Value Network Analysis

Assumptions

An analysis of the value network of Jordan’s medical tourism industry involved the following assumptions.

- Jordan’s marketplace is characterized by among others, the value network of its medical tourism industry.

- Stakeholders are the most important components covered in the network

- The network focused its emphasis on the medical industry

- Secondary data that was obtained from presentations, websites among others, and interviews formed as the information source for creating the network

- Reports were generated through Value network analysis software available at www.valuenetworkanalysis.com

Network Map

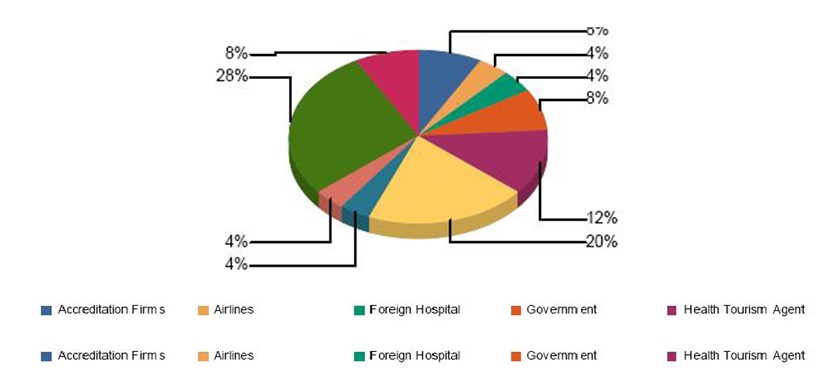

Jordan’s medical value network map is illustrated in detail below (See Figure 9).

Note: Appendix C provides basic input data for Value Network Analysis.

The three areas to which the roles are broadly classified include:

Consumers

Tourists in the medical industry

Service Providers

- Hospitals for medical tourists

- The health tourism agents

Enablers

- Privately working Associations

- The Government

- Legally accredited Firms

- Hotel services

- Airlines carriers and services

- Hospital catering for foreigners

- The Media

The purpose of the above classification is to ease and enhance later explanations as the project progresses towards its end. Requirements may cause an interchange of roles such as like in the case of a private association may take the roles of a service provider to tourists in the medical industry by supplying hospital information, registering complaints, with some of the roles briefly explained below.

Tourists in the medical industry: Financially underprivileged to access special medicine or elective surgery medical services in their country and aged 50 years plus, these tourists move out in search of cheaper but good quality healthcare elsewhere.

The health tourism agents (HTA): Carry value addition activities by interlinking other service providers such as the airline industry, insurance companies among others to create and add value to a medical tourism industry that meets the expectations of its customers. In addition to that, it is argued that the tourism industry lifts off the burden on hospitals that otherwise could not cope with the needs of these patients. Among the tourism agencies is Jordanhealthcare.com that provides medical services, packaged medical services in the areas of healthcare screening, and bypass cardiac graft. This company’s network covers countries such as the UK, Asian countries such as Japan, and goes as far as New Zealand and Australia to the Middle East to source medical tourists. Additionally, cosmetic surgery packages are provided by GorgeousGetaways HTA, a popularly known firm among Australian medical tourists.

Privately working Associations: Hospitals and the government are linked by these associations by focusing on the coordination of private hospitals’ activities tailored towards high-quality medical services. Information about the various medical services is available here and these are among the widely known private associations including Jordan are APHM and Jordanian Medical Association. Disease prevention, co-operation with the MoH, healthcare deliveries, and answers to queries by medical tourists are all under the representations so these associations.

Accreditation Firms: Concerns by medical tourists about the quality of medicinal services are catered for by various bodies including the accredited Joint Commission International (JCI), Healthcare (ISQua) a well-known firm, and the Jordan Society for Quality in Health (MSQH) in the line of those accredited and recognized firms.

Reasons for accreditation to JCI include:

- The fulfillment of outlined standards and requirements for patient care

- Measuring up to international standards for patient quality care and safety

- Standardized procedures for patient isolation in the event of a disease outbreak

- English as a standard language of communication and issuance of instruction for clarity

- Ensuring patient privacy and individual rights are kept

Despite the fear expressed on the strength of JCI standards compared to those of the joint Commission as reportedly argued in the American Medical Association “The JCI has accredited over 100 foreign facilities but given the significant differences between the JCI’s international and US standards, does that mean that the quality of care in those hospitals is truly comparable?” An argument refuted by this argument “In a field where experience is as important as technology, Escorts Heart Institute and Research Center in Delhi and Faridabad, India performs nearly 15,000 heart operations every year and the death rate among patients during surgery is only 0.8 percent, less than half the rate of most hospitals in the U.S.”

