Executive Summary

This is a property valuation document for John Lewis Partnership presented as a consultancy report evaluating the effective application of modern valuation methods in the company. The aim is to assess the organization’s practical and ethical needs by providing a reasoned explanation of the different bases of valuation used and suggesting the methodology that should be used to arrive at the opinion of value. The report consists of a critical analysis of the potentials and barriers to the innovative adoption of modern valuation methods.

Introduction

John Lewis Partnership Plc is an active business with a physical address in London, SW1E 5NN. The company works under SIC Code 68100, the purchasing and selling own housing infrastructures in the property market. With a 100% shareholding, John Lewis Plc is the company’s major stakeholder (La Torre et al., 2020). It was founded in 1935 with an estimated turnover of £30.8 million. Growth has been slowing in recent years. The John Lewis Partnership is the owner and operator of John Lewis and Waitrose, two of Britain’s most well-known retail companies. With approximately 78,000 personnel as Partners in the company, the Association, which began as a novel notion almost a century ago, is the biggest employee-owned corporation in the UK and is among the world’s largest organizations in the real estate and retail brands.

The company’s profits are returned to the company to benefit clients and stakeholders. In the UK, John Lewis runs 34 stores, one outlet, and johnlewis.com. In England, Germany, Scotland, and the Canary Islands, Waitrose operates over 330 stores, including 59 retail outlets and an additional 27 stores at Welcome Break sites (La Torre et al., 2020). Waitrose.com serves as the company’s online shopping platform for groceries and online specialty stores like waitrosecellar.com for wine. Equally, the outlet has branch support under the waitroseflorist.com domains for houseplants are all part of the retailer’s Omni channel operations.

The Practical & Ethical needs of John Lewis Partnership

To better meet the business’s ethical and practical demands, the management has worked to strengthen international cooperation on important problems. For instance, the organization organized a roundtable meeting of business executives in Glasgow during COP26 to discuss how companies can assist customers in making more sustainable decisions (Bryson 2021). Waitrose, the firm’s CEO, unveiled the largest-ever food waste awareness campaign in conjunction with COP 26 (Jones 2021). The project contacted more than 10 million individuals, which inspired consumers to lessen food waste. The corporation also committed measures to reduce greenhouse gas emissions by 22.18 percent annually starting in 2018, creating a precedent for other organizations. By 2035, the corporation wants its activities to be net carbon neutral.

The management is also devoted to creating goals for our operations and supply chain based on science. The John Lewis Partnership’s website states that the firm has made progress toward eliminating the usage of fossil fuels in its transportation fleet and that 252 of its 581 big vehicles currently run on biomethane (La Torre et al., 2020). By 2030, the firm wants to completely phase out the usage of fossil fuels in all of the Partnership’s transportation. Waitrose retained its top ranking for the seventh consecutive year in the global Business Benchmark on Farm Animal Welfare.

Through our network of Health & Wellbeing Champions, targeted ads, and content, we have concentrated on raising awareness in important areas this year, such as menopause, cancer-related diseases, and emotional health. The epidemic has made it more crucial to assist digital platforms. Irrespective of whether a partner has had a Covid-19 immunization, the firm has provided sick pay throughout the year (Bryson, J.R., 2021). For more than 1,000 Partners, the organization has offered over 8,000 psychosocial support sessions. More than 230 team captains participated in the mental health promotion program as a result of the management’s action.

