Introduction

Johnson & Johnson (JNJ) began as a tiny manufacturer of surgical dressings in 1886. It was founded by three brothers based on Joseph Lister’s then-recent studies into the nature of airborne germs and infectious diseases. To enhance Lister’s carbolic acid-spraying method for post-operative sterilization, the new company would investigate sterilizing methods and surgical dressings. The three brothers finally incorporated the business as Johnson & Johnson in 1887. Since 1887 the corporation expanded into more than 250 subsidiary firms operating in practically every medical sector, generating annual sales of over $70 billion (Johnson and Johnson Company, 2022). It has diversified to include a range of products used in the interventional solutions, surgery, and vision fields.

Procter and Gamble (P&G) Company is a leading soap, cleansers, and other household products manufacturer in the U.S. The company was founded in 1837 by a British candlemaker and Irish soap maker named William Procter and James Gamble. The main ingredient for the product was mainly animal fat from the hog-butchering center of Cincinnati. Procter and Gamble initially sold Ivory soap, synthetic detergent, and liquid synthetic detergents. Over the succeeding years, the company expanded its product line to include coffee, tea, toothpaste, and baking mixes. Today, P&G is the biggest manufacturer of laundry and cleaning supply products, including the cosmetics and personal care sector.

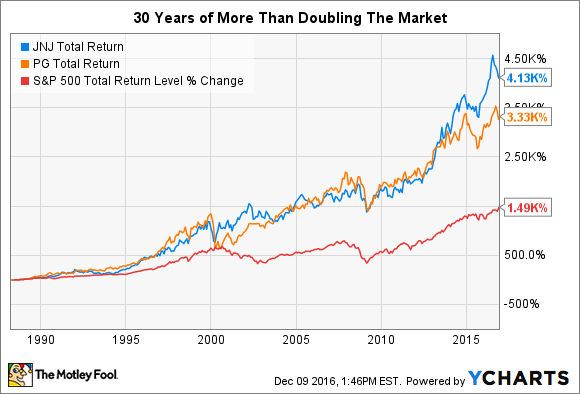

Proctor and Gamble and JNJ are among the world’s biggest and most successful businesses. Johnson and Johnson specialize in health-related products, while P&G focuses consumer consumer-branded packaged goods like laundry detergents and cosmetics. Over the past 30 years, both companies have produced results that would please any investor (see Figure 1). The fact that each can generate more than $10 billion in free cash flow each year is a good indicator. But since this is a competition, credit goes to Johnson & Johnson. The company generates higher income and free cash flow compared to its size and has a significantly better cash-to-debt ratio.

Organization Ethics, Legal and Current Events

JUST Capital polls Americans yearly to identify the issues that define business behavior most. This analysis drives their rankings, in which PNJ came in at position 49 out of 954 businesses and first out of 46 pharmaceutical and biotech firms (Ethical Consumer, 2018). Likewise, a report card on lesbian, gay, bisexual, and transgender equality in business America, both companies as having the best practices. P&G, on the other hand, P&G came in second place out of 9 personal products firms and rated 59th overall (Ethical Consumer, 2018). It indicates that PNJ ranks as the ideal company considering organizational ethics.

A Pennsylvania judge ordered Johnson and Johnson to pay US$52 million in penalties and damages in December 2010 after determining that the pharmaceutical company had fraudulently overstated the pricing of its products (Ethical Consumer, 2018). In 2014, French competition regulators penalized the firm and 12 other consumer product companies for a total of 951 million euros for price fixing in supermarkets. European Union regulators have punished Proctor & Gamble and Unilever for fixing washing powder prices in eight EU nations. French competition authorities also penalized the business for price fixing in supermarkets (Ethical Consumer, 2018). Both companies have had their fair share of legal issues, so they are on par. However, both firms have made substantial efforts to cut greenhouse gas emissions and minimize climate change hazards. The sustainability Assessment also reveals both companies are doing well in corporate governance, risk management, environmental reporting, climate strategy, human rights, and labor practices.

