Introduction

Financial system is dependent on numerous external factors, and the recent events in Japanese economy may be regarded as one of the brightest instances of such a dependence. The aggregate demand and supply parameters are the clear indicators of the short- and long-run processes in the economy, therefore, they may be used as the analysis background for forecasting the further tendencies and processes in economy.

Aggregate Demand and Supply Analysis

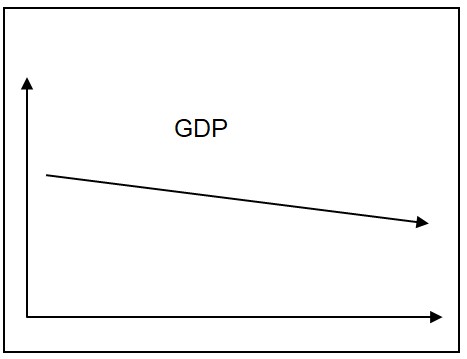

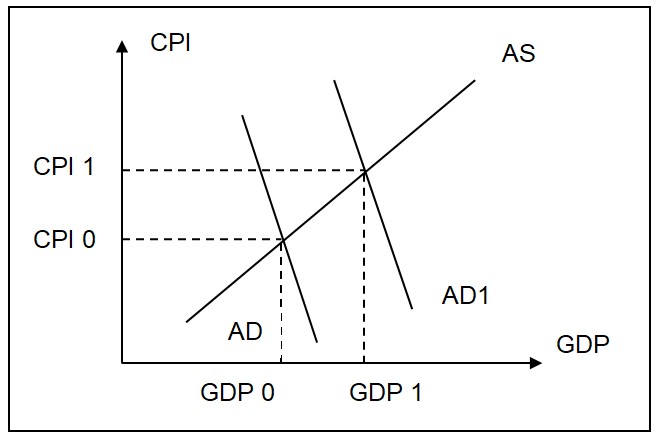

Aggregate demand and supply volumes in Japan has been subjected to essential changes. Therefore, as it is emphasized by McCallum (2011), aggregate supply has fallen since the start of the disaster, while aggregate demand of the State stays comparatively on the same level. Therefore, the third largest economy experiences decrease in GDP, and the growth rate is -0.3% (Worldbank.org, 2011)

CPI level has been subjected to zero inflation, and the short term forecasts on the GDP and CPI levels are: -0.3 to -0.5%, and 0 to -0.3% correspondingly. The long term forecasts are too vague, however, the average indicators are: 0.8 to 1.2% for the GDP, and 0.1% inflation for CPI rates.

From the perspective of this figure, the AD level is affected by consumption levels (domestic household), investment, net exports and money supply.

Yen / Dollar Changes

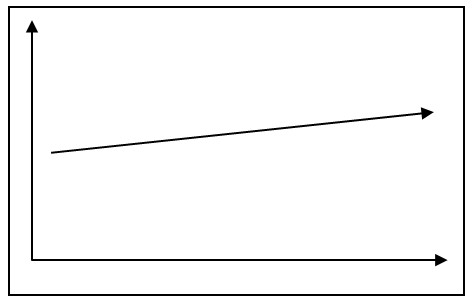

The currency exchange rate for the recent 60 days is given on figure 2

The period taken for the analysis is from Feb, 3 2011 to April 3, 2011. The lowers exchange rate was observed on March 18, and it totaled 78.90. The highest rate was observed on April, 3 – 84.06. Regardless of the fact that the largest industries in the Japanese economic system experience crisis, and lowering of the manufacturing powers, the exchange rate stays on the comparatively high level, as some manufacturing powers are outsourced, and this is the key insurance measure that helped to preserve the power of JPY.

