Introduction

The task is a close analysis of Bank of America. This is accomplished by using the SWOT analysis, Porter and Millar’s five forces model, Porter’s competitive strategy, Nolan’s stage model and McFarlan’s strategic grid.

Additionally, issues relating to e-business strategy formulation, an evaluation of proposed e-business strategy, discussion of the barriers to the adaptation of m-commerce by the company and evaluation of the critical success factors for the e-business are succinctly covered.

SWOT Analysis

The bank needs to invest in ICT which will later provide education and training to her employees. Similarly, there is a need for the bank to have in place a set of strategies that will help address concerns of customers hence making the business stable

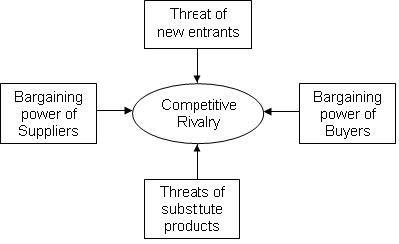

Porter and Millar’s Five Forces Model

It is worth noting that the model brings an understanding to business community that the following five aspects have an impact on profitability of an incumbent firm, the intensity of competition, ability of suppliers or buyers of a firm’s product to restrain profits of the firm, behaviors of those firms that produce similar goods and services, and potential for entry into the market by new entrants or firms (Bocij et al., 129).

Figure 1: Porter and Millar’s five forces model

Source: Adapted from Porter M., Competitive Strategy, Free Press, 1980.

Competitive rivalry

Bank of Africa has faced and will continue facing stiff competition from such big banks as Citigroup, Well Fargo and JP Morgan.

Globalization which has opened the world into a global village will create oversea competitors both in the U.S and other countries where the bank operates or intends to operate. It is evident that the slow speed of the industry growth in the US provides a serious state of competition for market share among the major competitors.

To curb this issue, it is the responsibility of the body responsible for global operation to help the firm capture new markets, new customers as well as ensure that the existing ones are satisfied. There is also the need to have the e-business strategy to be unified so that it was effective and efficient (Bocij 412).

Customers’ bargaining power

It is worth noting that since the banking industry is experiencing a decline in market share, there are no possibilities of having new customers hence the existing ones have more power. Additionally, due to public education, the customers are more informed and clearly know what they want from banks, as well as from the associated price tags (Porter 172).

To help address this issue, the bank needs to further improve its customer care services concerning both, online and offline banking. Additionally, the bank needs to furnish its website and ensure that it works effectively and it is user friendly.

This will help capture new market and attract new customers. Lastly, there is a need to be vertically integrated in terms of major consumers as this will help address the bargaining power of customers (Porter 238).

Suppliers’ bargaining power

Since the firm is a large company, it is an important customer of supplier group. There are few suppliers who can meet the demands of such a big firm. Considering that there are also other big firms such as Citigroup, the supplier will have a higher bargaining power.

To curb this issue, Bank of America needs to have a unified data base where it will be able to evaluate the prices of the various suppliers and choose the one which is favorable and that will allow the bank to charge customers different prices as a result of differences in the value created from the supplier hence a competitive advantage.

Threat of new entrants

It is difficult for an outsider to replicate the position of Bank of America due to the following reasons; the firm has a well developed brand that cannot be copied and the cost of entry particularly investing in technology and human resource.

I strongly believe that in order for the bank to successfully curb these five forces, there is need for it to adopt e-business. This will not only strengthen its core competencies but also widen its market share and maintain existing customers who are obsessed with technology.

Additionally, having in place an effective and user-friendly website will be a plus to this goal. Lastly, having in place well trained and motivated employees will help in ensuring that the firm maintains and improves its current position.

Substitute products

There are indeed substitute products from other related industries, such as JP Morgan and Well Fargo among others. To curb this issue, Bank of America should engage in non banking products and services. Similarly, it should continue building its brand which will make substitute brands less appealing to current, as well as new customers (Porter 244).

Porter’s generic competitive strategies

The position of a firm within its industry is dictated by whether its profitability is below or above the industry average which is a result of long term sustainable competitive advantage. There are three main generic strategies to achieving low cost or differentiation performance and include cost leadership, differentiation and focus.

For the bank of America, the strategy it has been applying for long is cost leadership in terms of proprietary technology (Johnston 132). The firm has been always in the forefront in adopting new technologies to help it stay a step ahead of its competitors. Indeed, the adaptation of these technologies was well throughout and sufficiently met the demands of customers (Chen 78).

