Introduction

Economic theories have tried to ascertain the factors that can explain the need for foreign trade and the evolution of trade patterns. Economists have tried to provide various rationales for trade. David Ricardo believed that the presence of technological differences between countries leads to a comparative advantage. According to the Heckscher-Ohlin model, factor endowments such as labour, capital, and natural resources, leads to a relative situation that forms the trade patterns. More recent trade theories opine that larger countries with a strong economy will have an edge in exporting the goods that are consumed more in the domestic market (Chinn 2004). According to this theory, the trade cost is the greatest obstacle to trade. On the other hand, there are economists who believe that the quality of socio-political situation of a country influences its trade pattern. Evidently, there are numerous factors that have been considered as an influence on trade of a country. In this paper, I will look into the trade pattern of the United States with its top ten trading partners and ascertain what factors could have influenced them.

US Trade

For the analysis of the US trade data, we consider the countries with the largest amount of trade volume with the US. These countries are highlighted in the following table. The table shows that the largest amount of trade volume of the US is with Canada and the rest are given in the order of their amount of trade. The partner countries with the first ten highest trade volumes from 2009 through 2015 are considered for the analysis. The main export partners of the US are Canada, China, Mexico, Japan, Germany, South Korea, United Kingdom, France, Brazil, and Saudi Arabia. In percentage terms from 2010 to 2015, the US trade with Canada has been a large 22.5% of the total trade volume. Table 1 shows that trade with the top three countries has been a whopping 60% of the total trade volume from 2010 through 2015. Therefore, the main trading partners of the US undoubtedly are Canada, Mexico, and China. The other seven of the top ten countries have 26.05% of the total trading volume.

Table 1: List of Countries with Total Trade Volume in Descending Order (Own Calculations)

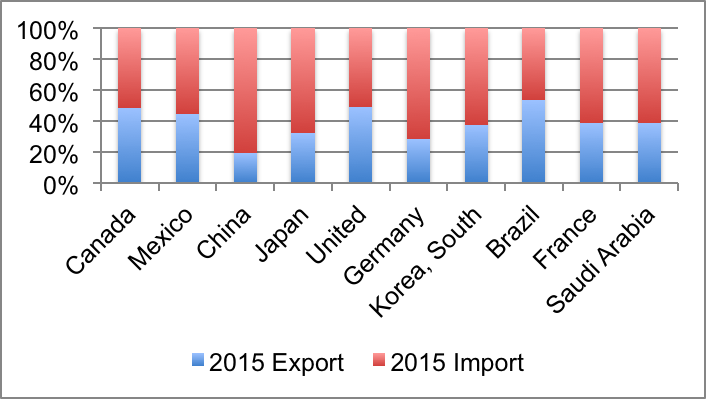

The percentage of exports to the total exports and that of imports for the top ten countries is presented in the following figure (see Figure 2). The graph shows that in 2015 for all the top ten trading partners, the exports has been more than the imports. This indicates that the US has a trade deficit in their trade balance.

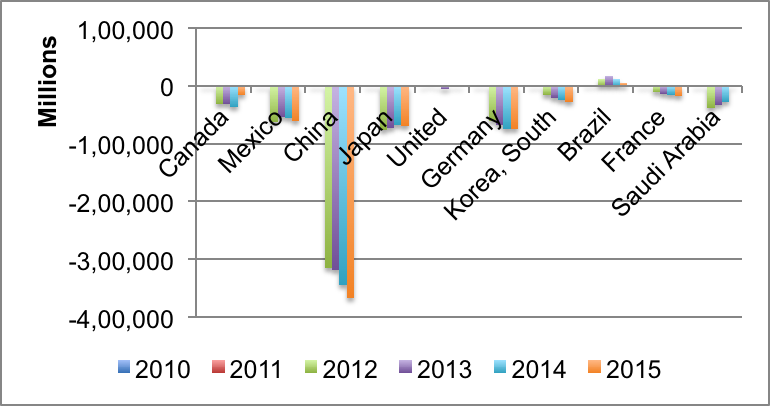

Figure 1 shows the trade balance for the top trading partners of the US from 2010 to 2015. Trade balance is the difference between the bilateral exports and imports. A positive trade balance indicates a trade surplus while a negative balance shows trade deficit. The figure shows that all the top ten trading partners, except Brazil, have shown a negative trade balance from 2009 through 2015. Thus, the US has a trade deficit in trade with all the countries, except Brazil. The bilateral trade balance for most of the trading partners is negative, which is an area of serious concern for the policymakers. The bilateral trade balance has been highest for China. Further, it is observed that the trade balance for all the bilateral trades have increased except in Canada where there has been a minor decline in 2015. This indicates that the bulk of the total trade with China is imports and not exports. Therefore, the US market acts as a consumer.