Marketing Financials and Accounting

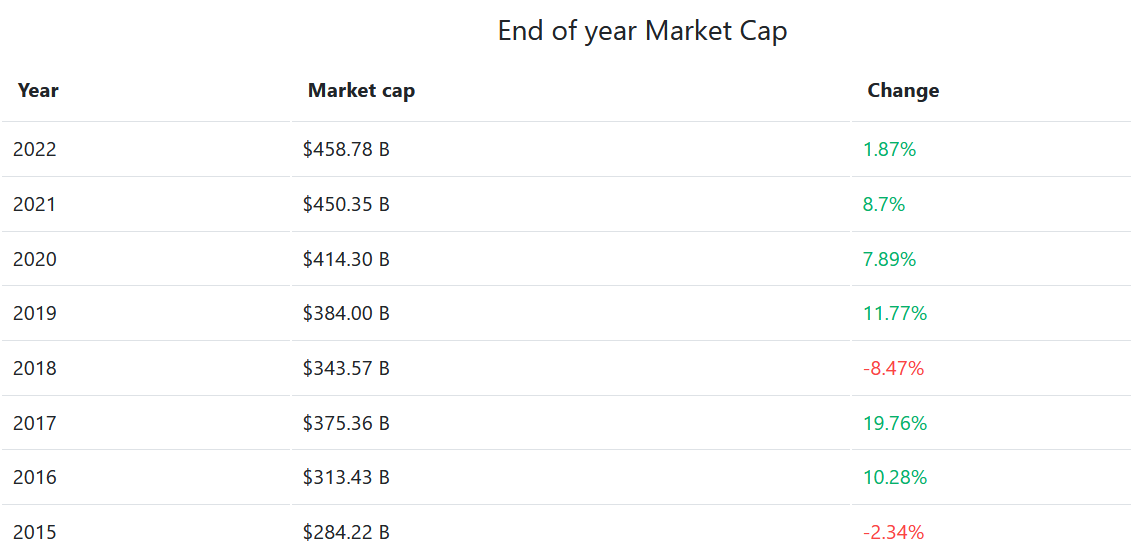

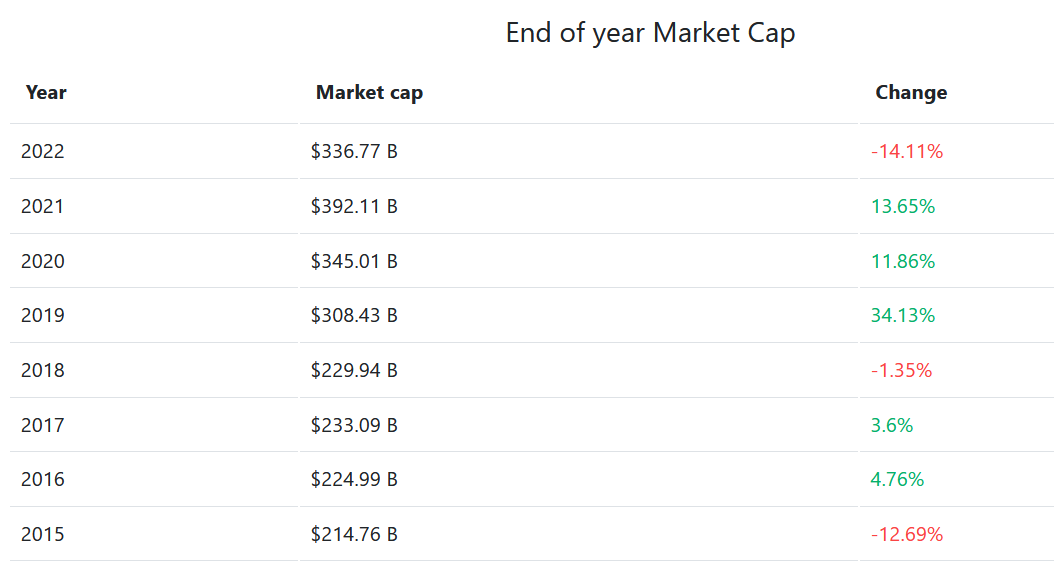

Market caps for JNJ and P&G are $293,1 billion and $224,64 billion, respectively. The market caps do not indicate which business is a superior investment. It is crucial to consider data that recognize growth and earnings dependability to identify the firm shares worthy of investment. In 2022, JNJ was anticipated to grow by 1.87%, while P&G is expected to shrink by 14.11% (see Figures 2 and 3). Therefore, there JNJ is clear of P&G considering the potential growth of these companies. Similarly, JNJ holds a clear advantage on P&G profitability, with a net margin of 21.99% over Proctor and Gamble’s 12.23%. Considering return on investment (ROE), PNJ (24.77) outshines P&G (18.26) as well as projected sales. JNJ beats P&G in all growth metrics, making it more appealing to investors.

Over the past 60 days, analysts have revised Johnson & Johnson’s earnings estimates in various ways. Three experts have increased their forecasts, and two have decreased their profit projections for the current quarter. Johnson and Johnson exceeded our Earnings per share (EPS) consensus prediction in each of the previous four quarters. Over a similar period, PG has experienced a wave of decreasing earnings estimate revisions (Tobey, 2022). Eight experts have lowered their earnings projections over that time. There have been no upward revisions to analyst profit projections. It seems a one-sided battle here since JNJ is anticipated to grow more quickly than P&G. Besides, JNJ currently trades at a discount relative to the expected earnings, giving a final blow to P&G that analysts offered only negative revisions. The earnings and growth indicators show an investor should consider buying company shares in Johnson and Johnson.

Organization Culture, People, and Diversity

Johnson and Johnson’s company was recognized as one of the top 10 mom-friendly employers in Seramount’s 100 Best Companies 2022 (Ethical Consumer, 2022). The firms offer family-friendly benefits, such as gender-neutral paid parental leave, phase-back programs, bereavement leave following a miscarriage, reimbursement for reproductive costs, and expanded mental health benefits for staff (Ethical Consumer, 2022). Seramount also named P&G company the 100 best employees for a mum-friendly employer. However, only P&G appears in the Bloomberg Gender-Equality Index, signifying a commitment to supporting gender equality through policy development, representation, and transparency (Ethical Consumer, 2022). It implies P&G emphasizes more on gender equality more than JNJ.

