Differences between the players and owners’ positions regarding the reported earnings

It is clear that agency conflicts exist between the owners and players of Kansas City Zephyrs Baseball Club, Inc. The main reason for the contentious issues is the profitability disbursement to between the club operations and players.

The owners want to maximize their interest through reduction of taxes yet the players want to get the most of their salaries and benefits. As such, an extensive reference to the Generally Accepted Accounting Principles and International Accounting Standards are significant to understand the contentious profitability issues of the major league baseball teams. There are only a few areas we dispute, but these areas can have a significant impact on the overall profitability of the team.

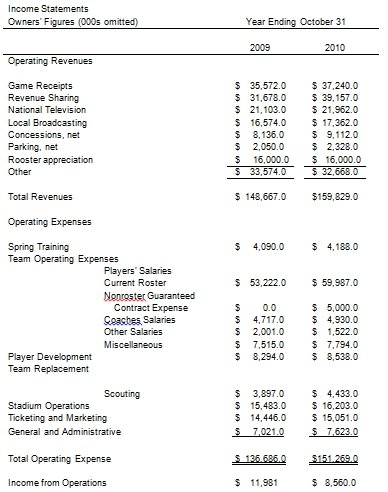

The owners have used three techniques to “hide” profits: (1) roster depreciation, (2) overstated player salary expense, and (3) related-party transactions. We feel it gives numbers that are not meaningful. The players’ version of the financial statements showed profits before tax of $24.5 million for 2009 and $23.6 million for 2010 as compared to the losses of $ 4.0 million end $7.4 million on the Owners’ statements.

The accrual basis of accounting and the cash basis accounting have presented the major issues in paying for expenses as well as the type of expenses. Again, the period of bonuses payment has raised concern and arguments that have left Bill Ahern in confused state. The depreciation expense arises only when a team is sold, so you can have two identical teams that will show dramatically different results if one had been sold and the other had not.

On the other hand, the players argued that their interpretation of skills and competencies was increasing with experience, which would increase goodwill or the value of the club. The owners had categorized the item under depreciation. Much contradiction arose from the thinking of the owners that depreciation is real because most of the players actually improve their skills with experience, so if anything, there should be an increase in roster value over time, not a reduction as the depreciation would lead you to believe.

The owners had agreed to defer a portion of their salary for 10 years. That helps save them taxes and provides them with some income after their playing days are over. The players value their payment and feel this is a way of denying them their pay through hiding profits.

Players argued that the owners had overstated player expense in several ways. One is that they expense the signing bonuses in the year they are paid. The players take the bonuses as a part of the compensation package, and that for accounting purposes, the bonuses should be spread over the term of the player’s contract. However, the contracts revealed clearly that the player is to receive, say, $1,000,000, of which $200,000 is deferred to the year 2018. In the same line, it indicates that the salary expense is $500,000.

Why the owners want to maximize their interest through reduction of taxes

The owners want to reduce taxes to increase their share of earnings. Taxes reduce the profits that the company has earned. Therefore, reducing the value through allocation of depreciation will reduce earnings before income tax (EBIT). The percentage charge will effect on a lesser value.

The company will have more retained profits, previously allocated to depreciation. This raises the value of the business. As such, the owners’ attain their main objective, which is to increase the wealth of the business. Again, it will reflect on less debt capital, and much equity financing. This raises the value of the firm and maximizes shareholders wealth.

Resolving the accounting conflict between the owners and players

Extensive and intensive reference to the Generally Accepted Accounting Principles and International Accounting Standards are significant to understand the contentious profitability issues of the major league baseball teams. This will enable Bill Ahern to handle the case under the same level of consideration.

As such, the statements may be subject to auditing to ensure that they have met the qualitative and quantitative qualities according to international standards. As such, it will pave a clear way on expenses, depreciation and payment of bonuses. As such, should share in the teams’ profits according to the contracts signed between each other, which are in line with GAAP.

Bill approached the accounting unit, depreciation, amortization of intangibles, and related-party transactions through construction of a new financial statement will reveal. This is urgent due to the tight deadline. Again, it was not at all obvious to him how to define “good accounting methods” for the Zephyrs Baseball Club. With the above adjustments, the net income shall change to profits of $11,981 in 2009, and $ 8,560.0 in the year 2010 (see the new income statement).

The decision to remove depreciation

The decision made was the most adequate to solve the agency conflict. The approach considered the interest of the players and the owners. Depreciation was removed because the players improve in experience and they become better with time. As employees earn goodwill overtime, players also add value to the organization because of acquired experience and skills.

Depreciation is normally allocated to fixed assets like equipment and machinery. In fact, players can leave anytime due to better opportunities or injuries. Therefore, depreciation was considered a mechanism of increasing the company owners’ wealth at the expense players’ payments.