The study of Figures raises one potent question – what is the reasons behind the widening gap between export and import in the US? It is essential to understand why the trade deficit in the country’s bilateral trade with countries like China, Mexico, Germany, and South Korea has continually increased. The factors responsible for the bilateral trade deficit are ascertained in the paper.

Analysis

The analysis concentrates on the trade deficit with the countries that show the highest trade imbalance and then it is extended to the other nine countries. In this case, we will study China as the primary bilateral trade partner as it shows the US has the highest trade deficit with the country. Though, the reason for the bilateral trade deficit may be different for different trading partners, but the main issue of the lack of exports to the countries and the need to import is almost same. Hence the study of one country can easily be generalised for other trading partners.

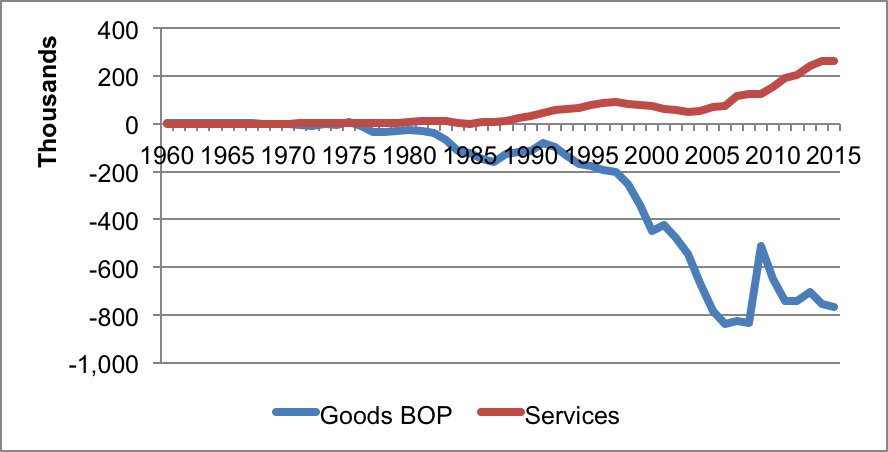

An analysis of the historical trade balance of goods and services from 1960 through 2015 shows that the balance for services and goods trade has been positive in the US till the early 1970s (see Figure 3). However, the services sector started becoming stranger since the 1970s and the trade balance for goods started to become negative. This shows that more goods are imported in the US. The gap has increased significantly since 2005 (US Census Bureau 2016). Why there has been a widened gap in the two balances? One plausible explanation is the fall in manufacturing in the US. As goods are products manufactured or produced in the country, the data shows that there has been a fall in the amount of tradable goods. The reason for this decline can be two-fold – first, a fall in production and a second a rise in domestic demand for the goods provided production remained the same. Evidently, there has been a gap in the production and export. There has been a fall in manufacturing output in the US, which has reduced the amount that can be exported. The widening gap between goods and services trade balance indicates that there has been a fall in the demand for the goods in international markets produced in the US. The rising trade deficit of goods has become the primary reason for the rising trade deficit of the country. What might be the reason that could contribute to the fall in demand for US-made goods in the international market? One reason for this rising imbalance is the proliferation of Chinese-made goods in the international market. This is discussed in greater detail in the following paragraphs.

China is so important in the study of US trade patterns because the US trade balances have shown a deficit of more than a decade. The study of the top trading partners from 2010 to 2015 shows that the trade balance has been largest in the case of China. More specifically, it has been more than 45% of the total trade balance of the US. This shows that the trade deficit with China has been a strong influence in creating a deficit in the overall trade deficit. It was 45.2% in 2009 and has increased to 49.5% in 2015 (See Table 2). That is why it is essential to understand the reason for the increasing gap in the export and import in the bilateral trade between the US and China.

Table 2: US Trade Balance with Bilateral Partners as a Percentage of Total Trade Balance

Trade with China has resulted in skewed trade balance for the US (Bown et al. 2005). The reason is the rise in imports from China. When we look at the comparative advantage trade theory presented by Ricardo, it is observed that it is more profitable to produce in a country where labour is cheaper (Bown et al. 2005). For instance, if we want to produce a sports shoe, it is cheaper to produce in China because labour is cheaper. Thus, low cost of labour reduces the production cost, thus, making production more profitable. In case of sports shoe manufacturing, the US-based manufacturers have shifted their manufacturing bases from the US to China, thus, reducing their manufacturing cost. However, these sports shoes produced in China are then imported to the US as fresh products, thus, increasing trade imbalances with China (Bown et al. 2005). The trend has been mostly in the manufacturing sector. Now let us consider the causes for the high trade deficit between the US and China. The main goods that are imported from China by the US are consumer goods, machinery, and clothing (Autor, Dorn & Hanson 2013; Amadeo 2016; Chinn 2004). Many US-based manufacturers send raw material to China where the vendors produce the products at a lower cost (Baily & Bosworth 2014). However, the materials that are exported to China are priced lower than the finished products that are imported from China, thus, creating the trade imbalance. The cost of production in China is lower due to the lower standard of living and higher value of US dollar (Amadeo 2016).