Nolan’s stage model

The model holds that an organization which adopts information technology has to undergo four main stages of maturity. The stages are as follows: initiation stage, expansion or contagion stage, formulation or control stage and integration or maturity stage.

However, there are cases where some firms skip some of these stages nonetheless; the stages provide us with an opportunity to analyze the growth of an organization based on its adoption of IT.

Linking the model with the Bank of America, it is evident that it has tried to use technology in running its day to day business. The firm has gained control over the IT resources and has actively engaged in formalizing processes, as well as standards. In numerous occasions the firm has tried to employ cost-effective criteria.

Although reports come from various departments, such as sales and marketing, to be sorted out by the company. There are some serious issues, such as the lack of adequate skilled manpower in the department of Information Technology preventing to do this (Johnston 57). Thus, the firm is in stage three ‘formalization or control stage’.

For the firm to reach or attain the perfection stage or maturity stage, e-business strategy will play an integral role where the firm will have a well thought-out plan.

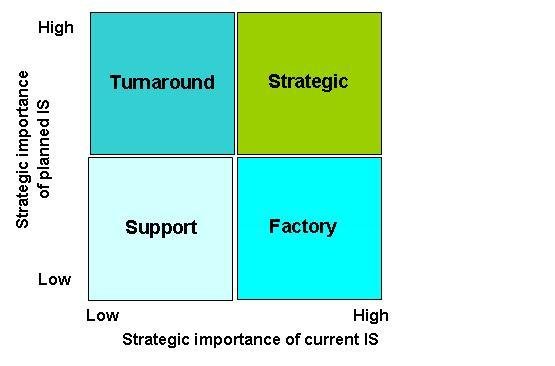

Mc Farlan’s Strategic Grid

This is an Information Technology specific model usually used to examine the nature of a set of projects which an organization is undertaking to establish how best the portfolio supports the day to day running of the organization in question. Ideally the model has 4 sections namely turnaround, strategic, factory and support (Figure 2).

Figure 3: McFarlan’s strategic grid

Source: Bocij et al (2006) Business Information System, 3rd edition.

In the case of the bank of America it is evident that it has employed information technology in her business processes as well as management issues. In terms of factory it will about effective resource use, high quality of product and services.

In terms of strategy it will add high value, enhance vertical integration, as well as foster continuous innovation. It is also evident that concerning support, IT has supported efficiency as well as sustained quality. Lastly, with regards to turnaround, it will initiate cost control. In my view, adopting e-business will ensure that all these are realized.

E-business strategy formulation

Ideally, this entails part of a business strategy that will transform the firm from a brick to click while ensuring that it maintains the current customers, attracts and maintains new ones through fostering provision of high quality services and products, efficient and effective operation not only in America but also in the entire world. The following opts to be done;

- Developing a website that is effective and user friendly characterized by high speed of data link to enhance e-business

- Linking both, online and offline sales and marketing strategies whereby the firm will introduce services that customers can access through both, website and from the banks.

- Developing an online system where it will be possible for customers to track the firms’ products and services

- The customers will also be able to make inquires, issues of concern are addressed online and even product acquisition and other forms of transaction be accomplished without visiting the brick and mortar offices.

- The system needs to support communication across the globe

- It would be rational for the firm to create and use customer relation management software which should be user friendly

- Fully adopt IT in all the relevant sectors and have all data set unified and managed by a central organ to enhance efficient and productive operation.

- Have a plan to regularly train and educate employees on IT issues so that they are be able to use the IT

- It will also be rational to have annual budget that will support investment and maintenance of ICT department

To implement this strategy, there is a need for the firm to do it step by step. It is the responsibility of the chief information officer to decide on these steps and the related reviews.

Evaluation

The proposed strategy will be accommodated by the budget of the firm. It is the task of a chief information officer to choose one of the ERP applications that can be integrated with other separate softwares to develop a unified database. For the firm to achieve success, it should adopt a strategy where there is ongoing training of relevant employees during the building of the plan.

Having an improved website that is easy to use will help foster interactions between customers and the firm. Similarly the customer relation management software will help the firm to capture new customers. Ideally, adopting technology will help the firm to maximize its operation thereby meeting the demands and aspirations of customers.