The Government: Government components constitute the Ministry of Health with the role of developing and Ministry of Tourism that works to promote the industry in collaboration with privately working associations. Collaborating on that note, key hospitals that promote medical tourism are pinpointed. These hospitals are continuously scrutinized and evaluated for adherence to the standards and procedures required to meet the requirements and expectations of medical tourists. value addition was realized when stay on visas was extended for six months from the previous six days

Network Map Analysis

Resilience

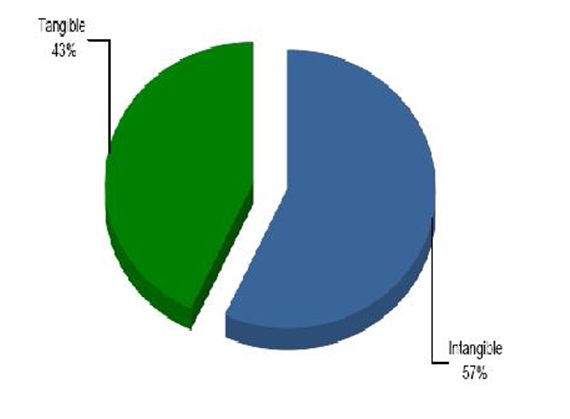

Informal and formal knowledge are critical components required in their correct balance for a resilient network. A resilient network flexibly changes with changing conditions and can be evaluated on a ratio of Intangible/Tangible transactions indicator

The percentage of intangible and intangible transactions from the above charts are 43% and 57% respectively based on corresponding numbers of intangible and tangible transactions being 43 and 54 respectively, with a ratio of 1:32 as illustrated on the above charts (See Figure 11 and 12). The variations between the tangible and intangibles demonstrate the fact that this industry is still in its infancy. The industry lacks a clear communication framework, and breakdowns lead to frequent misreports and misunderstandings evident from the lack of active support from the government, APHM, and failure to provide published information on their activities. Complex relationships are characterized by more intangibles than tangibles, with roles specific tasks well defined. However, the lack of value chain activities in the upstream and downstream impedes promotional activities in attracting more medical tourists.

Knowledge exchange among roles is dominant, calling upon flexibility on collaborations and mutual trust, an essential component in this industry. A further indication of the social nature of the industry makes it deficient in formal and financial relationships.

Value Creation

Agents need to be active in value creation within the network where active participation is counterproductive of both tangible and intangible value. The decreases in resource availability and productivity are measurable on the degree to which the values of outputs have decreased. Efficient resource and asset utilization rely on a network’s utilization capacity pegged on its financial and non-financial viability.

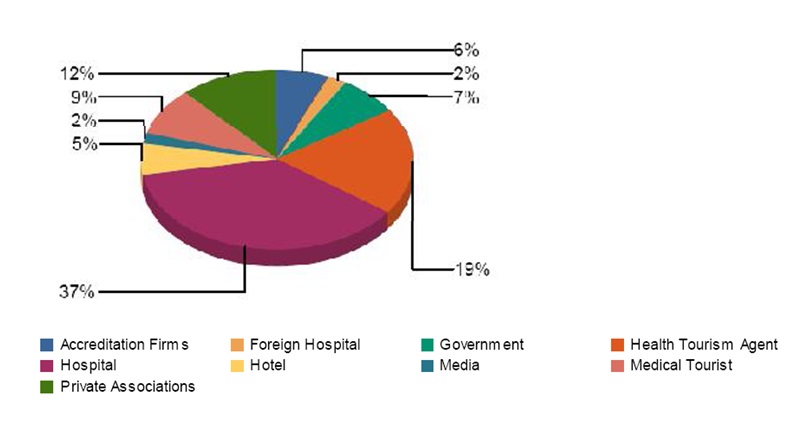

The above pie-chart (See Figure 13) is evident that hospitals are the main source of transactions with an average rate of 9.50. However, it is worth noting that a lower value than 9.50 may fail to capture value for the medical tourist industry. Brand

Management – Perceived Value

Perception of product offerings is a critical component in managing a brand.

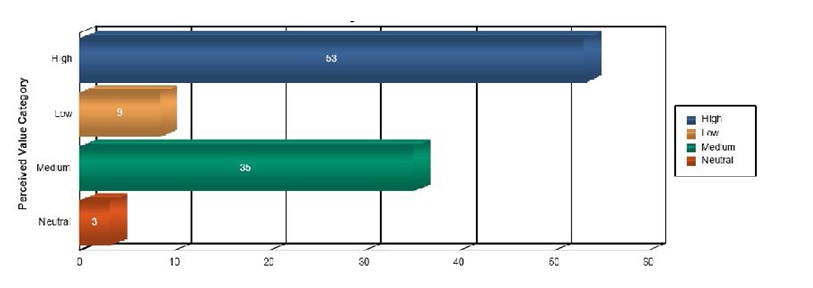

Value roles can be evaluated from the levels of perceptions held on services people from deliverables at the individual, network, and roles levels. The meaning of perceived Value may not be conveyed in spoken words, but are being created unconsciously or consciously. Perceived value is a component that is vital in evaluating tangible deliverables.