Asset Portfolio & Strategy

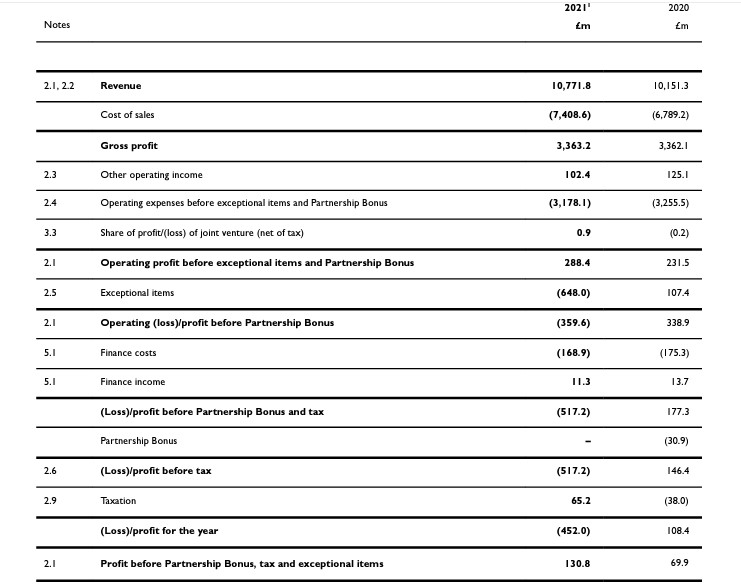

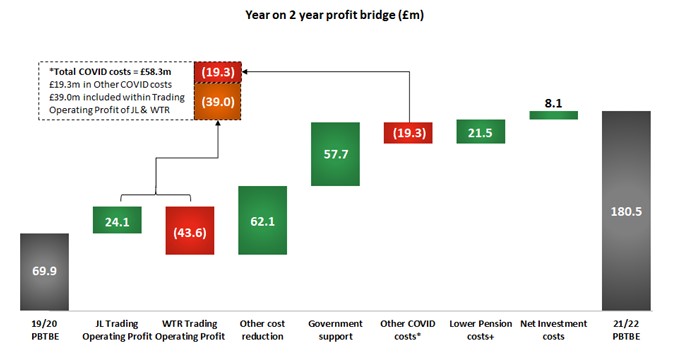

For Table 1, the Profit before Partnership Bonus, Tax, and Exceptional Expenses (PBTBE) is applied as the Partnership’s internal reporting indicator of trade success for the profitability for 20212022 FY. The evaluated PBTBE for the FY year was £180.5 million, rising by £110.6 million and £49.7 million from FY 2020-2021 and FY 2019-2020 (Bryson 2021). Since 2017–18, the trends in the Partnership have shown potential for higher PBTBE values (La Torre et al., 2020). Unlike FY 2022, for the first quarter of 2020, the value was £173.1 million less than the earnings two years earlier. Trading operational profit for our brands is included in the values, along with other capital costs handled centrally, such as head office costs, net financing costs, infrastructure costs, maintenance, and capital investment.

From the financial trends, John Lewis Partnership’s five-year corporate turnaround initiative, which began in 2021, reduced its pre-tax losses from £517 million to £26 million. The business closed eight John Lewis storefronts and a delivery center to reduce expenses by £170 million over the year. It also reduced the number of management employees in its central teams and stores. The company stated while announcing its turnaround plan that it will save £300 million by the end of 2022 (Iqbal 2021). Throughout 2021, the first year after its five financial years’ operating recovery strategy, The John Lewis Partnership effectively reduced its pre-tax losses from £517 million to £26 million (Bryson 2021). Eight John Lewis stores and a delivery center were closed, and the firm slashed expenses by £170 million over the year (Bryson 2021). It also reduced the number of management professionals working in the major teams and the stores. The company pledged to save £300 million by the end of 2022 when it unveiled its turnaround plan.

In terms of welfare, the company has made significant strides. According to the company’s portfolio, over 11,000 users who had active engagements with the platform downloaded the free psychological health Unmind app. The group’s Health and Wellness Practitioners handled more than 17,000 requests, and over 1,000 associates enrolled as wellbeing ambassadors (Shandas and Hellman 2022). More than £459,000 in financial assistance was given to Partners as grants or loans with no interest. The initiative made possible approximately 7,000 Partners, including members of 23 Partnership groups and societies ranging from sailing to singing (Bryson 2021). Over 67,000 nights in the five partnership hotels operated by the corporation were made available to Partners, their family, and acquaintances at discounted prices as a result of the efforts