M-commerce

There is no doubt that mobile phones, together with the internet, have revolutionized consumers’ engagement in firms and business. For this reason, organizations have gone a step further to adopt m-commerce which considers utilizing mobile devices such as mobile phones to support business transactions via a mobile telecommunication network (Chaffey 254).

The following can be done through m-commerce advertising and promotion, store location, in-store navigation, comparison shopping, information and extended packaging, payment, among others. However, there are some potential barriers that face each and every organization when trying to adopt this technology, bank of America is not an exception (Nash 197).

Among the challenges that a firm can face are

Issues related to infrastructure levels and requirements; It is a fact that to utilize mobile devices in business effectively, there is a need to have in place a platform that offers speed data access (Chen 408). The firm needs also to develop a platform that will be compatible with the mobile network. In addition, employees are to be well trained and educated to support its adoption.

Another barrier is central to the different mobile devices capabilities. Although it might be the desire of the firm to provide its customers with all relevant products and services, this will be limited by the type of mobile handset one owns. The low memories of some mobile handsets will hinder such an effort (Turban et al., 123).

Similarly other emerging issues pertain to personal security. It is a fact that viruses have spread quickly within networks compromising the privacy of customers.

On the same note scientists have linked some health complications such as cancer to using mobile devices so people will try to avoid using them at all costs. Concerning privacy, people are always apprehensive when it comes to doing business through mobile devices (Turban & Volonino 89).

It is not to be assumed that all individuals are literate. For that reason, the efforts of the bank top adopt m-commerce might be jeopardized since some individuals particularly in developing countries which offers new market opportunity for the bank are not well versed with technology advancement.

Lastly, it is evident that it is easy for one to loss a mobile device. The mobile phone contains a lot of personal information that when it gets into the wrong hands, the customer will have a lot of problems. This will potentially restrain possible customers from using it (Chaffey 12).

In my view, to overcome the afore mentioned barriers, the firm needs to do the following;

- Do a thorough consultation on how best it can create a standard platform to be used by the potential customers.

- Since it will be a global initiative, the firm should try to understand legal provisions, laws and taxation of the respective countries

- There is the need for the firms to assure customers of their privacy and security while doing transaction through mobile devices

- Have in place a webhost that is secure; periodically evaluate the state of security and use the best antivirus possible to help curb issues related to information theft.

- Employing individuals who are well versed and experience in mobile technology will be plus since they will also train other workers about the technology

Critical success factors for e-business

Capturing new markets

With technological advancement, the world has turned into a global village and the only way to survive it is to continue attracting new customers as well as capturing new markets. To accomplish this, the bank ought to develop new products and services and give added value to their customers. It is no doubt that the e-business initiative if done successfully will help the firm respond quickly to the demands of new markets.

Supporting the IT department

Technology plays an integral part in development of any organization in the present century. Funds need to be allocated to ensure regular upgrade of the ICT equipment as well as employee training.

Customer centered marketing

There is the need to always center on the needs and aspiration of customers when doing marketing. Since customers are well informed, having customer based policies will help maintain the stability of the firm as well as cut it self an edge in this competitive world. With this, it will be possible to collect large data about customers’ preferences and behavior (Turban et al., 234).

Works Cited

Bocij, Paul, Chaffey, Dave, Greasley, Andrew, and Simon Hickie. Business Information Systems. Essex, England: Pearson Education Limited, 2006. Print.

Chaffey, Dave. E-Business and E-Commerce Management. Upper Saddle River, NJ: Prentice Inc., 2007. Print.

Chen, Stephen. Strategic Management of E-Business. Chichester, England: John Wiley & Sons Ltd, 2005. Print.

Johnston, Moira. Roller Coaster: The Bank of America and the Future of American Banking. New York: Ticknor & Fields, 1990. Print.

Nash, Gerald D. A.P. Giannini and the Bank of America. Norman, Oklahoma: University of Oklahoma Press, 1992. Print.

Porter, Michael E. Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press, 1980. Print.

Turban, Efraim and Linda Volonino. Information Technology for Management, 7th edn. New Jersey: John Wiley & Sons Inc., 2009. Print.

Turban, Efraim, King, David, McKay, Judy, Marshall, Peter, Lee, Jae and Dennis Viehland. Electronic Commerce 2008: A Managerial Perspective. Upper Saddle River, NJ: Pearson Education, 2008. Print.