon. When they are in the store they are not contented to simply spend the amount indicated in the gift card. Thus, the loyalty program creates other ways of increasing revenue.

There are other benefits aside from the expected increase in revenue and ensuring the loyalty of the customers. According to Martin Hayward, the director of strategy and futures at Dunnhumby, “the benefits of loyalty schemes for retailers are profound, offering an insight into customer spending patterns and the opportunity to tailor promotional campaigns” (Taylor, 2009, p.1). In the normal course of a business transaction, a vendor sells a product, the customer receives the goods paid for and then the business owner issues a receipt. But with a loyalty scheme the store can track down and record pertinent information regarding a particular customer’s purchasing behaviour.

In the old way of transacting with customers, the business information that can be gleaned from such type of transaction is limited to inventory purposes only. In other words a shop owner can create a record of goods sold in a given week, month or year. This type of data allows the entrepreneur to stock more on some items and limits the inventory on others. In a supermarket setting this type of information allows the manager to monitor items that are on consignment and at the same time allows him to update suppliers with regards to the movement of the products in the supermarket shelves.

Aside from tracking the movement of goods there is little that management can do when it comes to the personal preferences of individual customers. They have no idea who bought the goods that they sold for the past few months. There is also no way of improving customer service because of the inability to gather more information regarding customer behaviour. One of the solutions made popular in recent years is the loyalty scheme adopted by many stores in the UK. The following advantages help explain why supermarkets and retailers are compelled to develop their unique loyalty schemes, “In retailing, a large number of individual stores and chains have customer loyalty cards. To receive one of these cards, the customer has to complete a form, stating their name, address and other contact details. Each time the customer uses their card, the business puts the details of their transaction to the computer database” (Smith, 2011, p.41). It was an important discovery for many corporate leaders.

The use of Information Technology enabled supermarkets and retailers to “generate individual statements, vouchers and offers to match the buying habits of the customer” as a result the store can reward customers for being loyal (Lamb, Hair, & McDaniel, 2010, p.9). Thus, a loyalty scheme that integrates IT-based applications to the system is not only self-sustaining but also self-enhancing because it provides information that can help management to improve the system.

However, there are numerous complaints. Some of the major weaknesses of loyalty cards can be linked to the fact that there are many “loyalty schemes that are only applicable to low-value items” (The Guardian, 2009, p.1). In other words, there are many who may find it too late, that after “all the time they’ve spent accumulating points; they discover that they only have the option to redeem their points for something they don’t really want” (The Guardian, 2009, p.1). The problems cited here is typical of loyalty schemes that can be found in most supermarkets. The management team responsible for these types of loyalty programs are in for a rude awakening when they discover that their customers are more discerning and instead of attracting new members they are going to discover that they customer base is shrinking.

Another common weakness when it comes to loyalty schemes is the considerable process that has to be completed before a customer can receive a reward. A typical loyalty program requires the accumulation of points as a result of repeated purchases from the same establishment. As a result there are customers voicing out their displeasure, “A criticism that’s often made against loyalty schemes is that they don’t allow you to gain an instant reward in the way that a cash back or voucher scheme would let you” (The Guardian, 2009, p.1). This weakness can be easily resolved by providing quality items that can be redeemed against the points earned by the said loyalty scheme.

Security Concerns

The sophisticated computer systems used to establish a loyalty scheme can help management record and track personal information of the customer. Its power to store information can be used by unscrupulous people that may attempt to a type of credit card fraud or identity theft (Shelly & Vermaat, 2010). Information gleaned from the servers can be used for the purpose of robbery and other criminal acts. It is therefore important to secure the IT system used for loyalty schemes.

According to one report, credit card fraud resulted in over $2 Billion in loses for merchants and card issuers (Shelly & Vermaat, 2010). The link of the loyalty card and credit card must be carefully scrutinized. For example, it is important to find out if the system used allows for the creation of a database that stores the loyalty card’s identifier and credit card information in the same computer.

Cybercriminals must not be given the opportunity to take hold of sensitive information especially personal details that are included in the application form for the said loyalty scheme. It is therefore important that business leaders must invest in the creation of a system that protects a system that contains the personal information of customers.

A savvy customer may have taken steps to shield itself from credit card fraud, but criminals may find a loophole or a weakness in the system through the loyalty card. As mentioned earlier, in order to enjoy the benefits of a loyalty card, the issuer requires the disclosure of certain personal information.

It is important to reveal this type of information because the issuer has to assemble a database that contains all pertinent customer information. It helps them track sales and inventory, but more importantly it helps them study the shopping habits of customers. But the data system employed by a supermarket chain can be accessed by unscrupulous individuals and the information that can be stolen from the said database can be used to launch a more significant attempt to steal from a victim.