Autor et al. (2013) have shown that the Chinese labour market has been a serious factor that has affected US manufacturing and ultimately US imports. Thus, trade from labour-intensive country like China has resulted in a trade imbalance in the US. They point out that in the 1990s, the US trade with low-income low-wage countries has been just 9% of the total trade. However, in 2000 it had increased to 15%, which then increased to 28% in 2007, with China contributing to 89% of this growth (Autor et al. 2013). Thus, import competition for the US industries has continually increased.

Krugman (2010) points out that the undervalued Chinese currency has resulted in its advantage as a desired country for outsourced manufacturing. Krugman argues that China has deliberately kept the Renminbi undervalued in order to increase its attractiveness as a manufacturing destination, and has been manipulating their exchange rate in order to gain competitive advantage in international trade.

The relationship between Chinese exchange rate and the US trade balance has been studied by Yue and Zhang (2013). The argument presented by Yue and Zhang is that if the trade deficit of the US was caused solely by the low exchange rate of the Chinese currency, then the deficit should have reduced when there is a rise in the exchange rate. However, this does not happen, showing that the Chinese exchange rate is not responsible for the US trade deficit. Their study shows that there is no specific relation between the rise in the trade deficit with China and that with the fall or rise in the exchange rate of China and the US. Similar results have been found in the study conducted by Yuan (2014). Yuan argues that the American economists blame Chinese imports as the main reason for the trade deficit of the US. However, he has shown that even if there were no imports from China the US economy will still have trade deficit. The fact remains that China is a major importer and a main cause of the trade imbalance in the US.

Mann and Plück (2007) point out that the income and relative price elasticities in the US, which differ by trading partner and commodity. The results show that there has been a persistent trade difference between the US and its trading partners depending on the commodity that is exported or imported and the reason is the difference in price elasticities of the products.

Conclusion

The study shows that the top ten trading partners of the US in Table 1. The study also shows that the main reason for the trade deficit of the US is the disadvantage it gains from its high exchange rate value. Further, the other reason that we have shown is the decline in the goods export in the US, which is presumably due to the fall in the manufacturing in the country (Baily & Bosworth 2014). Thus, the gap between goods and service trade shows a potential reason for the large trade deficit. Further, the study of the top ten trading partners of the US shows that even though Canada is one of the largest trading partners, China affects the trade deficit more than any other country for the trade volumes with China is mainly comprises of imports from the country. To summarise, the factors that affect the US trade for the top ten trading partners are exchange rate and relative labour cost.

Reference List

Amadeo, K 2016, ‘Why Is the U.S./China Trade Deficit So High?’, The Balance, Web.

Autor, DH, Dorn, D & Hanson, GH 2013, ‘The China Syndrome: Local Labor Market Effects of Import Competition in the United States’, American Economic Review, vol 103, no. 6, pp. 2121-2168.

Baily, MN & Bosworth, BP 2014, ‘US Manufacturing: Understanding Its Past and Its Potential Future’, The Journal of Economic Perspectives, vol 28, no. 1, pp. 3-25.

Bown, CP, Crowley, MA, McCulloch, R & Nakajima, DJ 2005, ‘The US trade deficit: Made in China?’, Economic Perspectives, vol 29, no. 4, pp. 2-18.

Chinn, MD 2004, ‘Incomes, exchange rates and the US trade deficit, once again’, International Finance, vol 7, no. 3, pp. 451-469.

Krugman, P. 2010, ‘Taking On China’, New York Times, Web.

Mann, CL & Plück, K 2007, ‘Understanding the U.S. Trade Deficit’, in RH Clarida (ed.), G7 Current Account Imbalances: Sustainability and Adjustment, University of Chicago Press, Chicago, pp. 247-281.

US Census Bureau 2016, Foreign Trade, Web.

Yuan, T 2014, ‘The U.S. Trade Deficit with China: An Excuse’, in SpringerBriefs in Business, Springer, Heidelberg, Germany, pp. 77-94.

Yue, K & Zhang, KH 2013, ‘How Much Does China’s Exchange Rate Affect the U.S. Trade Deficit?’, The Chinese Economy, vol 46, no. 6, pp. 80–93.