Bond and Stock Market Forecasts

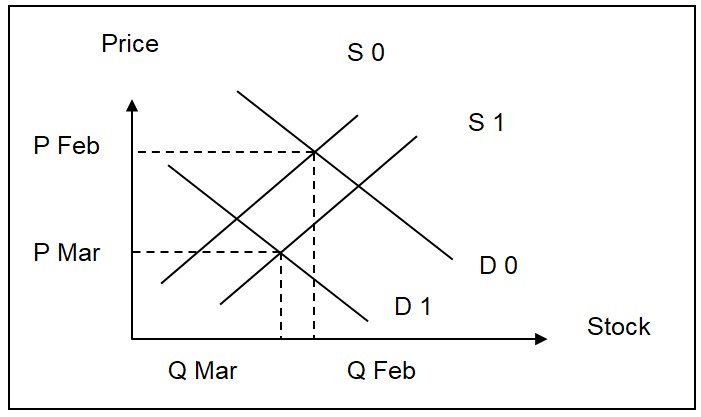

These forecasts are mainly based on previous instances of earthquakes in Japan, and tempos of Japanese economy restoration. Hence, it is forecasted that the decease of the trade volumes will be changed with the immense growth, and restoration of the trade volumes within the next 5-7 months. Therefore, it is forecasted that the situation on the stock market will not worsen essentially, and the following year will be featured with the cyclic growth of stocks.

All the losses caused by tsunami are short-term, and analysis hope that the $ 100 billion losses will be compensated soon by the rapid growth caused by intensive tempos of after-disaster restoration.

The same is on the matters of bond market. Catastrophic failure is not expected, however, the growth is not forecasted. He estimated growth rate is 0.75% yearly for the next year, thought, year 2012 tendencies are not known, as too many factors need to be considered by experts for getting precise rates.

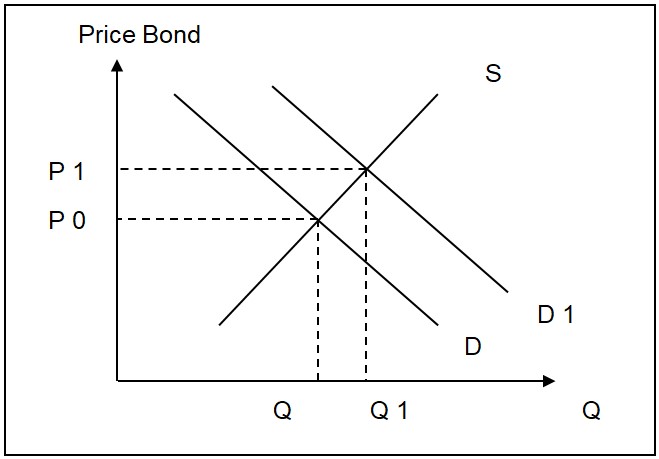

Price Bond The stock failure will be featured by the decreased purchase levels, and increased stock prices. However, the situation may change essentially, and the cyclic rises and falls are expected.

The slight increase of the bond level is explained by the fact of economic instability. Bonds are considered safer in these times.

World Commodity Prices

In accordance with the global forecasts, the commodity prices are expected to grow in the second half of the year 2011. The expected growth in 3.5% which doubles the indicators of annual inflation rates. Therefore, most price growth tendencies are explained by the inflation rates, however, the forecasted rates will depend on the current price growth tendencies. As it stated by McCallum (2011, p. 29):

The World Trade Organization announced recently that metals, food, and other raw material are expected to continue to increase in 2011. In remarks addressed to a United Nations conference, director-general of the WTO Pascal Lamy noted that soybeans, corn, gold, copper and crude oil will see the biggest price hikes, however also going up would be cattle, zinc and gasoline. This is being attributed largely to emerging economies which have been creating an increased demand for commodities.

In the light of this fact it should be emphasized that commodity prices grow independently on world disasters, and the actual importance of the commodity price analysis is explained by the necessity to control the world price forming tendencies.

Monetary Policy Recommendations

It is generally stated that crisis situations require monopolistic control and solution, as the demand for quick and even courageous solutions is crucial. Therefore, the key recommendation will be linked with the restriction of the authorized personnel for solving economic issues. Considering the fact that monetary policy of Japan is mainly conservative, further tightening of the regulation mechanisms will be a reasonable solution for defining the restoration strategy. It is stated that tax reduction, as well as tax growth will not help to overcome the problems, however, the central bank needs to focus on the long-term risks that should be mitigated. This will help to improve the financial basis of the economic system.

Conclusion

Finally, it should be emphasized that the actual importance of proper analysis is explained by the opportunity to follow the economic growth and development tendencies, linked with the commodity prices, stock and bond markets, aggregate demand and supply rates. These levels are essential for outlining the general tendencies of economic development or regress, as well as control of economy related spheres.

Reference List

McCallum, B. T., (2011) Japanese Monetary Policy. Washington: Shadow Open Market Committee.

Worldbank.org (2011) Prospects for Development. Blogs. Web.