The above graphs (See Figure 14 and 15) illustrate the positiveness with which medical tourists accepts transactions compared to senders. A case in point is where a tourist can call in at a medical center that operates 24/7 to inquire about personal medical needs. The sender and the receivers are the patient and hospital respectively. Overtime pay for additional manpower and other infrastructure requirements are catered for. This illustrates the neutrality in financial terms of the sender’s perceived value while the receiver benefits by drawing on the medical assistance and care available. This example illustrates the reason for the positiveness or negativeness of perceived values.

For employees to be attracted to work in an industry, the sender and receiver’s perceived values need to be above neutral. Transactions carried out in this environment have a high likelihood of producing positive results. Both scenarios lead to a win-win atmosphere.

Asset Impact

The pie chart below shows the asset impact of all transactions.

Any business industry like the medical tourism industry is out to make money. However, it is evident from the chart (See Figure 16) the significant role played by human resources in running the industry in the provision of its services besides the financial gains it makes. Congenial relationships ought to exist between the agents, the hospital, the Government, airline carriers, and privately working associations for the industry to thrive on success. Human resources equipped with various skills make the industry a success. Database management experts are among the skilled human resource persons.

Reciprocity

Ties reciprocate between roles and participants with varying intensities. An analysis has yielded information that In Jordan’s medical tourism industry, 78.57% persist with a reciprocatory connection. This brings to light the taking nature of roles to each other. This clearly illustrates the healthy communication infrastructure that appears to be flattened instead of being hierarchical.

Structure and Value

This is a standard for evaluating value on a structural approach. Ties are clearly defined on the centrality indicator on their strengths. Roles that incorporate more ties have a closer connection and take critical structural positions. Optional pathways, therefore, exist for meeting their needs with reduced dependency on individuals. Roles with multiple options have easy access to more network resources though a role’s strong position in the network does not provide increased value to the network. However, value creation is identified on outgoing transaction gains from the network, while on the other hand, incoming transactions show gains to the network for a specific role. Calculations based on the centrality indicator can be achieved as follows:

Centrality in (Degrees º) is equivalent to gains in value a role makes from a network.

Centrality Out ((Degrees º) is equivalent to gains in value a role makes from a network.

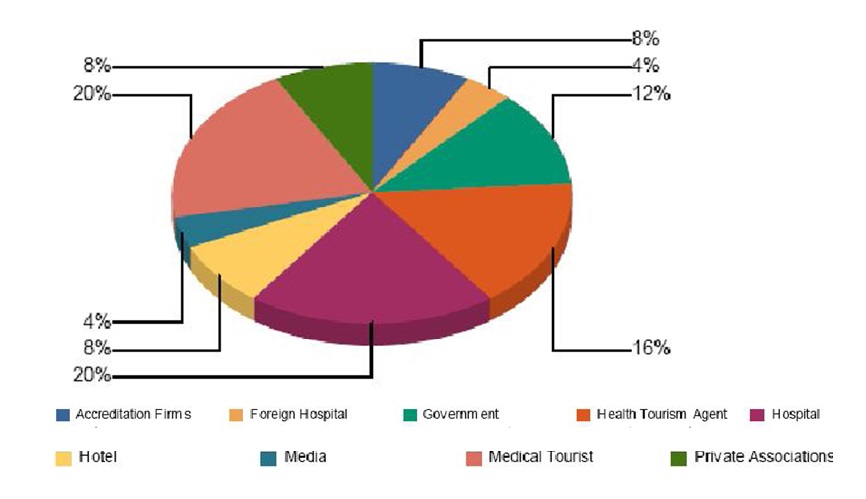

The above pie chart illustrates gains made by medical tourists from the network, the most important goal of the medical tourism industry (See Figure 17), and reinforces the evidence about the three most important providers.

The above chart (See Figure 17 and 18), illustrates the fact that medical tourists are characterized by their value and co-producers of value.

Agility

The degree of separation determines the extent to which information spreads out in a network and is averaged at around 1.93 for the Jordanian Medical Industry.

Summary of Analysis

From the above discussion, VNA and JH play vital roles in the medical industry under the support of HTAs along with the Government and privately working associations with accredited firms to operate sustainably and avert any losses as summarized below.

- Research has shown that Jordan’s medical tourism industry is in its infancy.

- The industry structure is weak

- Calculated figures on perceived value indicate that the industry is thriving and vibrant and a good employer

- The receiver is advantaged with more benefits compared to losses

- Finance is a weak factor for measuring the major asset impact which is measured on business relationships

Medical tourists characterized as both prosumers with hospitals as major sources.