Findings

The success of Tesco and other business groups that incorporated loyalty schemes into their business operations attest to the fact that a loyalty card can be an effective business tool.It is imperative for management to improve their loyalty programs and provide more attractive offers.

However, improvement in the loyalty scheme can never assure customer loyalty. There will always be the issue of savings and stretching the purchasing power of the consumer to the highest level “for them, the pursuit of the cheapest price transcends any notion of loyalty” (Taylor, 2009, p.1). Thus, a loyalty scheme cannot afford to focus only on the rewards but also on the prices of the goods for sale.

A successful loyalty scheme uses an integrative approach that considers the type of reward offered, the quality of the products for sale, and the price of the goods. A well-developed loyalty scheme does not only provide rewards for the loyal customers but also enhances the value of the membership to the said program.

The desire of supermarket and retail store owners to develop attractive loyalty schemes does not guarantee customer loyalty and may only trigger a mere increase in application as explained in the following statement: “customers are spoilt for choice and switch brands or businesses far more easily than before” (Lamb, Hair, & McDaniel, 2010, p.10).

On the other hand, cost does not automatically drive customers away. Customers are known to pay extra for the sake of quality, “It may simply mean that these people buy a brand at a higher price because they perceive it to be better” (Saunders, Skinner, & Lewicki, 2010, p.107). Thus, a loyalty scheme must adhere to an integrative model wherein it is important to consider the cost of the goods sold, the expected reward and the quality of the products sold.

There are numerous problems enumerated against the use of loyalty programs such as a store’s loyalty card. Nevertheless, these findings do not automatically mean that loyalty programs do not work. The assertion that a store’s loyalty card is ineffective can be countered by the recommendation that there are ways to improve a particular loyalty program’s chance of success by considering the following steps.

First of all, it must be made clear that business leaders must “design the loyalty program to enhance the value proposition of a product or service” (Saunders, Skinner, & Lewicki, 2010, p.12). Thus, it is wrong to simply reward customers with their purchase because based on the previous discussion customers are willing to pay a higher price if they believe that they can get value for their money.

Discussion

The success of a loyalty scheme can be traced to the appropriate application of the correct business model. In the case of loyalty schemes, the application of business theory will reveal that customers are wary of loyalty cards that cannot create value for them. As a result many complained about the need to purchase items that they do not need just to receive a particular reward. At the end, they realized that the reward offered was not worth their time, effort and money. Thus, an effective loyalty scheme is the one that enhances the shopping experience of the customer. This positive response can be measured by customer loyalty. It can also be measured by a significant increase in revenue.

There is a need to review different types of loyalty schemes and develop better strategies when it comes to the issuers of loyalty cards. The most important thing to find out is the significance of a loyalty card when it comes to loyal customers. A determination must be made whether customers are loyal because of a loyalty scheme or if they are loyal because of other factors. Based on the examination of the strengths and weaknesses of loyalty schemes, it can be argued that customers are only loyal if they believe that they can get value for their money. But at the same time customers can easily transfer and use the services of related companies within a particular industry.

It is therefore, important to go beyond the reduction of prices. A customer does not only need reduced prices of goods, a customer also requires the benefits that can be gleaned from relationship marketing. Thus, a particular business organization must also make the extra effort to interact with their customers. It is no longer enough to simply provide goods and services without creating a point of interaction wit the customers. There are certain industries that require personalized service for the customer. But the more practical application of relationship marketing is to determine the needs of a client and develop a loyalty scheme that answers that particular need.

Another important thing to consider is that a loyalty scheme must not be limited and tied down to “conditional selling” but must be used with a little infusion of creativity. A good example, as pointed out earlier, is to develop a loyalty scheme that adds value to the company that provides for the said marketing strategy. A good example is to enhance the shopping experience of customers through the use of gift cards. It must be pointed out that the “gift card market is worth £3.8 billion a year business” (Hosea, 2009, p.1). Aside from the purpose of increasing customer loyalty, management must learn to expand the coverage and purpose of the same. Consider the following report:

One recent example of data capture working well as part of a voucher-led marketing scheme is a partnership between magazine Marie Claire’s website and retailer Uniqlo. ‘Therefore, this affiliate network called LinkShare was able to secure editorial exposure on Marie Claire’s website, featuring ten of Uniqlo’s recommended products in return for an exclusive 20% discount voucher from Uniqlo’ (Hosea, 2009, p.1).

The £150 million invested by Tesco in their attempt to attract an additional 1 million members is enough proof of the success and importance of loyalty schemes. Thus, it can be said that from the perspective of management, loyalty schemes enhances the profitability of a business organization. However, it is important to highlight the fact that the business organizations have to utilize considerable amounts of resources in order to establish and sustain a loyalty scheme (Gretzel, Law, & Fuchs, 2010). In other words, a poorly developed loyalty scheme can attract first time users but the organization can never expect to retain a loyal customer base.