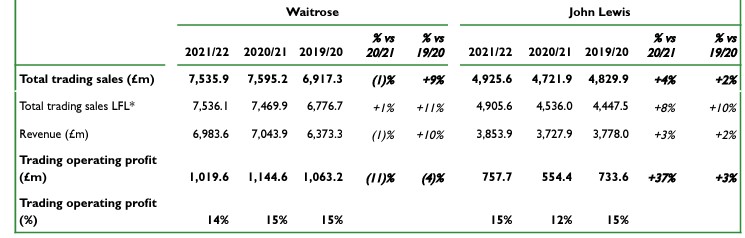

Valuation & Performance of Asset Portfolio

In terms of valuation and performance of assets, John Lewis Partnership has experienced dynamics triggered by the shifts in consumer behavior triggered by external factors such as the health pandemic. Due to the interaction of the external market forces, Waitrose Trading’s operating profit decreased by 11%, from £125.0 million to an average of £1,000.6 million (Shandas and Hellman 2022). Some of these constraints were lessened by our cost reductions, which totaled approximately £75 million and were reflected in the Waitrose results. Due to fewer lockdowns in 2021 than in 2020, John Lewis experienced an increase in overall trade revenues of 8% (Madhusudhanan et al., 2021). Despite John Lewis stores being shuttered for ten weeks at the beginning of the fiscal year, total sales were up 10% from FY 2019–2020. The channel mix for the year averaged 65% online and 35% in stores visits, continuing the long-term movement online as consumer behavior changes.

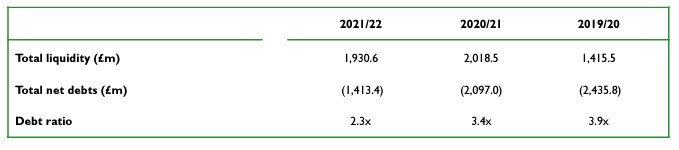

The firm now has a debt-to-earnings ratio of 2.3x, which is lower than the 3.4x ratio from the prior year. Table 2 shows that the company’s pension deficit has significantly decreased thanks to robust cash flow throughout the year and debt repayments that didn’t need refinancing. The corporation reported a net pension accounting surplus for TY 2021-2022 but did not include this benefit in determining its net indebtedness or the debt ratio (Child 2021). The financial accounting used in the derivation assumed that the pension plan was at a breakeven point. The total net indebtedness and Debt ratio correlations include the compensation deficit in FY 2020–2021 and FY 2019–2020.

Analysis and Evaluation of Asset Portfolio Valuation

The pace of growth for the company has been promising, with sales for the John Lewis brand solely reaching its greatest level ever at £4.93 billion in financial year (FY) 2021, up 10% from 2019. Waitrose, a sibling company, reported revenues of approximately £7.5 billion, an increase of 1% over the prior year and 11% compared to FY 2020 and FY 2019 (Shandas and Hellman 2022, pp.33). The company’s management acknowledges that although company is only one year into our five-year restructuring, the organization has achieved a promising start with the Partner Plan designed for the 2021-2021 FY. As the plans enter the second year of its strategy, the company needs to double down on becoming the go-to trademark for quality services, sustainability, and progressive values. The company should invest aggressively since the transition is on track.

Asset Portfolio Valuation Analysis

Regarding the assets portfolio, the company’s valuation increased by 3% from the previous year and 2% from troubled FY 2019–2020. Commercial and operational profit of approximately £757 million was recorded in the subsequent FY was up 37%, showing that John Lewis’ margin had significantly increased. The onset of market recovery in the fourth quarter of FY 2020 and the first quarter of FY 2021 showed stronger sales, less clearance on sales, and various sales in the emerging markets (Bryson, 2021). In contrast to FY 2019-2020, the company witnessed a bigger percentage of the fashion and real estate market in FY 2021-2022 that had higher margins than technology revenues, which were very robust in FY 2020-2021.