The two businesses score highly in terms of corporate best practices for racial, ethnic, persons with disabilities, and transgender equality. The companies also provide a conducive environment for career growth, including competitive salaries and robust networking opportunities. For example, JNJ promotes an organizational culture that values each person’s unique perspective and approach. It also fosters an environment that values and capitalizes on diversity. Meanwhile, Procter & Gamble emphasizes trust in leadership and direction and promotes employee value for its strong culture of equity and inclusion. Despite the positive reviews on organization culture, diversity, and people, there is a gross salary disparity between the top management and the regular employees of both companies. For example, JNJ CEO Alex Gorski came in at number 21 on the list, with a salary of $29,575,974 in 2021. (Ethical Consumer, 2022). The counterpart CEO at P&D is ranked 52 on the list, having been paid US$22,905,128 in 2021 (Ethical Consumer, 2022). The gross overpayment is detrimental to the companies, shareholders, consumers, coworkers, the economy, and society.

Conclusion

Based on financial, accounting, and marketing growth considerations, Johnson and Johnson’s company has greater potential than P&G. Estimates of return on investment (ROI), including predicted sales, show that JNJ is in the lead. JNJ outperforms P&G in every parameter, according to all the indications, making it more attractive to investors. According to earnings and growth data, investors might consider buying Johnson and Johnson stock. The two businesses provide better benefits and compensation for employees, families, and health support initiatives. Despite the legal allegations that the corporations falsely exaggerated the prices of their products, they have made significant efforts to reduce greenhouse gas emissions, mitigate the risks associated with climate change, and enhance employee well-being.

References

Ethical Consumer. (2022). Shop ethidcal: company profile. Shop Ethical. Web.

Johnson and Johnson Company. (2022). 2021 anual report. Johnson & Johnson. Web.

Tobey, J. (2022). Inflation turns Procter & Gamble’s reported growth into a downturn. Forbes. Web.