References

Costa, M 2012, Finding their soft spot, Web.

CRM Trends 2012, Loyalty programs, Web.

Evans, T 2010, Which is the most popular loyalty scheme, Web.

Fernandez, J 2009, Building loyalty schemes with lasting power, Web.

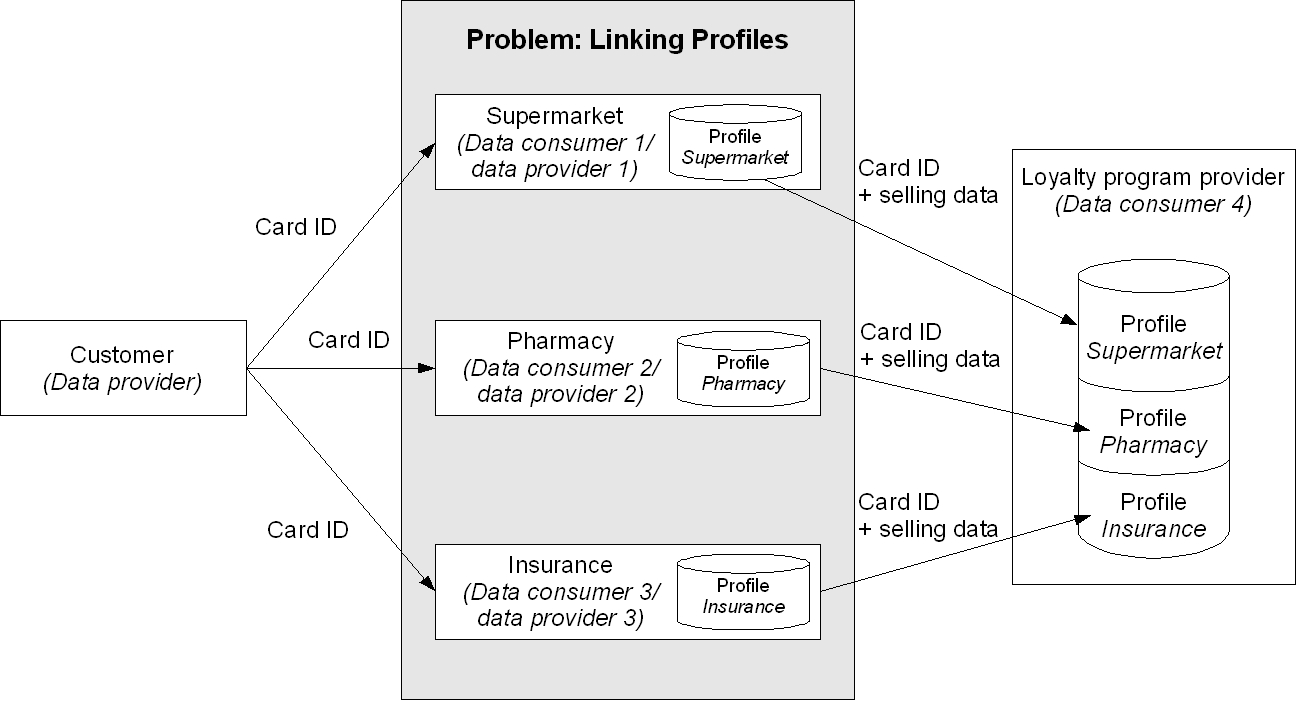

Future of Identity in a Network Society, 2012, Case study: privacy threats in a loyalty program, Web.

Gillis, T 2011, The IABC handbook of organizational communication, John Wiley & Sons, New Jersey.

Gretzel, U, Law, R & Fuchs, M 2010, Information and communication technologies in tourism 2010, Springer Science, London.

Hosea, M 2009, Token gesture gets you close to customers, Web.

Keeling, G 2009, Do loyalty schemes generally offer really good value to customers?, Web.

Lamb, C, Hair, J & McDaniel, C 2010, Marketing, Cengage Learning, Ohio.

Leonard, T 2009, Smart consumer: why it pays to have divided loyalties when you shop, Web.

Saunders, M, Skinner, D & Lewicki, R 2010, Organizational trust, Cambridge University Press, Cambridge.

Shelly, G, Vermaat M 2010, Discovering computers 2010, Cengage Learning Ohio.

Smith, M 2011, The new relationship marketing, John Wiley & Sons, New Jersey.

Taylor, P 2009, Shoppers trade store cards for bargains, Web.

The Guardian 2009, Do loyalty schemes generally offer really good value to customers?, Web.