Asset Portfolio Valuation Arguments

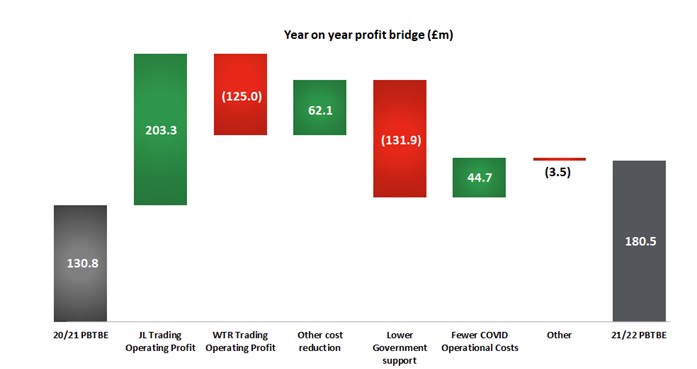

Figure 2 trends show that the company’s PBTBE growth of roughly £ 50 million over the full-year earnings for FY 2020-2021 resulted from various factors. The two main factors are the operational profits of John Lewis Trading, which increased by £203.3 million, and Waitrose Trading, which decreased by £125.0 million. These results consider the effect of cost reductions of about £100 million, which is around £35 million for John Lewis and £73 million for Waitrose (Shandas and Hellman 2022). Second, the reduction in other operational expenses of £62 million was achieved relative to FY 2020–2021, bringing the overall cost reductions for FY 2021-2022 to approximately £170 million.

Figure 3 demonstrates an expenditure increase in FY 2020 and FY 2021 due to increased market disruptions from the health pandemic. As a result of the corporation receiving less in business rates relief and making no claims under the Coronavirus Job Retention Scheme this year, government funding was reduced by £131.9 million. However, the cost strain was relieved as the demands on social distance, cleanliness, and PPE subsided compared to FY2020 (Michie, 2022, pp.98). The management notes that the corporation faced reduced expenditures related to the Covid-19 pandemic, which were reduced by around £45 million in FY 2021-2022. However, the FY2020-2021 was disruptive since many of the social distancing policies from the previous year that protected clients and partners were still in place. Similar to Figure 2, the company’s PBTBE of £180 million includes about £58 million in business rate relief that was completely offset by additional expenses related to the epidemic.

Future Valuation Methodology

The disruptions in the business dynamics showed the need for a more inclusive and diverse working environment. From such a perspective, initiatives promoting diversity and inclusion (D&I) are the company’s future. The business may take pride in becoming the first retailer in the UK to declare equal parental pay and leave. The company’s welfare initiatives should work to implement a two-week paid leave policy for any Partners who lose a pregnancy (Abernathy et al., 2019, p.37). One of the company’s long-term Partnership Plan goals should include hiring people with expertise in providing care as part of the welfare strategy.

Similarly, the company must focus on gender diversity and equality efforts to improve its performance in the market. There are now more female Partners in entry-level positions than male Partners in the firm. However, the proportion of female Partners in these positions has marginally decreased from 57.9 to 57.3 percent in FY 2022. The management recognizes a rise in the percentage of female Partners in middle management positions at Level 6 that, shifted from 53.9 to 57.2%. Currently, female Partners in Executive, Director, and Level 4 roles have also increased at the corporation, from 45.0 to 48.0 percent. Despite the encouraging developments, there is still a need to close the pay gap between men and women. Currently, the company’s mean and median gender pay gaps have decreased by 1.4 percent (Shandas and Hellman 2022, pp.121). An improved diversity position and welfare efforts for the company would improve the organization’s standing from the market’s perspective.

The Advice of Future Valuation and Development

With the growing market dynamics, the future valuation and development of the company should consider the impact of the health crisis, the need for diversity, and climate change. Within the Partnerships, work programs should be put in place in sectors to adjust to the physical dangers of climate change and reduce the transition risks. Physical hazards are managed by adaptation measures, while transition risks are managed through mitigation measures like lowering carbon emissions (Drake t al., 2019). The Partnership’s goals should also be in line with the considerations that the Directors are required to provide according to the provisions of the Companies Act. For instance, it is necessary to consider the remaining workforce’s interests and the long-term effects of any action.

The firm should also promote commercial partnerships with suppliers, clients, and other parties while considering its activities’ effects. To ensure that its actions align with its goal of building a more sustainable future for partners, consumers, suppliers, and communities, the organization should consider the community and the environment. The necessity to behave honestly and the importance of upholding a reputation for high standards in corporate behavior should be cultivated. With this mentality, the company would expand in a way that supports our shared goals of establishing more reliable business practices and cooperating to build a more just future.

Conclusion

John Lewis Partnership emerges as one of the most influential employee-owned companies in the UK. The founder, John Spedan Lewis, launched the company, which has proven to be a successful industry democracy venture inspired by the desire to improve ways of doing business. According to the John Lewis business model, every employee receives a portion of the corporation’s annual earnings and a voice in how it is operated. Theoretically, it increases employee investment in their job, increasing performance and earnings. Such a company model has the potential to grow as an industry leader.

Recommendation

However, given the dynamics external business environment, the corporation must continue to handle funds responsibly. The management should also ensure enough capital is available to withstand significant trading volatility. The Partnership specializes in the approach because the business’s strategy prevents it from accessing the stock markets. The company’s overall liquidity is now at a healthy $2 billion, comprising £1.5 billion in cash and short-term investments and £420 million in undrawn bank facilities (Shandas and Hellman, 2022, pp.111). Such a status is essential to deliver the Partnership Plan and fulfill the firms’ duties. Including leases and any pension shortfall, the corporation currently owes £1.5 billion in total net debt, with £500 million repaid over the next three years.

The company needs to spend up to £200 million on John Lewis’ retail locations, digital services, and distribution capabilities, in addition to approximately £100 million on the company’s digital services and distribution networks. Between 60 and 65 percent of John Lewis’s sales are online. Records from the business show that the recently updated John Lewis app currently represents 23% of online sales, an increase of 40% from 2020. The business has to acknowledge that consumers are engaging with the corporate teams through the app, which encourages them to access a variety of goods and materials that the teams provide. The company’s marketing plan should guarantee that programs that center on enhanced personalization are improved.

Since the Partnership wants 40% of revenues to originate from sources other than retail by 2030, John Lewis Partnership should keep investing to diversify its income sources. With an investment of over £60 million, the business should accelerate the expansion of John Lewis Financial Services while continuing to refine its home rental offering. The company needs to keep up with how quickly financial services are changing. For instance, management should pursue the point of sale credit as quickly as feasible to promote consumer convenience. The firm has now generated £100 million in revenues from only one program. With the firm’s diversification, the revenue growth fuelled by finance technologies can enhance the company’s chances of growth and product diversification.

References

Abernathy, J.L., Guo, F., Kubick, T.R. and Masli, A. (2019) ‘Financial statement footnote readability and corporate audit outcomes’, Auditing: A Journal of Practice & Theory, 38(2), pp.1-26. Web.

Bryson, J.R. (2021) ‘COVID-19 and the immediate and longer-term impacts on the retail and hospitality industries: dark stores and turnover-based rental models’, Living with Pandemic, 36(4), pp. 202-216.

Child, J., (2021) ‘Organizational participation in post-covid society–its contributions and enabling conditions’, International Review of Applied Economics, 35(2), pp.117-146.

Drake, M.S., Hales, J. and Rees, L. (2019) ‘Disclosure overload? A professional user perspective on the usefulness of general-purpose financial statements’, Contemporary Accounting Research, 36(4), pp.1935-1965.

Jones, P. (2021) ‘UK retailers and plant-based alternatives to meat and dairy products’, Auditing: A Journal of Practice & Theory, 38(2), pp.1-26. Web.

Iqbal, S. (2021) ‘Impact of COVID-19 on leadership’, Journal of Innovative Writings, 2(1), pp.1-11.

La Torre, M., Sabelfeld, S., Blomkvist, M. and Dumay, J. (2020) ‘Rebuilding trust: sustainability and non-financial reporting and the European Union regulation’, Meditari Accountancy Research, 28(5), pp.701-725.

Madhusudhanan, A.K., Na, X. and Cebon, D., (2021) ‘A computationally efficient framework for modelling energy consumption of ICE and electric vehicles’, Energies, 14(7), p.2031.

Michie, J. (2022) ‘Forms of ownership for sustainability and resilience: the need for biodiversity and corporate diversity’, Economic Policies for Sustainability and Resilience, 1(3), pp. 91-133.

Shandas, V. and Hellman, D. (2022) ‘Conclusion: common themes, lessons learned, and next steps’, Collaborating for Climate Equity, 3(5), pp. 101-106.

Appendix